This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 461

for the current year.

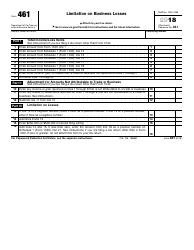

Instructions for IRS Form 461 Limitation on Business Losses

This document contains official instructions for IRS Form 461 , Limitation on Business Losses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is Form 461?

A: Form 461 is a form used by taxpayers to compute the amount of their allowable business losses that can be deducted for tax purposes.

Q: What is the purpose of Form 461?

A: The purpose of Form 461 is to help taxpayers determine the limit on deducting business losses to prevent excessive deductions.

Q: Who needs to file Form 461?

A: Taxpayers who have business losses that exceed their income need to file Form 461 to determine the limit on deducting those losses.

Q: What types of losses are covered by Form 461?

A: Form 461 covers business losses, including losses from farming, partnerships, S corporations, and passive activities.

Q: How does Form 461 calculate the limit on business losses?

A: Form 461 calculates the limit on business losses based on the taxpayer's other income, filing status, and the type of loss.

Q: Are there any exceptions or special rules for Form 461?

A: Yes, there are certain exceptions and special rules for specific types of losses, such as losses from a designated disaster area or those incurred by certain real estate professionals.

Q: When is the deadline for filing Form 461?

A: The deadline for filing Form 461 is the same as the deadline for filing your federal income tax return, usually April 15th of the following year.

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.