This version of the form is not currently in use and is provided for reference only. Download this version of

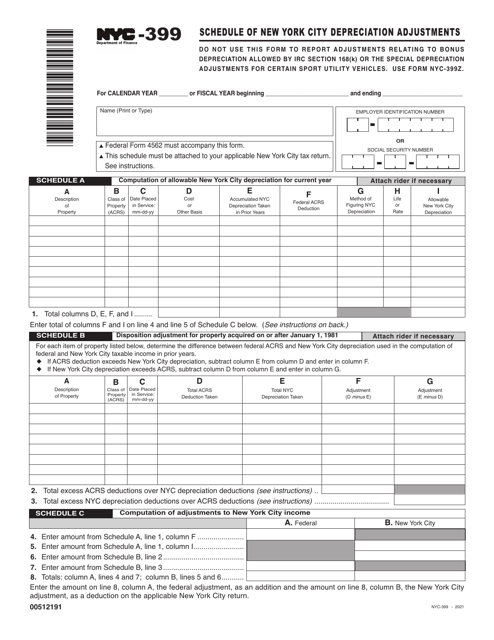

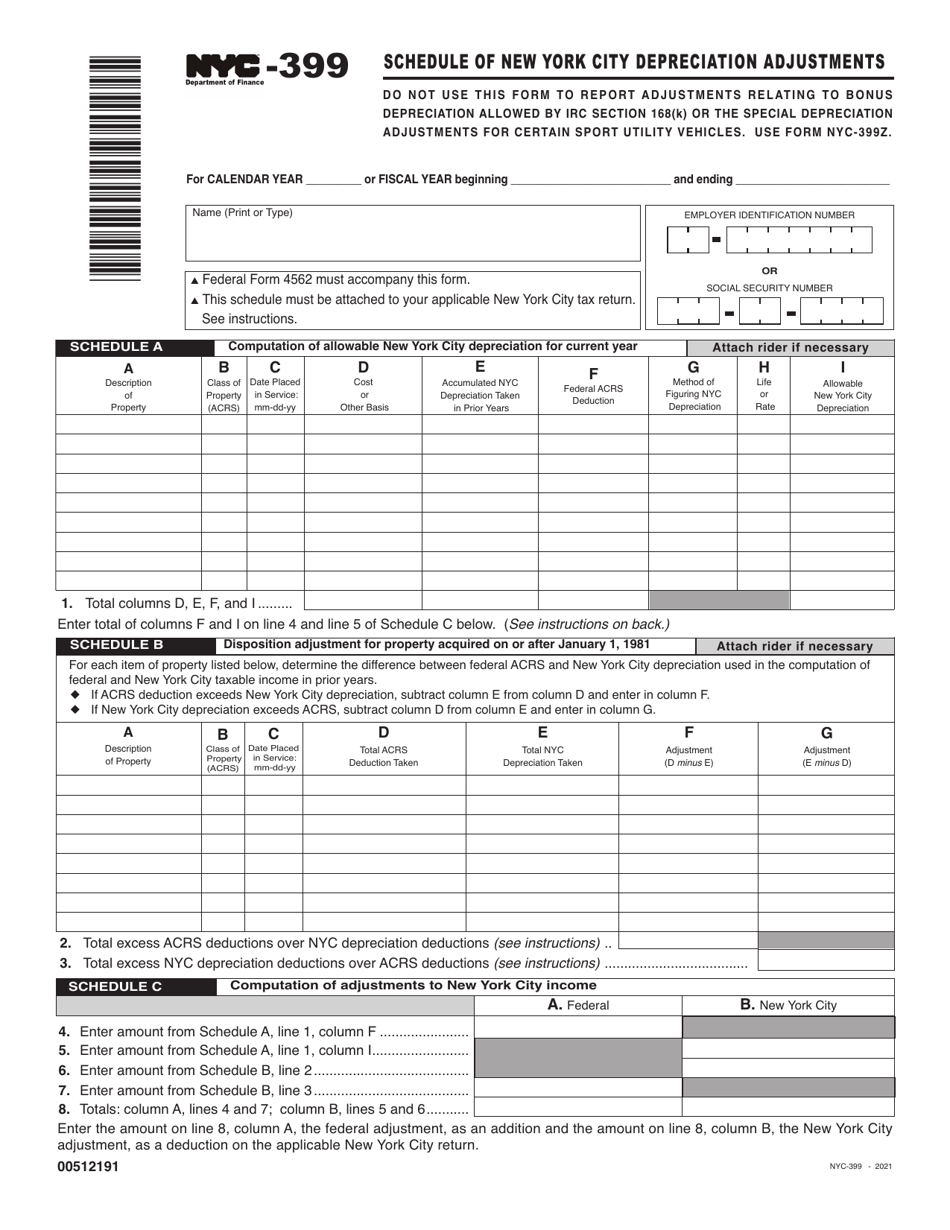

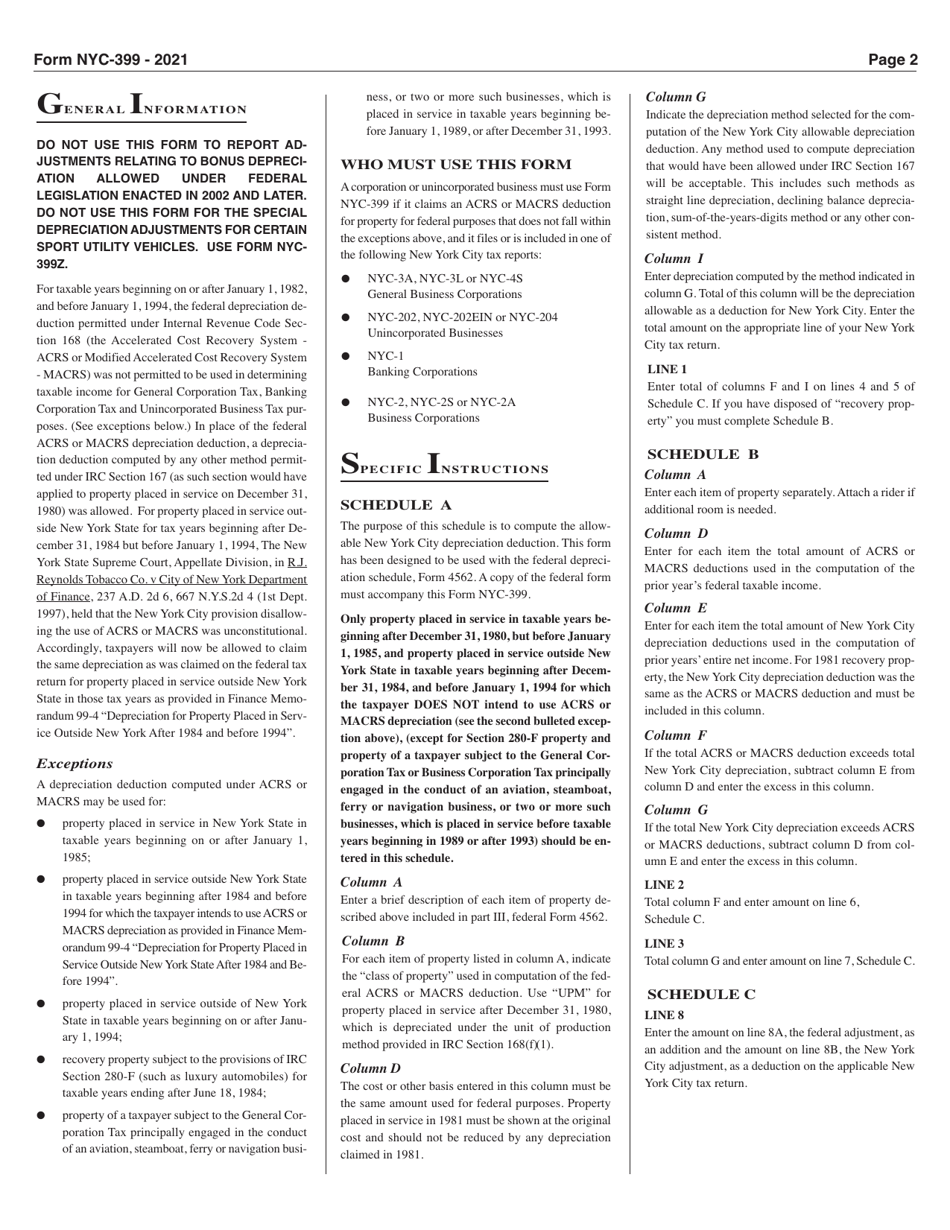

Form NYC-399

for the current year.

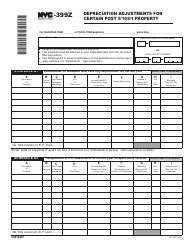

Form NYC-399 Schedule of New York City Depreciation Adjustments - New York City

What Is Form NYC-399?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-399 Schedule of New York City Depreciation Adjustments?

A: The NYC-399 Schedule is a form used by businesses to report depreciation adjustments for assets located in New York City.

Q: Who needs to file the NYC-399 Schedule?

A: Businesses that own assets located in New York City and have made depreciation adjustments for tax purposes need to file the NYC-399 Schedule.

Q: When is the deadline to file the NYC-399 Schedule?

A: The deadline to file the NYC-399 Schedule is typically March 15th of each year, or the next business day if it falls on a weekend or holiday.

Q: What kind of depreciation adjustments should be reported on the NYC-399 Schedule?

A: The NYC-399 Schedule should include depreciation adjustments related to assets located in New York City, such as changes in useful life, salvage value, or other factors affecting depreciation calculations.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-399 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.