This version of the form is not currently in use and is provided for reference only. Download this version of

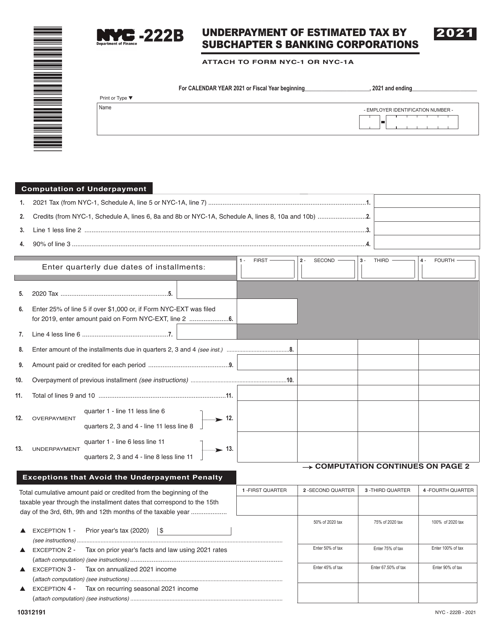

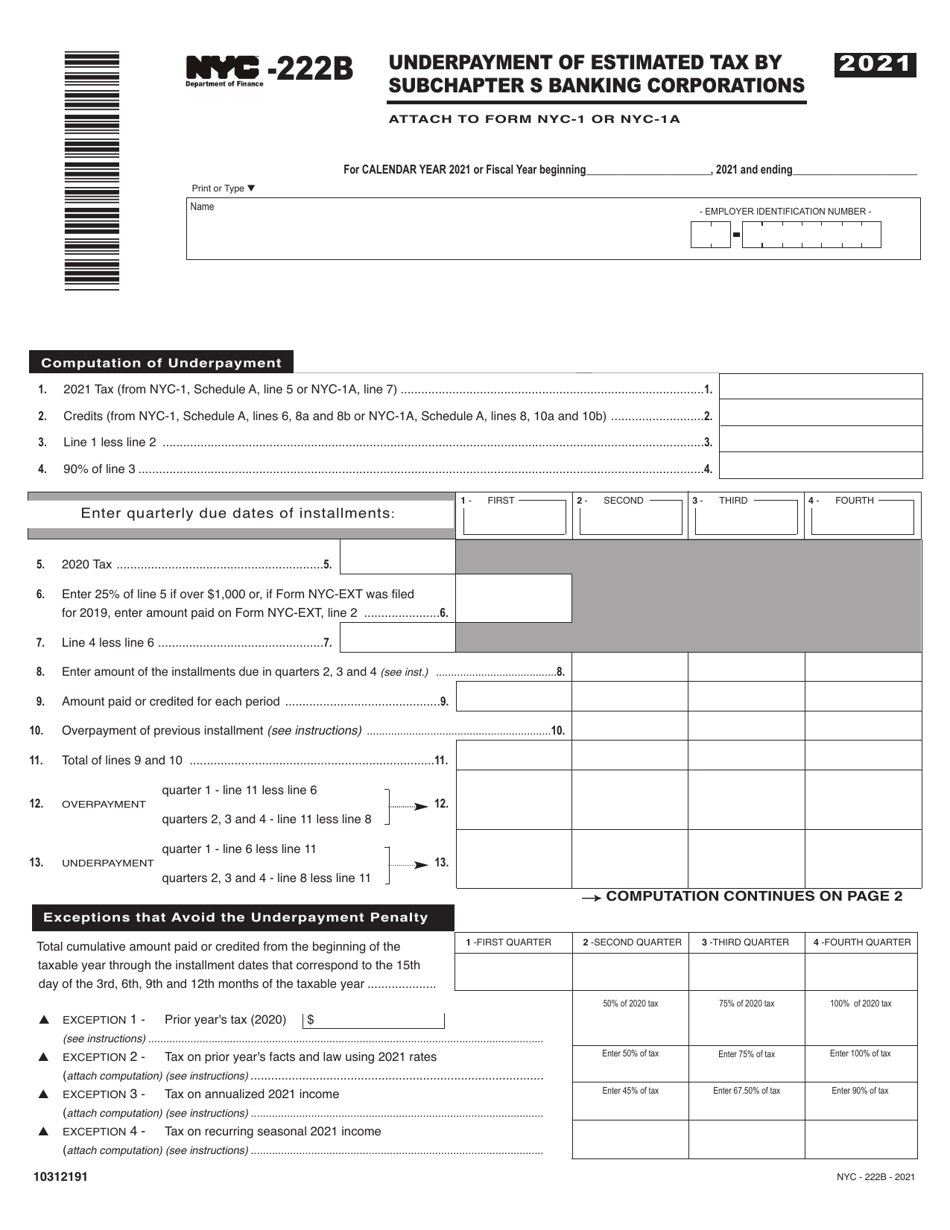

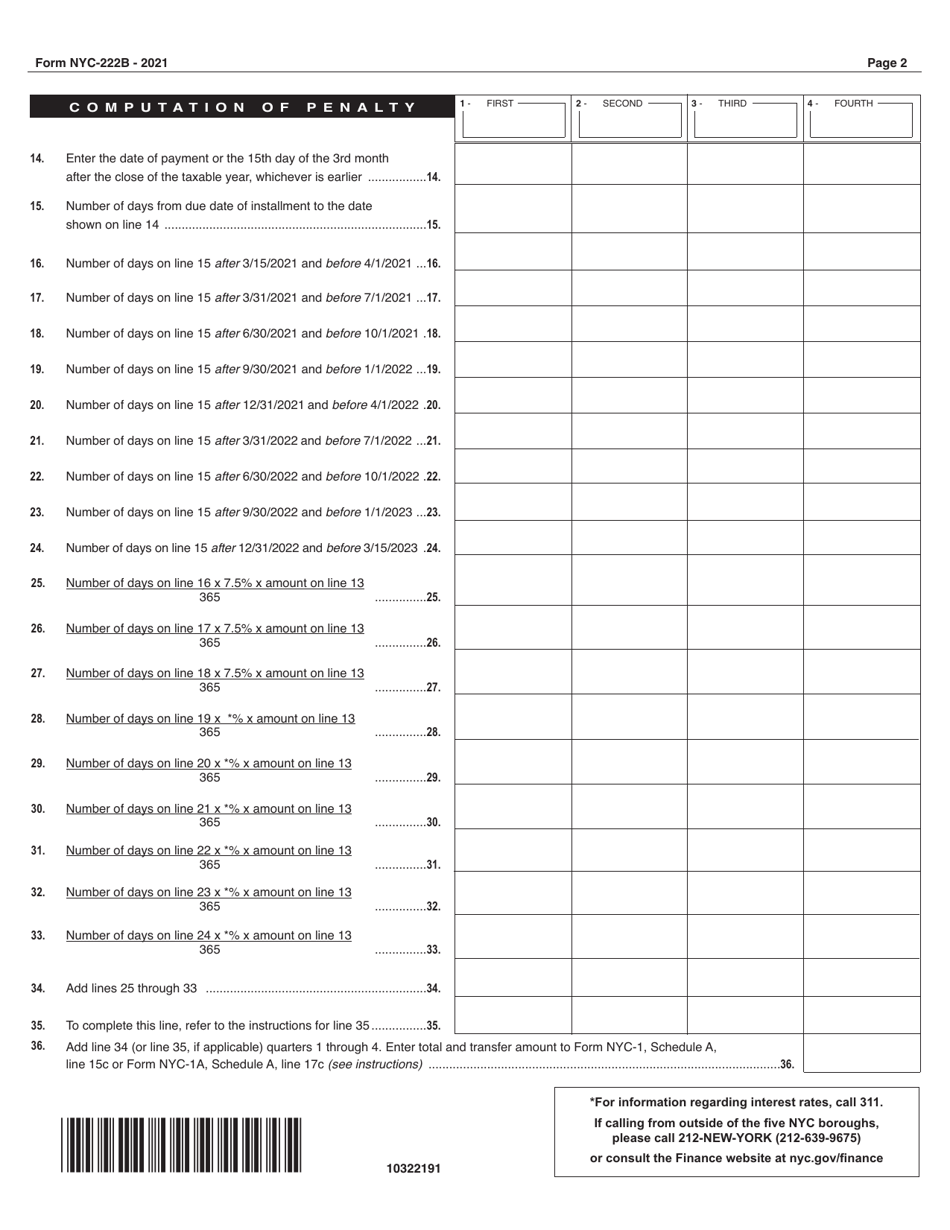

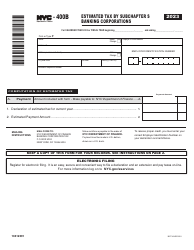

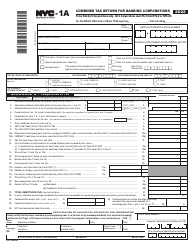

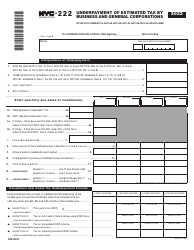

Form NYC-222B

for the current year.

Form NYC-222B Underpayment of Estimated Tax by Subchapter S Banking Corporations - New York City

What Is Form NYC-222B?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NYC-222B?

A: Form NYC-222B is a tax form used by subchapter S banking corporations in New York City to report and pay underpayment of estimated tax.

Q: Who needs to file Form NYC-222B?

A: Subchapter S banking corporations in New York City who have underpaid their estimated tax need to file Form NYC-222B.

Q: What is the purpose of Form NYC-222B?

A: The purpose of Form NYC-222B is to report and pay underpayment of estimated tax by subchapter S banking corporations in New York City.

Q: When is the due date for filing Form NYC-222B?

A: The due date for filing Form NYC-222B is the same as the due date for their annual franchise tax return, which is usually March 15th.

Q: Are there any penalties for late filing of Form NYC-222B?

A: Yes, there are penalties for late filing of Form NYC-222B. It is important to file the form on time to avoid penalties and interest charges.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-222B by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.