This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8804-W

for the current year.

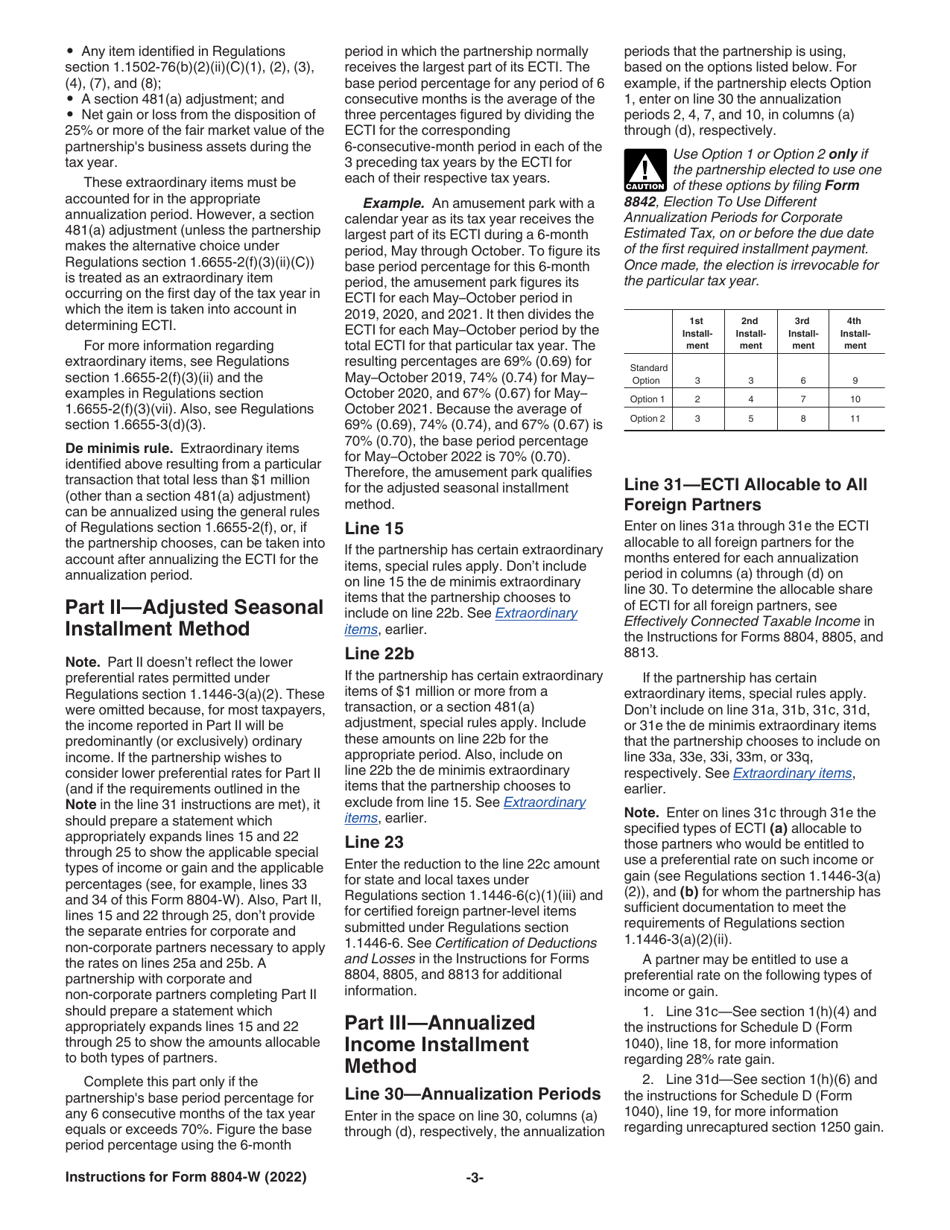

Instructions for IRS Form 8804-W Installment Payments of Section 1446 Tax for Partnerships

This document contains official instructions for IRS Form 8804-W , Installment Payments of Section 1446 Tax for Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8804-W?

A: IRS Form 8804-W is a form used for making installment payments of Section 1446 tax for partnerships.

Q: When should I use IRS Form 8804-W?

A: You should use IRS Form 8804-W if you are a partnership making installment payments for Section 1446 tax.

Q: What is Section 1446 tax?

A: Section 1446 tax is a withholding tax that applies to foreign partners of partnerships engaged in a US trade or business.

Q: How do I make installment payments using IRS Form 8804-W?

A: To make installment payments, fill out the form and follow the instructions for sending the payment to the IRS.

Q: What if I have questions or need help with IRS Form 8804-W?

A: If you have questions or need help, you can contact the IRS directly or consult a tax professional.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.