This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 3903

for the current year.

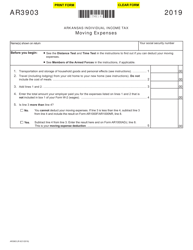

Instructions for IRS Form 3903 Moving Expenses

This document contains official instructions for IRS Form 3903 , Moving Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 3903?

A: IRS Form 3903 is used to report moving expenses for tax purposes.

Q: Who needs to file IRS Form 3903?

A: Those who have incurred moving expenses due to a job relocation may need to file IRS Form 3903.

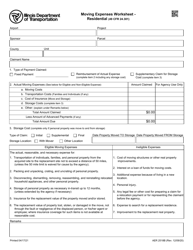

Q: What are considered moving expenses?

A: Common moving expenses include transportation costs, storage fees, and lodging expenses.

Q: Can I deduct all of my moving expenses?

A: You can only deduct eligible moving expenses that meet certain requirements set by the IRS.

Q: What documentation do I need to support my moving expenses?

A: You should keep receipts and other records to substantiate your moving expenses.

Q: When is the deadline to file IRS Form 3903?

A: IRS Form 3903 is typically filed along with your annual tax return by the tax filing deadline.

Q: Can I claim moving expenses if I am self-employed?

A: Yes, self-employed individuals may be able to claim eligible moving expenses.

Q: Are there any restrictions on claiming moving expenses?

A: There may be restrictions based on the distance and time of the move, as well as eligibility criteria set by the IRS.

Q: Do I need to attach receipts or other supporting documents to IRS Form 3903?

A: No, you do not need to attach receipts or other documents when filing IRS Form 3903, but you should keep them for your records.

Instruction Details:

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.