This version of the form is not currently in use and is provided for reference only. Download this version of

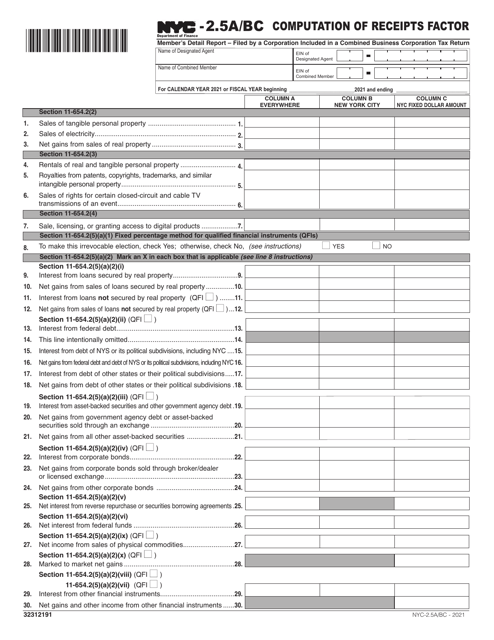

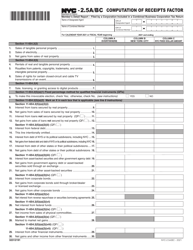

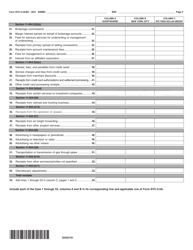

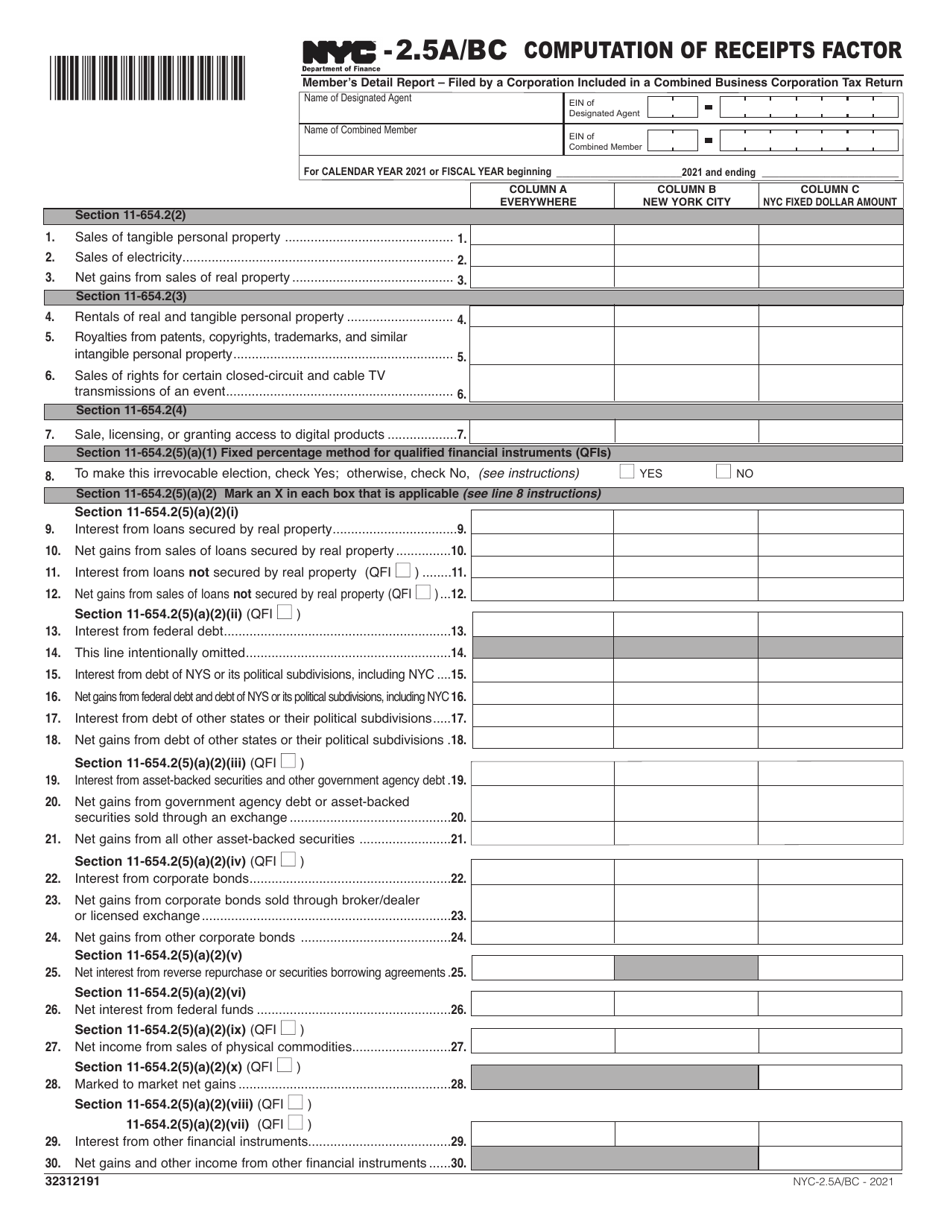

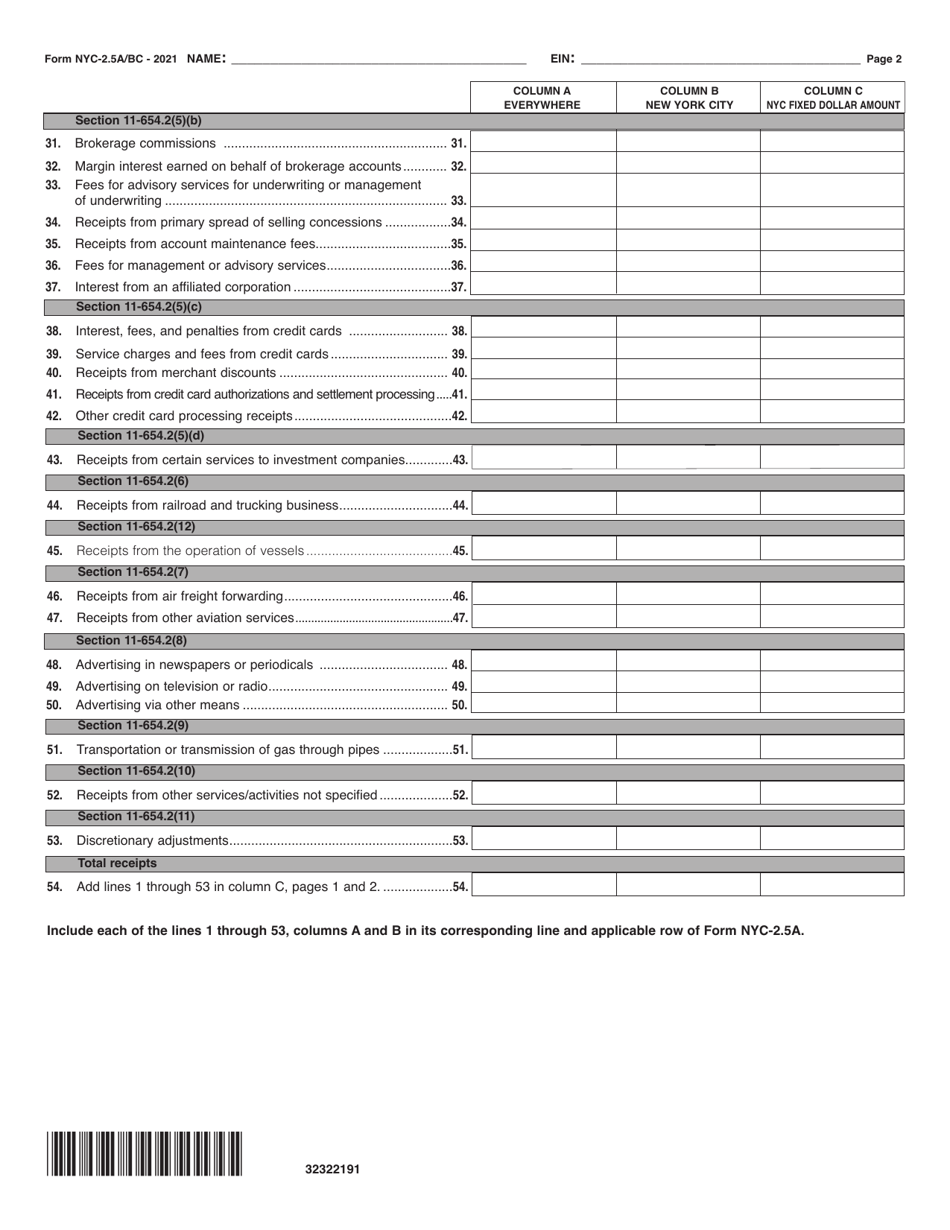

Form NYC-2.5A/BC

for the current year.

Form NYC-2.5A / BC Computation of Receipts Factor - New York City

What Is Form NYC-2.5A/BC?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-2.5A/BC?

A: NYC-2.5A/BC is a computation of the Receipts Factor specific to New York City.

Q: What is the Receipts Factor?

A: The Receipts Factor is a calculation used to determine the portion of a corporation's business income that is subject to taxation in a particular jurisdiction.

Q: How does NYC-2.5A/BC calculate the Receipts Factor?

A: NYC-2.5A/BC uses a specific formula to calculate the percentage of a corporation's gross receipts attributable to the City of New York.

Q: Why is the Receipts Factor important?

A: The Receipts Factor is important because it helps determine the amount of tax a corporation owes to the City of New York.

Q: Who needs to file NYC-2.5A/BC?

A: Corporations that have business activities in the City of New York and meet certain criteria are required to file NYC-2.5A/BC.

Q: What information is needed to complete NYC-2.5A/BC?

A: To complete NYC-2.5A/BC, you will need to provide information about your corporation's gross receipts, including those from New York City, as well as other relevant financial data.

Q: When is the deadline for filing NYC-2.5A/BC?

A: The deadline for filing NYC-2.5A/BC is typically on or before the fifteenth day of the fourth month following the close of the corporation's tax year.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.5A/BC by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.