This version of the form is not currently in use and is provided for reference only. Download this version of

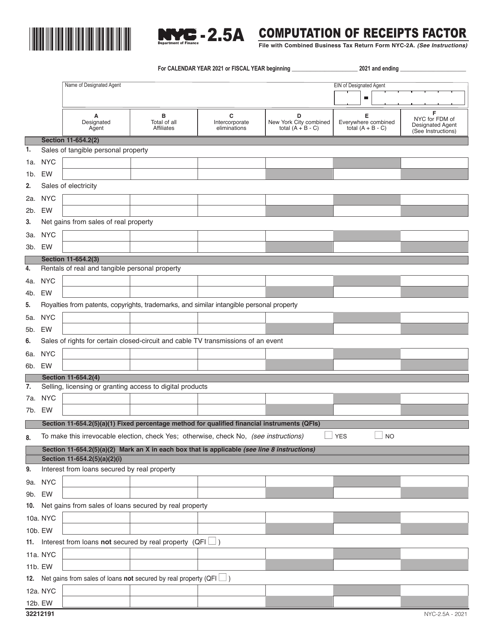

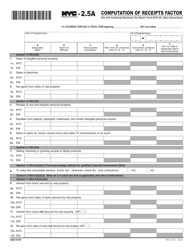

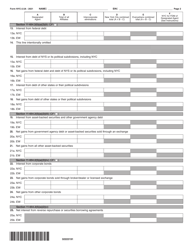

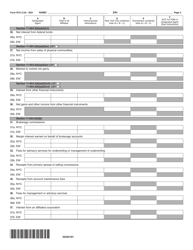

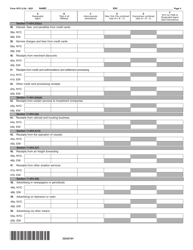

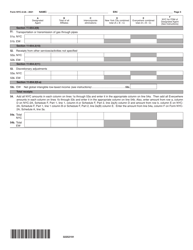

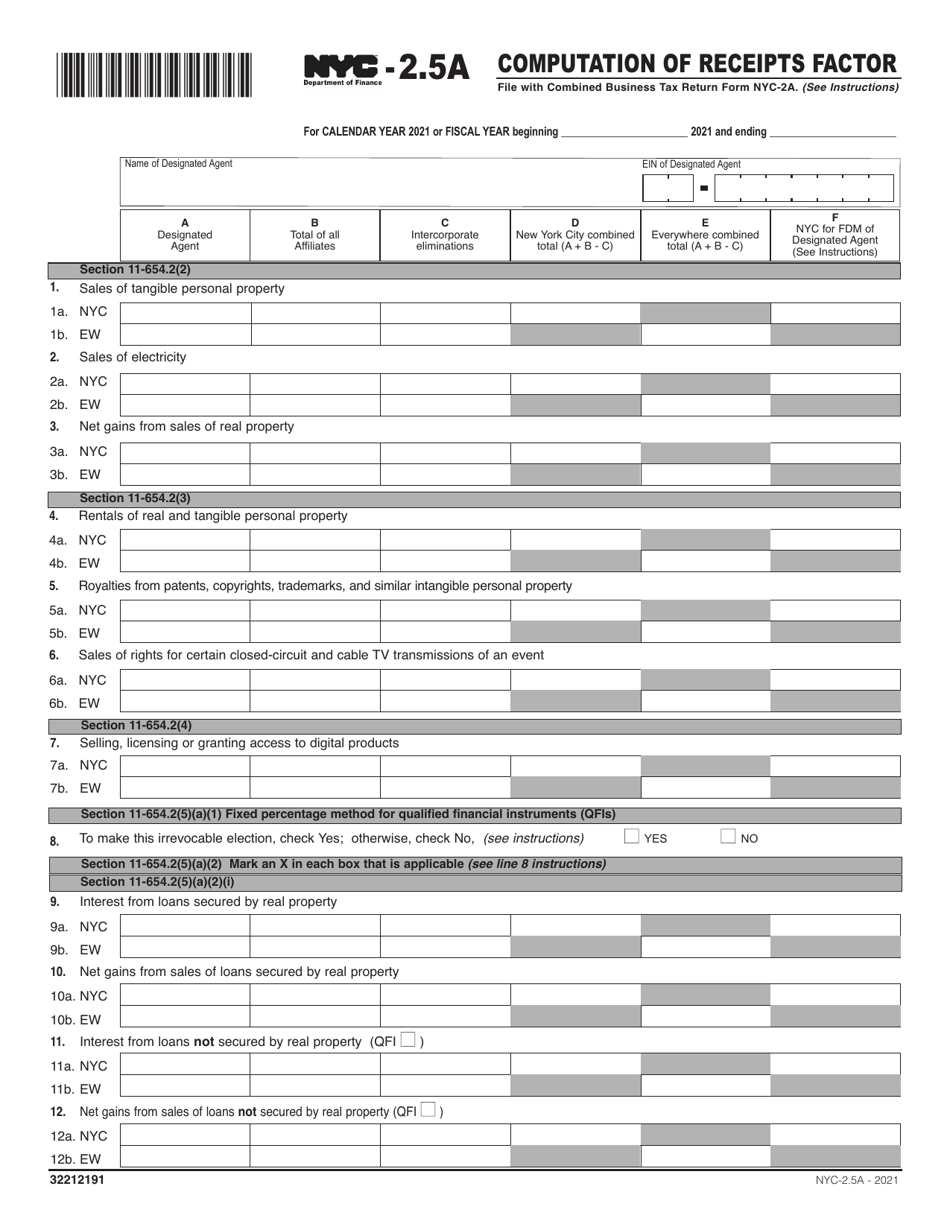

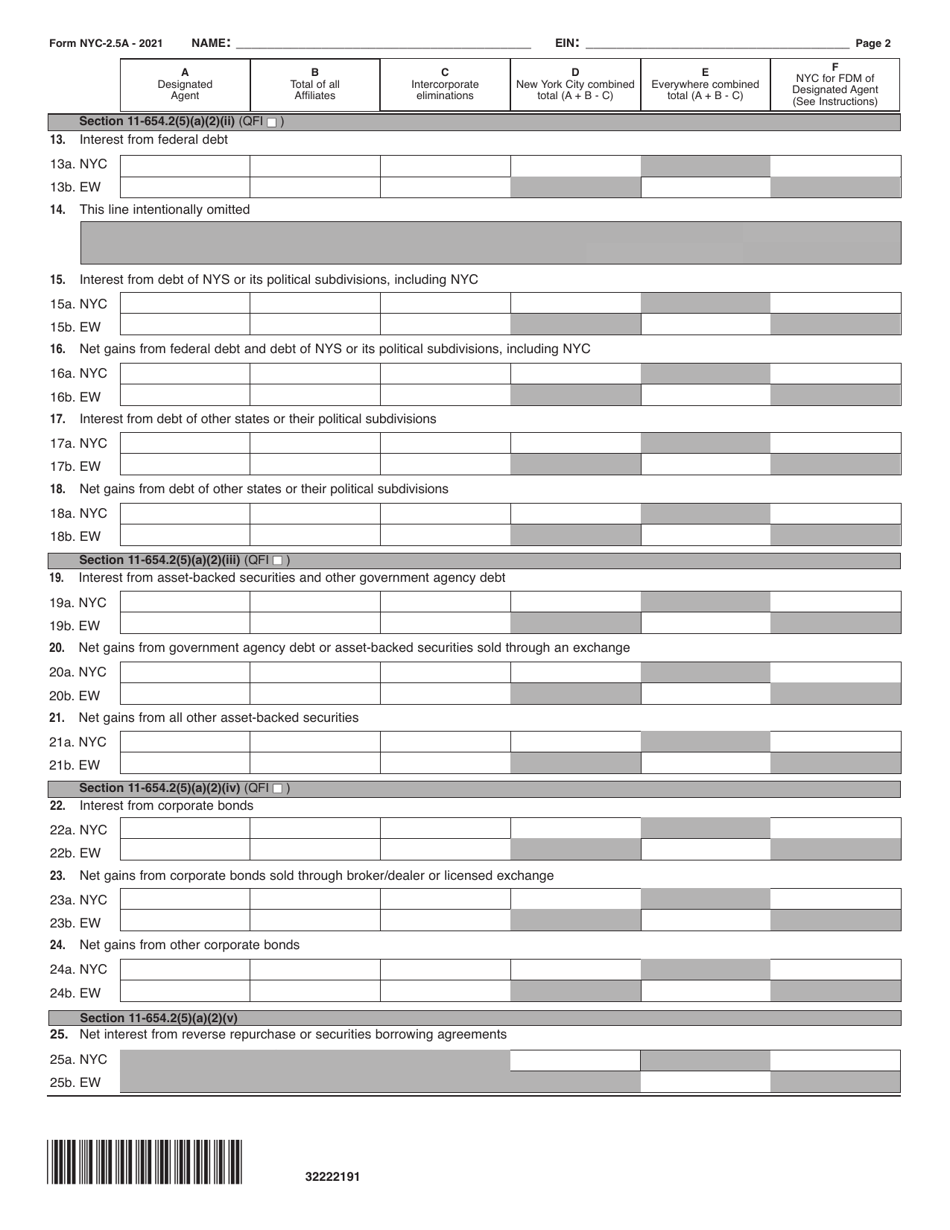

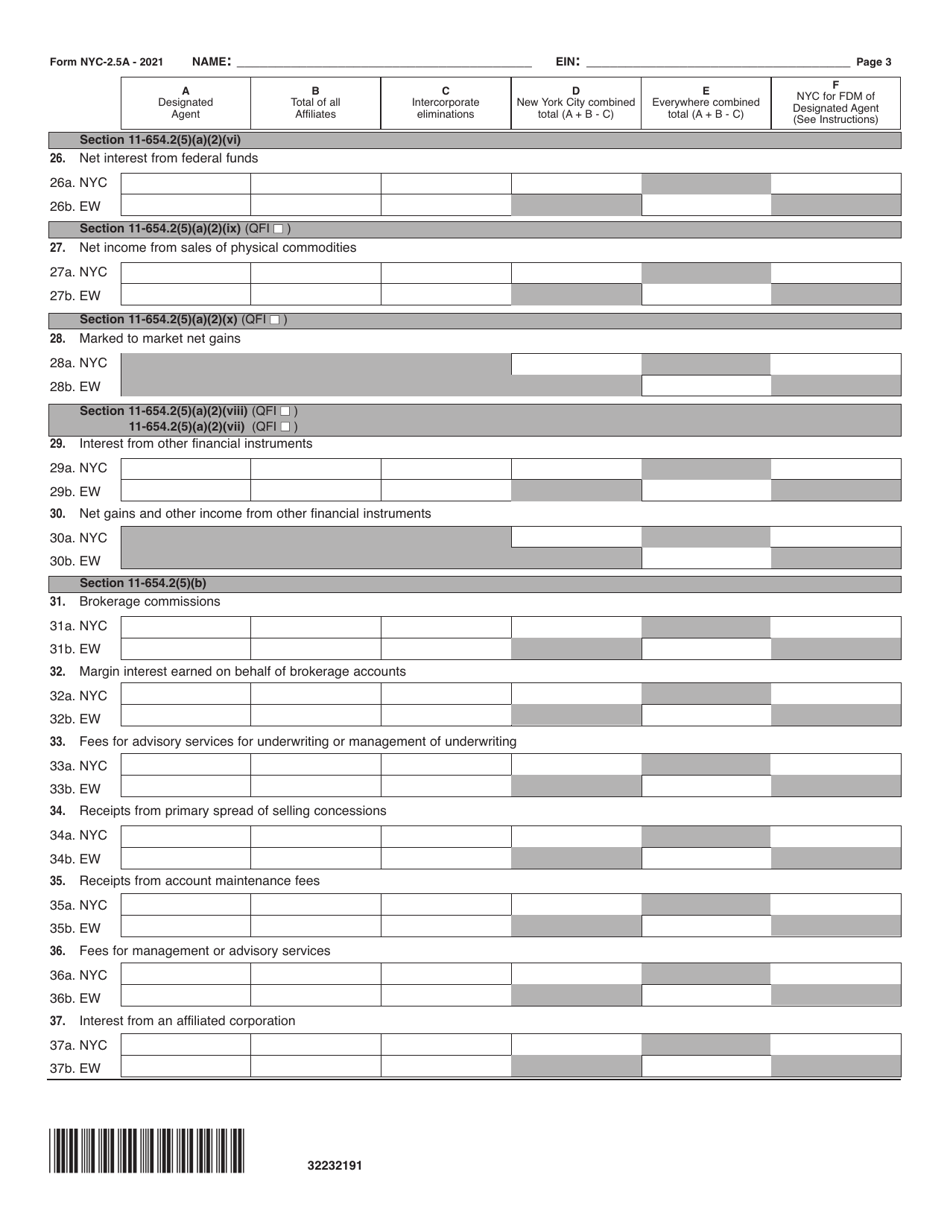

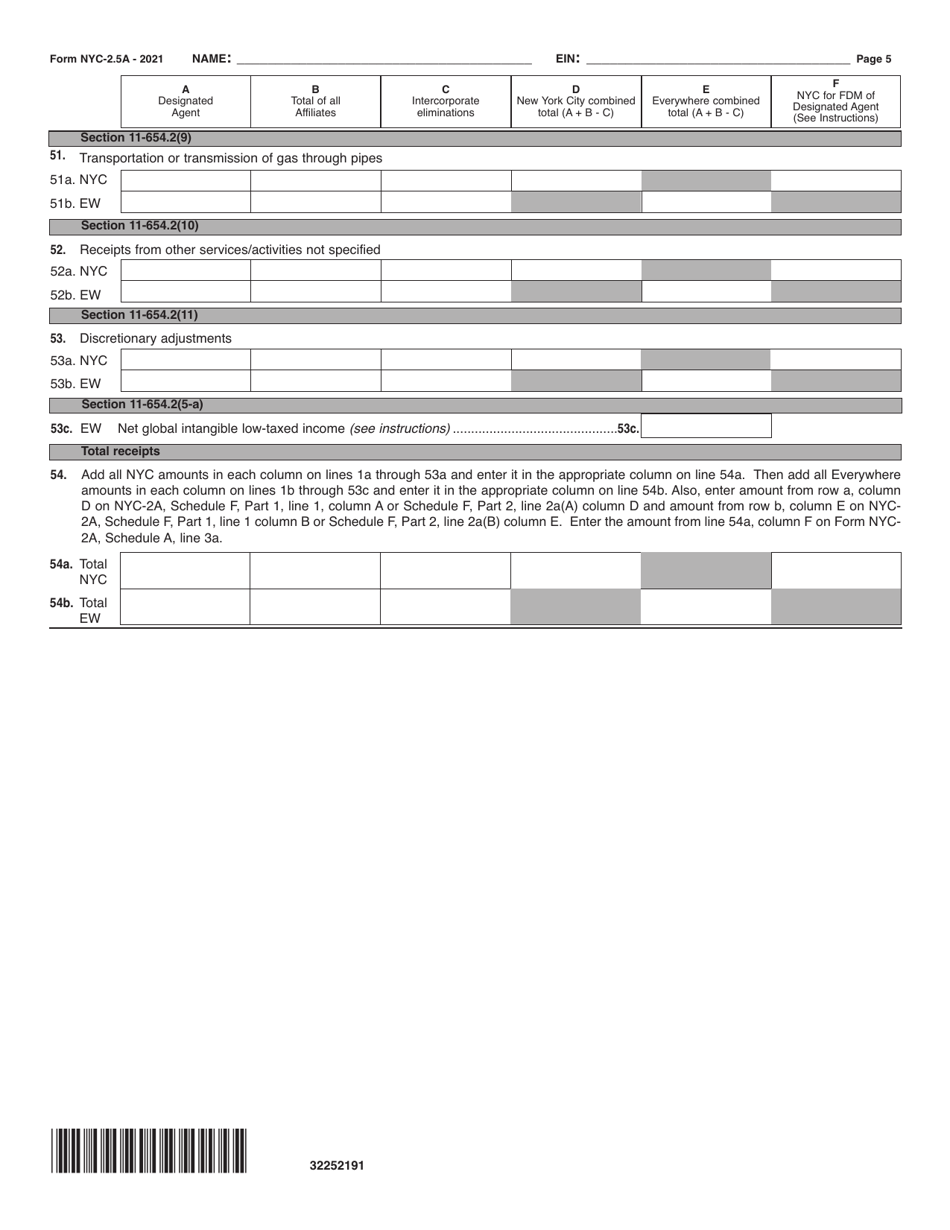

Form NYC-2.5A

for the current year.

Form NYC-2.5A Computation of Receipts Factor - New York City

What Is Form NYC-2.5A?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-2.5A?

A: NYC-2.5A is a form used to calculate the Receipts Factor for New York City.

Q: What is the Receipts Factor?

A: The Receipts Factor is a ratio used to determine how much of a corporation's receipts are subject to tax in New York City.

Q: Why is the Receipts Factor important?

A: The Receipts Factor is important because it determines how much of a corporation's income is taxable in New York City.

Q: How is the Receipts Factor calculated?

A: The Receipts Factor is calculated by dividing a corporation's New York City receipts by its total receipts.

Q: What are New York City receipts?

A: New York City receipts are the corporation's receipts from activities within the city.

Q: What are total receipts?

A: Total receipts are the corporation's receipts from all activities, both within and outside of New York City.

Q: Are there any exemptions or adjustments to the Receipts Factor?

A: Yes, there may be exemptions or adjustments to the Receipts Factor, depending on the specific circumstances of the corporation.

Q: Is the Receipts Factor the only factor used to determine tax liability in New York City?

A: No, the Receipts Factor is one of several factors used to calculate tax liability in New York City.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.5A by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.