This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 944-X

for the current year.

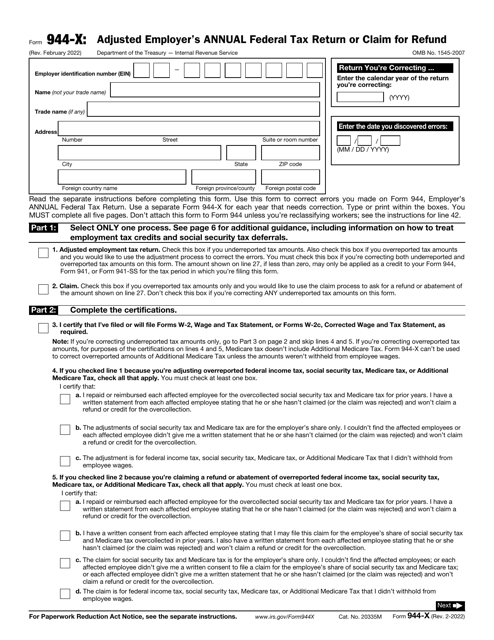

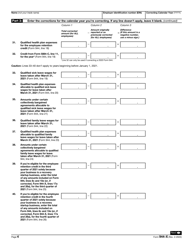

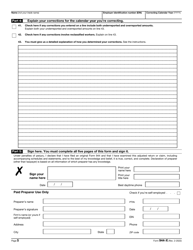

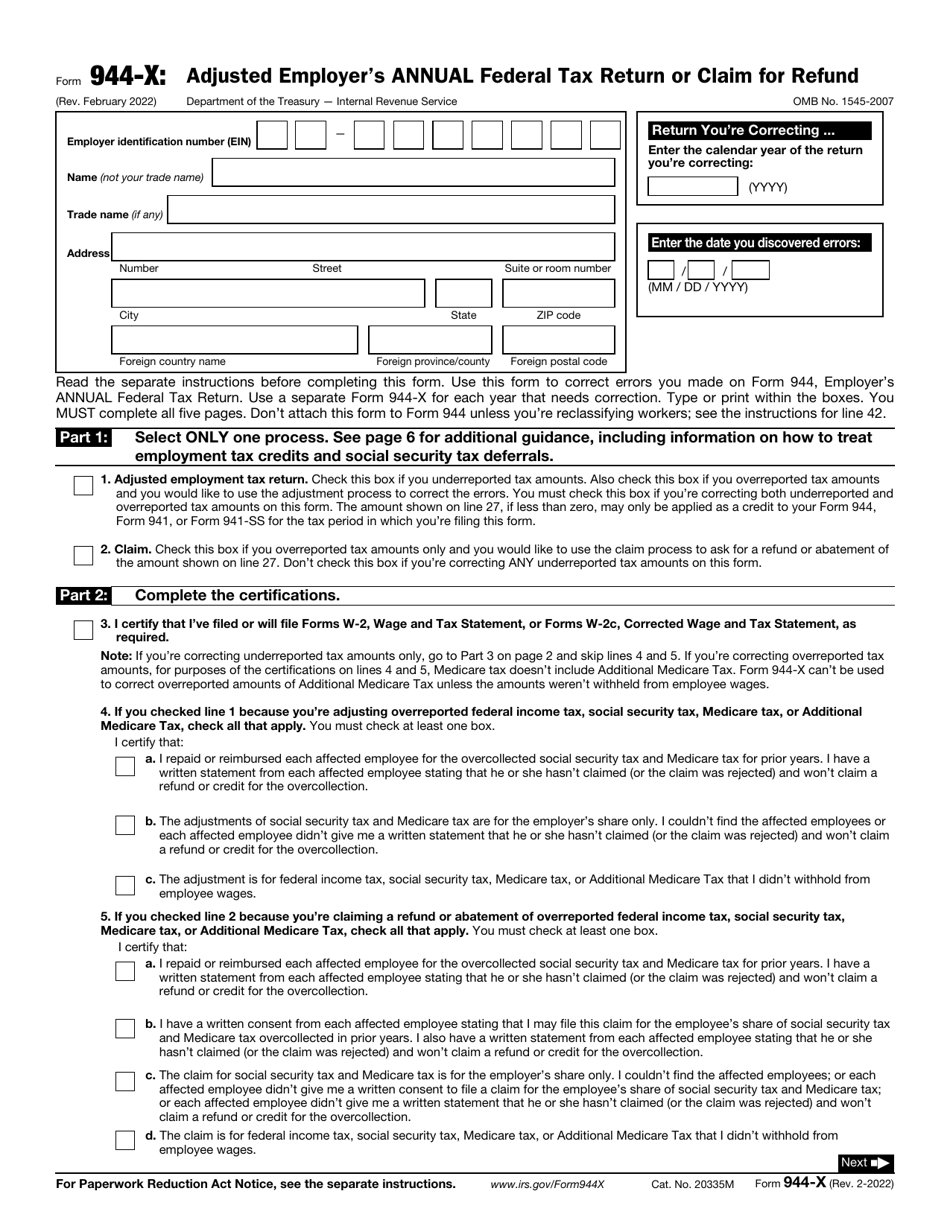

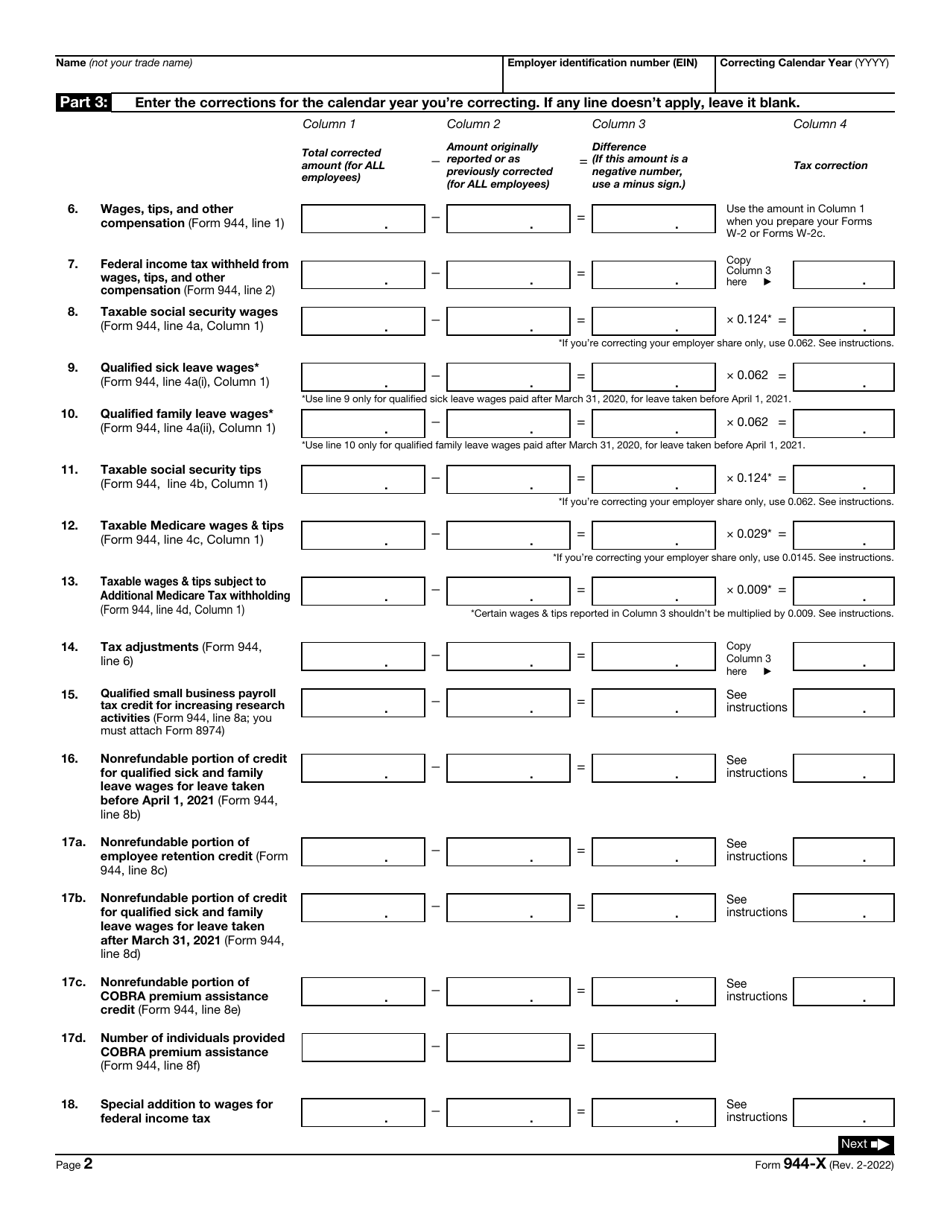

IRS Form 944-X Adjusted Employer's Annual Federal Tax Return or Claim for Refund

What Is IRS Form 944-X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2022. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 944-X?

A: IRS Form 944-X is the form used by employers to make adjustments to their annual federal tax returns or to claim refunds.

Q: Who should file IRS Form 944-X?

A: Employers who previously filed Form 944 and need to make adjustments or claim a refund should file IRS Form 944-X.

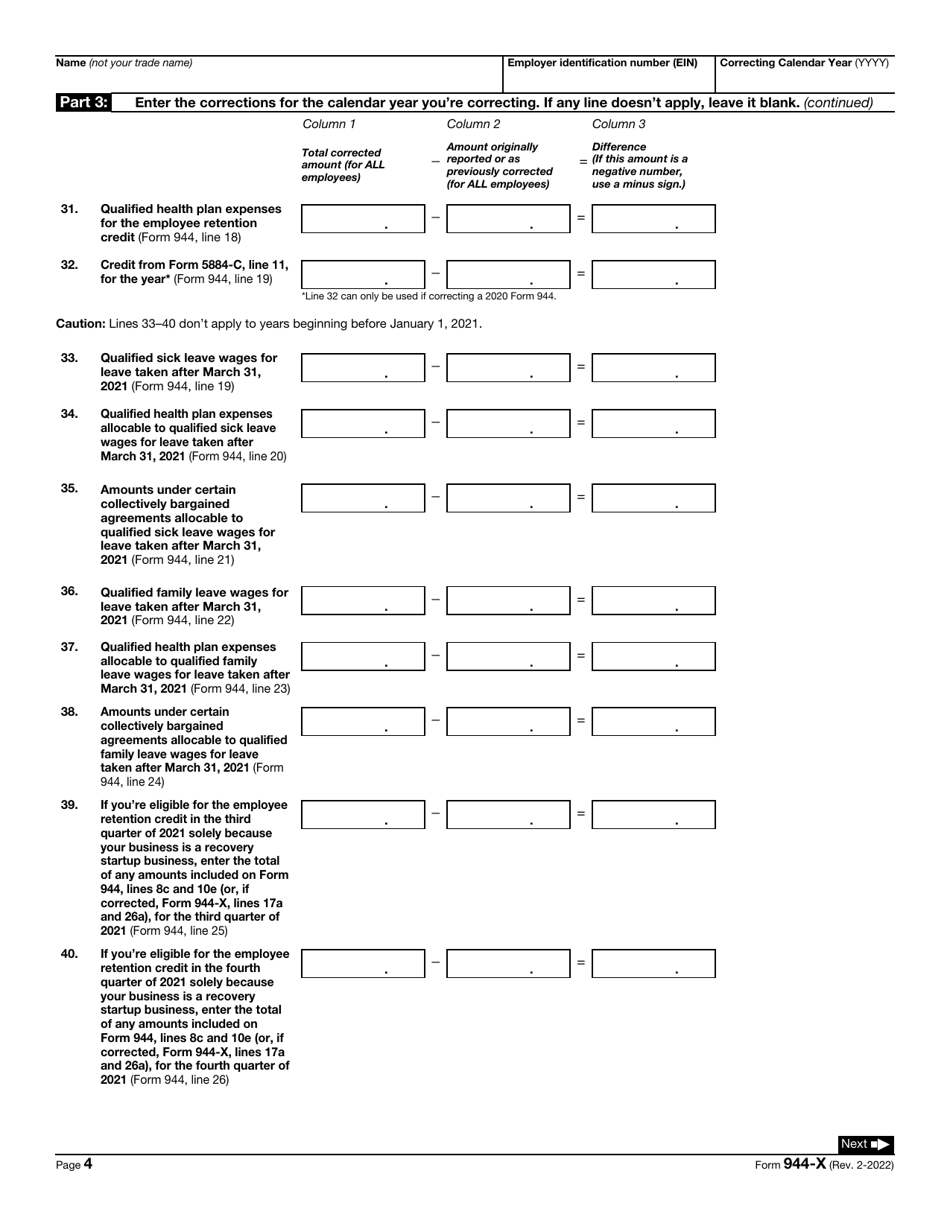

Q: What kind of adjustments can be made using Form 944-X?

A: Form 944-X can be used to make adjustments to wages, taxes, and other information reported on the original Form 944.

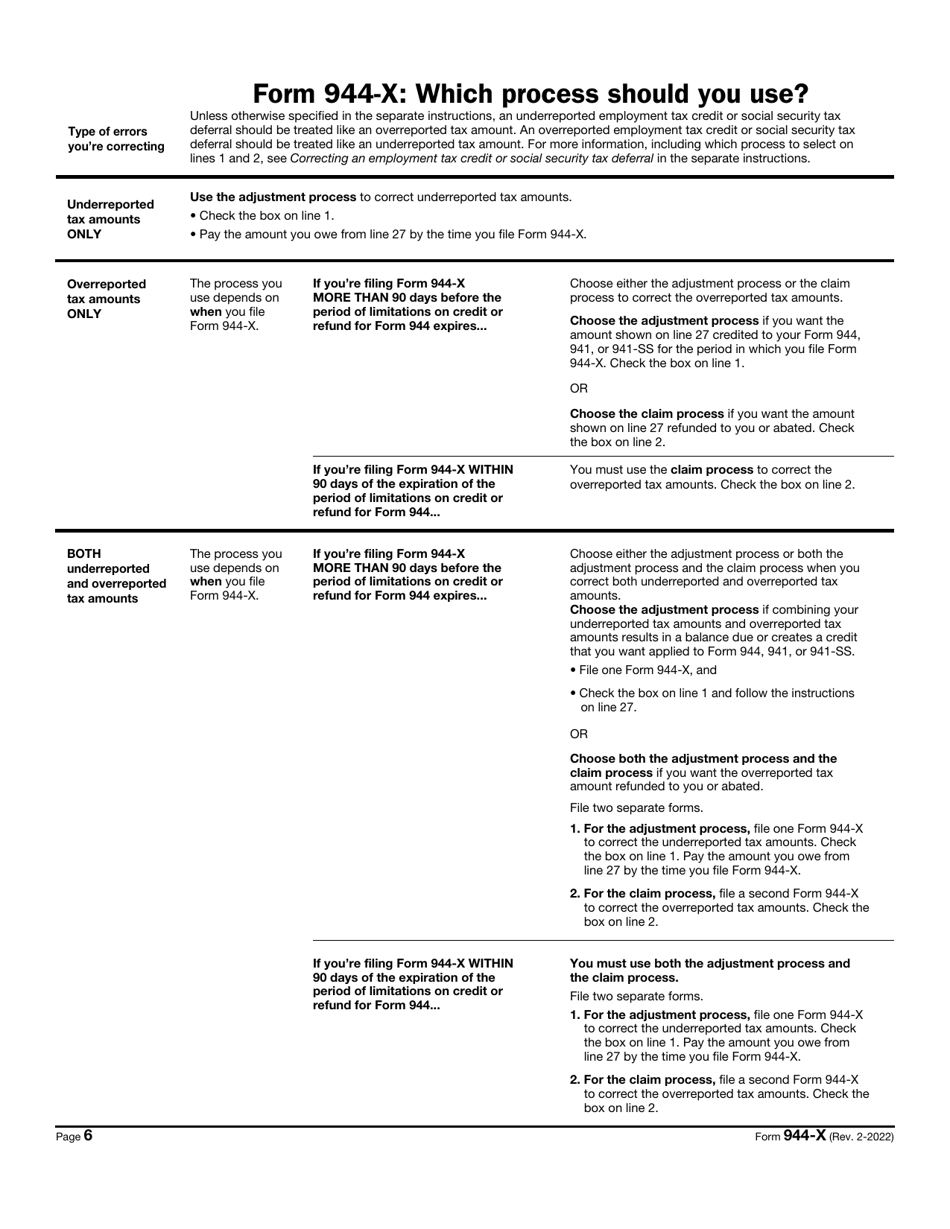

Q: How do I file Form 944-X?

A: Form 944-X should be filed by mail and should include any supporting documentation needed to explain the adjustments or claim the refund.

Q: What if I need to correct multiple years?

A: If you need to correct multiple years, you should file a separate Form 944-X for each year.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 944-X through the link below or browse more documents in our library of IRS Forms.