This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 4684

for the current year.

Instructions for IRS Form 4684 Casualties and Thefts

This document contains official instructions for IRS Form 4684 , Casualties and Thefts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 4684 is available for download through this link.

FAQ

Q: What is IRS Form 4684?

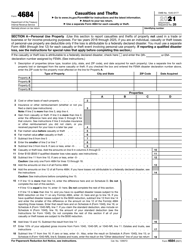

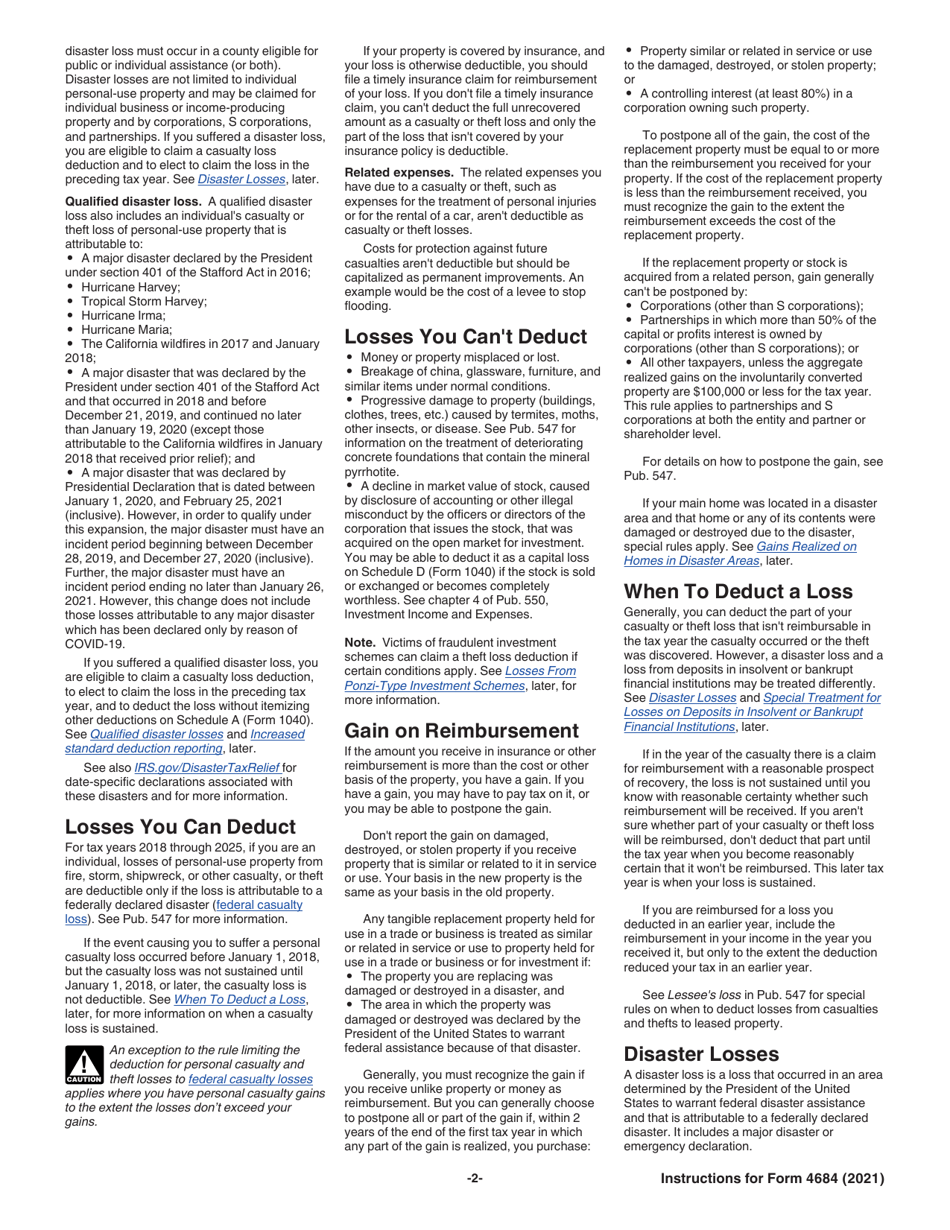

A: IRS Form 4684 is a form used to report casualties and thefts for tax purposes.

Q: When should I use IRS Form 4684?

A: You should use IRS Form 4684 if you have experienced a casualty, such as damage to your property, or a theft during the tax year.

Q: What information do I need to provide on IRS Form 4684?

A: You will need to provide details about the casualty or theft, including the date it occurred, a description of the property affected, the fair market value before and after the casualty or theft, and any insurance reimbursements received.

Q: Do I need to attach any documents with IRS Form 4684?

A: Yes, you may need to attach supporting documents such as police reports, insurance claims, or appraisals to substantiate your claim.

Q: Are there any deadlines for filing IRS Form 4684?

A: IRS Form 4684 should be filed with your tax return by the due date, which is typically April 15th. However, you may be eligible for an extension if needed.

Q: What should I do if I have questions or need assistance with IRS Form 4684?

A: If you have any questions or need assistance with IRS Form 4684, you can contact the IRS directly or consult with a tax professional.

Instruction Details:

- This 9-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.