This version of the form is not currently in use and is provided for reference only. Download this version of

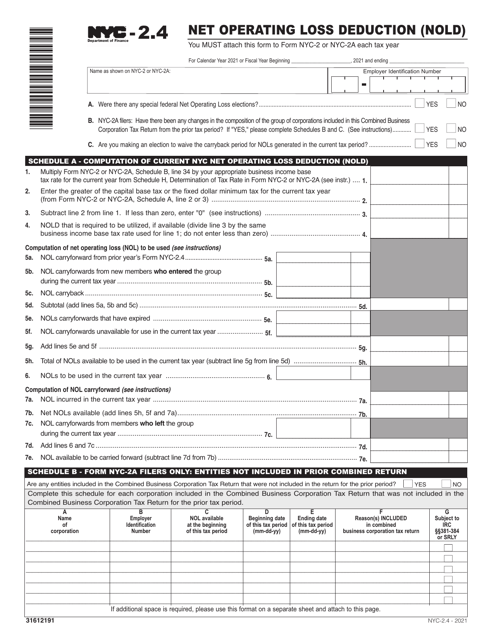

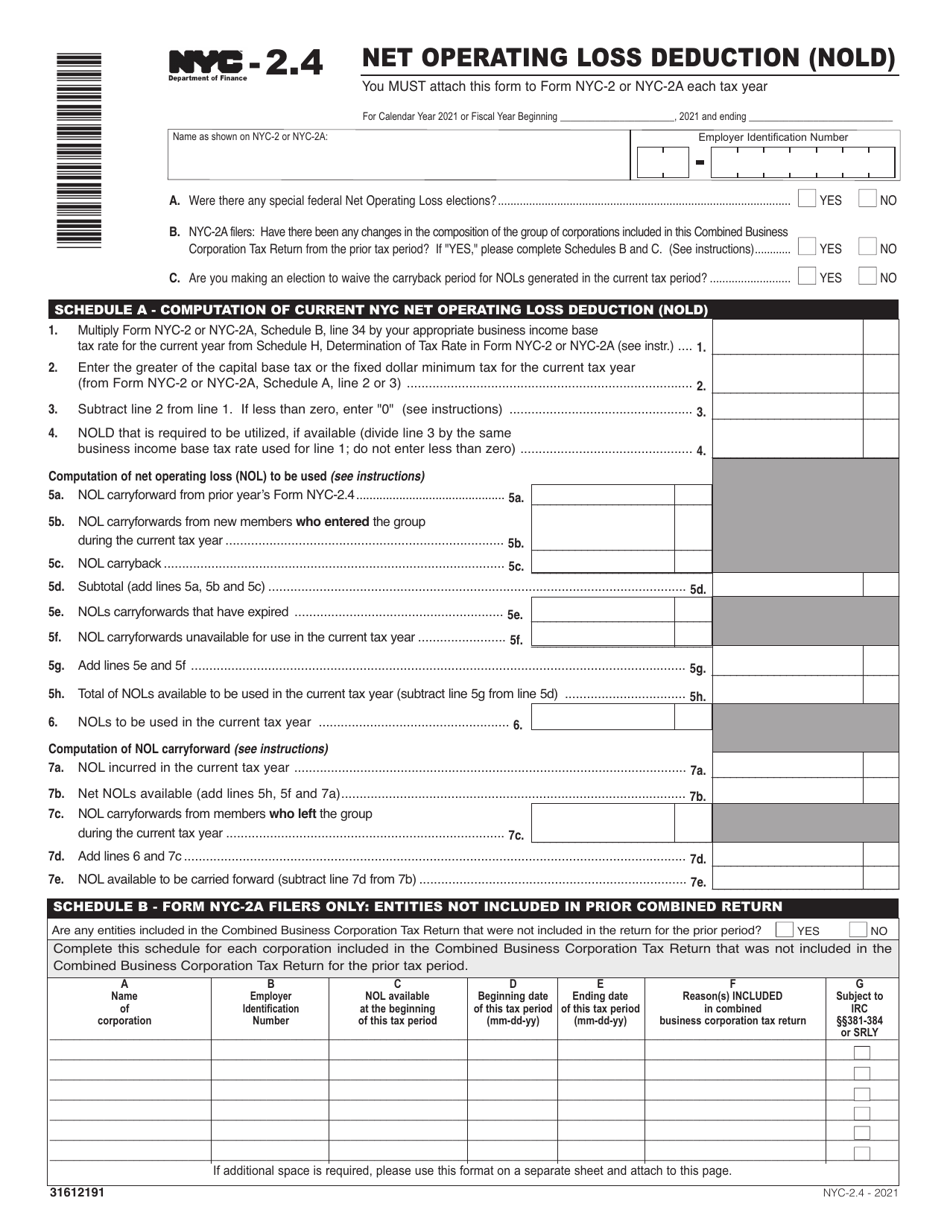

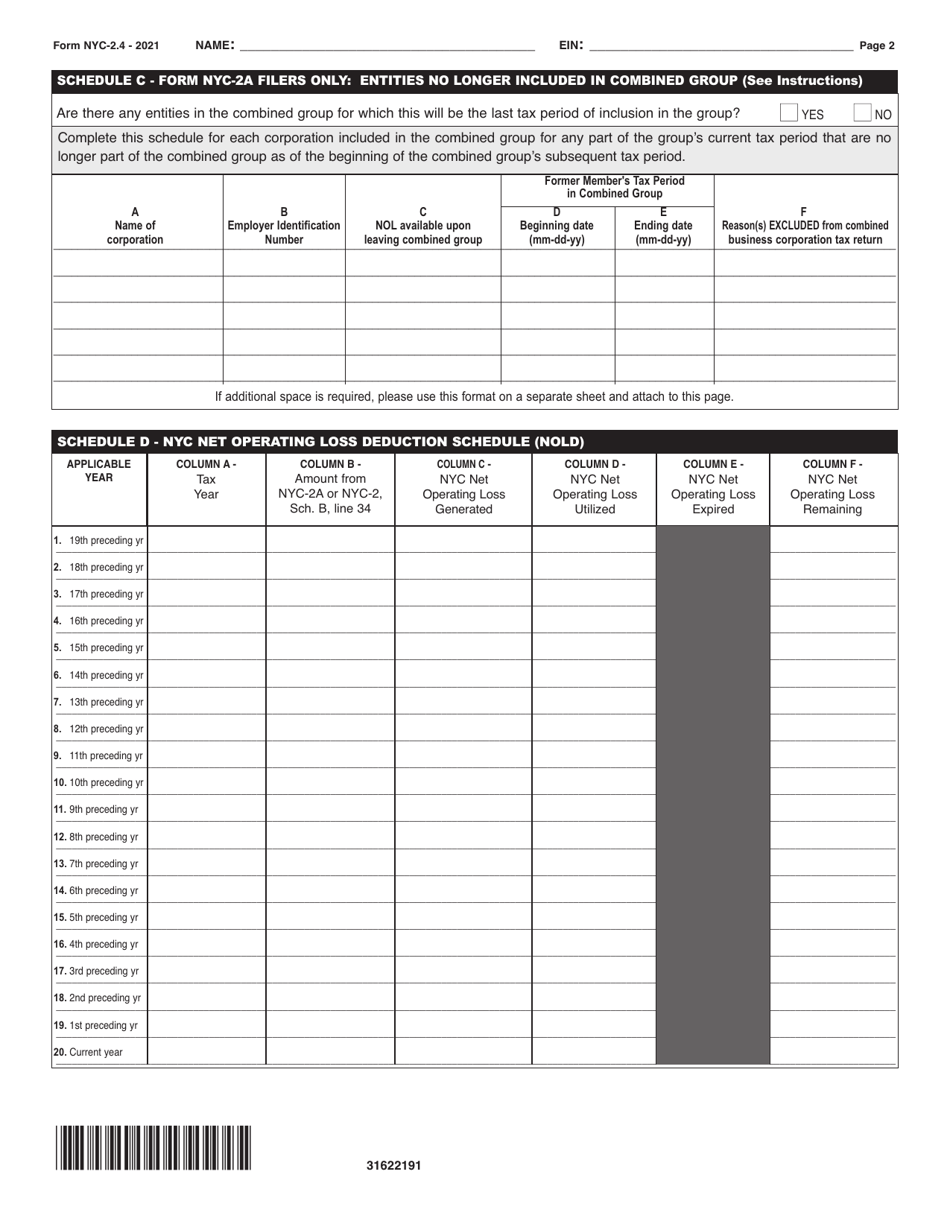

Form NYC-2.4

for the current year.

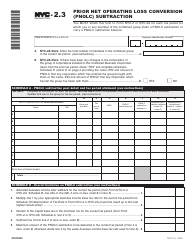

Form NYC-2.4 Net Operating Loss Deduction (Nold) - New York City

What Is Form NYC-2.4?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-2.4?

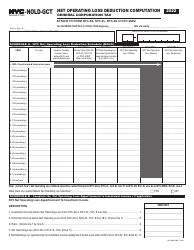

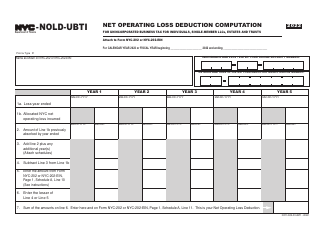

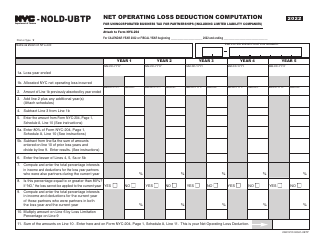

A: NYC-2.4 is the form used to claim the Net Operating Loss Deduction (NOLD) in New York City.

Q: What is the Net Operating Loss Deduction (NOLD)?

A: The Net Operating Loss Deduction (NOLD) allows individuals and businesses in New York City to offset their current year's income by deducting prior year net operating losses.

Q: Who can claim the NOLD?

A: Individuals and businesses that have incurred net operating losses in prior years can claim the Net Operating Loss Deduction (NOLD) in New York City.

Q: How do I claim the NOLD?

A: To claim the Net Operating Loss Deduction (NOLD) in New York City, you need to fill out form NYC-2.4 and attach it to your annual tax return.

Q: What information do I need to fill out form NYC-2.4?

A: To fill out form NYC-2.4, you will need information about your prior year net operating losses, including the year of the loss, the amount of the loss, and any deductions or credits previously claimed.

Q: When is the deadline to file form NYC-2.4?

A: The deadline to file form NYC-2.4 is usually the same as the deadline to file your annual tax return in New York City, which is generally April 15th.

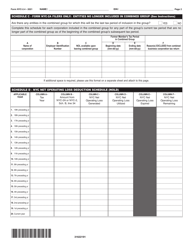

Q: Can I carry forward unused NOLD deductions?

A: Yes, you can carry forward unused Net Operating Loss Deduction (NOLD) deductions in New York City for up to 20 years, subject to certain limitations.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.4 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.