This version of the form is not currently in use and is provided for reference only. Download this version of

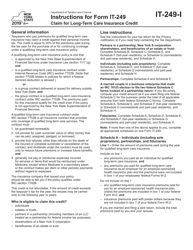

Instructions for IRS Form 8853

for the current year.

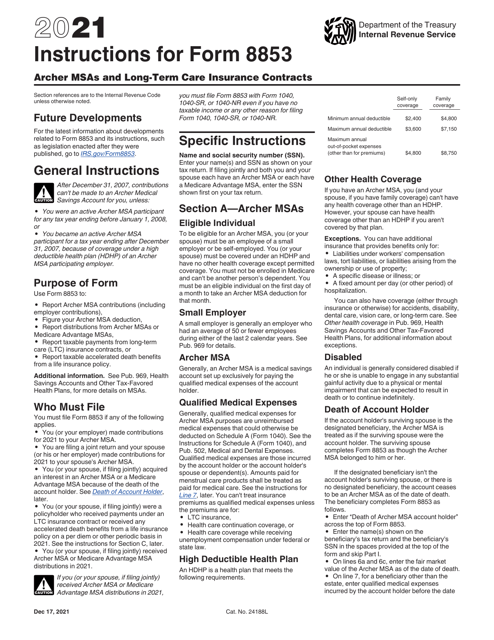

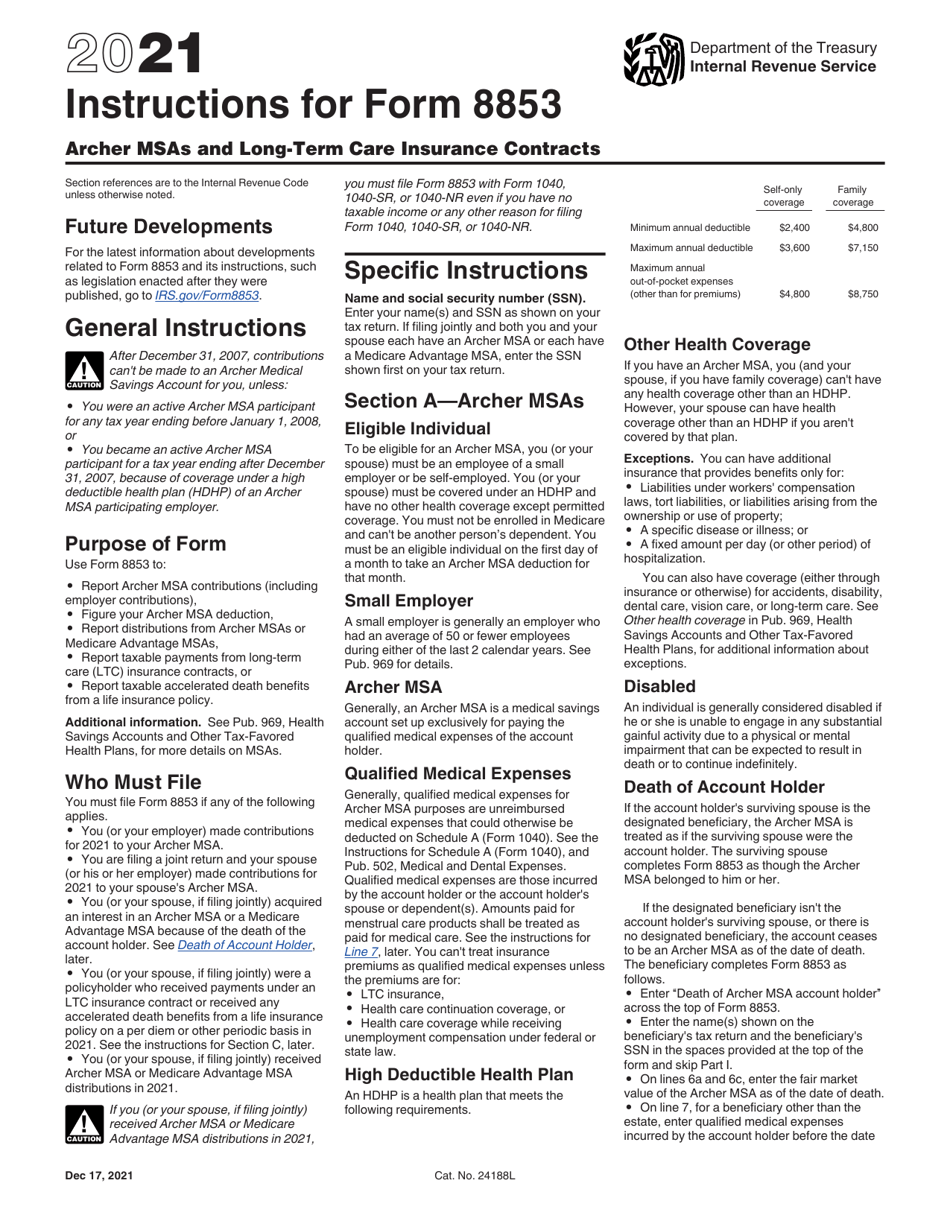

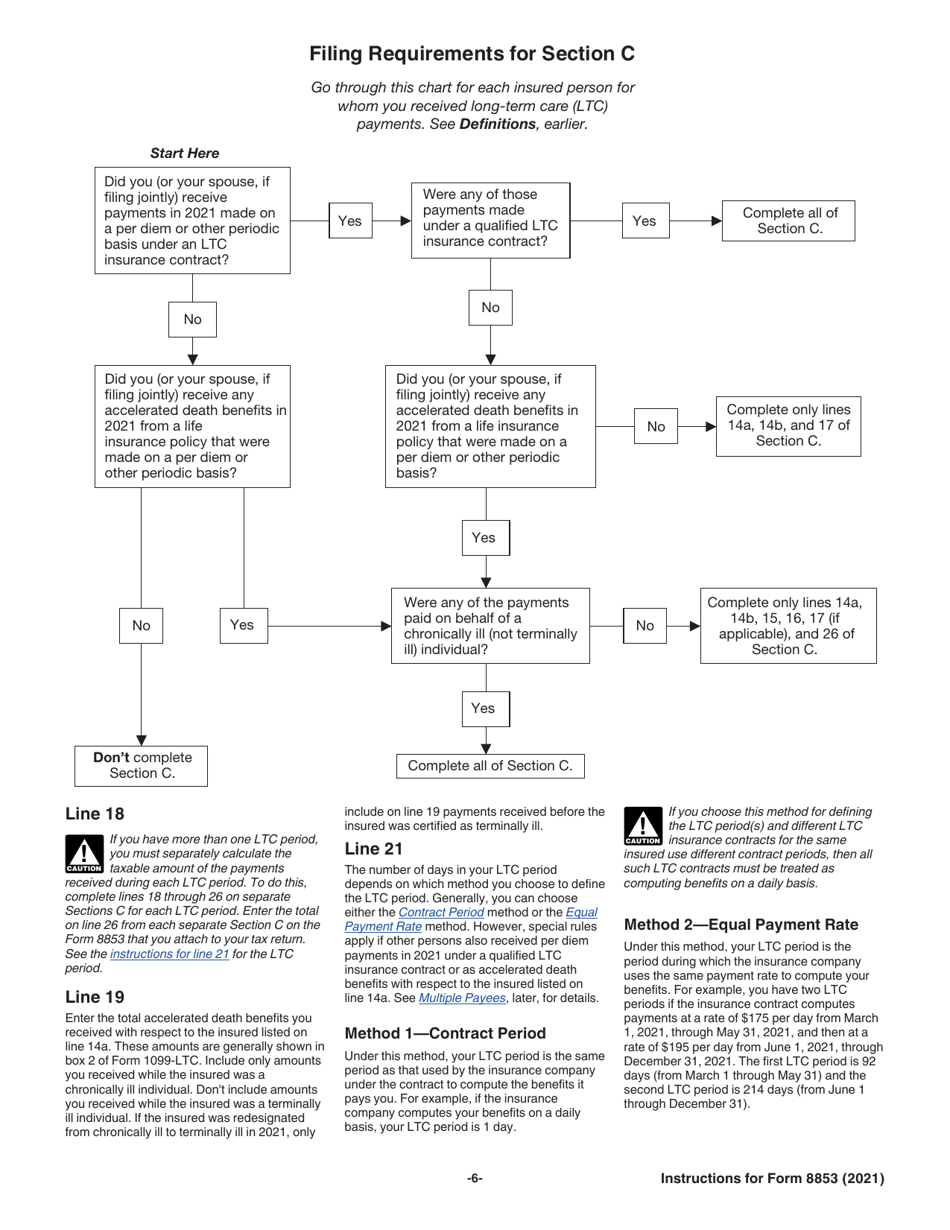

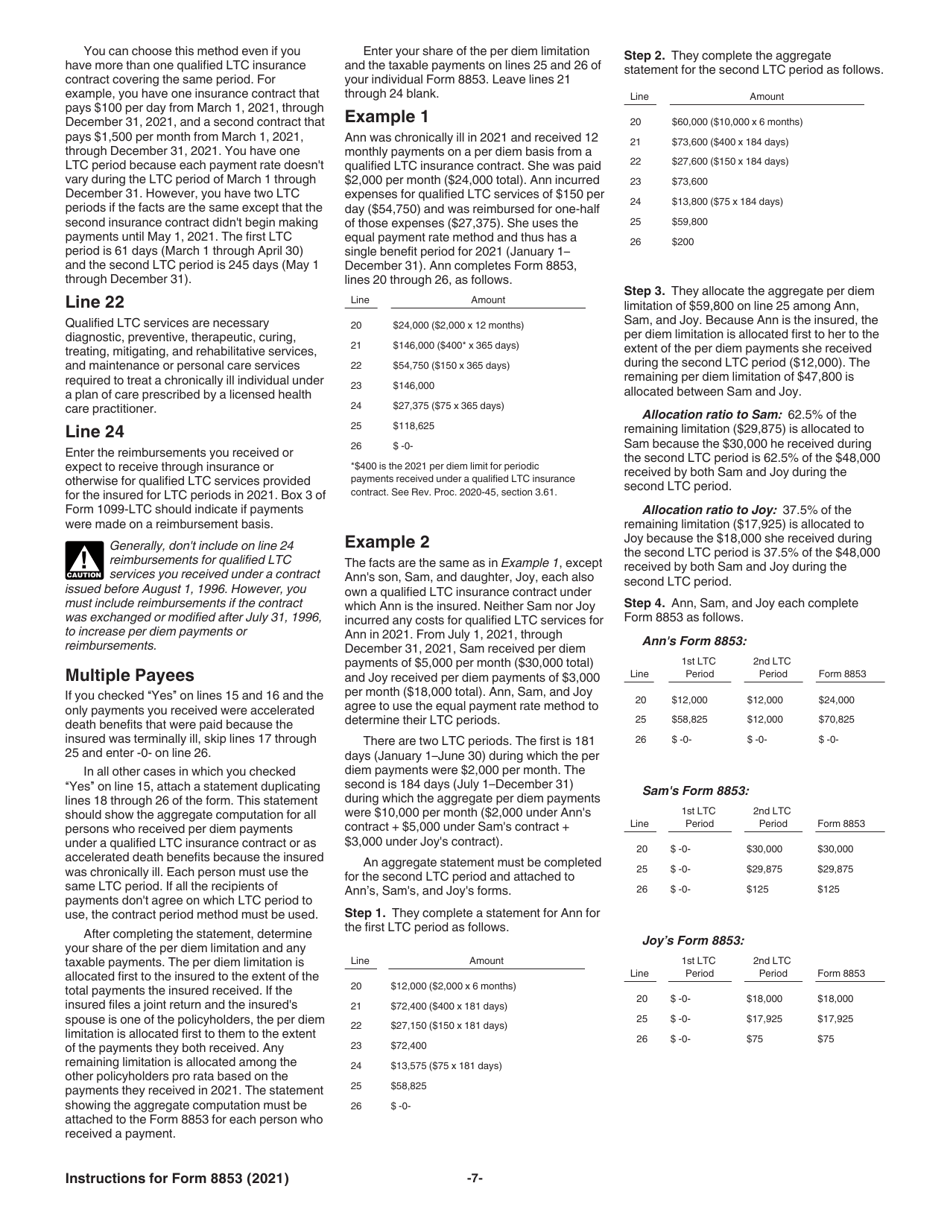

Instructions for IRS Form 8853 Archer Msas and Long-Term Care Insurance Contracts

This document contains official instructions for IRS Form 8853 , Archer Msas and Long-Term Care Insurance Contracts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8853 used for?

A: IRS Form 8853 is used to report Archer Medical Savings Accounts (MSAs) and Long-Term Care Insurance Contracts.

Q: What are Archer MSAs?

A: Archer MSAs are a type of medical savings account that allows individuals covered by a high-deductible health plan to contribute tax-deductible funds into the account.

Q: What are Long-Term Care Insurance Contracts?

A: Long-Term Care Insurance Contracts provide insurance coverage for long-term care services, such as nursing home care or home health care.

Q: Who needs to file Form 8853?

A: Individuals who have contributed to an Archer MSA or received distributions from an Archer MSA, or who have received payments from a Long-Term Care Insurance Contract, may need to file Form 8853.

Q: What information is required on Form 8853?

A: Form 8853 requires information pertaining to contributions to Archer MSAs, distributions from Archer MSAs, and payments received from Long-Term Care Insurance Contracts.

Q: When is the deadline to file Form 8853?

A: The deadline to file Form 8853 is typically April 15th of the year following the tax year in question.

Q: Can I e-file Form 8853?

A: No, Form 8853 cannot be e-filed and must be filed by mail.

Q: What are the consequences of not filing Form 8853?

A: Failure to file Form 8853 or inaccurately reporting information may result in penalties or additional taxes owed.

Q: Do I need to attach any supporting documentation to Form 8853?

A: Yes, you may need to attach certain supporting documentation, such as Form 1099-SA or Form 1099-LTC, depending on your situation.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.