This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-PC

for the current year.

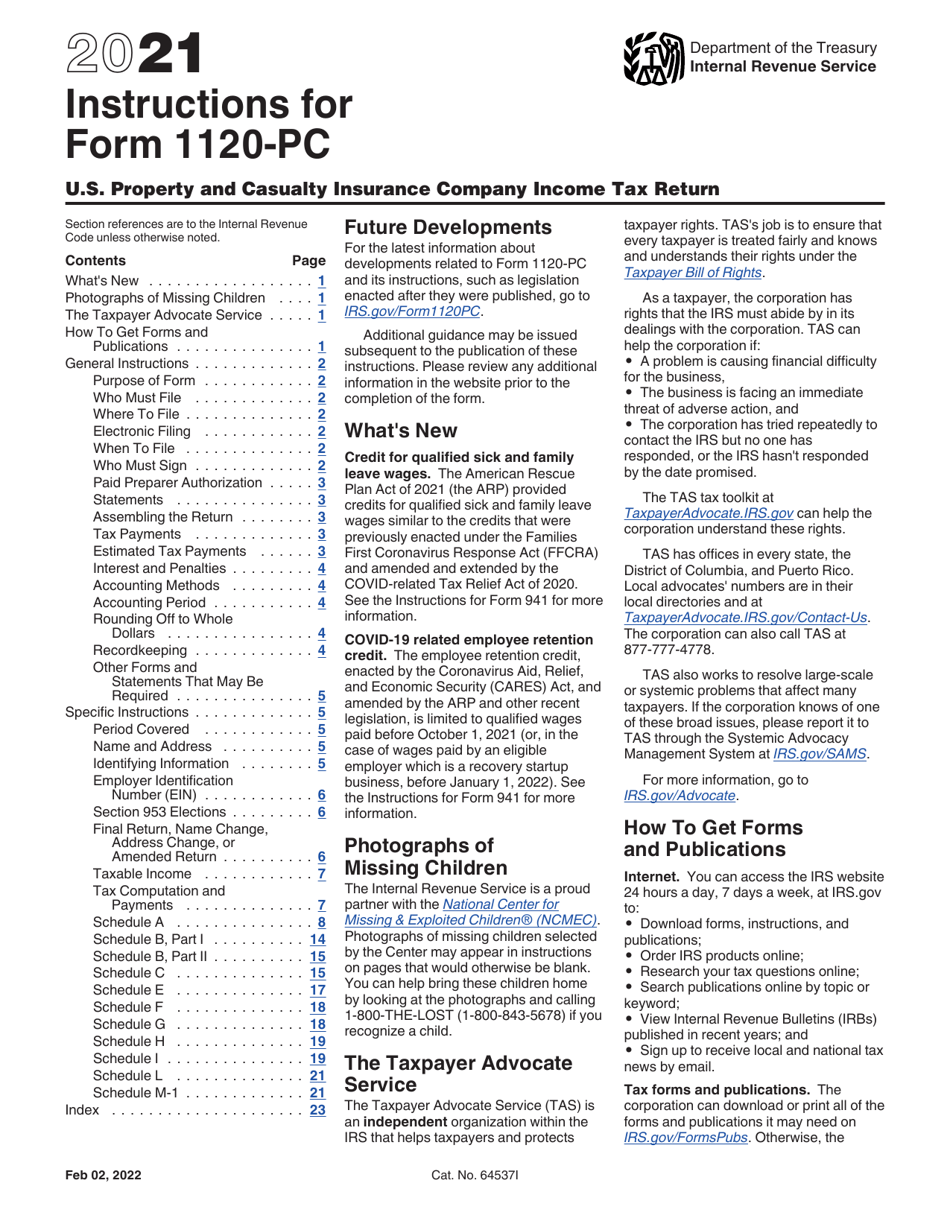

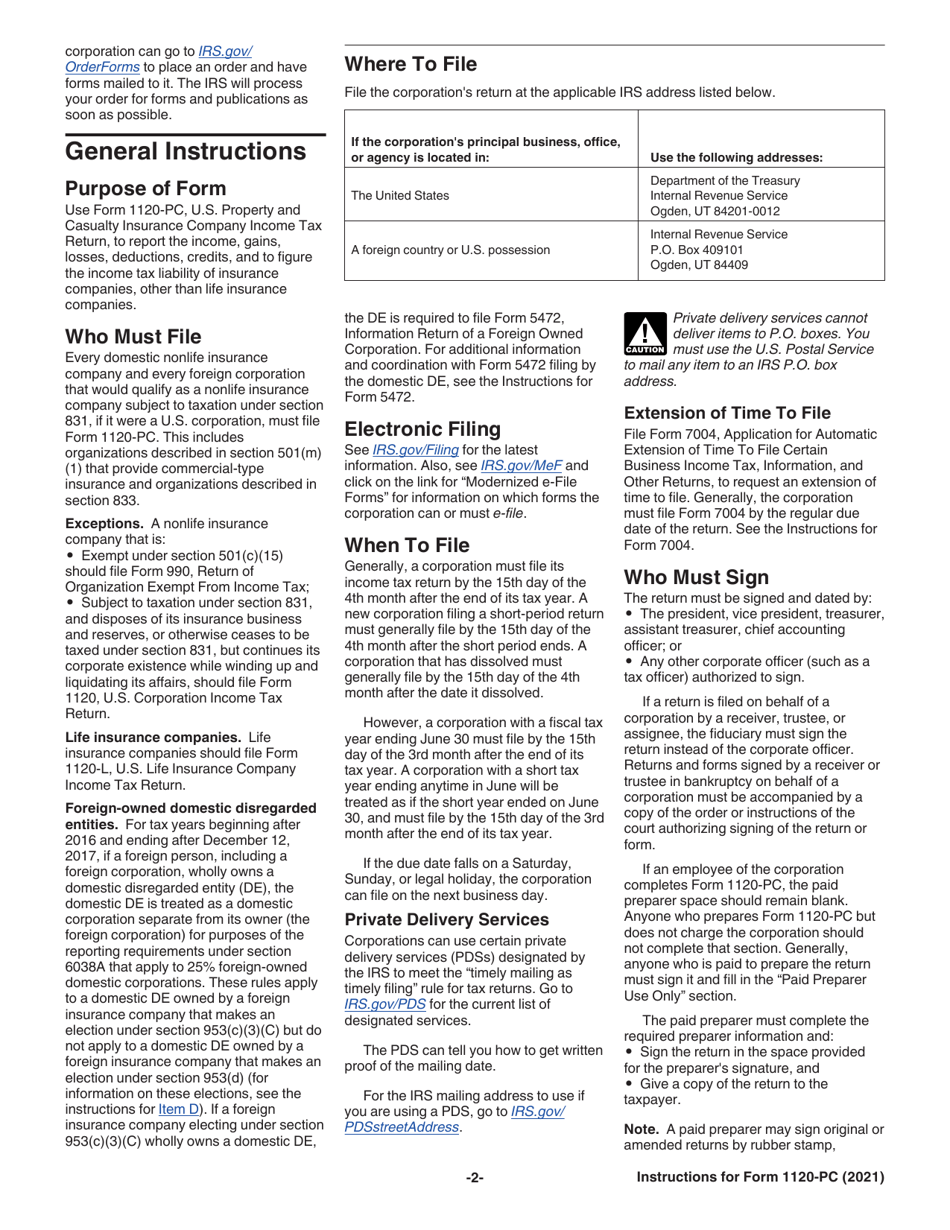

Instructions for IRS Form 1120-PC U.S. Property and Casualty Insurance Company Income Tax Return

This document contains official instructions for IRS Form 1120-PC , U.S. Property and Casualty Insurance Company Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1120-PC?

A: IRS Form 1120-PC is the U.S. Property and Casualty Insurance Company Income Tax Return.

Q: Who should file IRS Form 1120-PC?

A: U.S. property and casualty insurance companies should file IRS Form 1120-PC.

Q: What is the purpose of IRS Form 1120-PC?

A: The purpose of IRS Form 1120-PC is to report the income, deductions, and credits of property and casualty insurance companies.

Q: When is the deadline to file IRS Form 1120-PC?

A: The deadline to file IRS Form 1120-PC is typically March 15th of the year following the tax year.

Q: Are there any penalties for late filing of IRS Form 1120-PC?

A: Yes, there are penalties for late filing of IRS Form 1120-PC. It is important to file your return on time to avoid these penalties.

Q: What supporting documents are required to be attached to IRS Form 1120-PC?

A: The supporting documents required to be attached to IRS Form 1120-PC may vary depending on the specific circumstances of the insurance company. It is important to review the instructions for the form to determine the required supporting documents.

Q: Can I e-file IRS Form 1120-PC?

A: Yes, it is possible to e-file IRS Form 1120-PC. However, certain criteria and conditions may apply. It is recommended to review the IRS guidelines for e-filing.

Q: Can I request an extension to file IRS Form 1120-PC?

A: Yes, you can request an extension to file IRS Form 1120-PC. The extension request must be submitted before the original deadline, and there are specific procedures to follow.

Q: Is there a separate form for state income tax filing for property and casualty insurance companies?

A: Yes, each state may have its own requirements for income tax filing by property and casualty insurance companies. It is important to check with the respective state's tax authority for the applicable forms and deadlines.

Instruction Details:

- This 23-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.