This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 4797

for the current year.

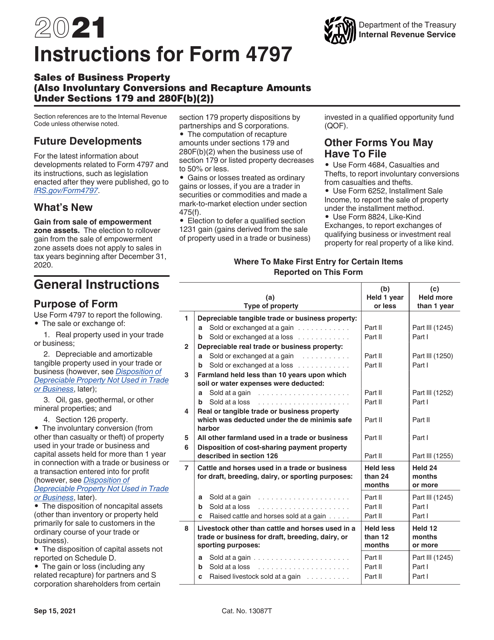

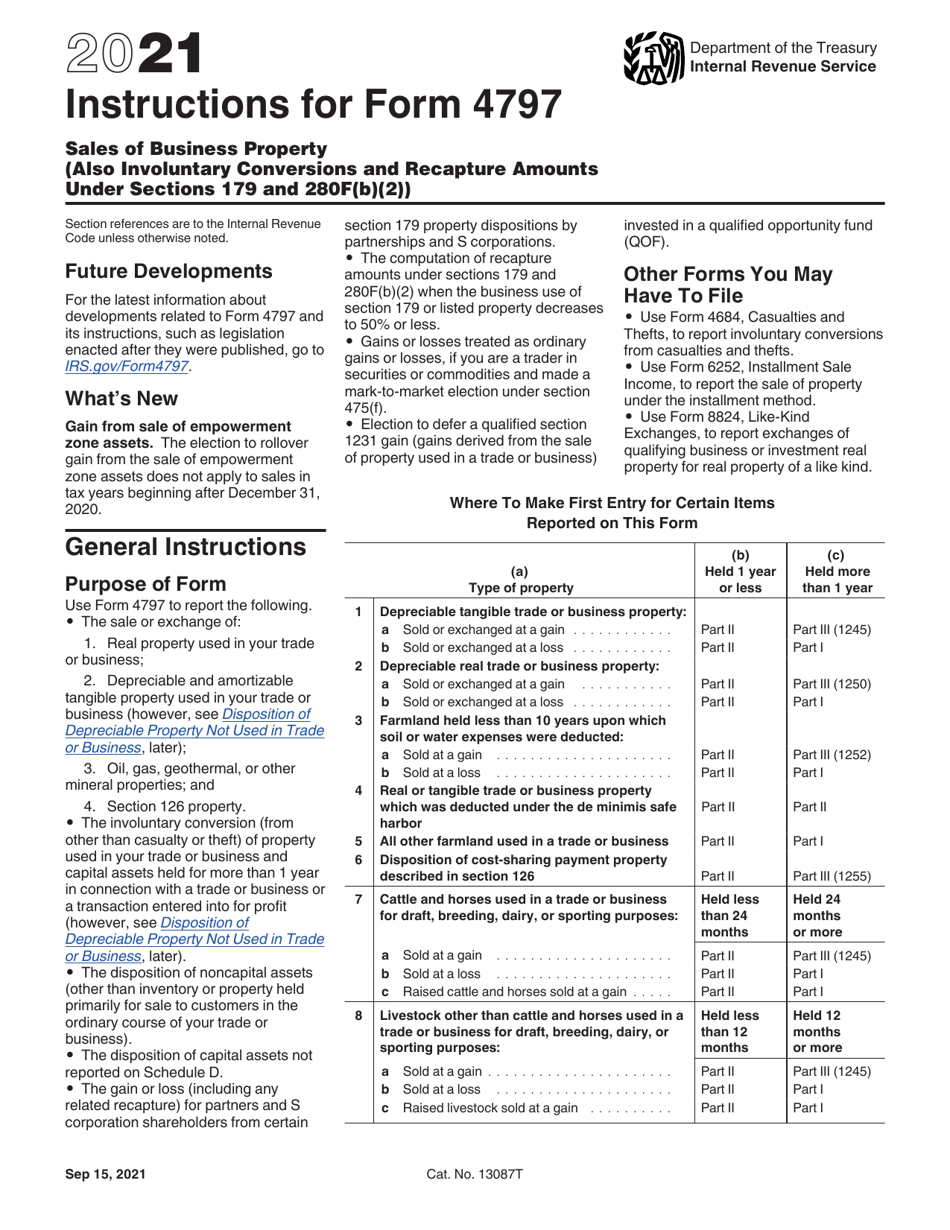

Instructions for IRS Form 4797 Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280f(B)(2))

This document contains official instructions for IRS Form 4797 , Sales of Involuntary Conversions and Recapture Amounts Under Sections 179 and 280f(B)(2)) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 4797?

A: IRS Form 4797 is used to report the sales of business property as well as involuntary conversions and recapture amounts.

Q: When should I use IRS Form 4797?

A: You should use IRS Form 4797 when you have sold or disposed of business property, experienced an involuntary conversion of property, or need to report recapture amounts under sections 179 and 280f(b)(2).

Q: What information do I need to fill out IRS Form 4797?

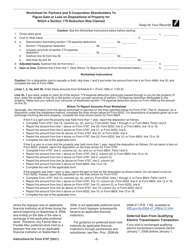

A: You will need information about the property being sold or converted, the dates of acquisition and sale, the sale price, and any expenses or recapture amounts associated with the property.

Q: Are there any special rules or considerations when filling out IRS Form 4797?

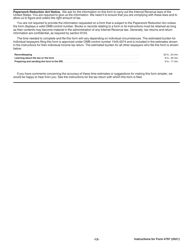

A: Yes, there are specific instructions and rules provided by the IRS for filling out Form 4797. It is important to carefully read and follow these instructions to accurately report your sales of business property.

Q: Is it necessary to submit IRS Form 4797 with my tax return?

A: Yes, if you have sales of business property, involuntary conversions, or recapture amounts, you must include Form 4797 with your tax return.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.