This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8915-D

for the current year.

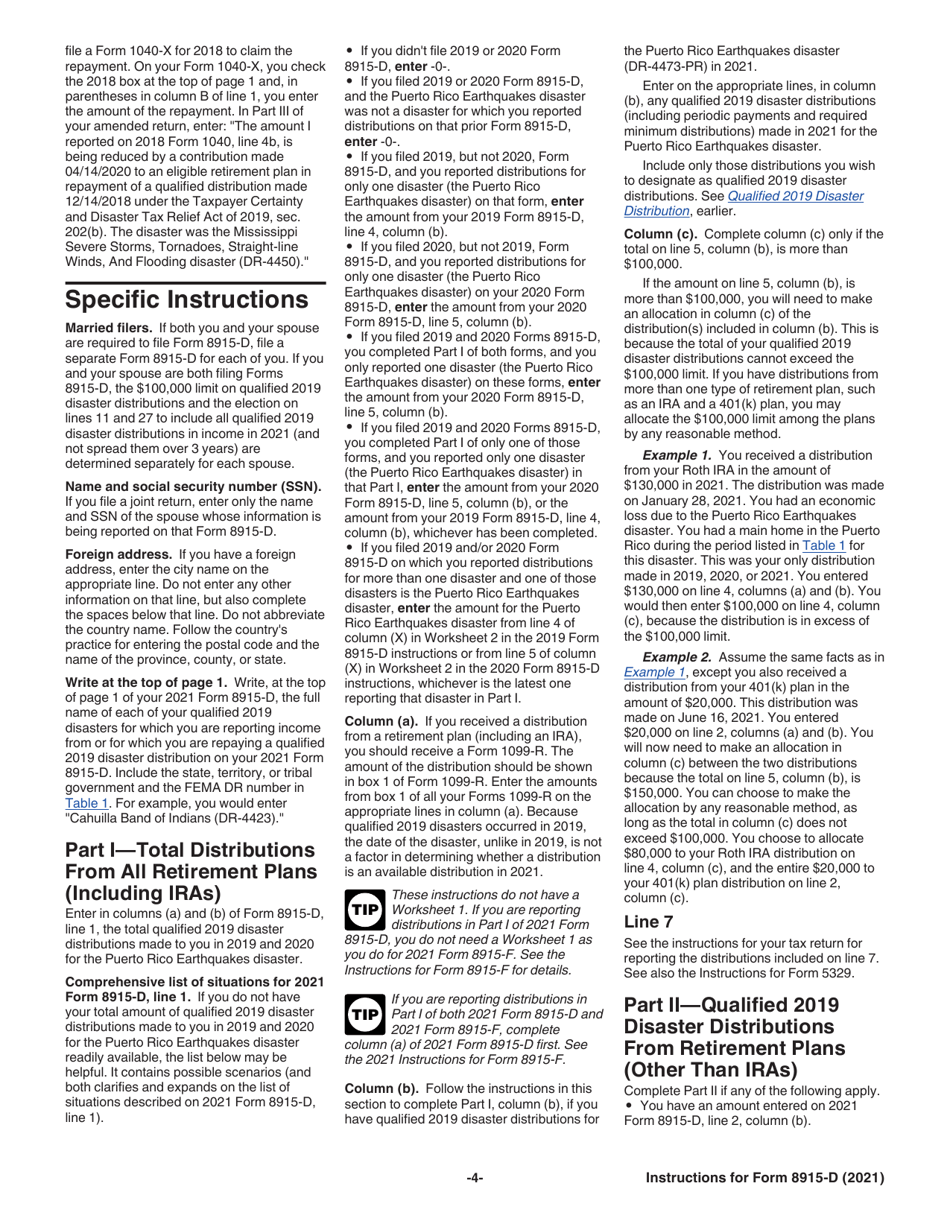

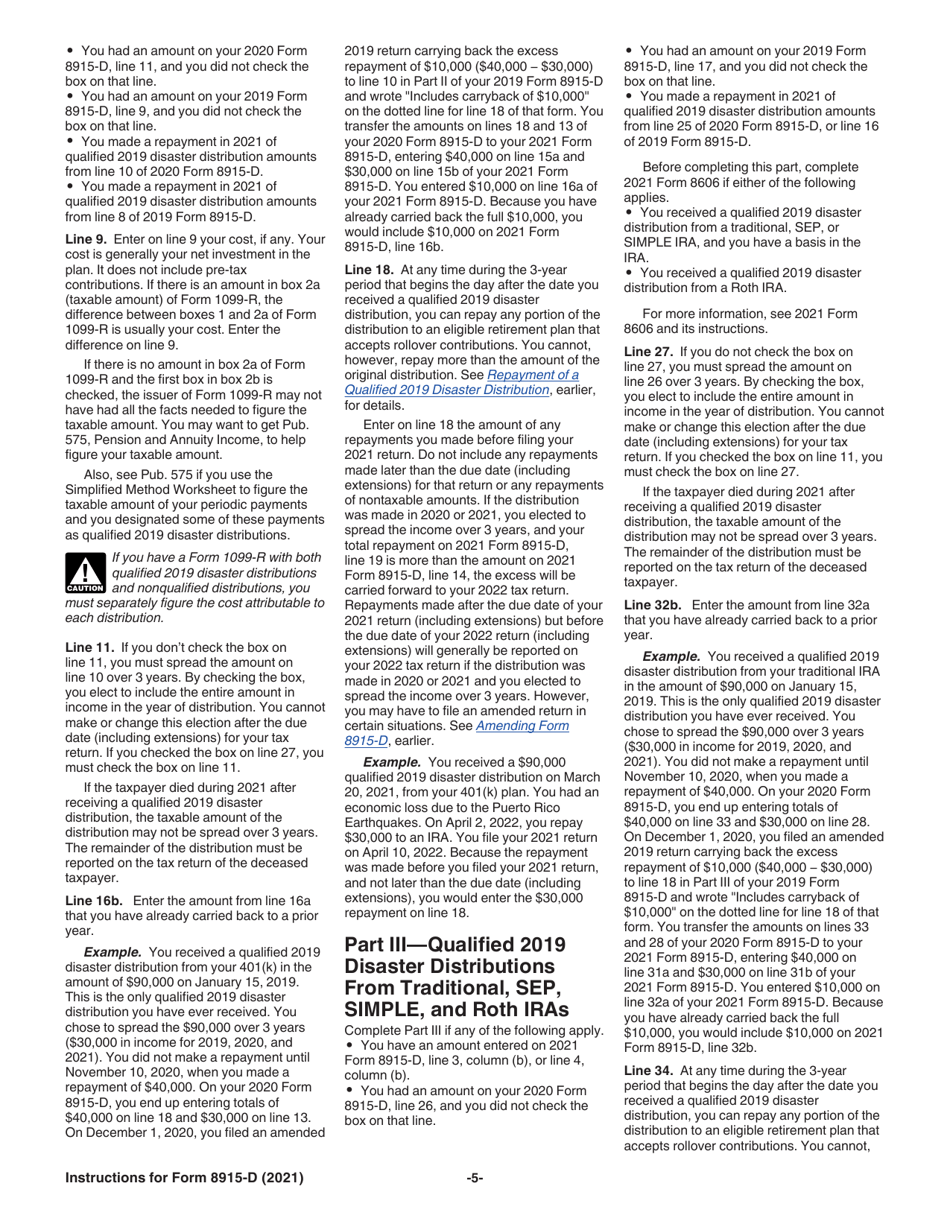

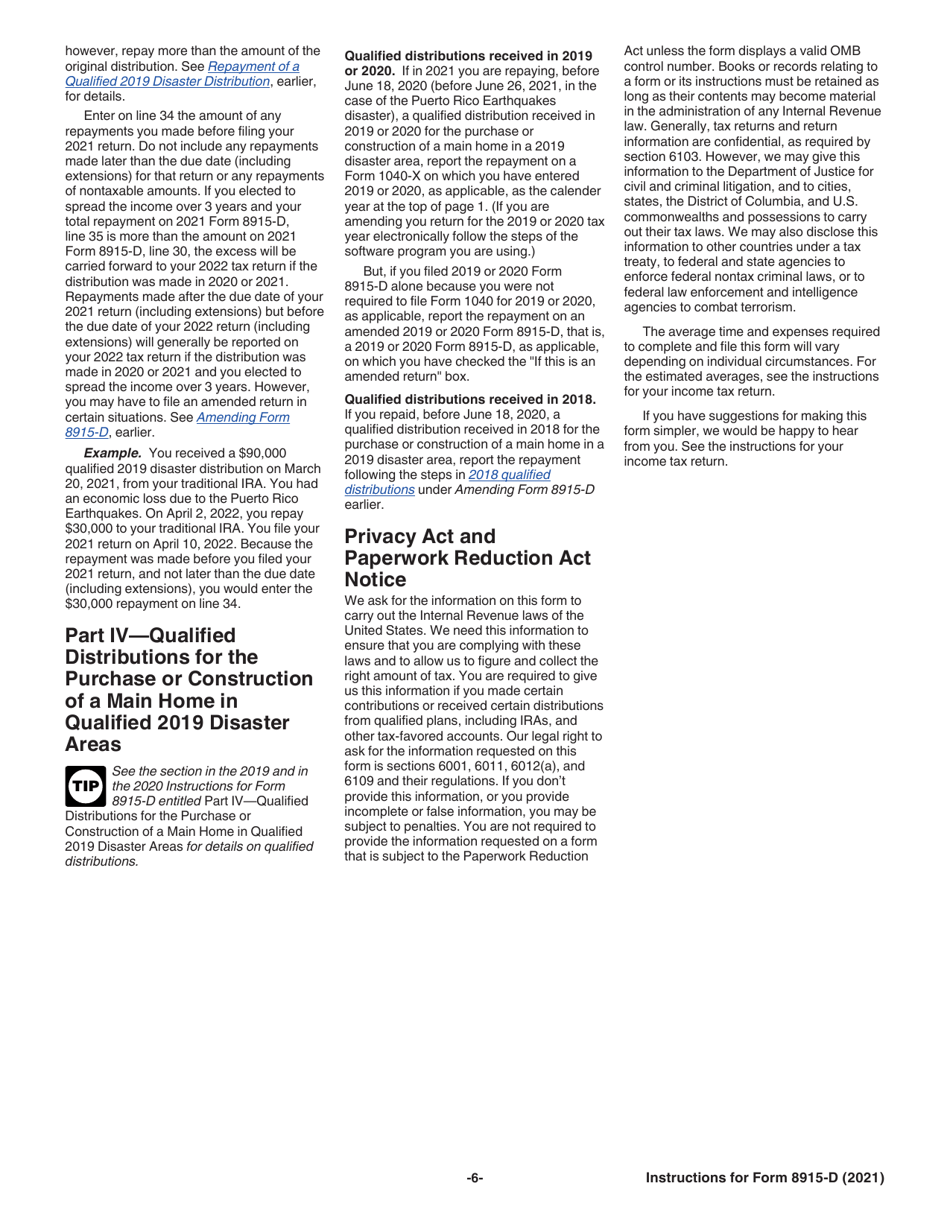

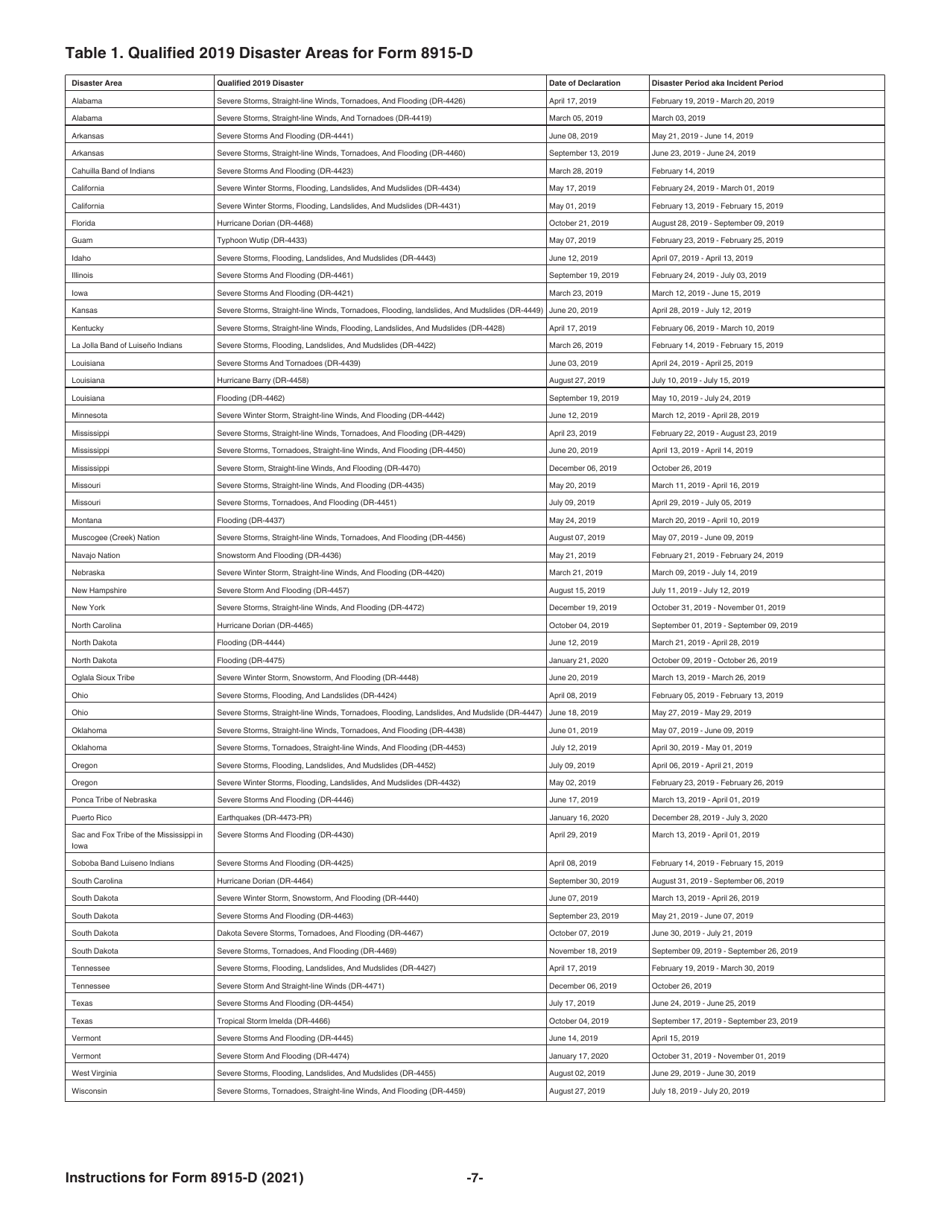

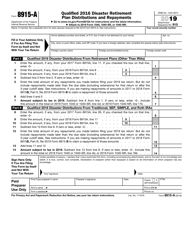

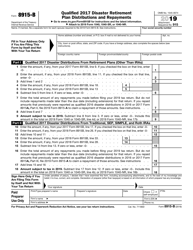

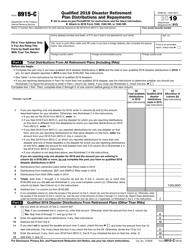

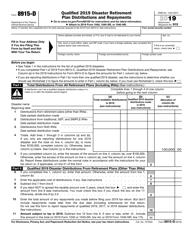

Instructions for IRS Form 8915-D Qualified 2019 Disaster Retirement Plan Distributions and Repayments

This document contains official instructions for IRS Form 8915-D , Qualified 2019 Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8915-D?

A: IRS Form 8915-D is the form used to report qualified disaster retirement plan distributions and repayments for the tax year 2019.

Q: What is a qualified disaster retirement plan distribution?

A: A qualified disaster retirement plan distribution is a distribution from a retirement plan that is made in response to a qualified disaster.

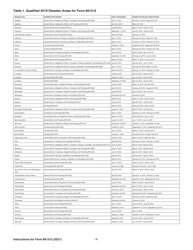

Q: What qualifies as a qualified disaster?

A: A qualified disaster is an event declared by the President of the United States or the Federal Emergency Management Agency (FEMA) to be a disaster.

Q: Who is eligible to use Form 8915-D?

A: Taxpayers who received qualified disaster retirement plan distributions in 2019 and who wish to repay all or a portion of those distributions are eligible to use Form 8915-D.

Q: What is the purpose of Form 8915-D?

A: The purpose of Form 8915-D is to report and calculate the amount of qualified disaster retirement plan distributions that are eligible for repayment and to determine the tax implications of those distributions.

Q: When is Form 8915-D due?

A: Form 8915-D is due on or before the tax filing deadline for the year in which the qualified disaster retirement plan distributions were received.

Q: Are there any penalties for late filing of Form 8915-D?

A: Yes, there may be penalties for late filing of Form 8915-D. It is important to file the form on time to avoid any potential penalties.

Q: Can I e-file Form 8915-D?

A: Yes, you can e-file Form 8915-D if you are using tax software or working with a tax professional who offers e-filing services.

Q: Can I make repayments of qualified disaster retirement plan distributions in installments?

A: Yes, you can make repayments in installments. Form 8915-D provides instructions on how to calculate and report these repayments.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.