This version of the form is not currently in use and is provided for reference only. Download this version of

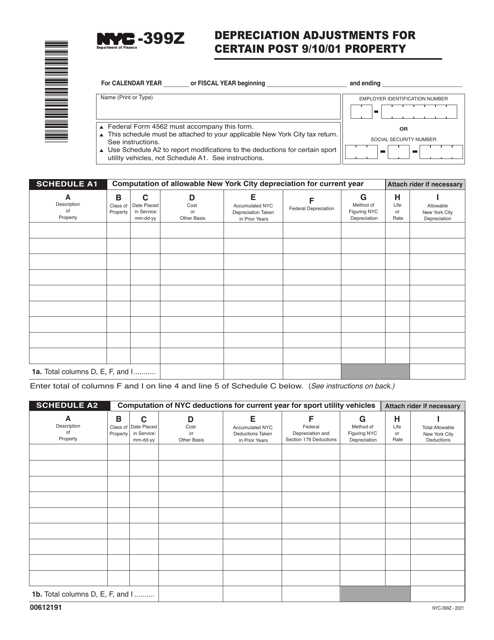

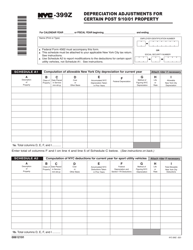

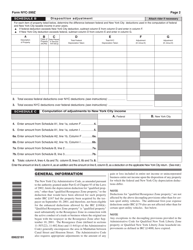

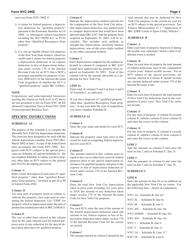

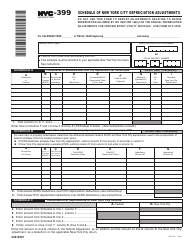

Form NYC-399Z

for the current year.

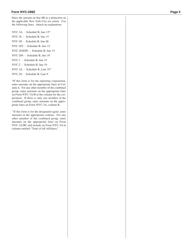

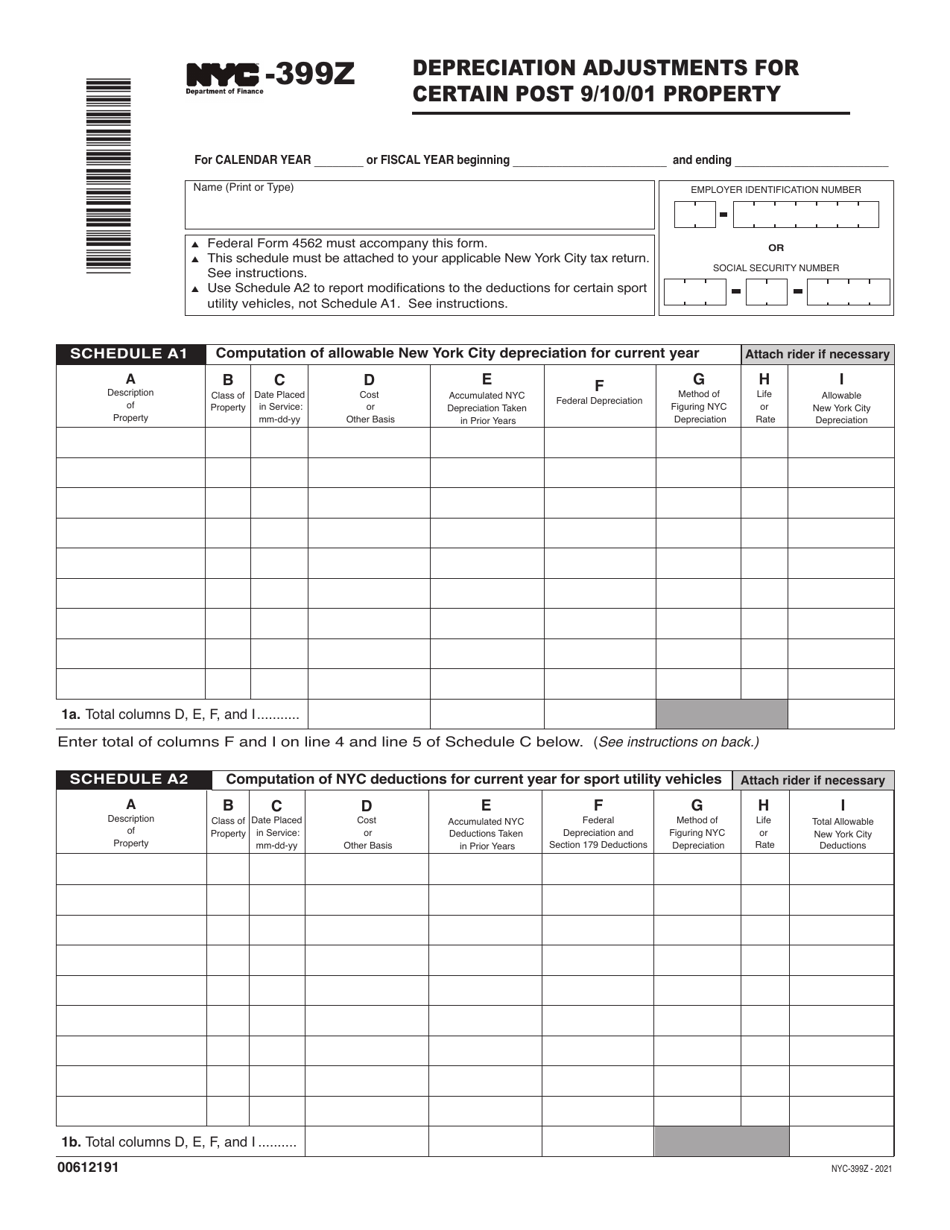

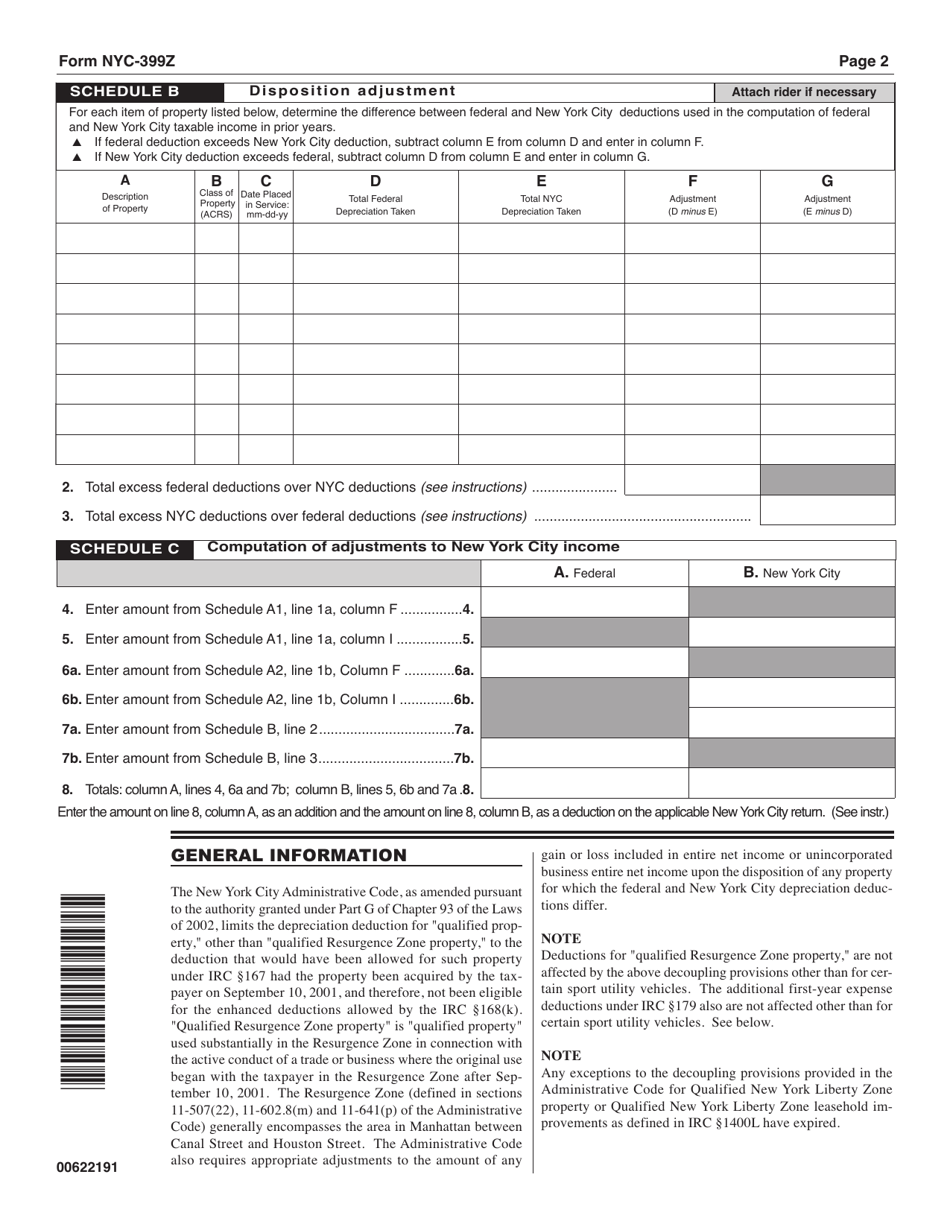

Form NYC-399Z Depreciation Adjustments for Certain Post 9 / 10 / 01 Property - New York City

What Is Form NYC-399Z?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-399Z?

A: NYC-399Z is a form used in New York City to report depreciation adjustments for certain post 9/10/01 property.

Q: What is the purpose of NYC-399Z?

A: The purpose of NYC-399Z is to report any depreciation adjustments that need to be made for certain types of property acquired after September 10, 2001 in New York City.

Q: Who needs to file NYC-399Z?

A: Individuals and businesses in New York City who have acquired eligible property after September 10, 2001 and need to report depreciation adjustments must file NYC-399Z.

Q: What types of property are eligible for depreciation adjustments on NYC-399Z?

A: Only certain types of property acquired after September 10, 2001 in New York City are eligible for depreciation adjustments on NYC-399Z. Details of eligible property can be found in the form instructions.

Q: When is the deadline for filing NYC-399Z?

A: The deadline for filing NYC-399Z is typically April 15th of the following tax year. However, it is always recommended to check the latest deadline with the New York City Department of Finance.

Q: Is there a penalty for not filing NYC-399Z?

A: Yes, there may be penalties for not filing NYC-399Z or filing it late. It is important to comply with the filing requirements to avoid penalties and potential audit issues.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-399Z by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.