This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 4506-B

for the current year.

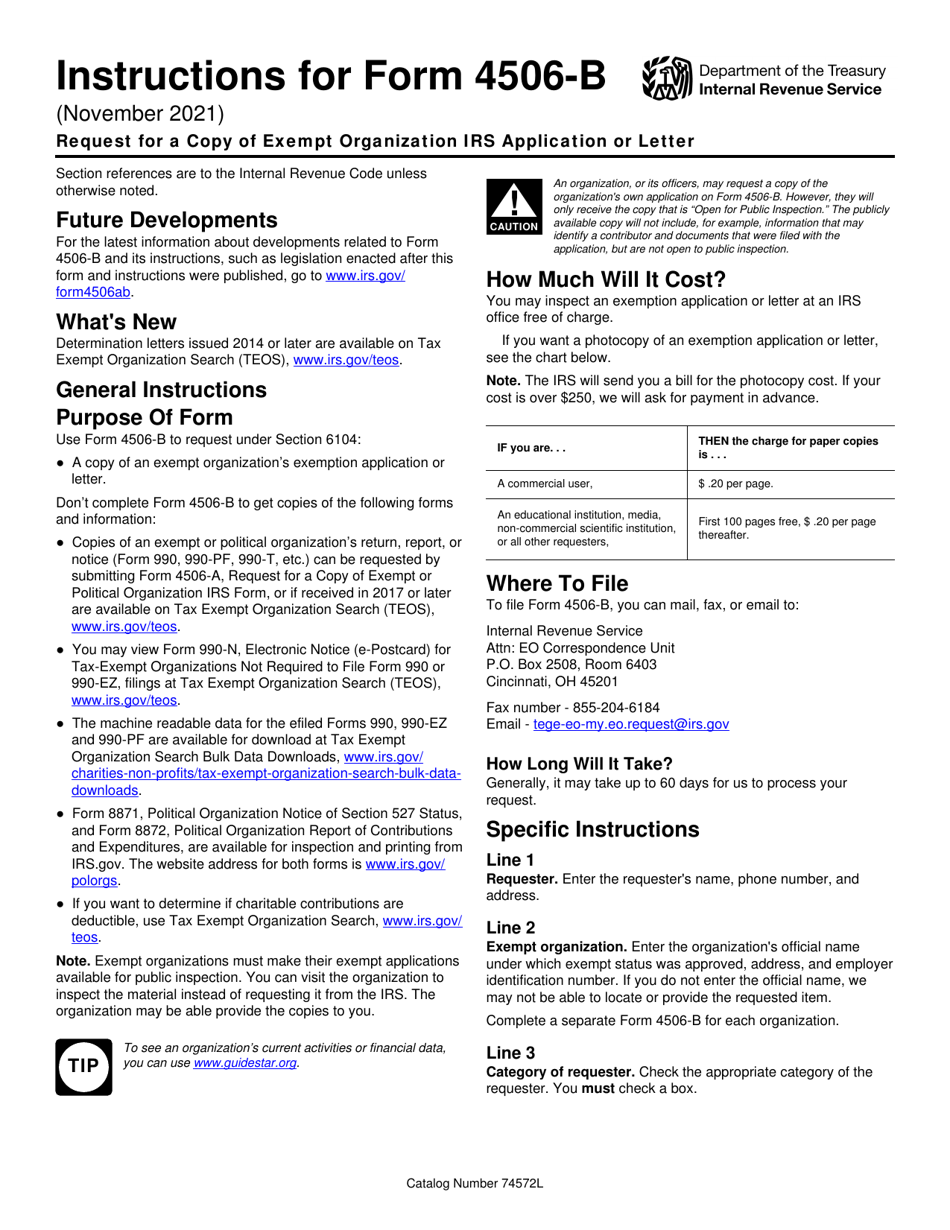

Instructions for IRS Form 4506-B Request for a Copy of Exempt Organization IRS Application or Letter

This document contains official instructions for IRS Form 4506-B , Request for a Copy of Exempt Organization IRS Application or Letter - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 4506-B is available for download through this link.

FAQ

Q: What is IRS Form 4506-B?

A: IRS Form 4506-B is a request for a copy of an exempt organization's IRS application or letter.

Q: Why would I need to use Form 4506-B?

A: You would use Form 4506-B to request a copy of an exempt organization's IRS application or determination letter.

Q: Who can use Form 4506-B?

A: Form 4506-B can be used by anyone who needs to request a copy of an exempt organization's IRS application or letter.

Q: Are there any fees associated with Form 4506-B?

A: Yes, there is a fee for requesting a copy of an exempt organization's IRS application or letter using Form 4506-B. The fee amount may vary.

Q: What should I do with Form 4506-B once I have filled it out?

A: You should mail the completed Form 4506-B to the address specified on the form.

Q: How long does it take to receive a copy of the requested documents?

A: The processing time for Form 4506-B requests can vary. It is recommended to allow several weeks for the request to be processed.

Q: Can I request multiple copies of an exempt organization's IRS application or letter?

A: Yes, you can request multiple copies of an exempt organization's IRS application or letter using Form 4506-B.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.