This version of the form is not currently in use and is provided for reference only. Download this version of

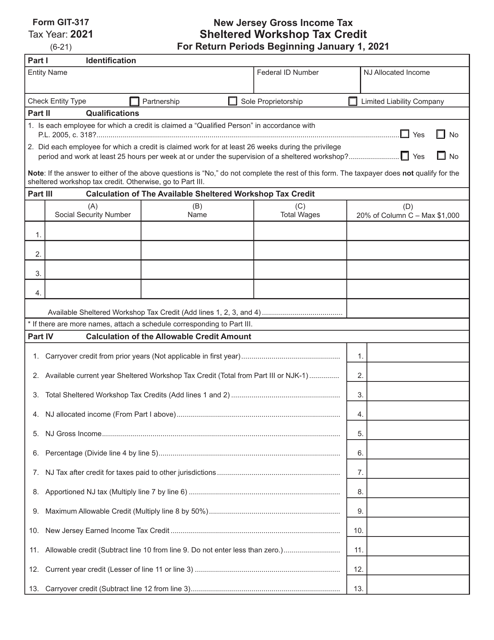

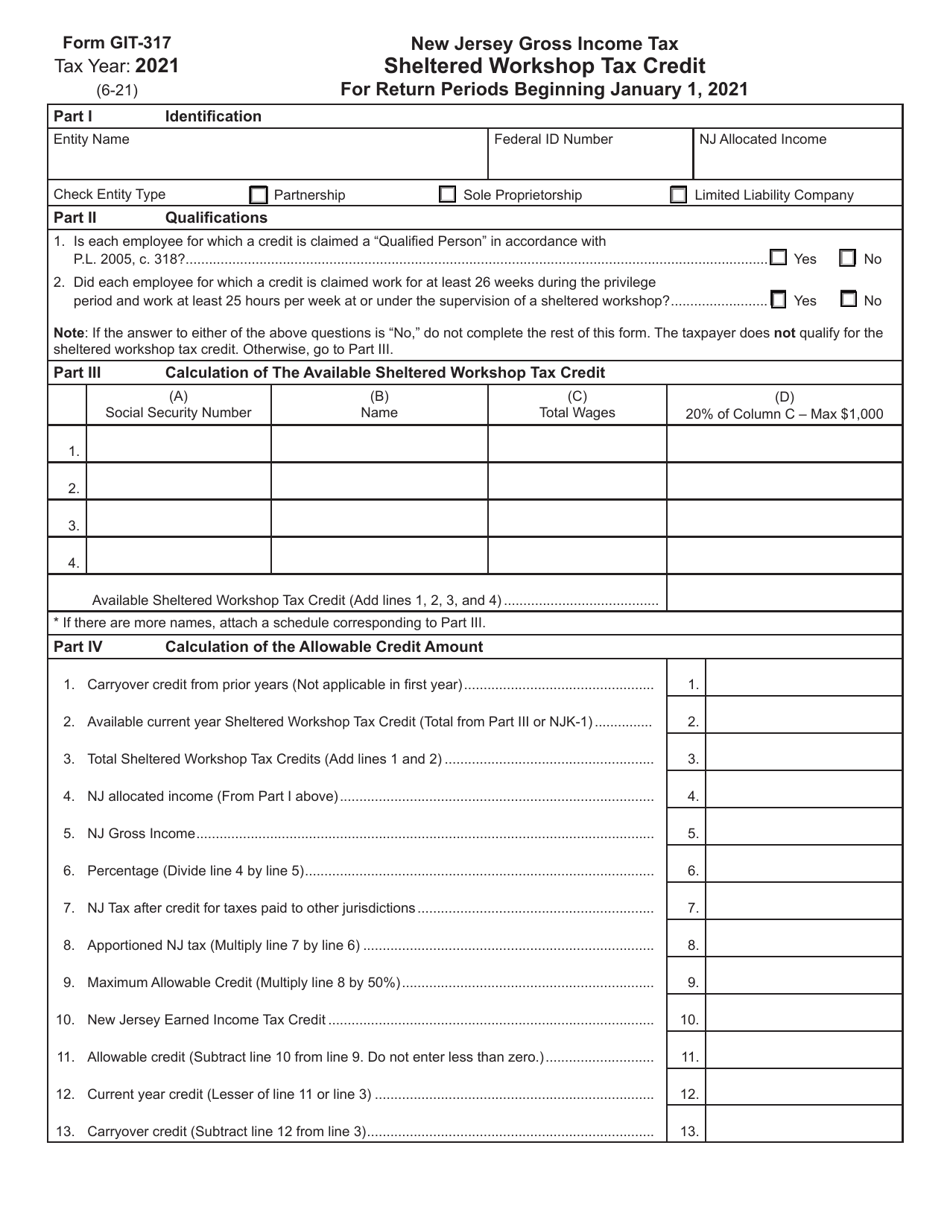

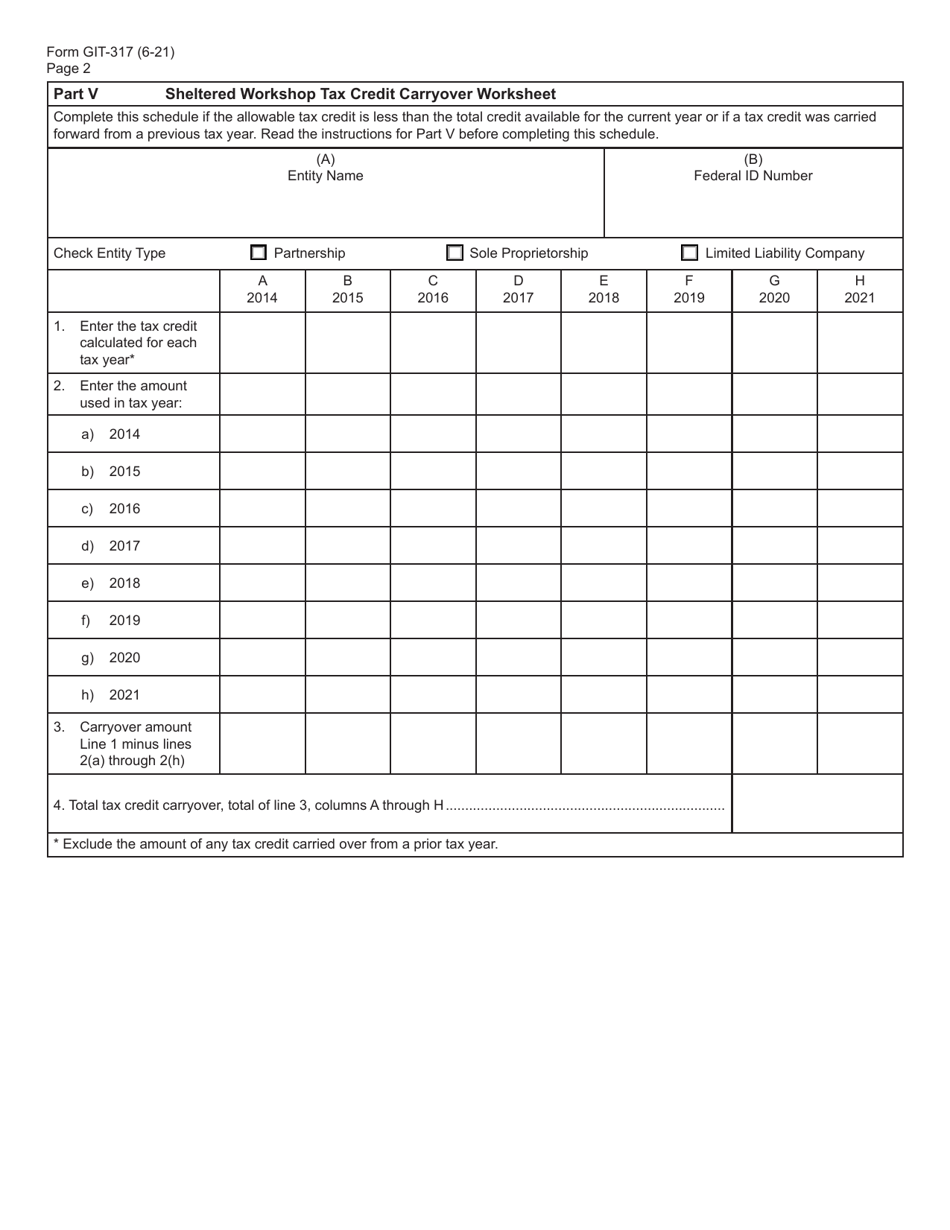

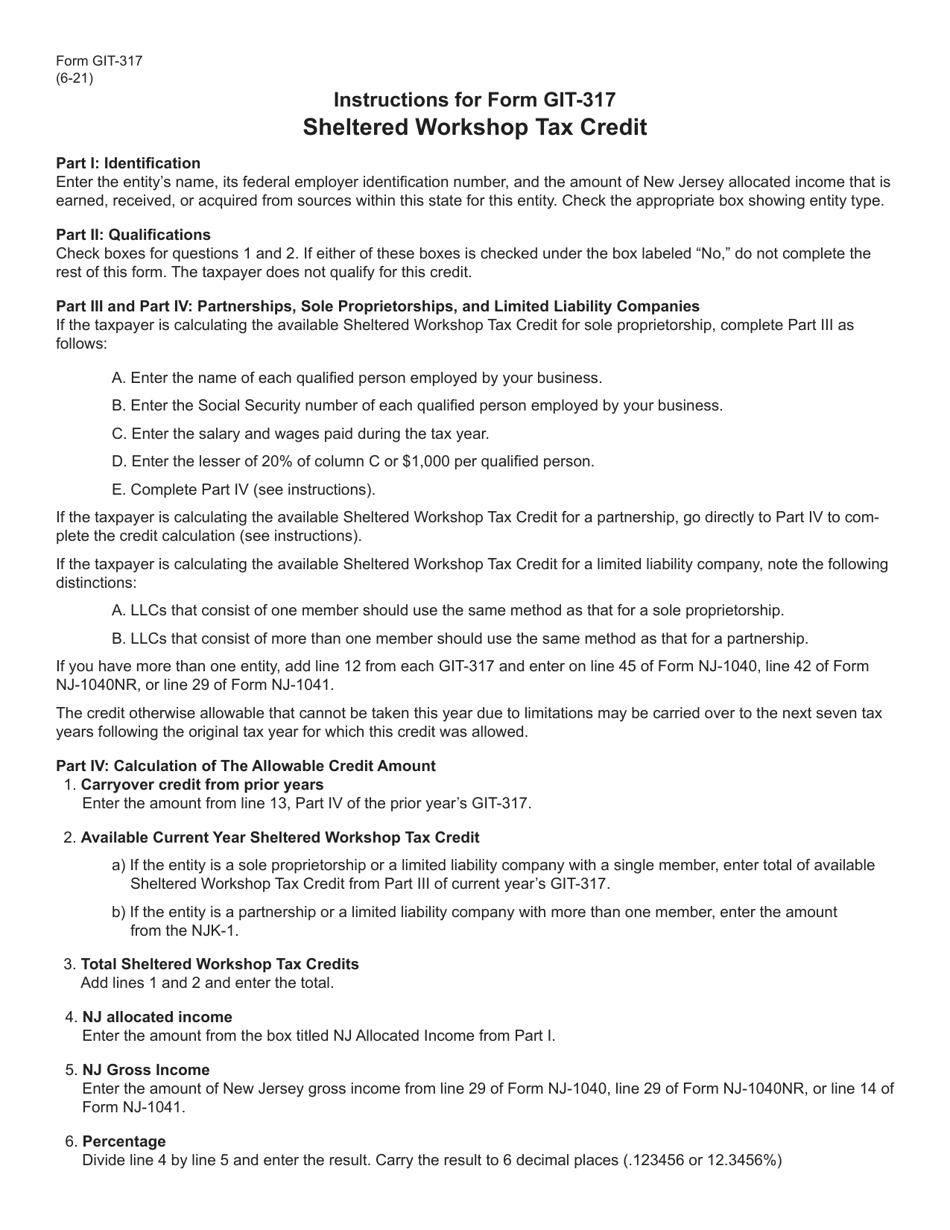

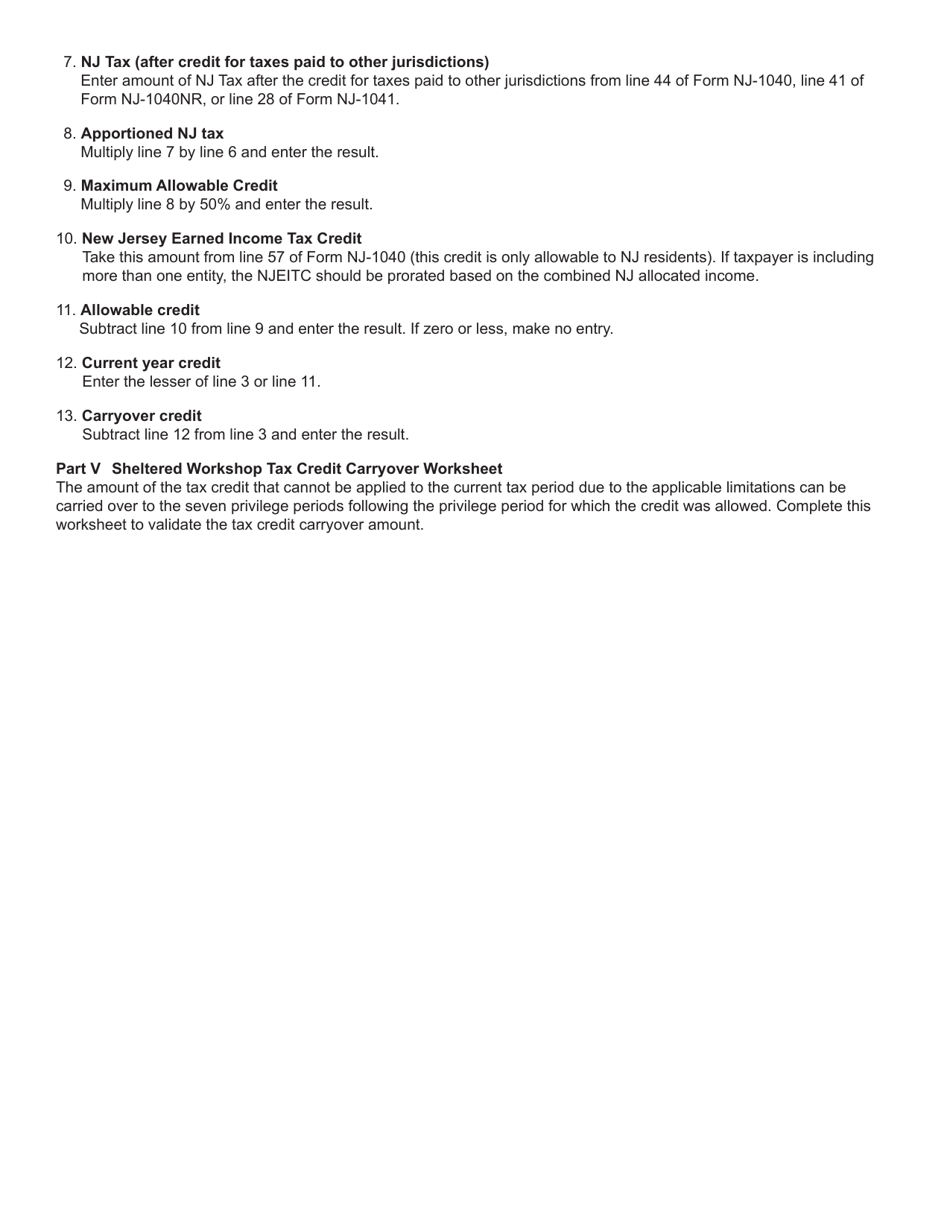

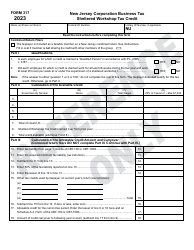

Form GIT-317

for the current year.

Form GIT-317 Sheltered Workshop Tax Credit - New Jersey

What Is Form GIT-317?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

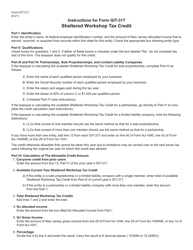

Q: What is the GIT-317 Sheltered Workshop Tax Credit?

A: The GIT-317 Sheltered Workshop Tax Credit is a tax credit provided by the state of New Jersey for businesses that employ individuals with disabilities in sheltered workshops.

Q: How do I qualify for the Sheltered Workshop Tax Credit?

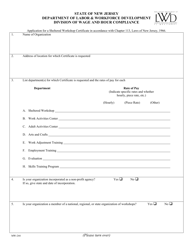

A: To qualify for the Sheltered Workshop Tax Credit, you must be a business that employs individuals with disabilities in sheltered workshops registered with the New Jersey Department of Labor and Workforce Development.

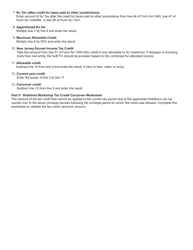

Q: How much is the tax credit?

A: The tax credit amount is $21.60 per day for each qualified individual with a disability employed in the sheltered workshop.

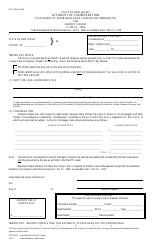

Q: How do I claim the Sheltered Workshop Tax Credit?

A: To claim the Sheltered Workshop Tax Credit, you need to complete and file the GIT-317 form with the New Jersey Division of Taxation.

Q: When is the deadline to file for the tax credit?

A: The deadline to file the GIT-317 form and claim the Sheltered Workshop Tax Credit is the same as the deadline for filing your New Jersey business tax return, typically April 15th.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-317 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.