This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1116 Schedule B

for the current year.

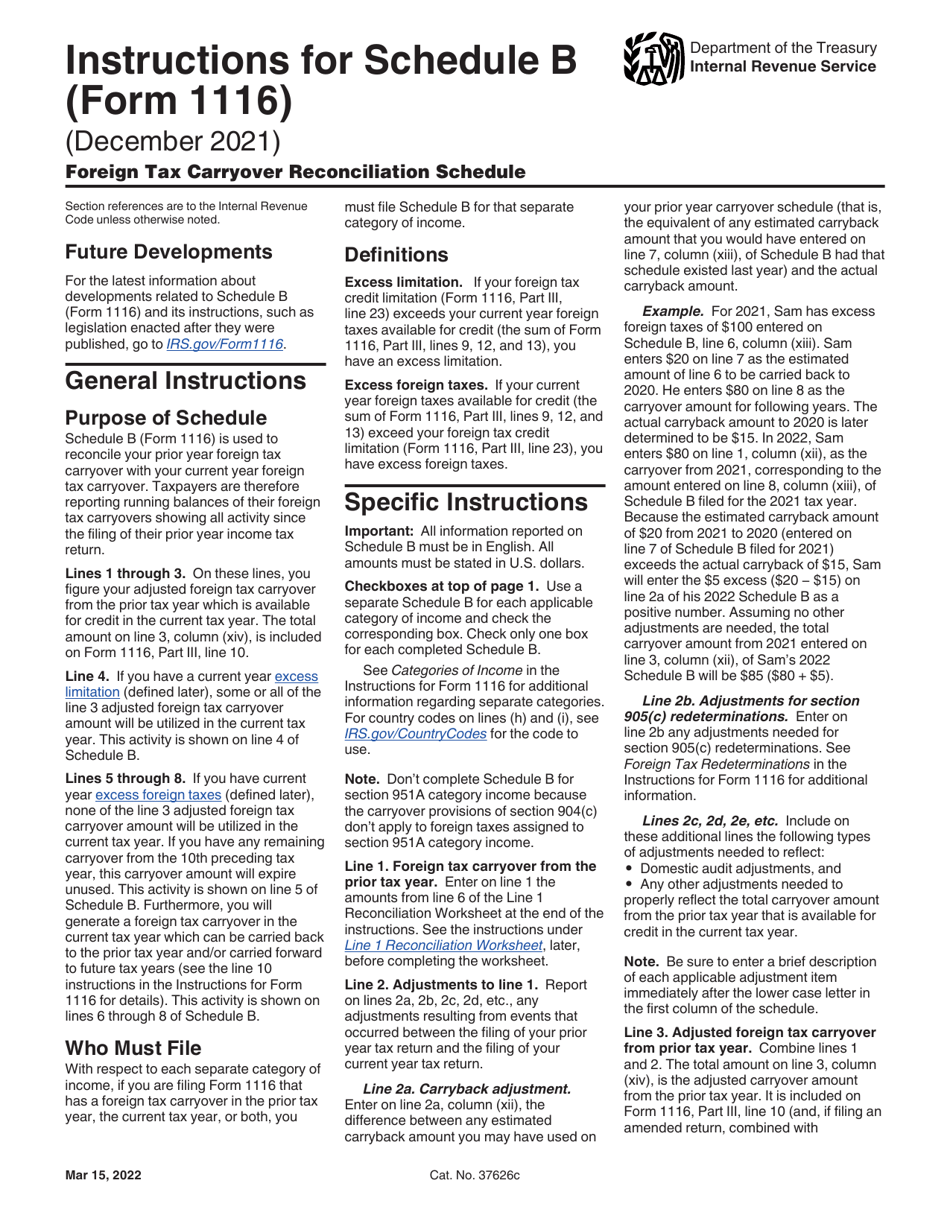

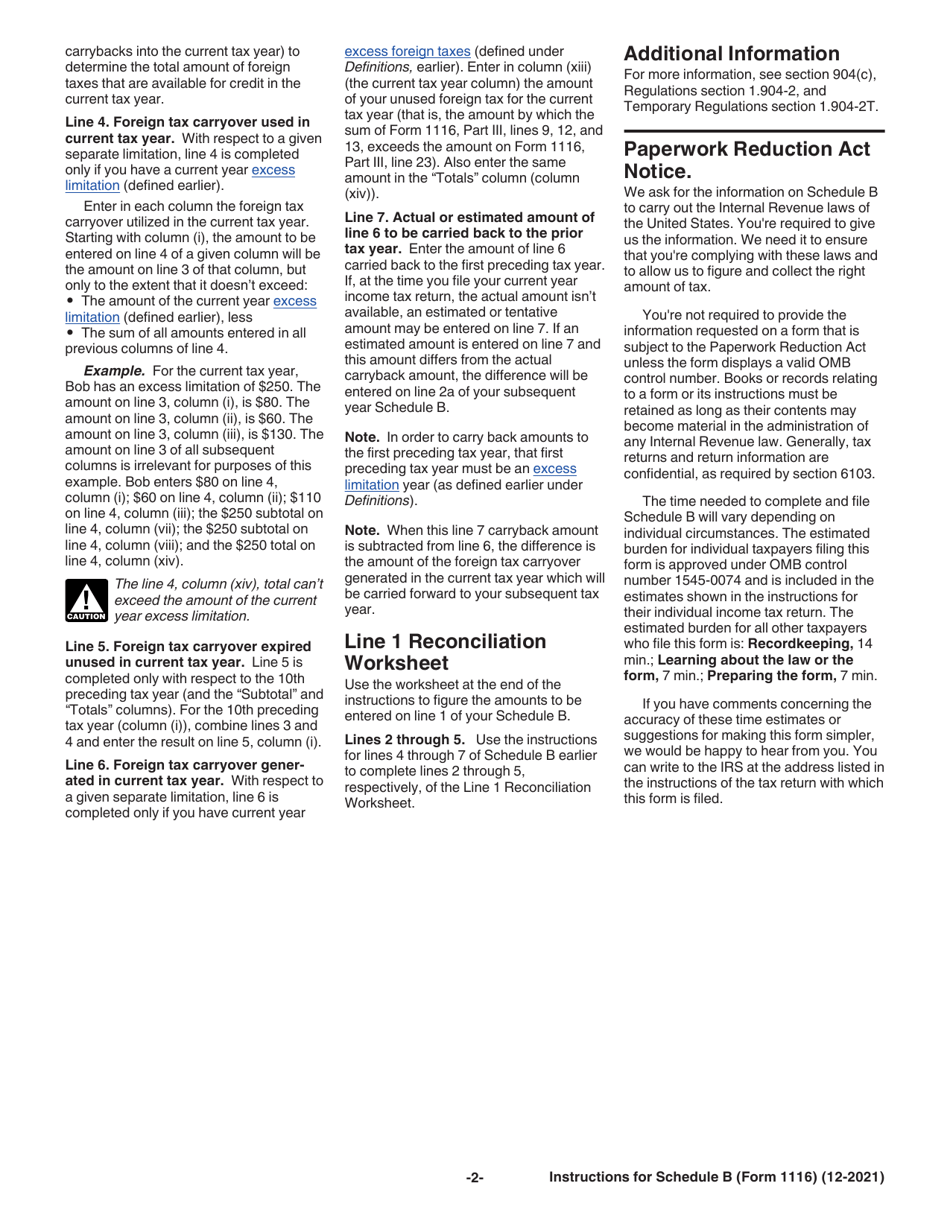

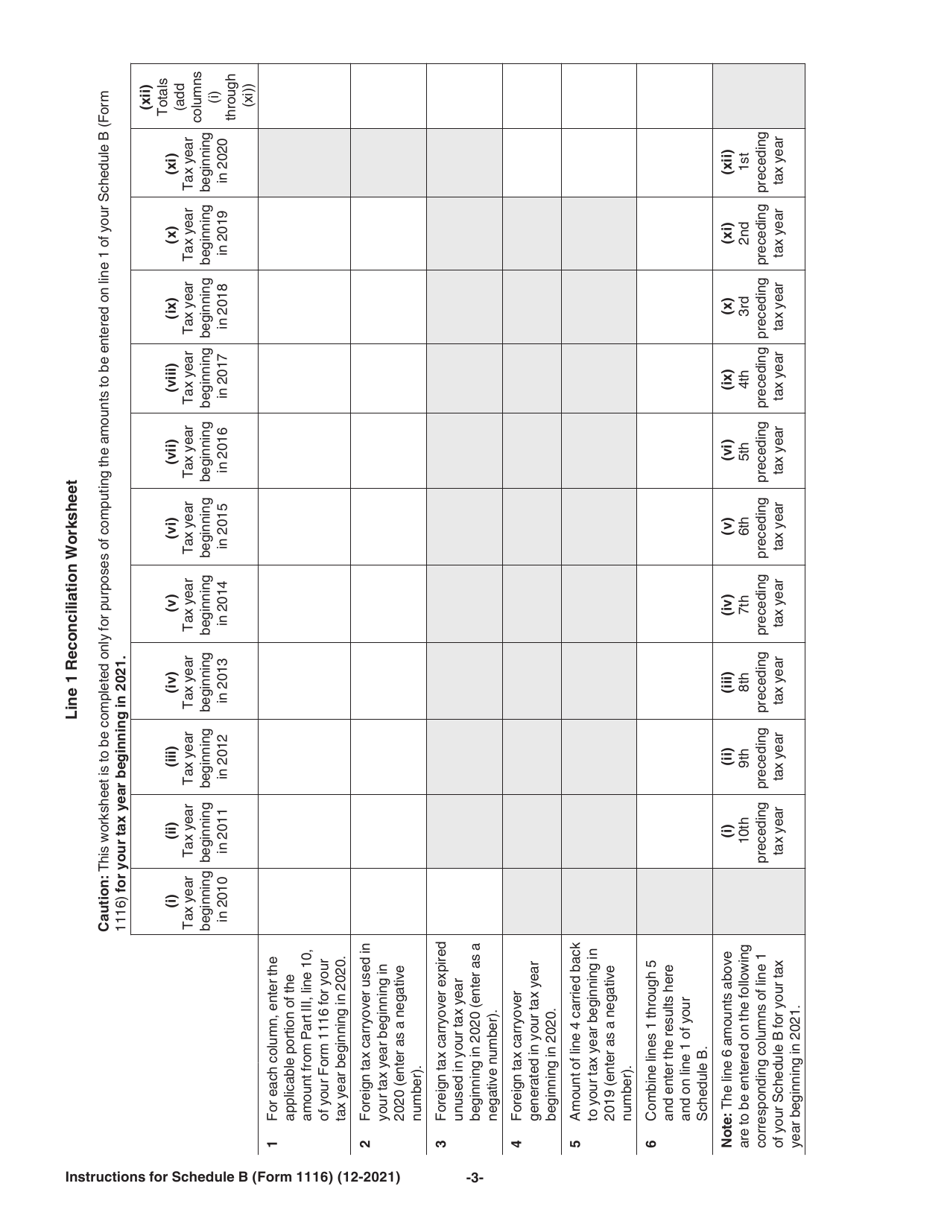

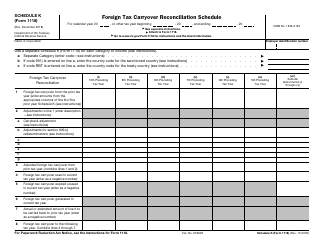

Instructions for IRS Form 1116 Schedule B Foreign Tax Carryover Reconciliation Schedule

This document contains official instructions for IRS Form 1116 Schedule B, Foreign Tax Carryover Reconciliation Schedule - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1116 Schedule B is available for download through this link.

FAQ

Q: What is IRS Form 1116?

A: IRS Form 1116 is used by U.S. taxpayers to claim a foreign tax credit.

Q: What is Schedule B?

A: Schedule B is a reconciliation schedule that helps calculate the foreign tax credit carryover.

Q: What is a foreign tax credit?

A: A foreign tax credit is a tax benefit that allows U.S. taxpayers to offset taxes paid to a foreign government.

Q: Why would I need to use Form 1116?

A: You would need to use Form 1116 if you have paid foreign taxes and want to claim a credit on your U.S. tax return.

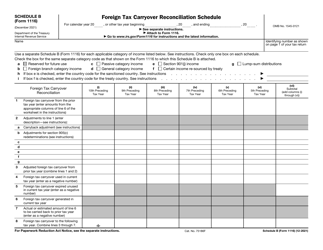

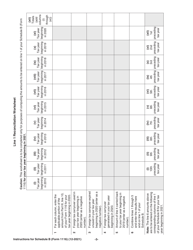

Q: What information is required on Schedule B?

A: Schedule B requires information about your foreign tax computations, any foreign tax carryovers from previous years, and any adjustments or limitations.

Q: Can I claim a foreign tax credit for all types of taxes paid to a foreign government?

A: Generally, you can claim a foreign tax credit for income taxes, but certain other taxes and fees may also qualify. Refer to the instructions for details.

Q: Is Form 1116 required for every taxpayer who paid foreign taxes?

A: No, not every taxpayer is required to file Form 1116. It depends on your individual situation and whether you are eligible for the foreign tax credit.

Q: Is there a deadline for filing Form 1116?

A: Form 1116 is usually filed with your annual tax return. The deadline for filing your tax return typically falls on April 15th, unless extended or modified by the IRS.

Q: Can I claim a foreign tax credit if I use the standard deduction?

A: Yes, you can still claim a foreign tax credit even if you use the standard deduction on your tax return. The foreign tax credit is a separate calculation that can benefit you regardless of whether you itemize deductions or take the standard deduction.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.