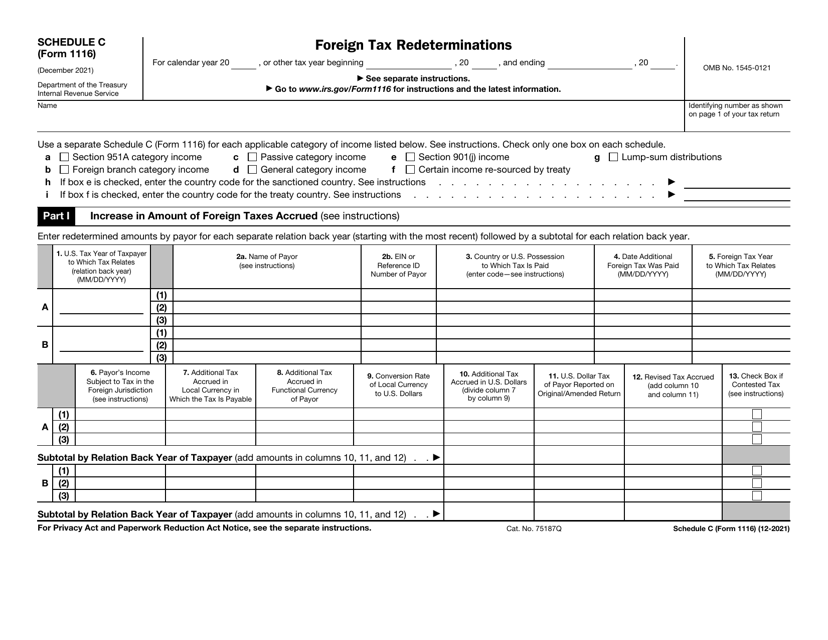

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1116 Schedule C

for the current year.

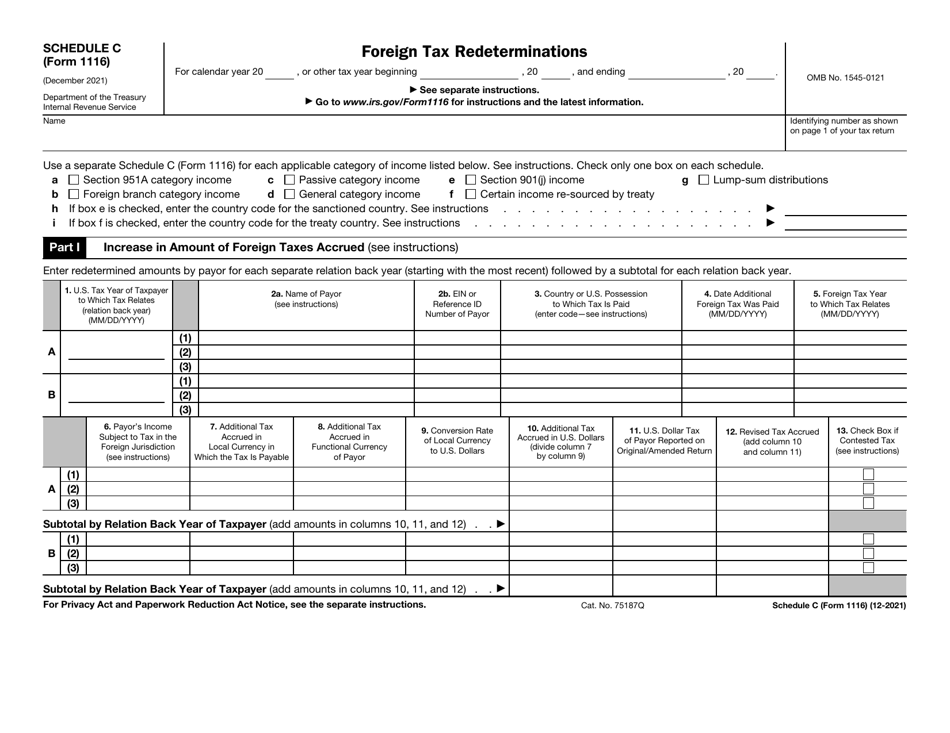

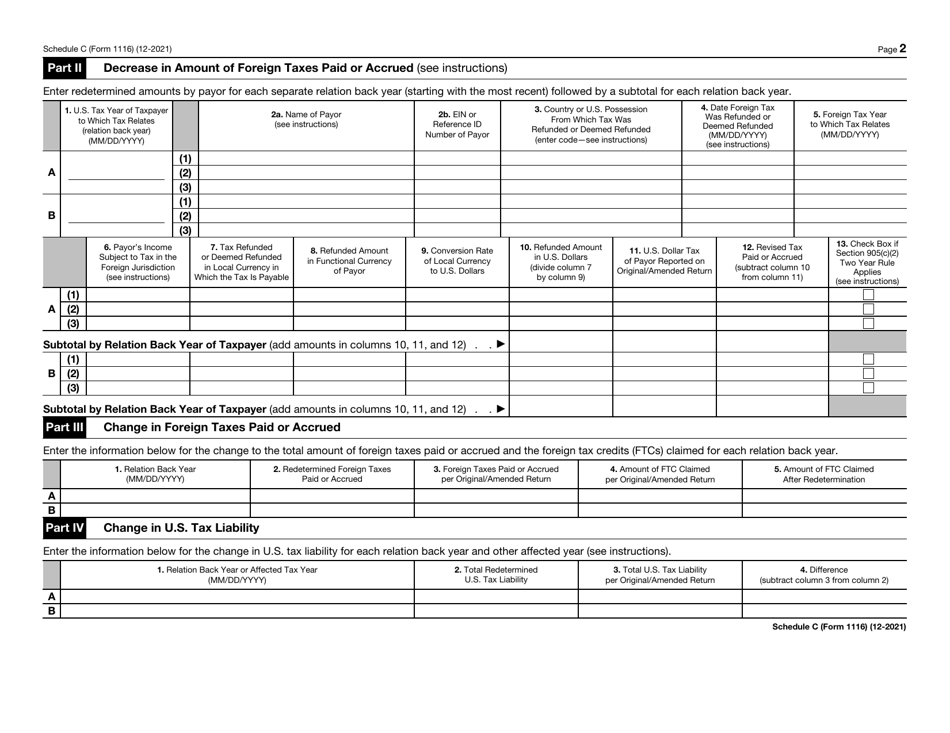

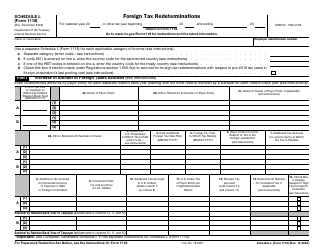

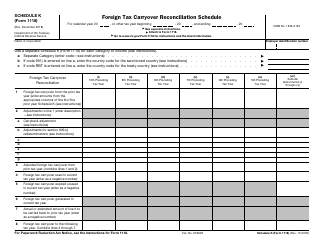

IRS Form 1116 Schedule C Foreign Tax Redeterminations

What Is IRS Form 1116 Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1116?

A: IRS Form 1116 is a form used to calculate the foreign tax credit.

Q: What is Schedule C?

A: Schedule C is a form used to report business income and expenses.

Q: What are foreign tax redeterminations?

A: Foreign tax redeterminations are changes made to previously reported foreign taxes.

Q: How do I report foreign tax redeterminations?

A: You report foreign tax redeterminations on Schedule C of IRS Form 1116.

Q: Why would foreign tax redeterminations occur?

A: Foreign tax redeterminations can occur due to changes in foreign tax laws or corrections to prior tax filings.

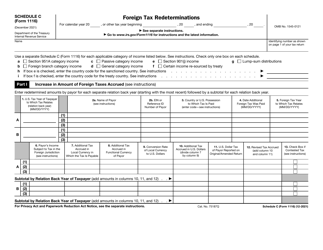

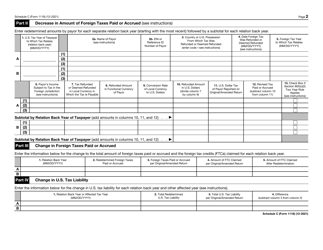

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1116 Schedule C through the link below or browse more documents in our library of IRS Forms.