This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 943 Schedule R

for the current year.

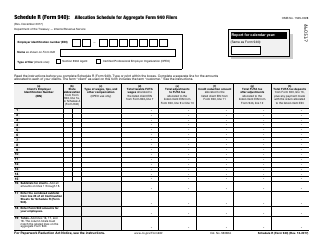

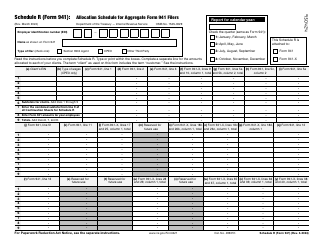

Instructions for IRS Form 943 Schedule R Allocation Schedule for Aggregate Form 943 Filers

This document contains official instructions for IRS Form 943 Schedule R, Allocation Schedule for Aggregate Form 943 Filers - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 943 Schedule R is available for download through this link.

FAQ

Q: What is IRS Form 943?

A: IRS Form 943 is used by employers to report wages and taxes for agricultural employees.

Q: What is Schedule R?

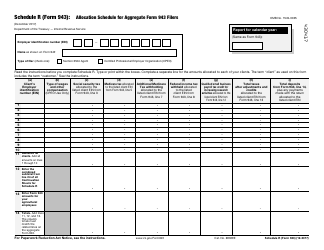

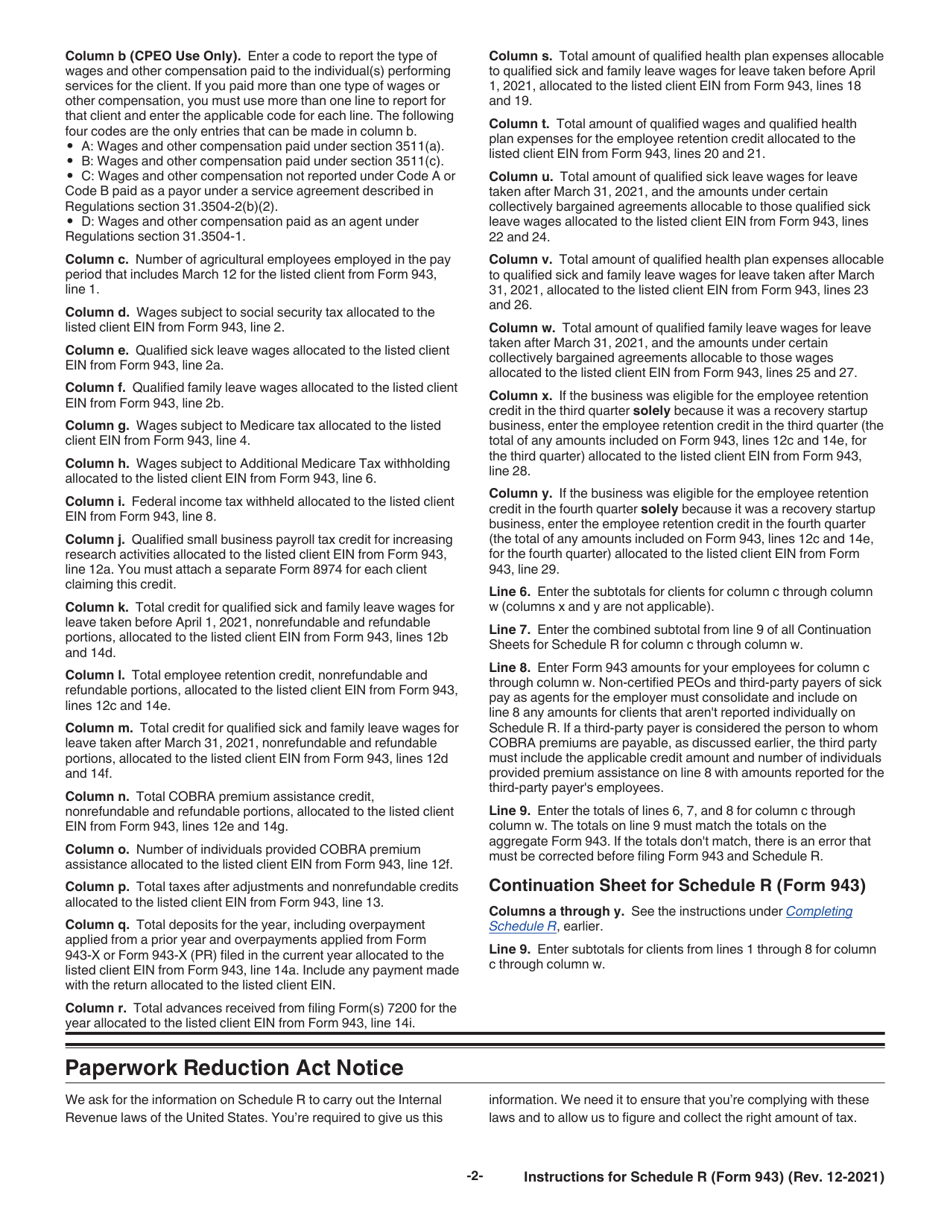

A: Schedule R is an allocation schedule used by aggregate Form 943 filers to allocate wages and taxes among their various establishments.

Q: Who uses Schedule R?

A: Schedule R is used by aggregate Form 943 filers, which are employers who have multiple establishments and file one Form 943 for all of their establishments combined.

Q: What is the purpose of Schedule R?

A: The purpose of Schedule R is to allocate the total wages and taxes reported on Form 943 among the different establishments of an aggregate filer.

Q: How does Schedule R work?

A: Schedule R works by assigning a percentage or dollar amount of the total wages and taxes to each establishment based on the allocation method chosen by the filer.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.