This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1065 Schedule M-3

for the current year.

Instructions for IRS Form 1065 Schedule M-3 Net Income (Loss) Reconciliation for Certain Partnerships

This document contains official instructions for IRS Form 1065 Schedule M-3, Net Income (Loss) Reconciliation for Certain Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1065 Schedule M-3 is available for download through this link.

FAQ

Q: What is IRS Form 1065 Schedule M-3?

A: IRS Form 1065 Schedule M-3 is a form used by certain partnerships to reconcile their net income (loss) for tax purposes.

Q: What is the purpose of Schedule M-3?

A: The purpose of Schedule M-3 is to reconcile the net income (loss) reported on a partnership's tax return with its financial statement income (loss).

Q: Who is required to file Schedule M-3?

A: Certain partnerships are required to file Schedule M-3, including those with total assets of $10 million or more, partnerships that have publicly traded securities, and partnerships that are required to file Form 1120.

Q: What information is required on Schedule M-3?

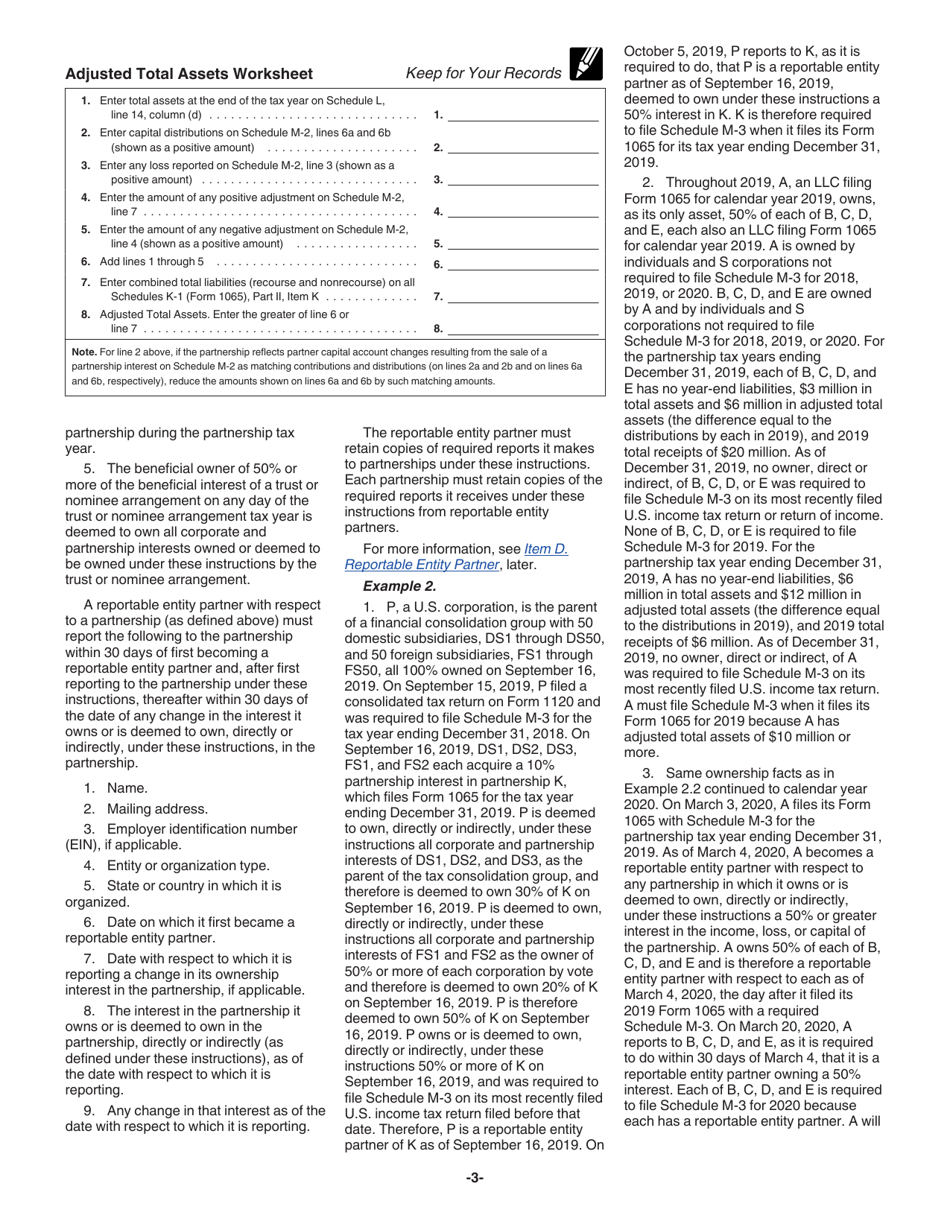

A: Schedule M-3 requires information about the partnership's financial statement income (loss), adjustments to reconcile the financial statement income (loss) to tax net income (loss), and certain other tax-related information.

Q: When is Schedule M-3 due?

A: Schedule M-3 is due with the partnership's tax return, which is typically filed by the original due date of the return, including extensions.

Instruction Details:

- This 20-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.