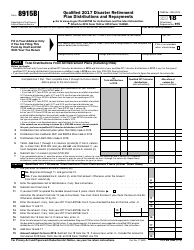

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 5405

for the current year.

Instructions for IRS Form 5405 Repayment of the First-Time Homebuyer Credit

This document contains official instructions for IRS Form 5405 , Repayment of the First-Time Homebuyer Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5405 is available for download through this link.

FAQ

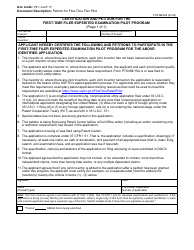

Q: What is IRS Form 5405?

A: IRS Form 5405 is a form used to report the repayment of the First-Time Homebuyer Credit.

Q: Who needs to use IRS Form 5405?

A: Anyone who received the First-Time Homebuyer Credit and needs to repay it must use IRS Form 5405.

Q: What is the First-Time Homebuyer Credit?

A: The First-Time Homebuyer Credit was a tax credit given to eligible individuals who purchased a home for the first time.

Q: Why do I need to repay the First-Time Homebuyer Credit?

A: If you received the First-Time Homebuyer Credit and no longer meet the eligibility requirements, you are required to repay the credit.

Q: What are the eligibility requirements for the First-Time Homebuyer Credit?

A: The eligibility requirements for the First-Time Homebuyer Credit varied based on the year the home was purchased. It's best to refer to the specific instructions for each year to determine the eligibility criteria.

Q: Can I e-file IRS Form 5405?

A: No, IRS Form 5405 cannot be e-filed. It must be filled out and mailed to the IRS.

Q: How do I fill out IRS Form 5405?

A: Follow the instructions provided on IRS Form 5405 and enter the required information accurately.

Q: When is the deadline to file IRS Form 5405?

A: The deadline to file IRS Form 5405 is typically the same as the deadline to file your federal income tax return, which is usually April 15th.

Q: What happens if I don't repay the First-Time Homebuyer Credit?

A: If you do not repay the First-Time Homebuyer Credit, the IRS may take collection actions, such as withholding future tax refunds.

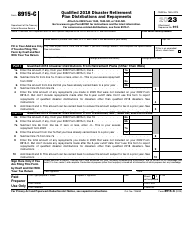

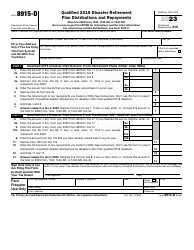

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.