This version of the form is not currently in use and is provided for reference only. Download this version of

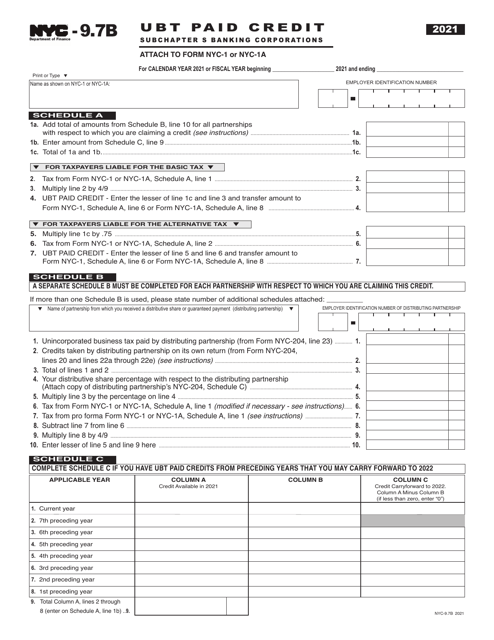

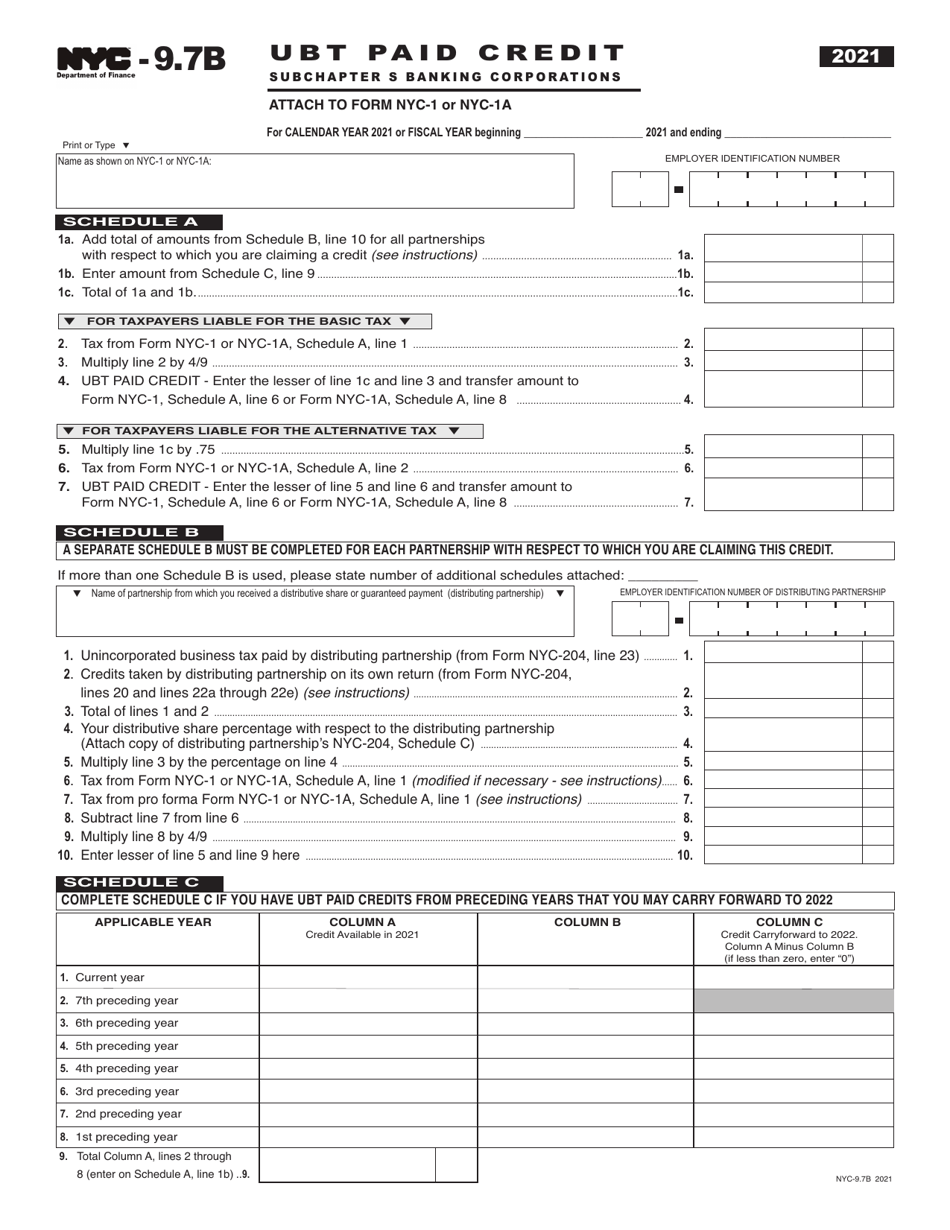

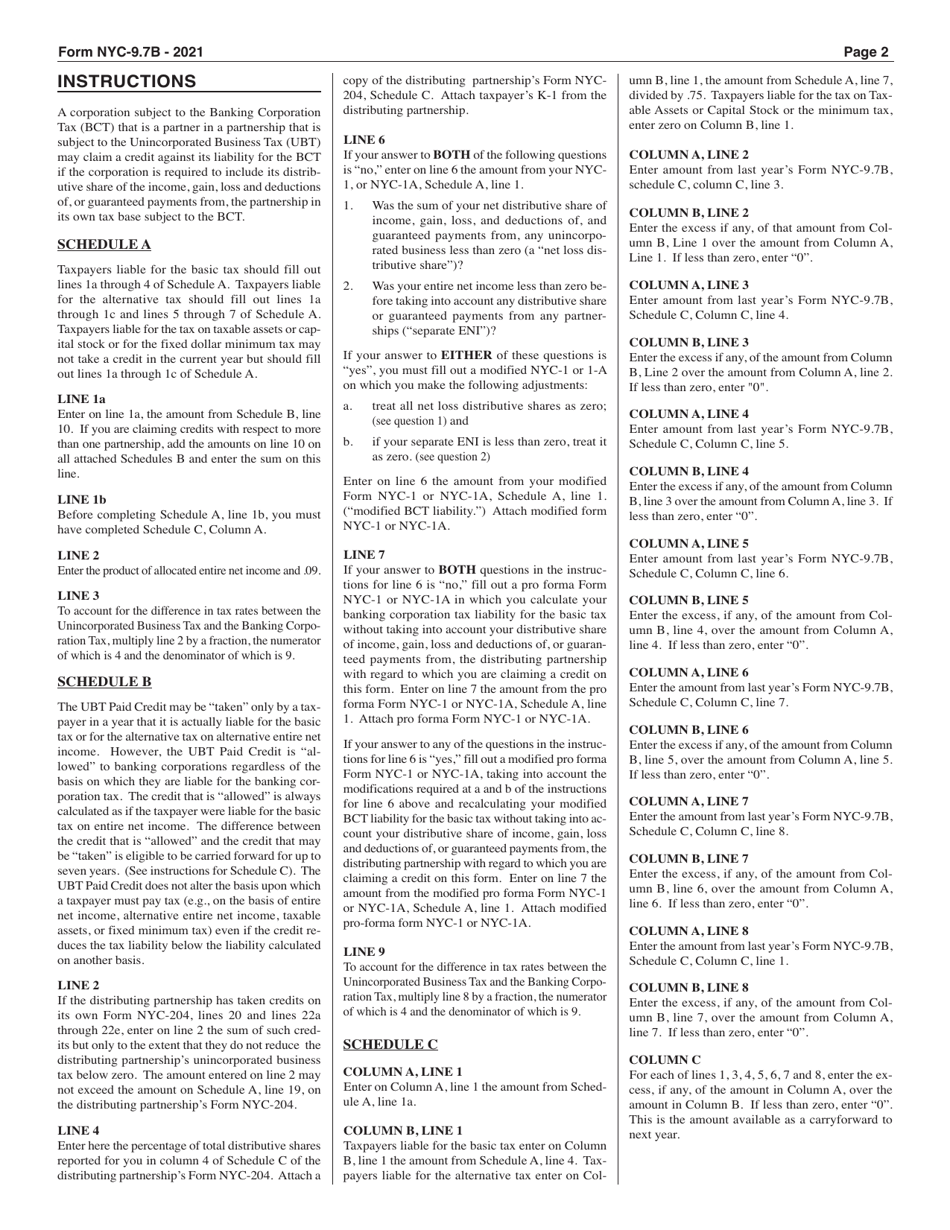

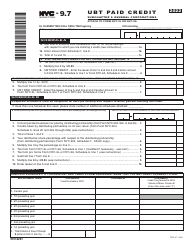

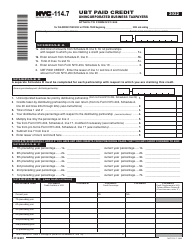

Form NYC-9.7B

for the current year.

Form NYC-9.7B Ubt Paid Credit - Subchapter S Banking Corporations - New York City

What Is Form NYC-9.7B?

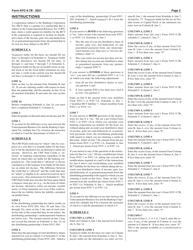

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-9.7B?

A: NYC-9.7B is a form used for reporting UBT paid credit for Subchapter S Banking Corporations in New York City.

Q: What does UBT stand for?

A: UBT stands for Unincorporated Business Tax.

Q: Who is required to file NYC-9.7B?

A: Subchapter S Banking Corporations in New York City are required to file NYC-9.7B.

Q: What is the purpose of NYC-9.7B?

A: The purpose of NYC-9.7B is to report the UBT paid credit for Subchapter S Banking Corporations.

Q: Are Subchapter S Banking Corporations exempt from UBT?

A: No, Subchapter S Banking Corporations are not exempt from UBT. They are required to pay the tax and report it on NYC-9.7B.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-9.7B by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.