This version of the form is not currently in use and is provided for reference only. Download this version of

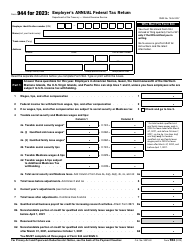

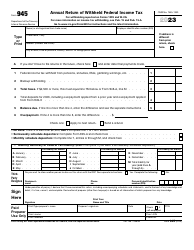

Instructions for IRS Form 945-A

for the current year.

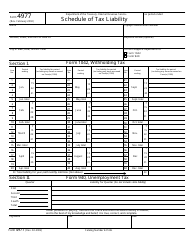

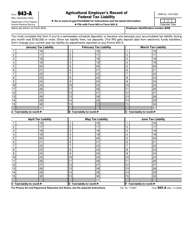

Instructions for IRS Form 945-A Annual Record of Federal Tax Liability

This document contains official instructions for IRS Form 945-A , Annual Record of Federal Tax Liability - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 945-A is available for download through this link.

FAQ

Q: What is IRS Form 945-A?

A: IRS Form 945-A is the Annual Record of Federal Tax Liability.

Q: Who needs to file IRS Form 945-A?

A: Employers who are required to deposit federal income tax withheld and both the employer and employee share of social security and Medicare taxes must file Form 945-A.

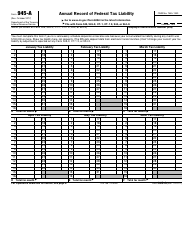

Q: What information is required on IRS Form 945-A?

A: Form 945-A requires information related to the employer, tax liability, and tax deposits made throughout the year.

Q: When is the deadline to file IRS Form 945-A?

A: Form 945-A should be filed by January 31 of the following year.

Q: What are the consequences of not filing IRS Form 945-A?

A: Failure to file Form 945-A may result in penalties and interest charges.

Q: Is IRS Form 945-A separate from Form 945?

A: Yes, IRS Form 945-A is a separate form that is used along with Form 945 to report federal tax liability and deposits.

Q: Can I file IRS Form 945-A electronically?

A: No, Form 945-A cannot be filed electronically. It must be filed by mail.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.