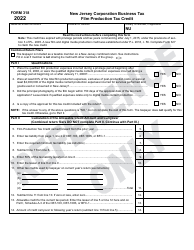

This version of the form is not currently in use and is provided for reference only. Download this version of

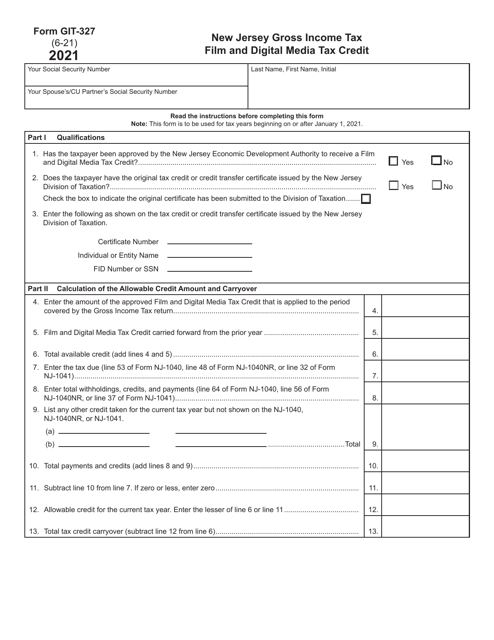

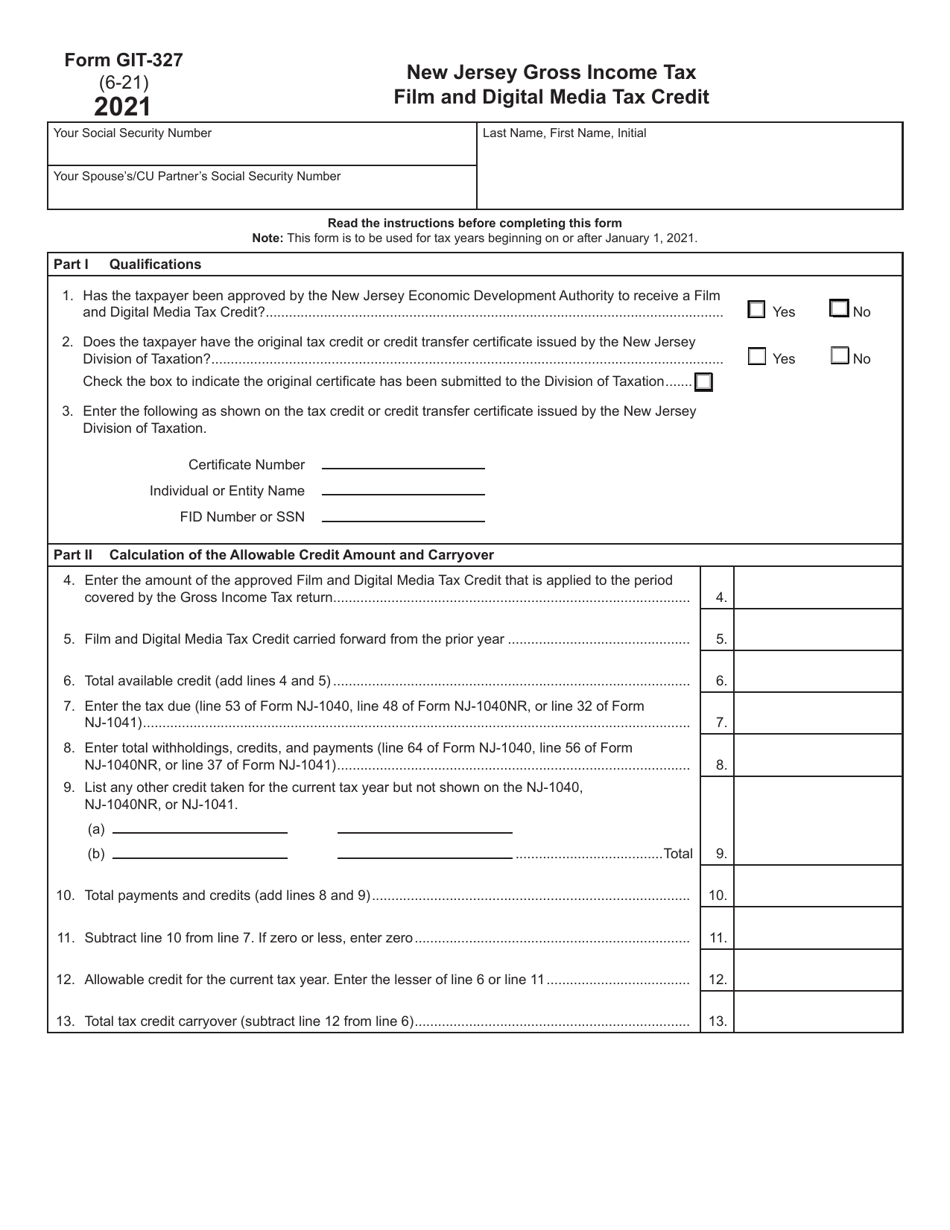

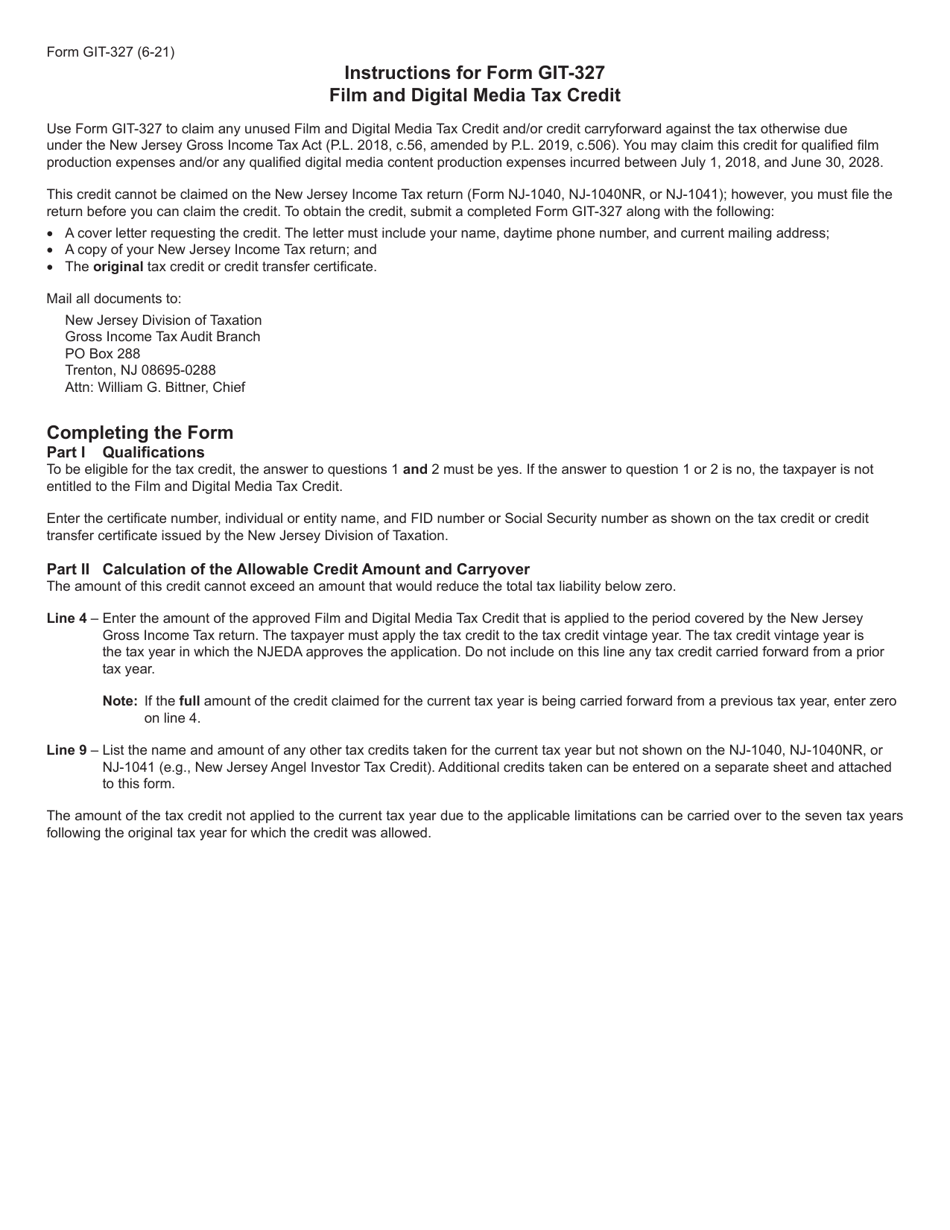

Form GIT-327

for the current year.

Form GIT-327 Film and Digital Media Tax Credit - New Jersey

What Is Form GIT-327?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

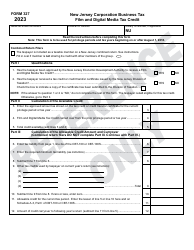

Q: What is the GIT-327 Film and Digital Media Tax Credit in New Jersey?

A: The GIT-327 Film and Digital Media Tax Credit is a tax credit program in New Jersey that provides financial incentives for film and digital media production companies.

Q: Who is eligible for the GIT-327 Film and Digital Media Tax Credit?

A: Eligible companies include film and digital media production companies that produce content in New Jersey.

Q: What types of expenses are eligible for the tax credit?

A: Eligible expenses include qualified production costs, such as wages paid to New Jersey residents, goods and services purchased in New Jersey, and certain other expenses related to the production.

Q: How much tax credit can a company receive?

A: The tax credit amount is generally 30% of qualified production expenses. Additional bonuses may be available for hiring certain groups, using certain facilities, or filming in specified locations.

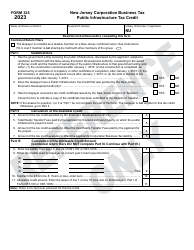

Q: Are there any limitations or caps on the tax credit?

A: Yes, there are annual caps on the total amount of tax credits available, as well as individual project caps. The program also has a sunset date, after which no new applications will be accepted.

Q: How does a company apply for the tax credit?

A: Companies must submit an application to the New Jersey Economic Development Authority (EDA) and meet certain criteria to be considered for the tax credit.

Q: Is there a deadline for submitting the application?

A: Yes, applications must be submitted to the EDA by the specified deadline, which is typically several months prior to the start of production.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-327 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.