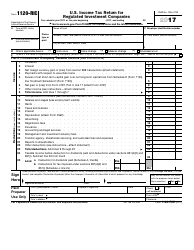

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-REIT

for the current year.

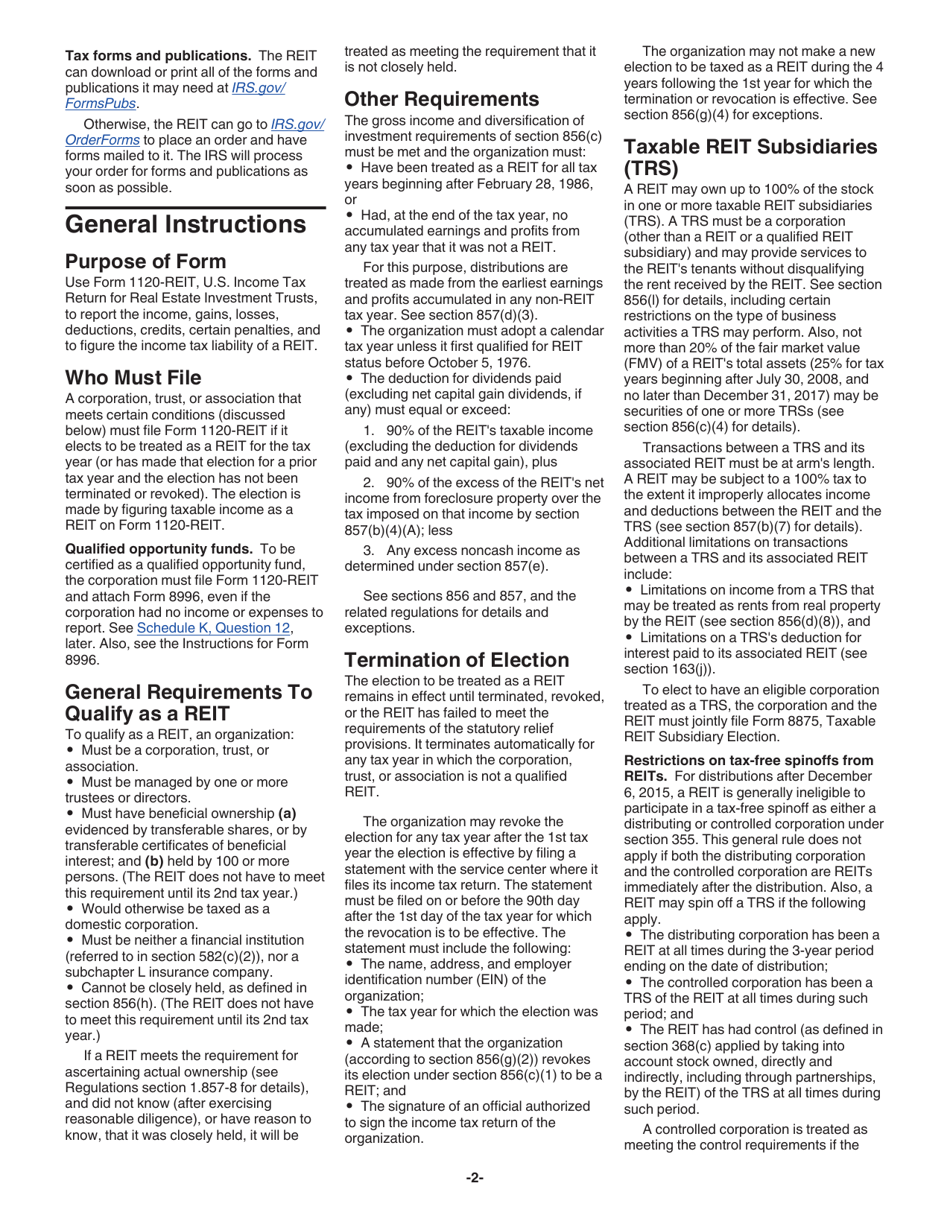

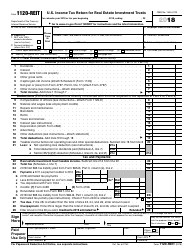

Instructions for IRS Form 1120-REIT U.S. Income Tax Return for Real Estate Investment Trusts

This document contains official instructions for IRS Form 1120-REIT , U.S. Income Tax Return for Real Estate Investment Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1120-REIT?

A: IRS Form 1120-REIT is a U.S. Income Tax Return specifically for Real Estate Investment Trusts.

Q: Who needs to file IRS Form 1120-REIT?

A: Real Estate Investment Trusts (REITs) need to file IRS Form 1120-REIT.

Q: What is the purpose of IRS Form 1120-REIT?

A: The purpose of IRS Form 1120-REIT is to report the income, deductions, and credits of a Real Estate Investment Trust.

Q: When is the deadline to file IRS Form 1120-REIT?

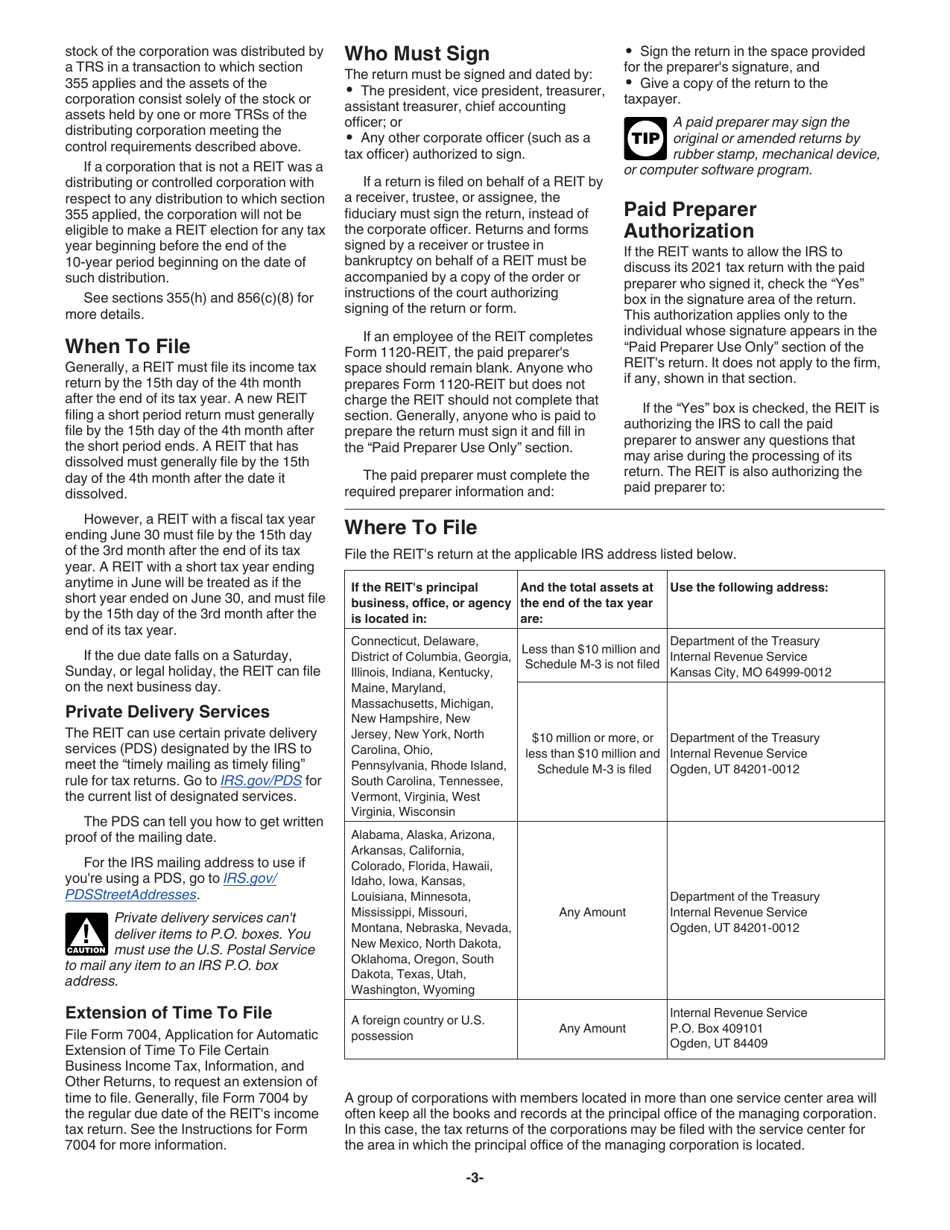

A: The deadline to file IRS Form 1120-REIT is on the 15th day of the 3rd month after the end of the REIT's tax year.

Q: Are there any penalties for late filing of IRS Form 1120-REIT?

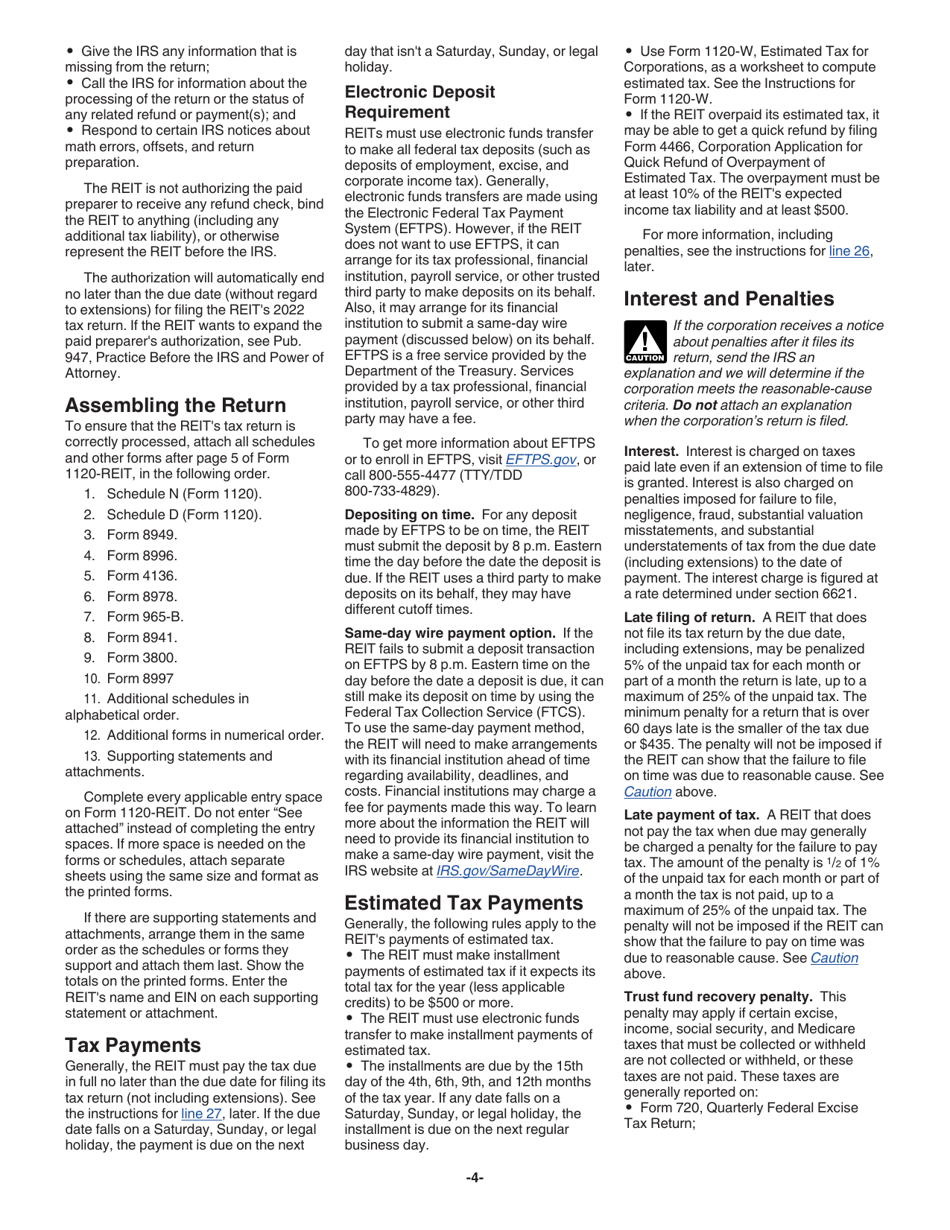

A: Yes, there are penalties for late filing of IRS Form 1120-REIT. It is important to file the form on time.

Q: Are there any special considerations for foreign REITs filing IRS Form 1120-REIT?

A: Yes, there are special considerations for foreign REITs filing IRS Form 1120-REIT. It is recommended to consult a tax professional for guidance.

Q: What supporting documents should I attach with IRS Form 1120-REIT?

A: You should attach Schedule M-3 and any other required schedules or supporting documents as specified by the IRS.

Q: Can I request an extension to file IRS Form 1120-REIT?

A: Yes, you can request an extension to file IRS Form 1120-REIT by filing Form 7004. However, be aware of the specific deadline for the extension request.

Instruction Details:

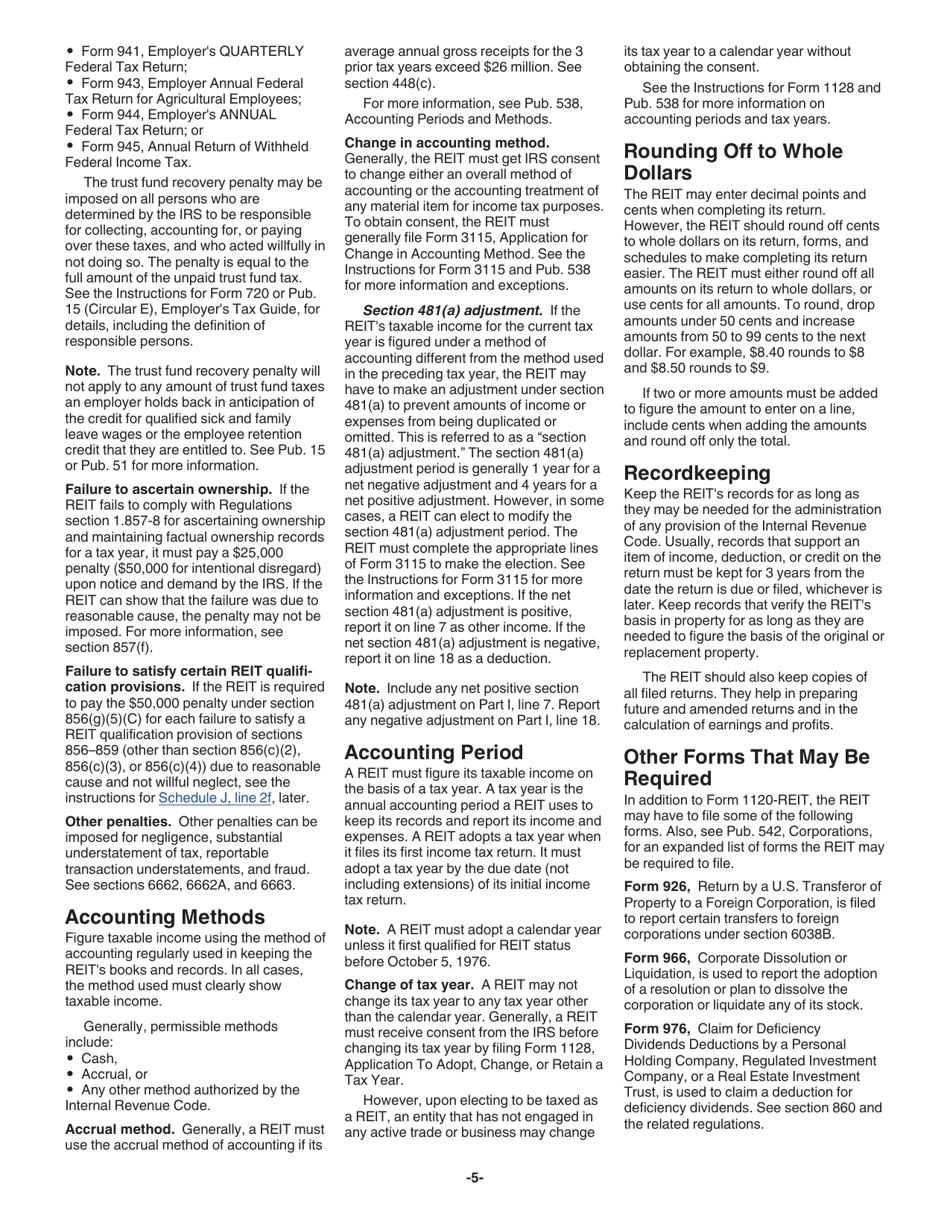

- This 21-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.