This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule F

for the current year.

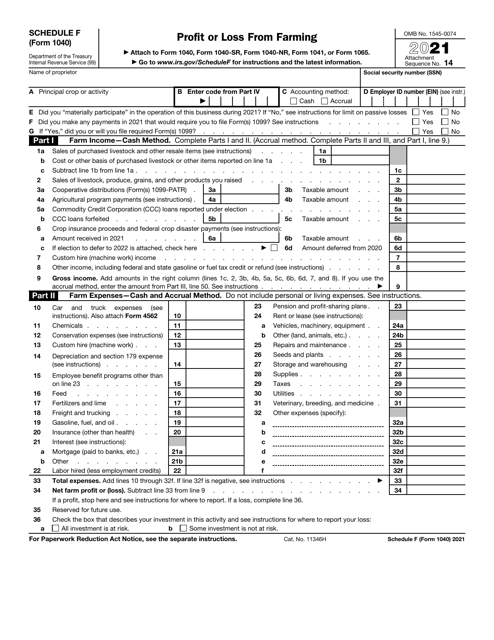

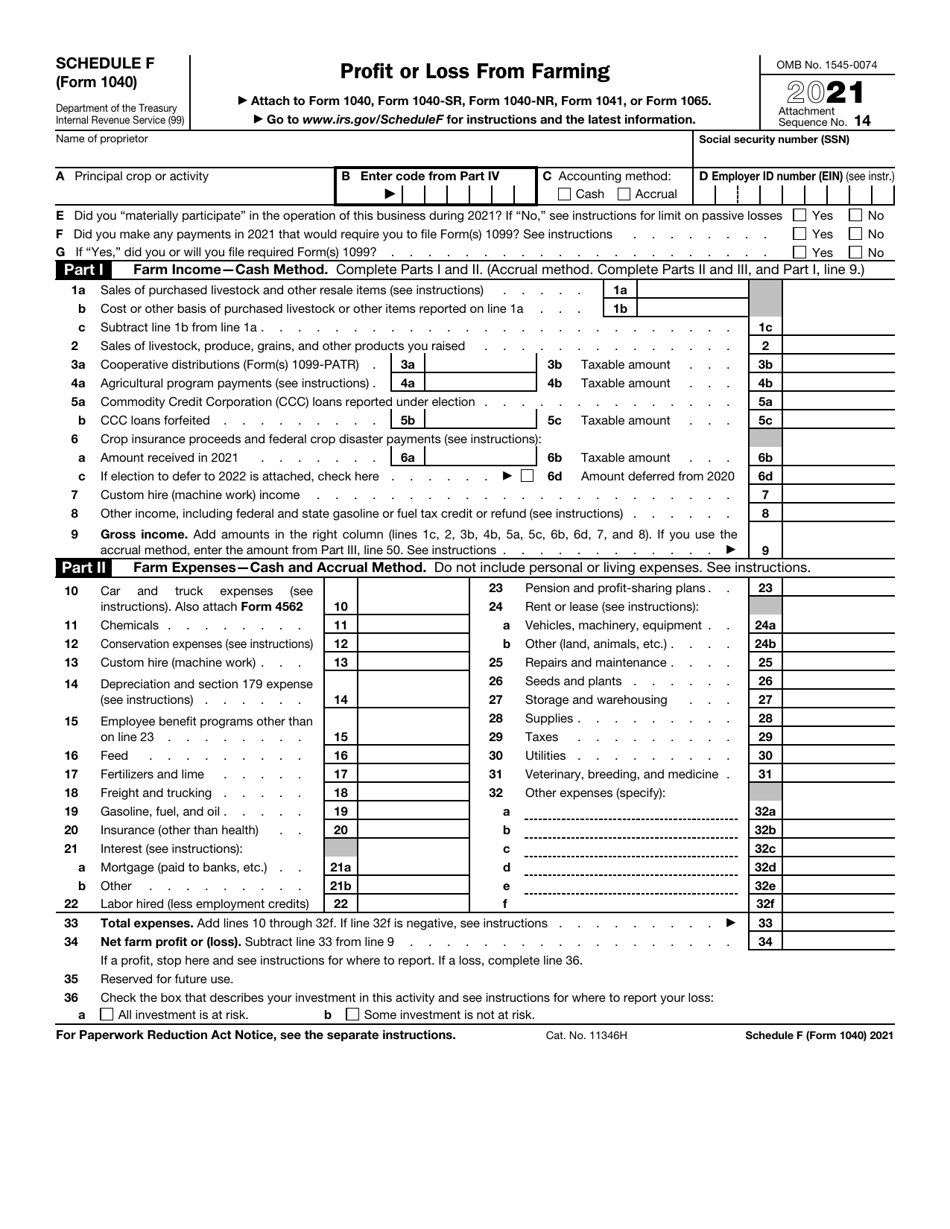

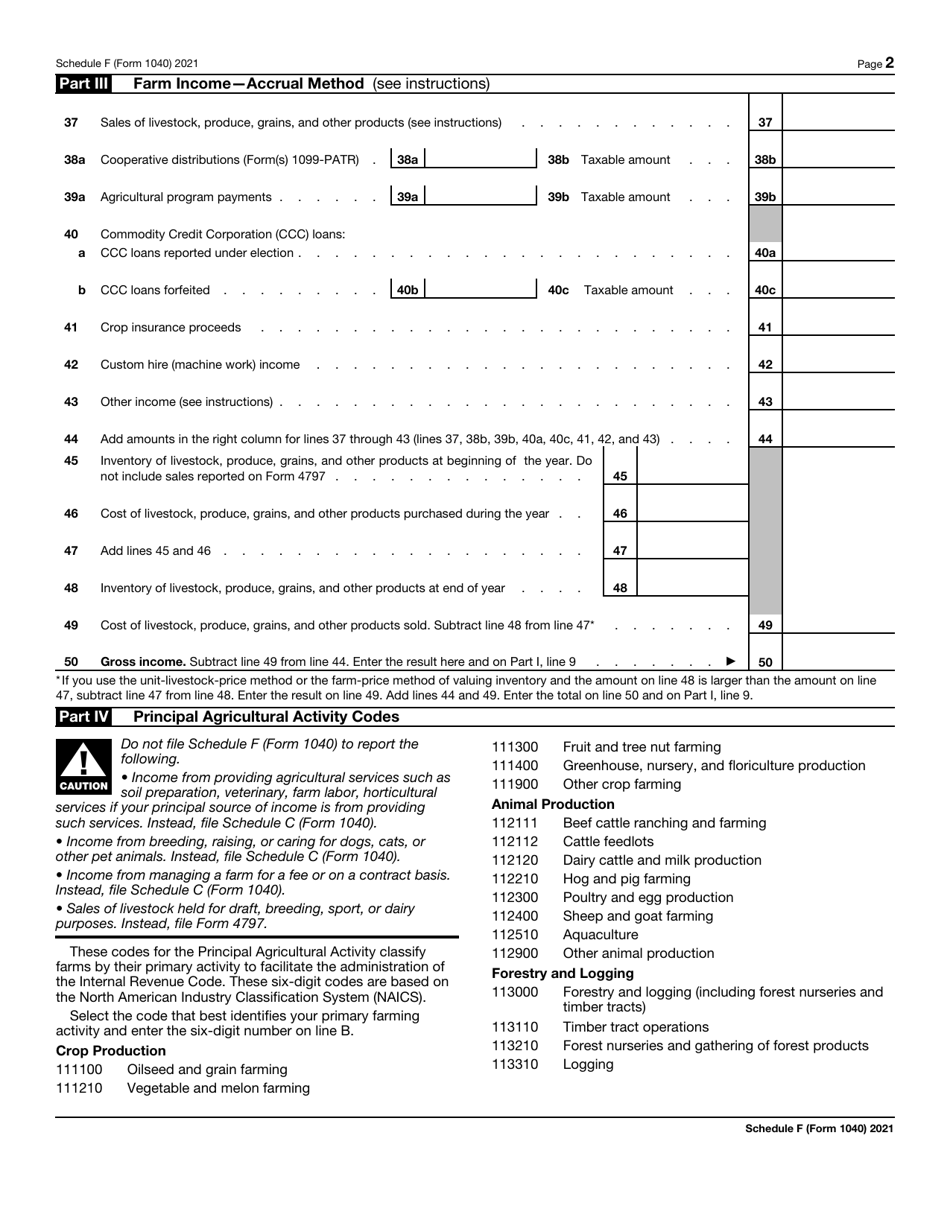

IRS Form 1040 Schedule F Profit or Loss From Farming

What Is IRS Form 1040 Schedule F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule F?

A: IRS Form 1040 Schedule F is a tax form used to report profit or loss from farming.

Q: Who should file IRS Form 1040 Schedule F?

A: Farmers who have a profit or loss from their farming activities should file IRS Form 1040 Schedule F.

Q: What kind of farming activities are included on IRS Form 1040 Schedule F?

A: IRS Form 1040 Schedule F includes activities such as cultivating land, operating a nursery or sod farm, or raising livestock or fish.

Q: What information is required on IRS Form 1040 Schedule F?

A: On IRS Form 1040 Schedule F, you will need to provide information about your farming income, expenses, and deductions.

Q: When is the deadline to file IRS Form 1040 Schedule F?

A: The deadline to file IRS Form 1040 Schedule F is typically the same as the deadline to file your federal income tax return, which is April 15th.

Q: Is there any specific threshold for filing IRS Form 1040 Schedule F?

A: No, there is no specific threshold for filing IRS Form 1040 Schedule F. If you have profit or loss from farming activities, you should file the form.

Q: Are there any specific deductions or credits available on IRS Form 1040 Schedule F for farmers?

A: Yes, there are several deductions and credits available on IRS Form 1040 Schedule F for farmers. These include deductions for farming expenses, self-employment taxes, and energy-efficient property.

Q: Can I electronically file IRS Form 1040 Schedule F?

A: Yes, you can electronically file IRS Form 1040 Schedule F using tax software or through a tax professional.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule F through the link below or browse more documents in our library of IRS Forms.