This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 4136

for the current year.

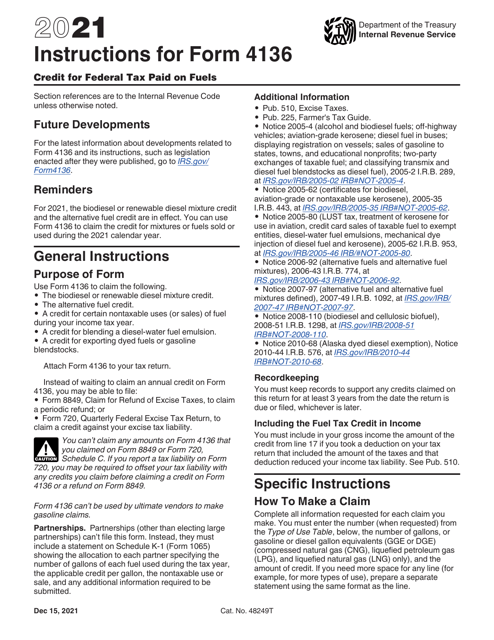

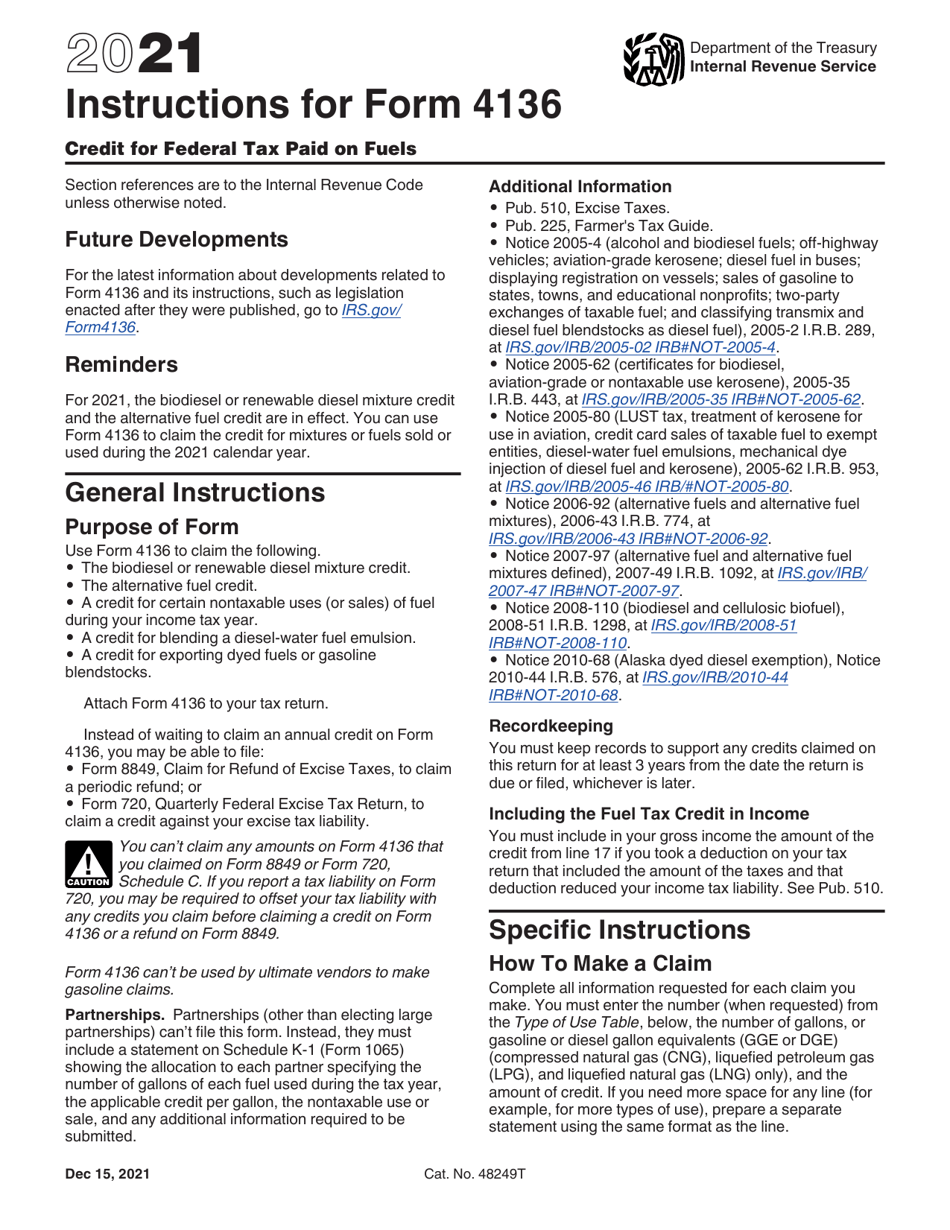

Instructions for IRS Form 4136 Credit for Federal Tax Paid on Fuels

This document contains official instructions for IRS Form 4136 , Credit for Federal Tax Paid on Fuels - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 4136 is available for download through this link.

FAQ

Q: What is Form 4136?

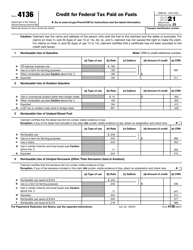

A: Form 4136 is a form used to claim the Credit for Federal Tax Paid on Fuels.

Q: What is the purpose of Form 4136?

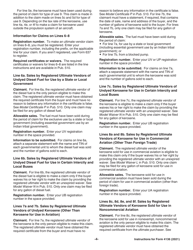

A: The purpose of Form 4136 is to calculate and claim a credit for federal taxes paid on certain types of fuels.

Q: Who can use Form 4136?

A: Taxpayers who have paid federal taxes on specific types of fuels can use Form 4136.

Q: What types of fuels are eligible for the credit?

A: Gasoline, diesel fuel, kerosene, and certain other fuels are eligible for the credit.

Q: How is the credit calculated?

A: The credit is calculated based on the amount of federal taxes paid on eligible fuels.

Q: Can the credit be claimed by individuals and businesses?

A: Yes, both individuals and businesses can claim the Credit for Federal Tax Paid on Fuels using Form 4136.

Q: Is there a limit to the amount of credit that can be claimed?

A: Yes, there is a limit to the amount of credit that can be claimed. The limit varies depending on the type of fuel.

Q: Are there any other requirements or documents needed to claim the credit?

A: In addition to Form 4136, taxpayers may need to provide supporting documentation such as receipts or other proof of tax payment.

Q: When is the deadline to file Form 4136?

A: Form 4136 is generally filed along with the taxpayer's annual income tax return by the tax filing deadline, which is usually April 15th.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.