This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1041 Schedule D

for the current year.

Instructions for IRS Form 1041 Schedule D Capital Gains and Losses

This document contains official instructions for IRS Form 1041 Schedule D, Capital Gains and Losses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1041?

A: IRS Form 1041 is a tax form used by estates and trusts to report their income, deductions, and taxes.

Q: What is Schedule D?

A: Schedule D is a supplemental form to IRS Form 1041 that is used to report capital gains and losses.

Q: What are capital gains and losses?

A: Capital gains are the profits made from selling assets like stocks or real estate. Capital losses are the losses incurred from selling these assets.

Q: Do I need to file Schedule D?

A: You need to file Schedule D if you have capital gains or losses to report on your estate or trust tax return.

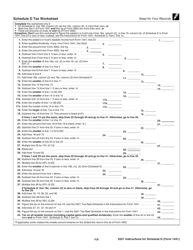

Q: How do I fill out Schedule D?

A: To fill out Schedule D, you will need to provide details of your capital gains and losses, including the assets sold and the amount of gain or loss.

Q: Are there any special rules or requirements for Schedule D?

A: Yes, there are special rules for reporting certain types of transactions, such as wash sales or like-kind exchanges. You may need to consult IRS instructions or a tax professional for guidance.

Q: When is the deadline to file Form 1041 Schedule D?

A: The deadline to file Form 1041, including Schedule D, is usually April 15th. However, it may vary depending on the tax year and any extensions you have requested.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.