This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-L

for the current year.

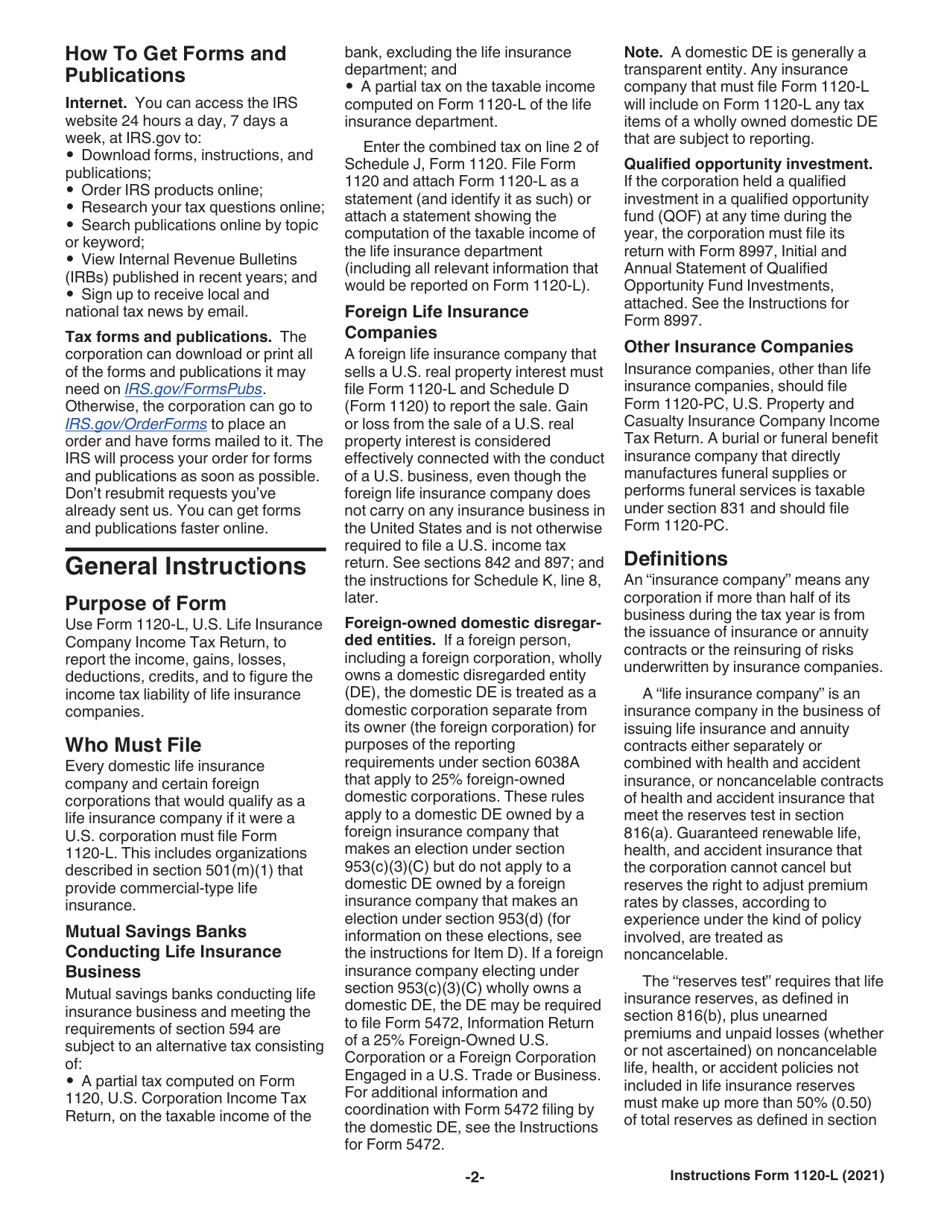

Instructions for IRS Form 1120-L U.S. Life Insurance Company Income Tax Return

This document contains official instructions for IRS Form 1120-L , U.S. Life Insurance Company Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is Form 1120-L?

A: Form 1120-L is the U.S. Life Insurance Company Income Tax Return.

Q: Who needs to file Form 1120-L?

A: Life insurance companies registered in the U.S. need to file Form 1120-L.

Q: What information is required on Form 1120-L?

A: Form 1120-L requires information about the company's income, deductions, and credits.

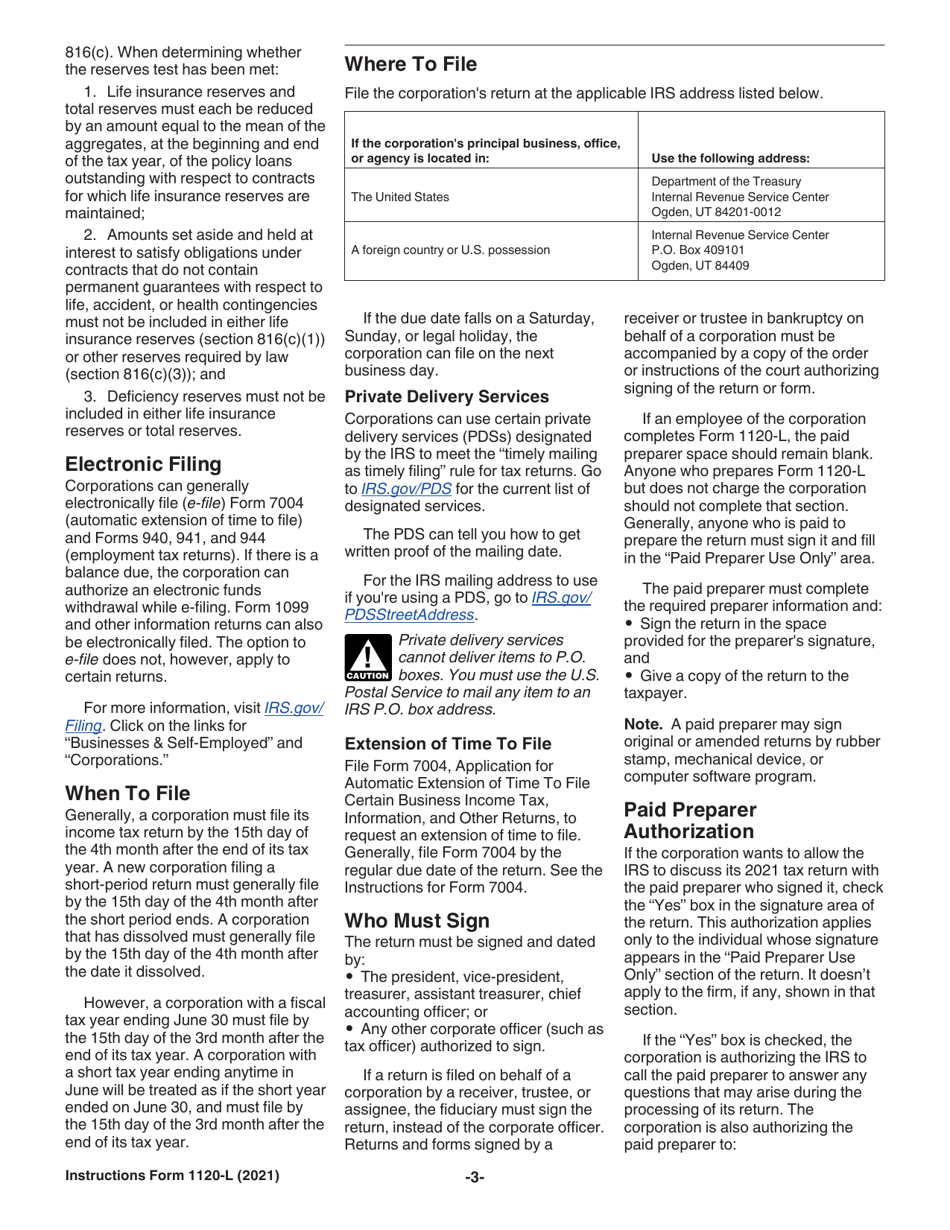

Q: When is the deadline to file Form 1120-L?

A: The deadline to file Form 1120-L is March 15th for calendar year taxpayers.

Q: Are there any extensions available for filing Form 1120-L?

A: Yes, extensions up to 6 months can be requested using Form 7004.

Q: Are there any penalties for late filing of Form 1120-L?

A: Yes, penalties may apply for late filing or failure to pay the taxes due.

Q: Can Form 1120-L be filed electronically?

A: Yes, electronic filing is available for Form 1120-L.

Q: Are there any specific requirements for recordkeeping?

A: Yes, life insurance companies must keep records that support the items reported on Form 1120-L.

Instruction Details:

- This 25-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.