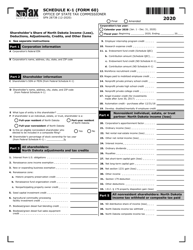

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-S Schedule K-1

for the current year.

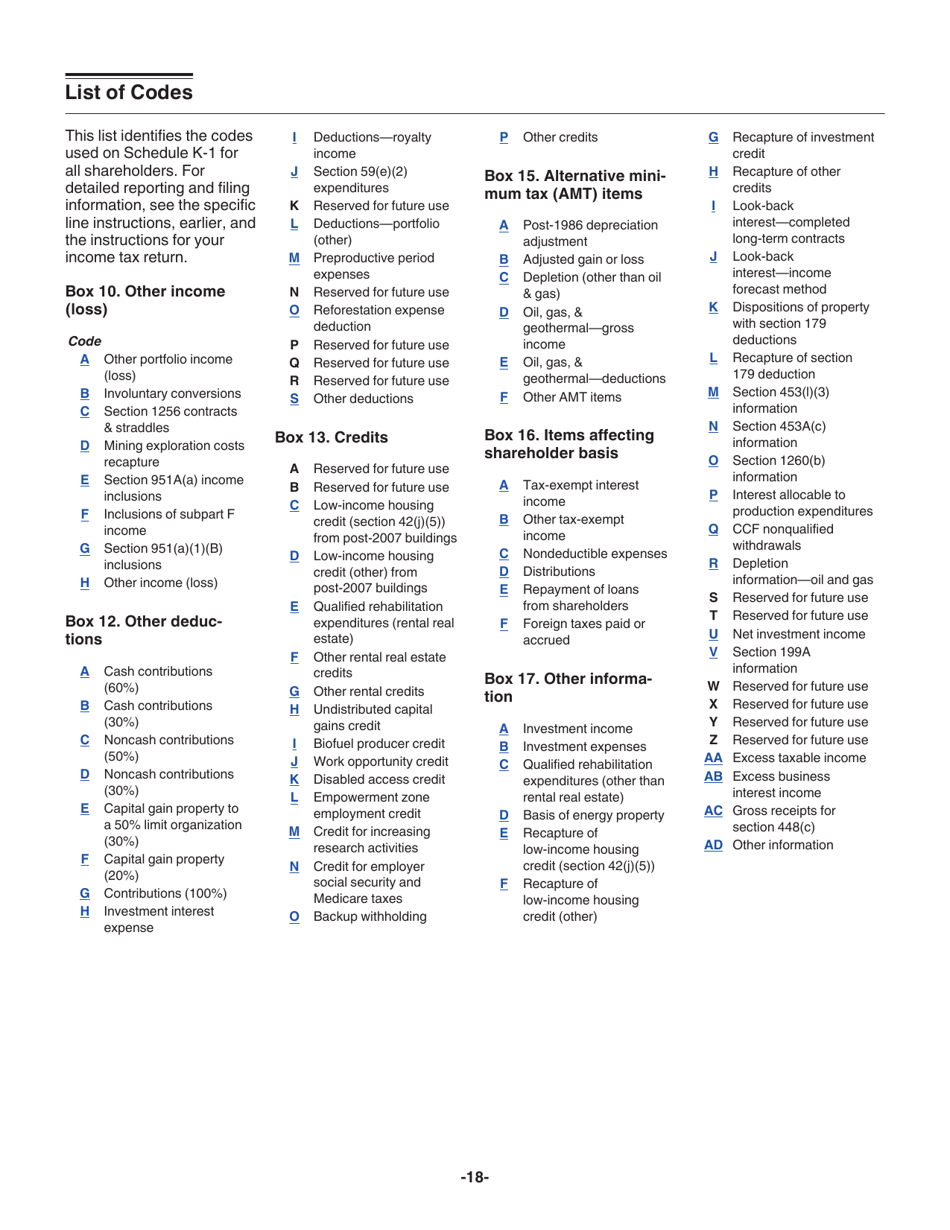

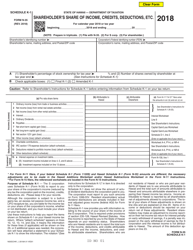

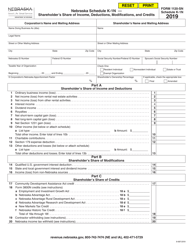

Instructions for IRS Form 1120-S Schedule K-1 Shareholder's Share of Income, Deductions, Credits, Etc.

This document contains official instructions for IRS Form 1120-S Schedule K-1, Shareholder's Share of Income, Deductions, Credits, Etc. - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1120-S Schedule K-1?

A: IRS Form 1120-S Schedule K-1 is a tax form used to report a shareholder's share of income, deductions, credits, and other information from a corporation.

Q: Who needs to file IRS Form 1120-S Schedule K-1?

A: Shareholders of an S corporation need to file IRS Form 1120-S Schedule K-1 to report their share of the corporation's financial information.

Q: What does IRS Form 1120-S Schedule K-1 include?

A: IRS Form 1120-S Schedule K-1 includes information on a shareholder's share of the corporation's income, deductions, credits, distributions, and other financial activities.

Q: When is the deadline for filing IRS Form 1120-S Schedule K-1?

A: The deadline for filing IRS Form 1120-S Schedule K-1 is typically on the same date as the S corporation's tax return, which is usually March 15th for calendar year taxpayers.

Instruction Details:

- This 18-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.