This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 6251

for the current year.

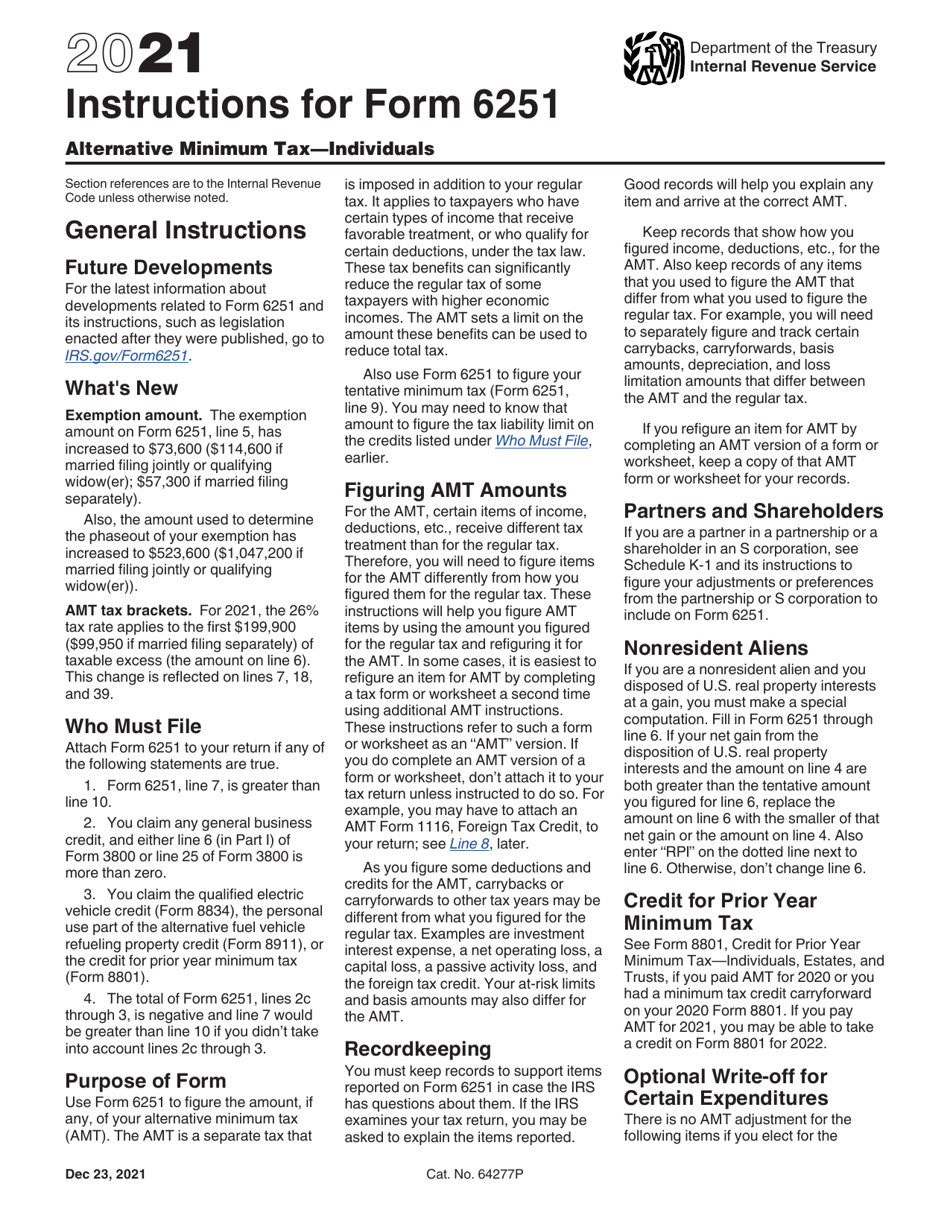

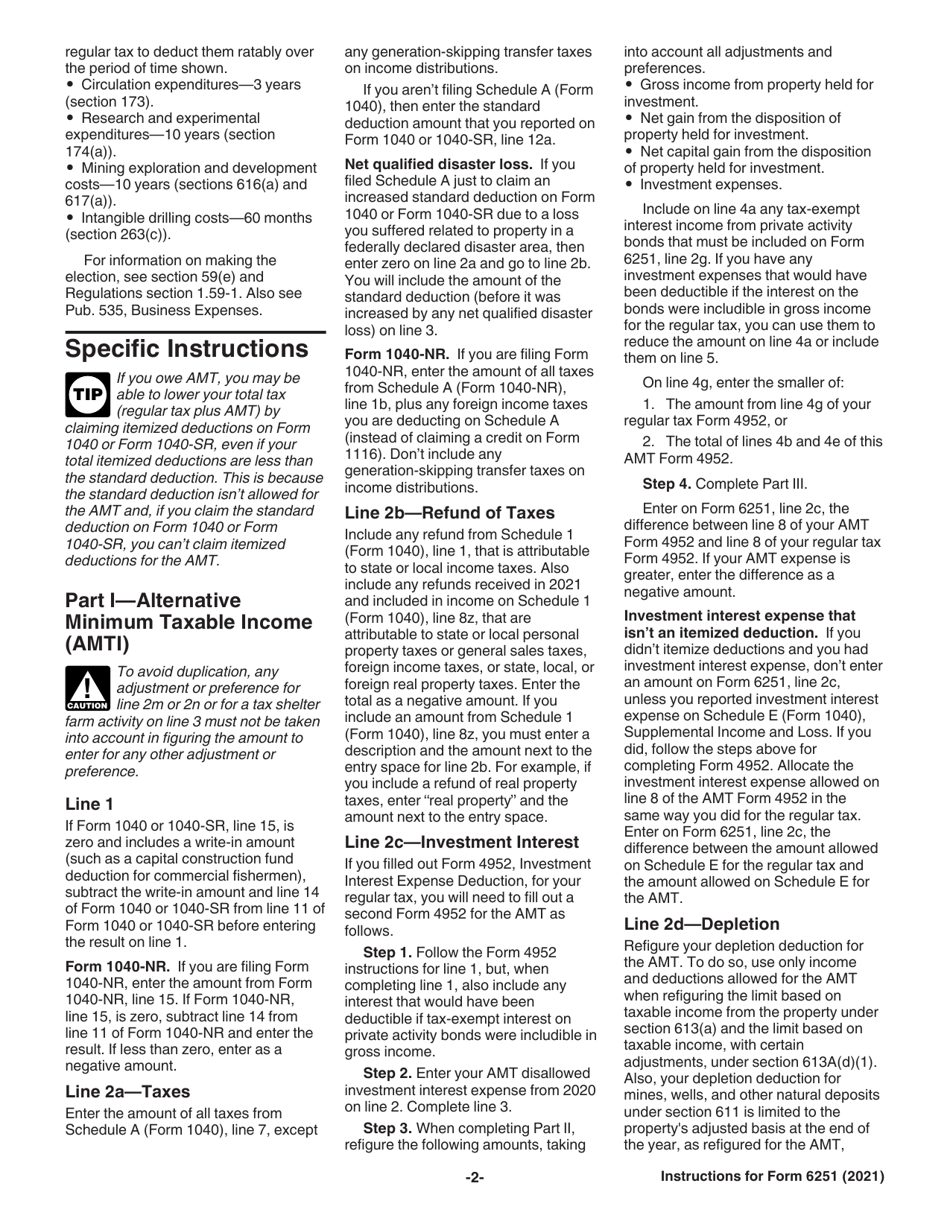

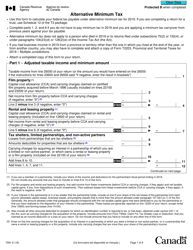

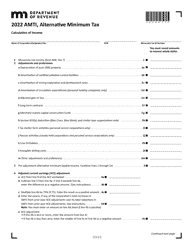

Instructions for IRS Form 6251 Alternative Minimum Tax - Individuals

This document contains official instructions for IRS Form 6251 , Alternative Minimum Tax - Individuals - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 6251?

A: IRS Form 6251 is used to calculate the alternative minimum tax (AMT) that individuals may owe.

Q: Why do I need to file IRS Form 6251?

A: You need to file IRS Form 6251 if you meet certain criteria that make you subject to the alternative minimum tax.

Q: How do I know if I need to pay alternative minimum tax?

A: You may need to pay alternative minimum tax if your income exceeds a certain threshold and you have certain deductions or preferences.

Q: What deductions and preferences trigger alternative minimum tax?

A: Some deductions and preferences, such as certain itemized deductions and tax-exempt interest, can trigger alternative minimum tax.

Q: What information do I need to complete IRS Form 6251?

A: You will need your regular income tax return and information about your AMT adjustments and preferences.

Q: When is the deadline to file IRS Form 6251?

A: The deadline to file IRS Form 6251 is the same as the deadline for your regular income tax return.

Q: What happens if I don't file IRS Form 6251 when required?

A: If you are subject to the alternative minimum tax and fail to file Form 6251, you may be subject to penalties and interest.

Q: Can I e-file IRS Form 6251?

A: As of now, you cannot e-file IRS Form 6251. It must be filed by mail.

Q: Do I need to file IRS Form 6251 every year?

A: You only need to file IRS Form 6251 if you meet the criteria for being subject to the alternative minimum tax.

Instruction Details:

- This 14-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.