This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8862

for the current year.

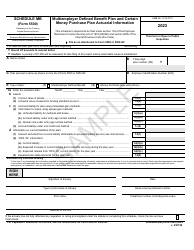

Instructions for IRS Form 8862 Information to Claim Certain Credits After Disallowance

This document contains official instructions for IRS Form 8862 , Information to Claim Certain Credits After Disallowance - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8862 is available for download through this link.

FAQ

Q: What is IRS Form 8862?

A: IRS Form 8862 is a form used to claim certain credits after they have been disallowed.

Q: What are the certain credits referred to in Form 8862?

A: The certain credits referred to in Form 8862 include the earned income credit (EIC), the child tax credit (CTC), and the American opportunity credit (AOTC).

Q: When should I use IRS Form 8862?

A: You should use IRS Form 8862 if your claim for any of the certain credits has been disallowed in a previous year.

Q: What information is required on Form 8862?

A: Form 8862 requires information about why your claim for the certain credits was disallowed, any changes in your circumstances that may affect your eligibility for the credits, and any other relevant information.

Q: How do I fill out IRS Form 8862?

A: To fill out IRS Form 8862, you need to provide accurate and complete information about your previous disallowed claim, changes in circumstances, and any other requested details.

Q: What should I do after filling out Form 8862?

A: After filling out Form 8862, you should attach it to your tax return and submit it to the IRS for processing.

Q: Can I e-file IRS Form 8862?

A: Yes, you can e-file IRS Form 8862 if you are submitting your tax return electronically.

Q: When will I know if my claim for the certain credits is allowed?

A: You will receive a notice from the IRS regarding the status of your claim for the certain credits after they have reviewed your Form 8862 and supporting documentation.

Q: What should I do if my claim for the certain credits is disallowed again?

A: If your claim for the certain credits is disallowed again, you should review the notice from the IRS and consider consulting a tax professional for guidance on potential next steps.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.