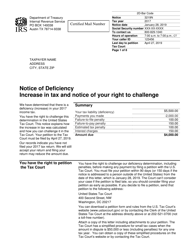

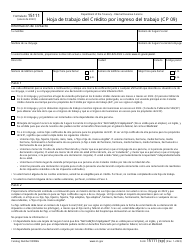

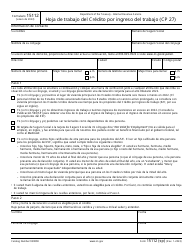

This version of the form is not currently in use and is provided for reference only. Download this version of

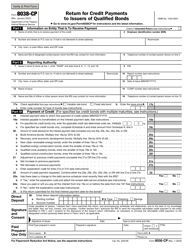

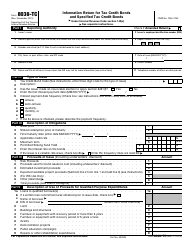

IRS Form 8038-CP Schedule A

for the current year.

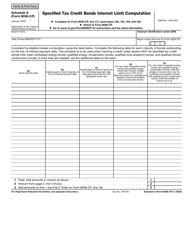

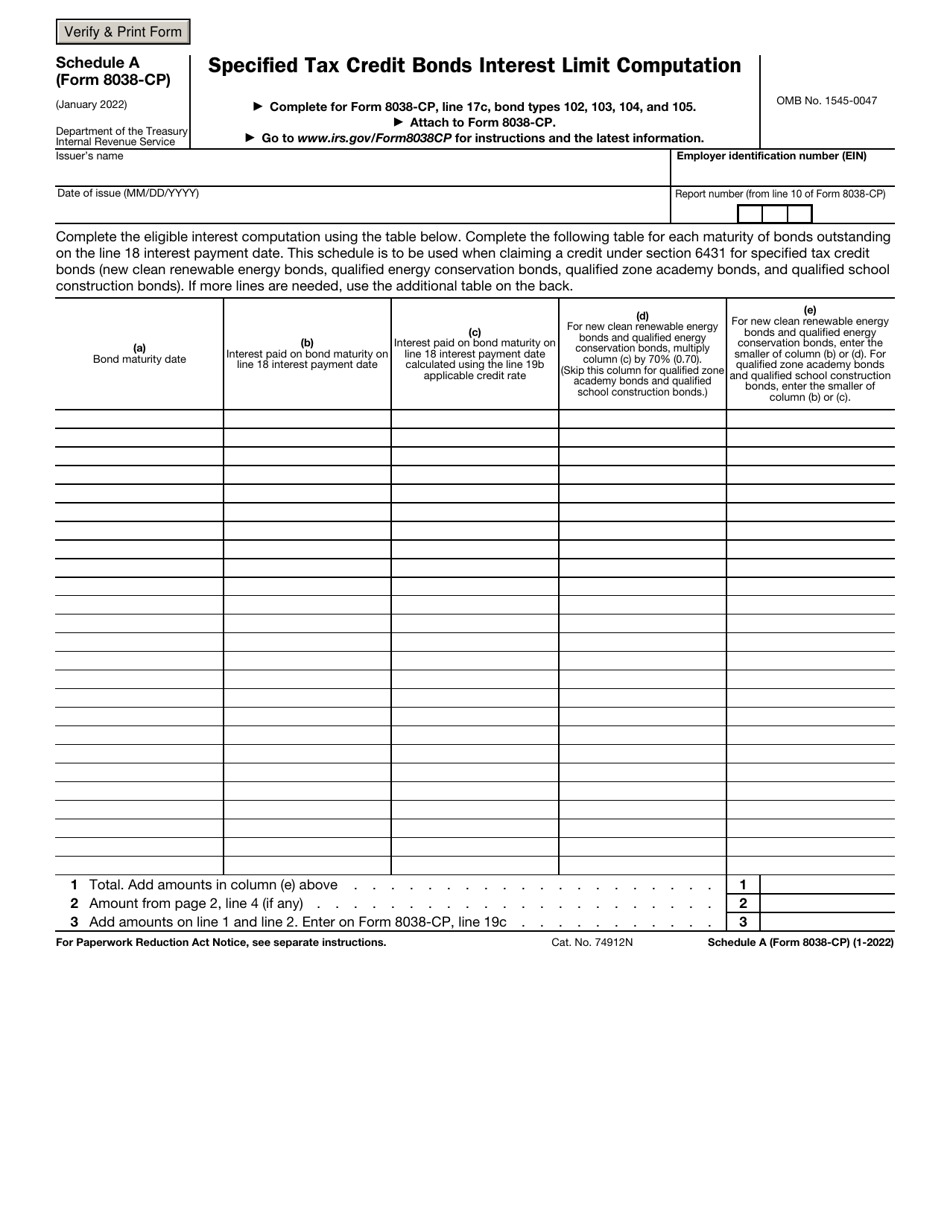

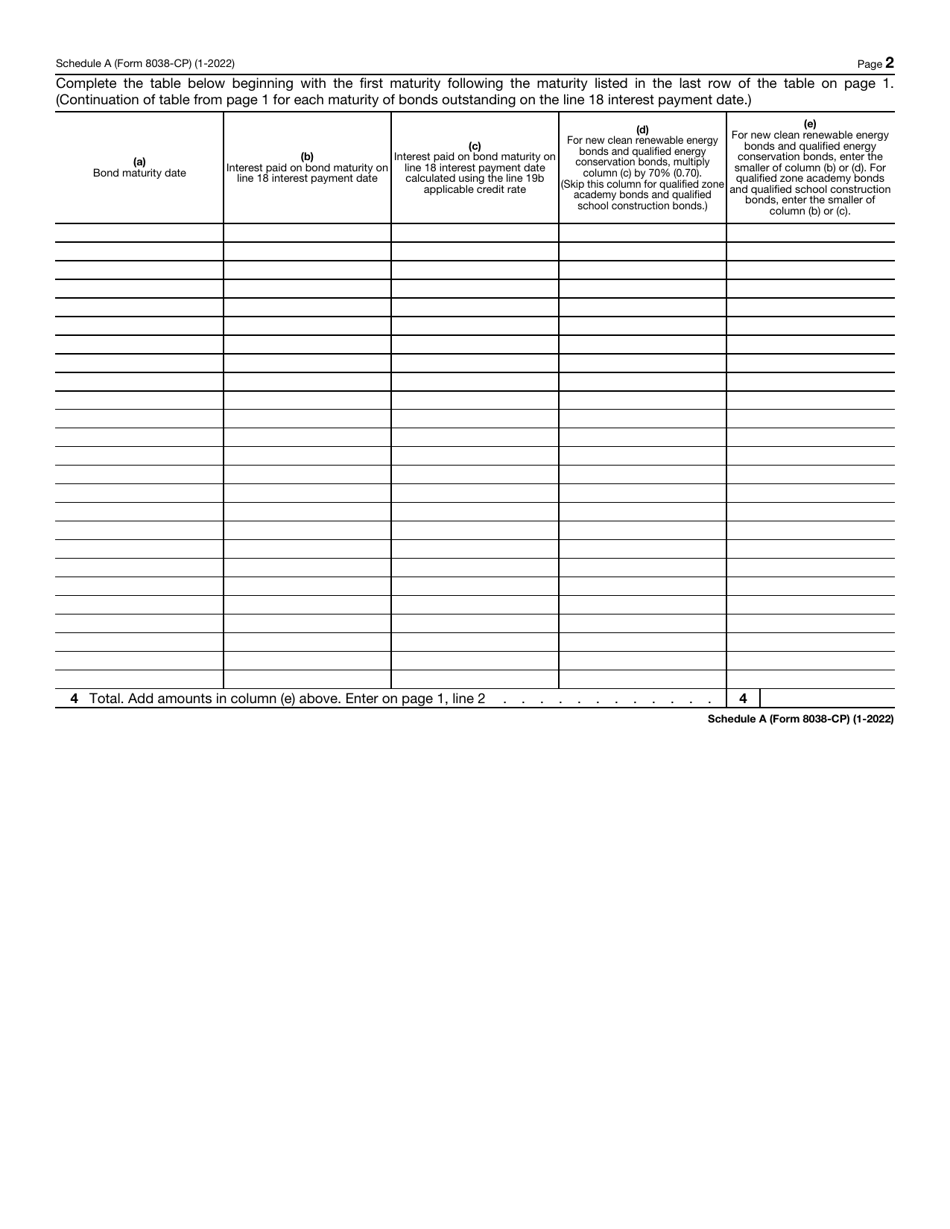

IRS Form 8038-CP Schedule A Specified Tax Credit Bonds Interest Limit Computation

What Is IRS Form 8038-CP Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2022. The document is a supplement to IRS Form 8038-CP, Return for Credit Payments to Issuers of Qualified Bonds. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8038-CP?

A: IRS Form 8038-CP is a form used to compute the interest limit for specified tax credit bonds.

Q: What is Schedule A of Form 8038-CP?

A: Schedule A is a part of Form 8038-CP that is used to calculate the interest limit for specified tax credit bonds.

Q: What are specified tax credit bonds?

A: Specified tax credit bonds are bonds that offer tax credits instead of interest payments to the bondholders.

Q: Why is the interest limit important for specified tax credit bonds?

A: The interest limit determines the maximum amount of interest that can be claimed on specified tax credit bonds for tax purposes.

Q: How do you compute the interest limit for specified tax credit bonds?

A: You can compute the interest limit by following the instructions provided in Schedule A of Form 8038-CP.

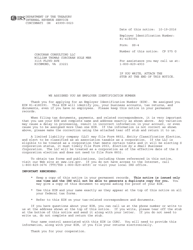

Q: Who needs to use IRS Form 8038-CP?

A: Any issuer of specified tax credit bonds needs to use IRS Form 8038-CP to compute the interest limit.

Q: Is there a deadline for filing Form 8038-CP?

A: Yes, there is a deadline for filing Form 8038-CP. The specific deadline can vary depending on the situation, so it is important to check the instructions or consult with a tax professional.

Q: What happens if I don't file Form 8038-CP?

A: Failure to file Form 8038-CP or filing it late can result in penalties or the loss of certain tax benefits.

Q: Can I e-file Form 8038-CP?

A: No, you cannot e-file Form 8038-CP. It must be filed in paper format and mailed to the designated IRS address.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8038-CP Schedule A through the link below or browse more documents in our library of IRS Forms.