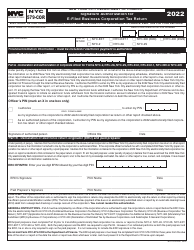

This version of the form is not currently in use and is provided for reference only. Download this version of

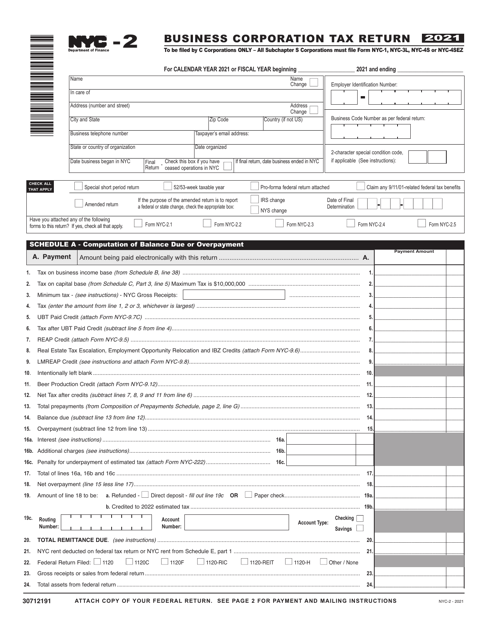

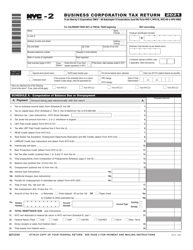

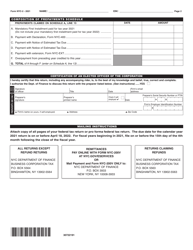

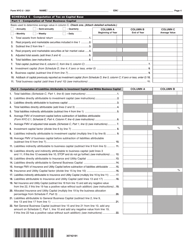

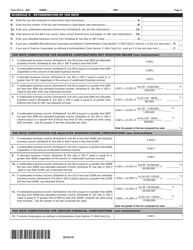

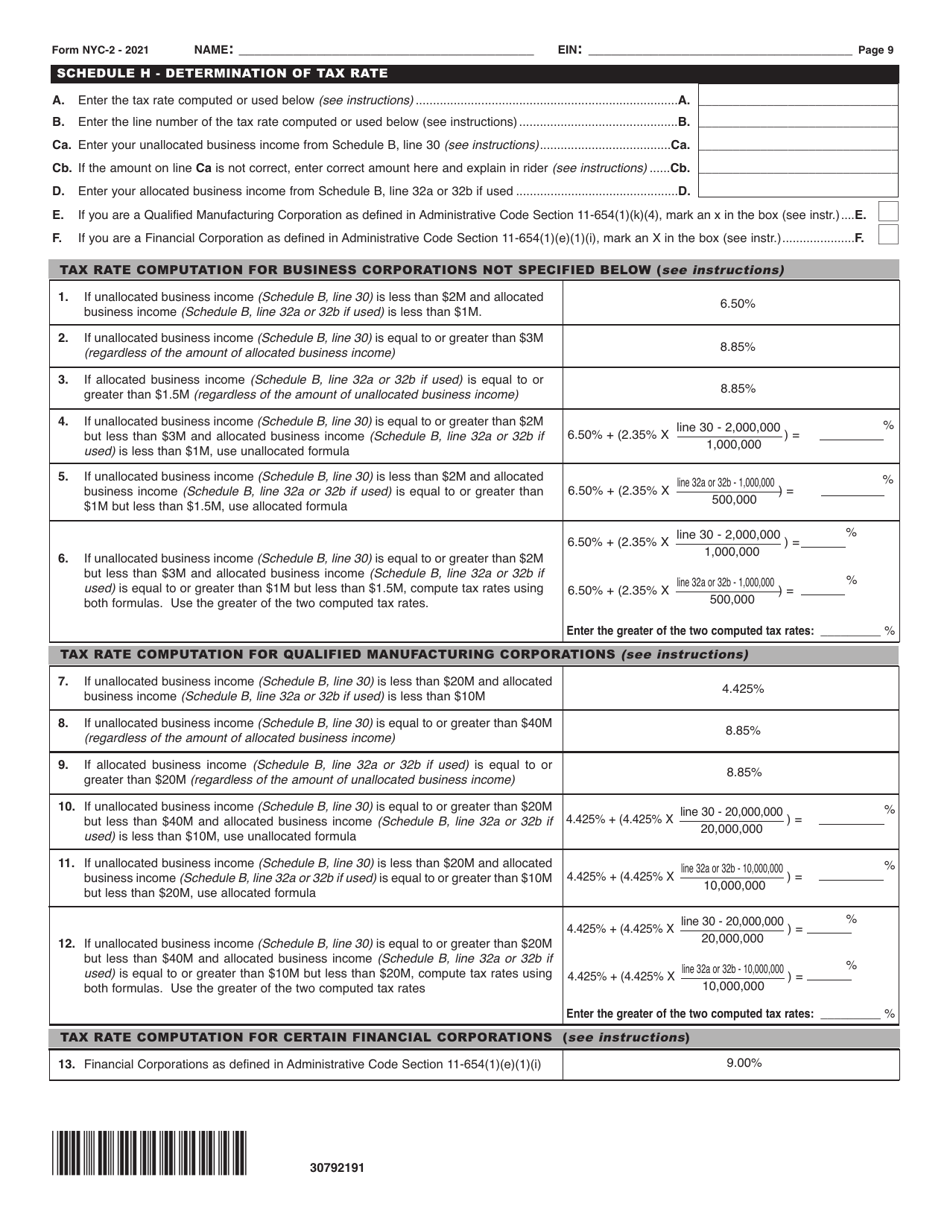

Form NYC-2

for the current year.

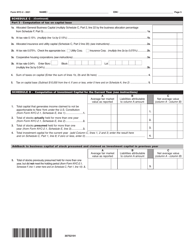

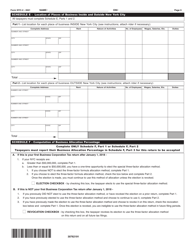

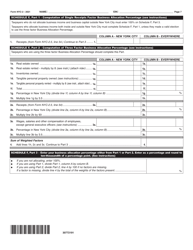

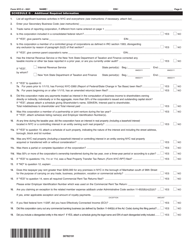

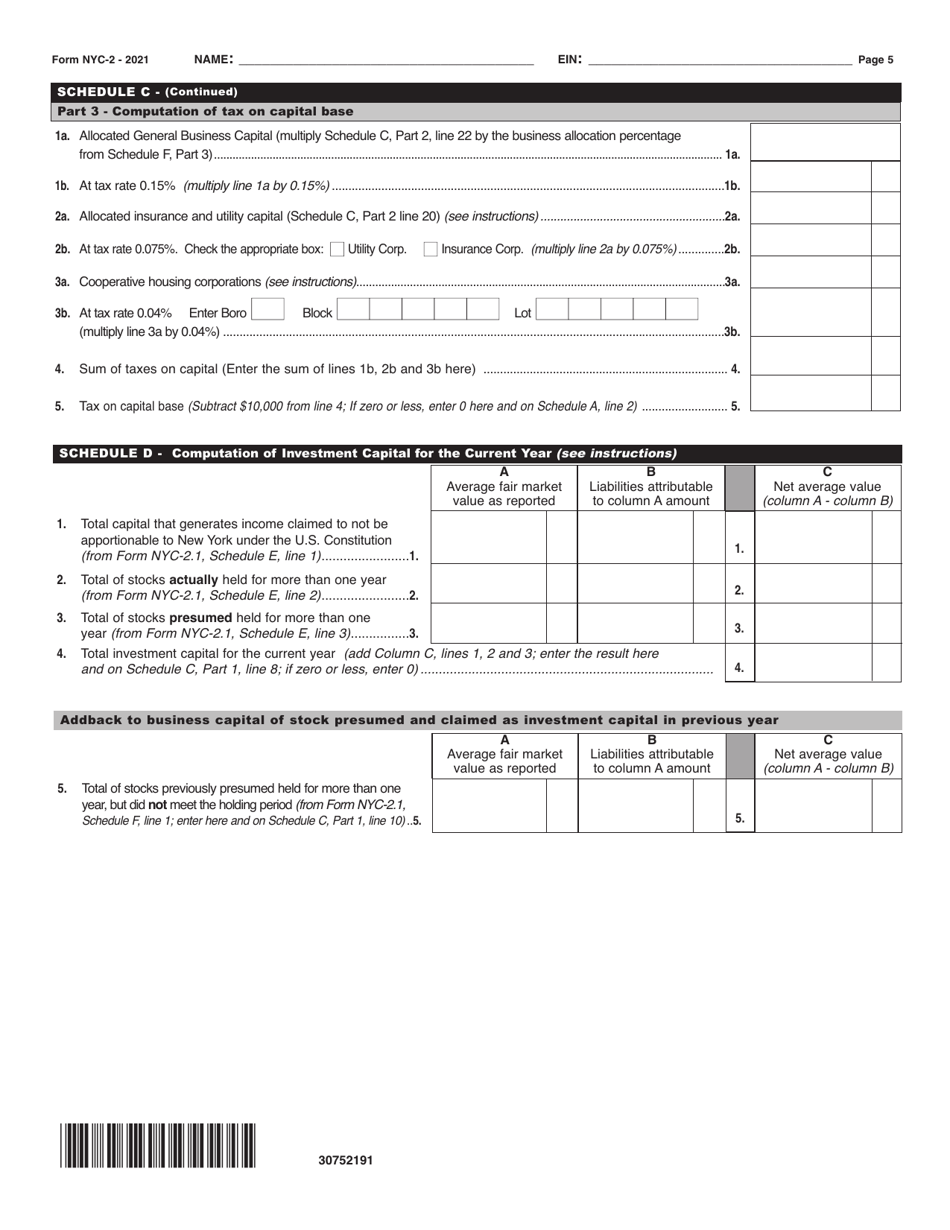

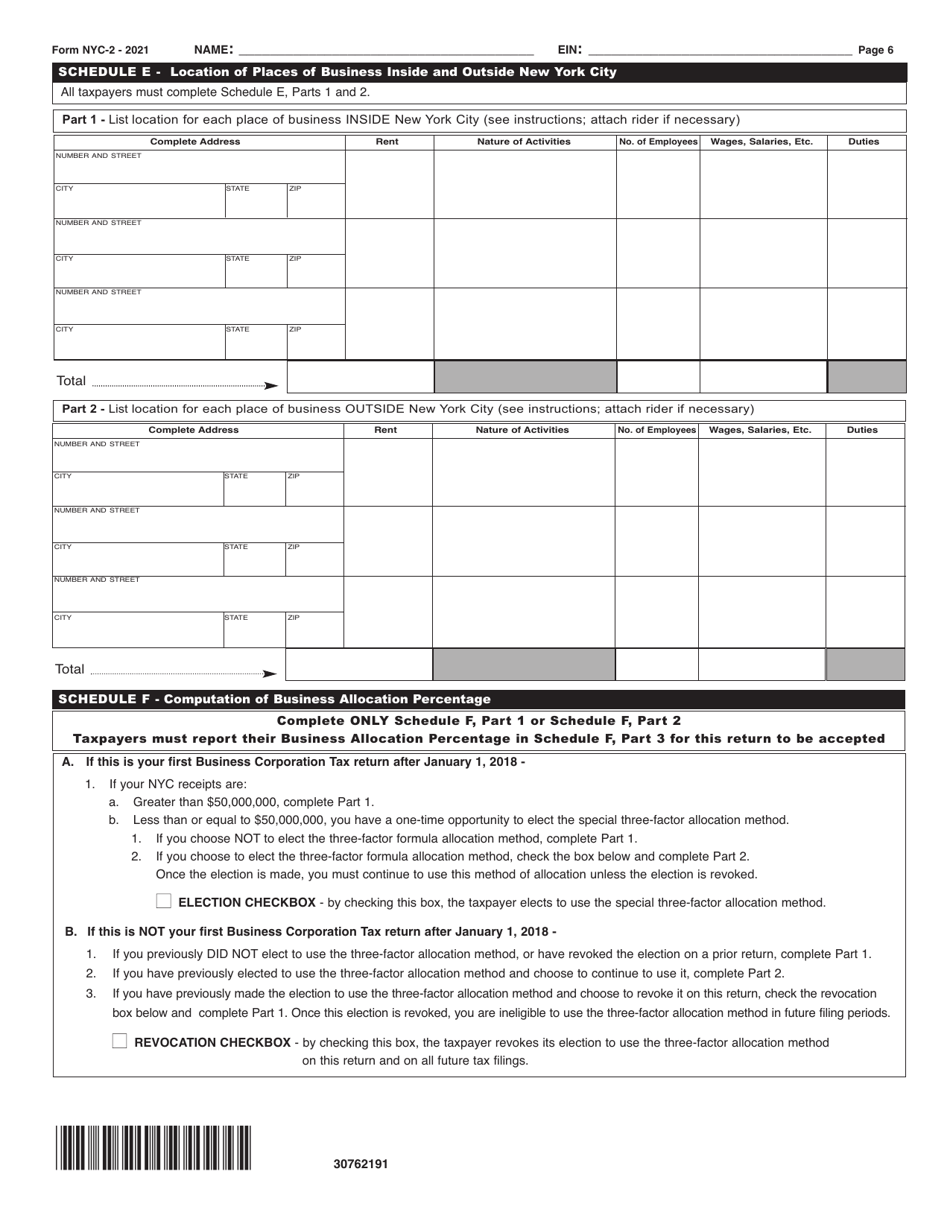

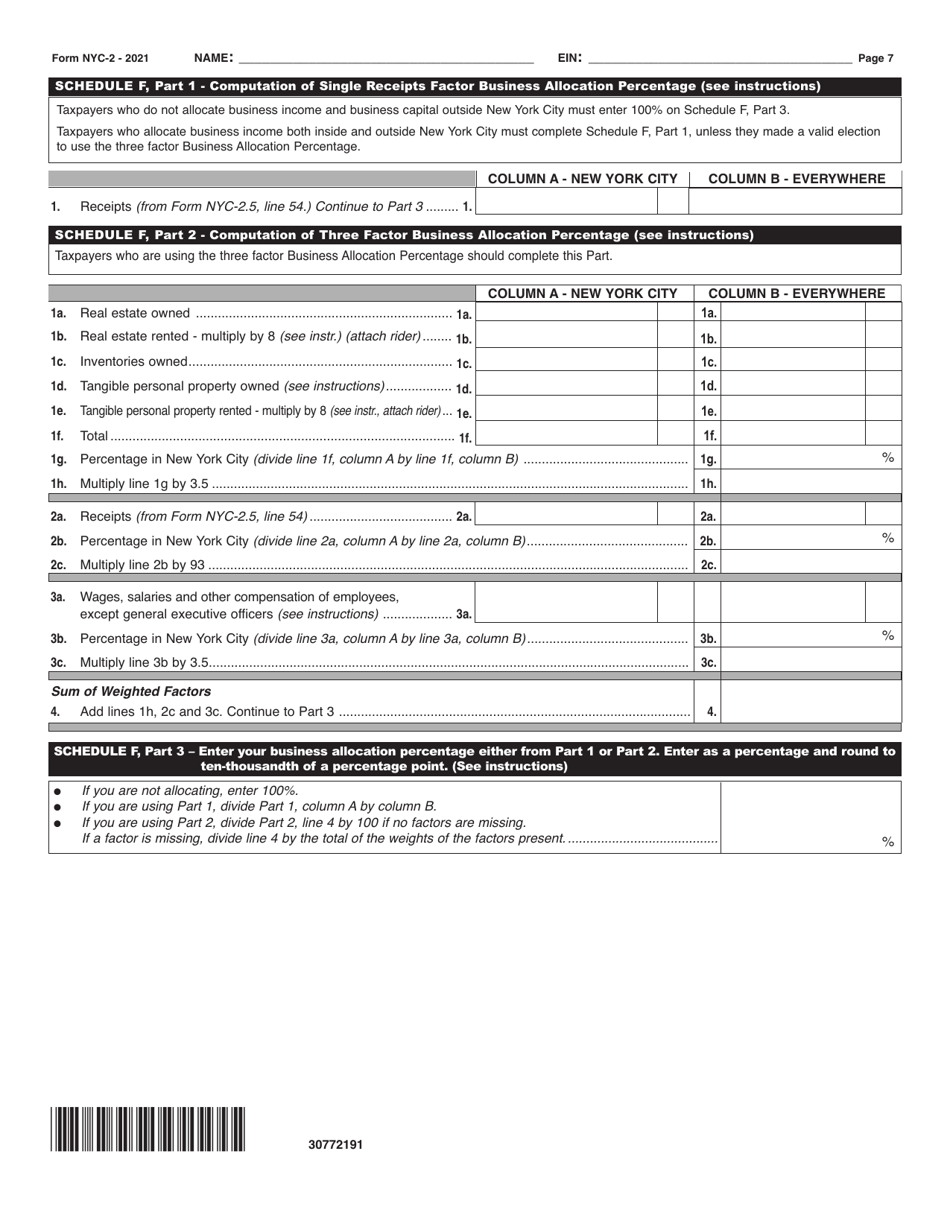

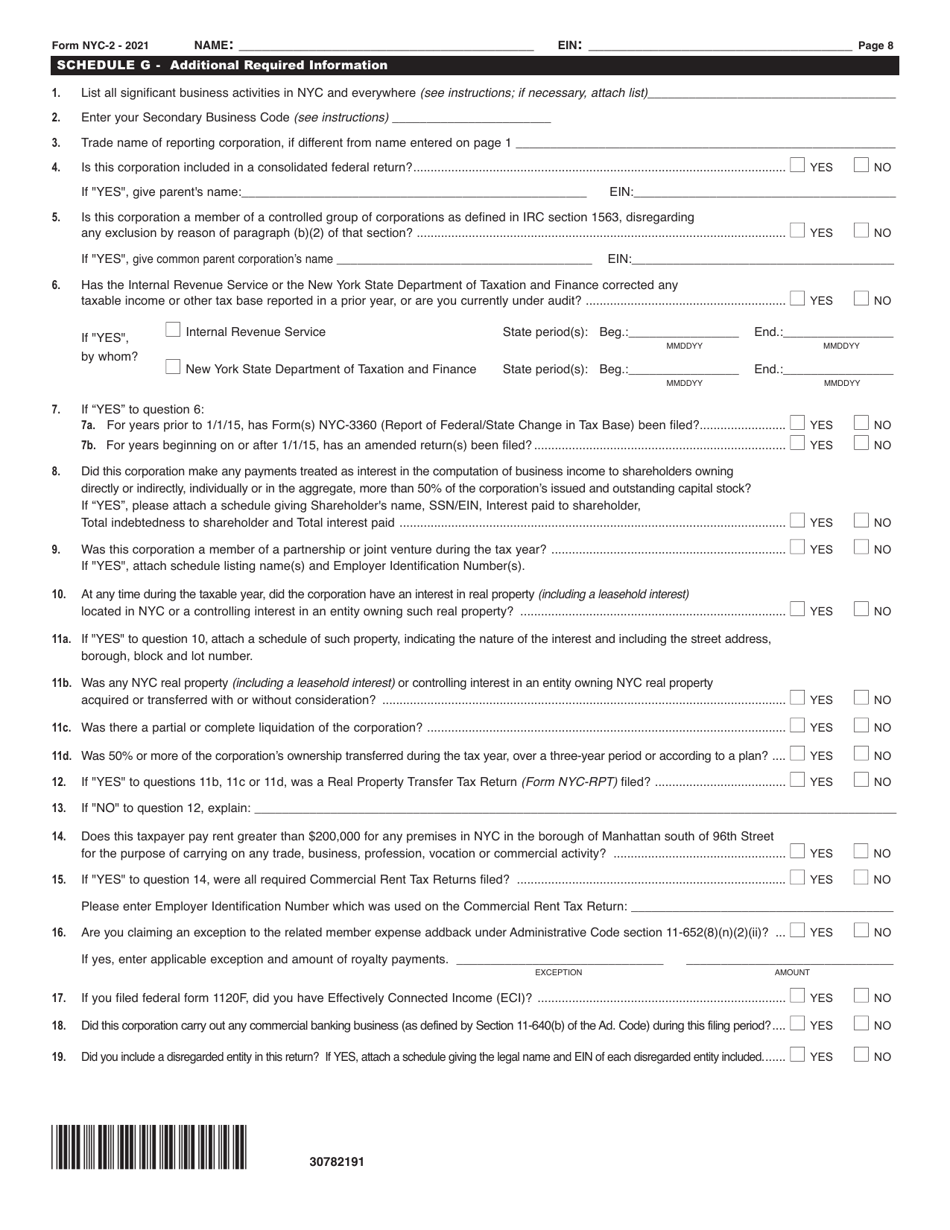

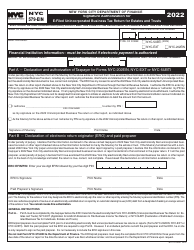

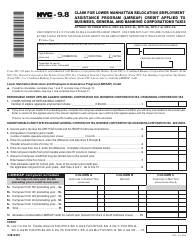

Form NYC-2 Business Corporation Tax Return - New York City

What Is Form NYC-2?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the NYC-2 Business Corporation Tax Return?

A: The NYC-2 Business Corporation Tax Return is a tax form that businesses in New York City need to file to report their corporate income and calculate their tax liability.

Q: Who needs to file the NYC-2 Business Corporation Tax Return?

A: Businesses that operate as corporations and have a presence in New York City are required to file the NYC-2 Business Corporation Tax Return.

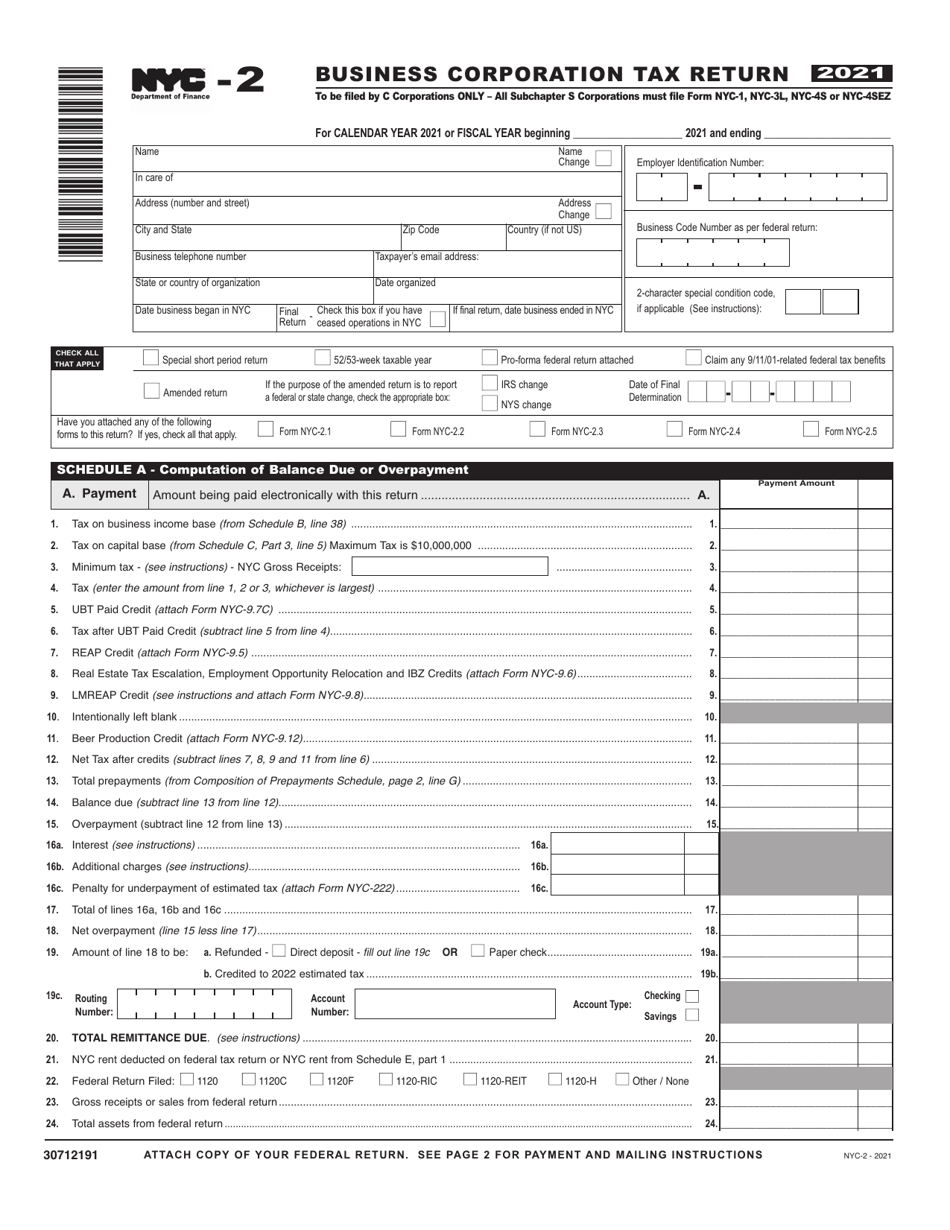

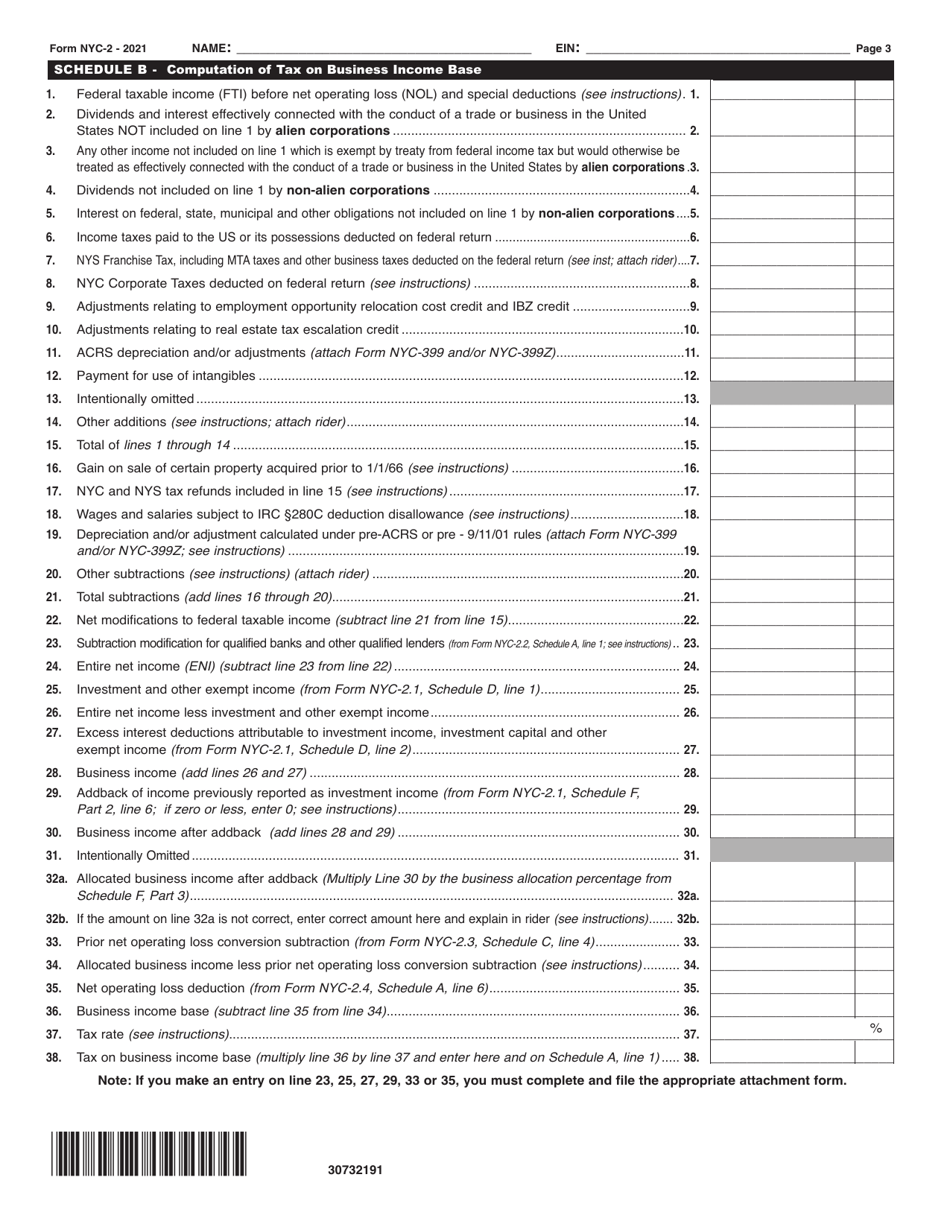

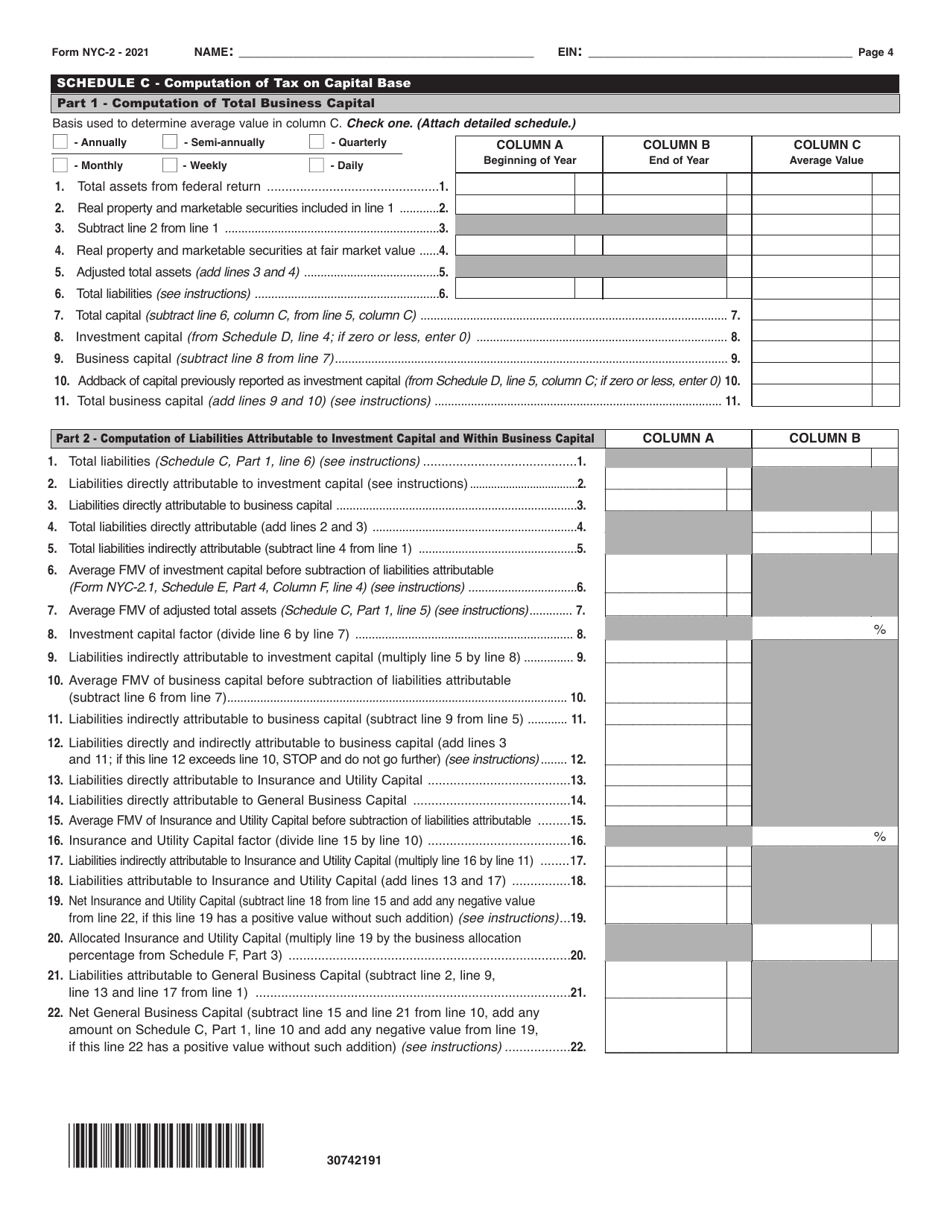

Q: What information is required to complete the NYC-2 Business Corporation Tax Return?

A: To complete the NYC-2 Business Corporation Tax Return, you will need to provide information about your business's income, deductions, credits, and other tax-related details.

Q: When is the deadline to file the NYC-2 Business Corporation Tax Return?

A: The deadline to file the NYC-2 Business Corporation Tax Return is generally on or before the 15th day of the third month following the close of your business's tax year.

Q: Are there any penalties for late filing or non-filing of the NYC-2 Business Corporation Tax Return?

A: Yes, there are penalties for late filing or non-filing of the NYC-2 Business Corporation Tax Return. It is important to file your return on time to avoid these penalties.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.