This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8915-C

for the current year.

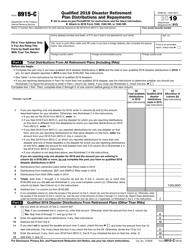

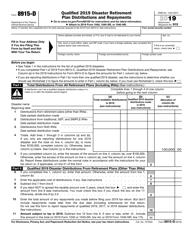

Instructions for IRS Form 8915-C Qualified 2018 Disaster Retirement Plan Distributions and Repayments

This document contains official instructions for IRS Form 8915-C , Qualified 2018 Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8915-C?

A: IRS Form 8915-C is a form used to report qualified 2018 disaster retirement plan distributions and repayments.

Q: Who should use IRS Form 8915-C?

A: Individuals who received qualified disaster retirement plan distributions and made repayments in 2018 should use IRS Form 8915-C.

Q: What are qualified disaster retirement plan distributions?

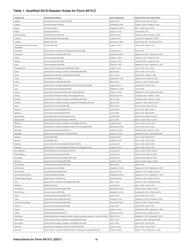

A: Qualified disaster retirement plan distributions are distributions made from a retirement plan in connection with a qualified disaster.

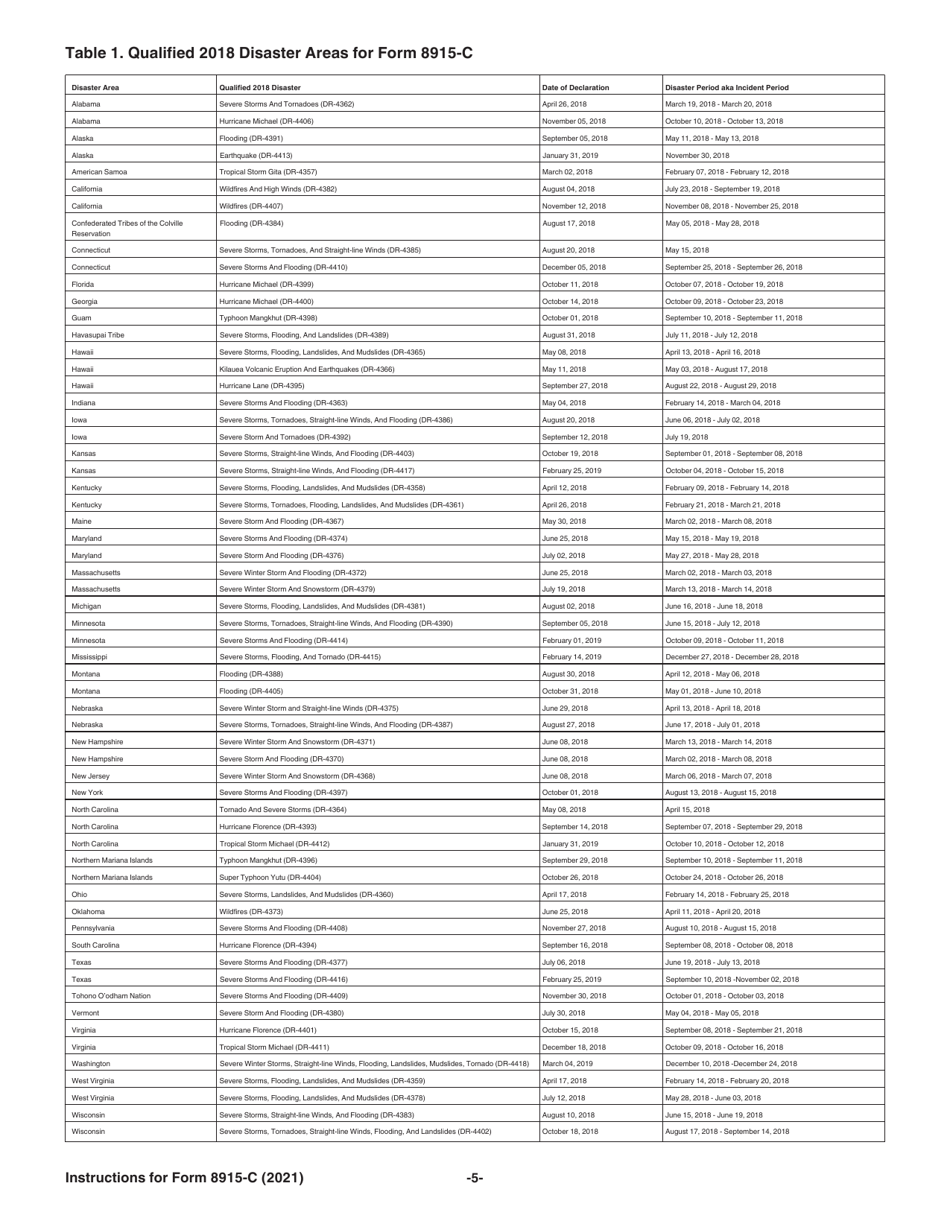

Q: What is a qualified disaster?

A: A qualified disaster is a disaster that occurred in 2018 and was determined by the President of the United States to warrant federal assistance.

Q: What is the purpose of Form 8915-C?

A: The purpose of Form 8915-C is to report qualified disaster retirement plan distributions and repayments in order to calculate any taxes or penalties owed.

Q: What information is required on Form 8915-C?

A: Form 8915-C requires information such as the taxpayer's name, Social Security number, and the amount and repayment of qualified disaster retirement plan distributions.

Q: Are there any deadlines for filing Form 8915-C?

A: Yes, the deadline for filing Form 8915-C is typically April 15 of the year following the year in which the qualified disaster retirement plan distributions were received.

Q: Are there any penalties for not filing Form 8915-C?

A: Failure to file Form 8915-C or reporting incorrect information may result in penalties or interest assessed by the IRS.

Q: Can I use Form 8915-C to claim a refund?

A: Yes, if you made repayments of qualified disaster retirement plan distributions in 2018, you may be eligible to claim a refund of any taxes paid on those distributions.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.