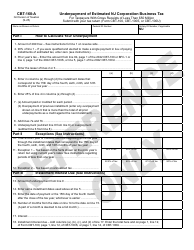

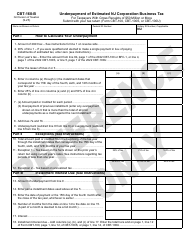

This version of the form is not currently in use and is provided for reference only. Download this version of

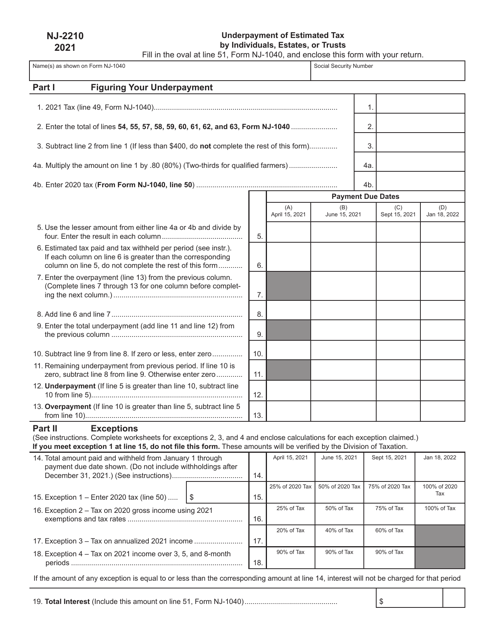

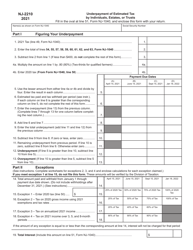

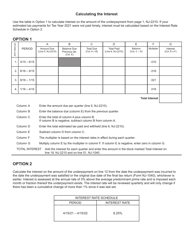

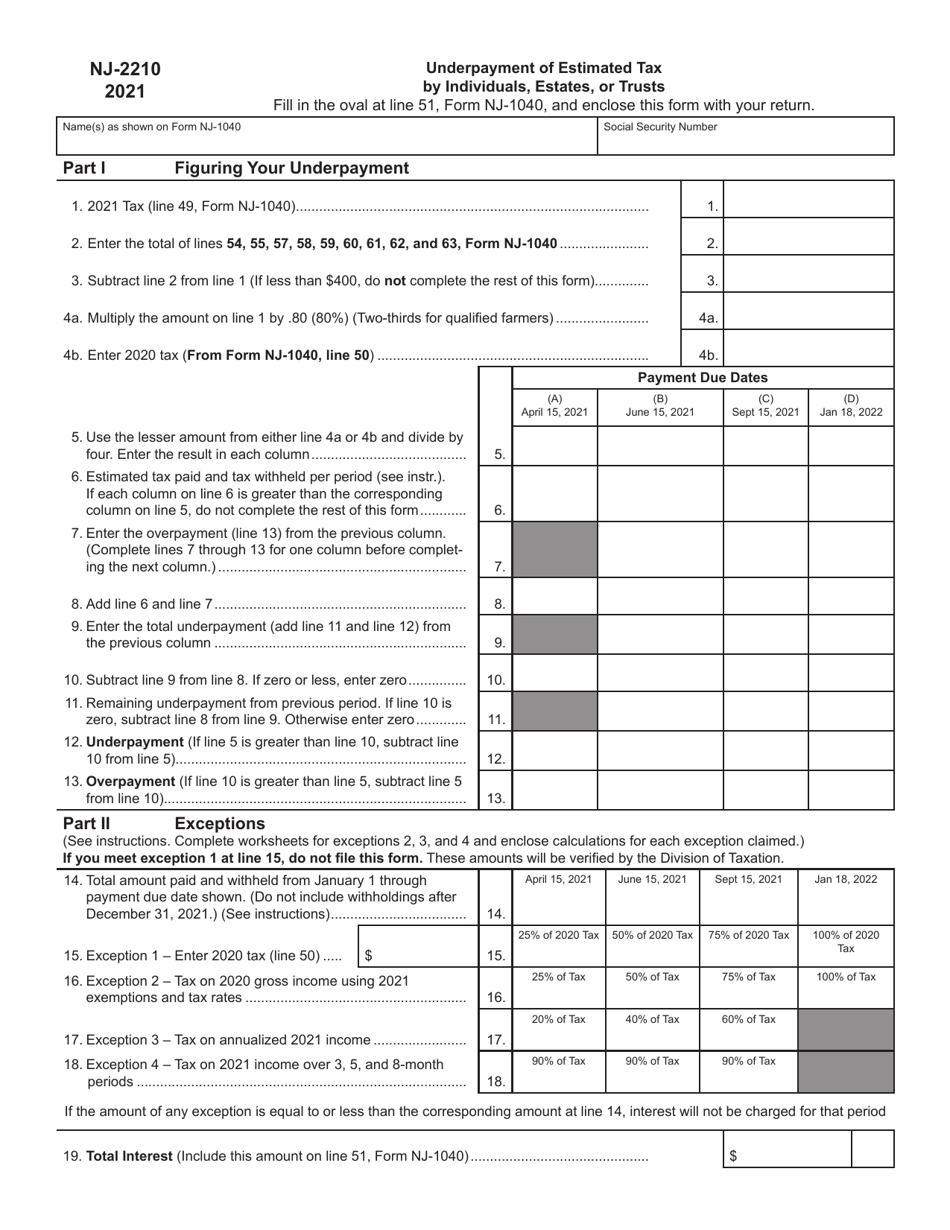

Form NJ-2210

for the current year.

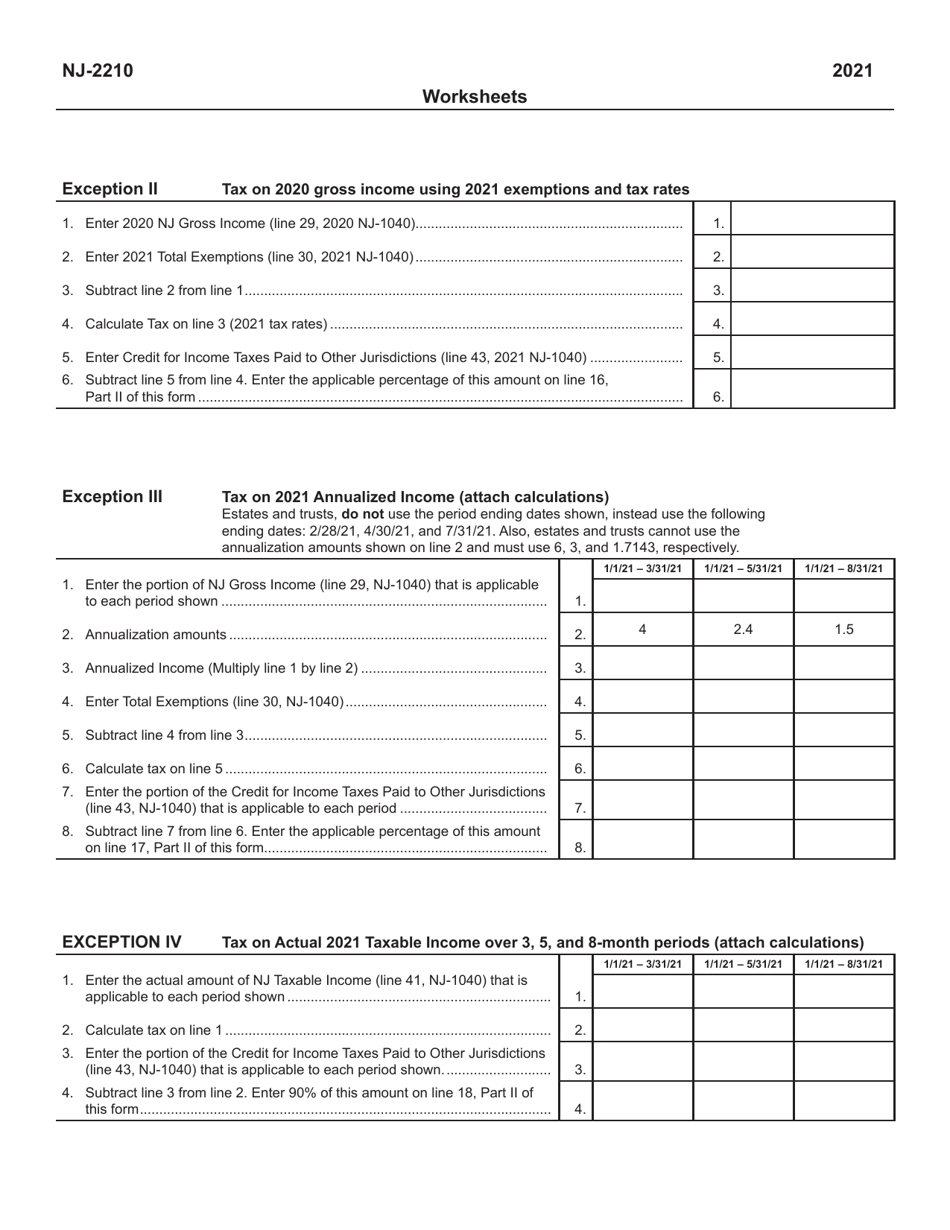

Form NJ-2210 Underpayment of Estimated Tax by Individuals, Estates, or Trusts - New Jersey

What Is Form NJ-2210?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

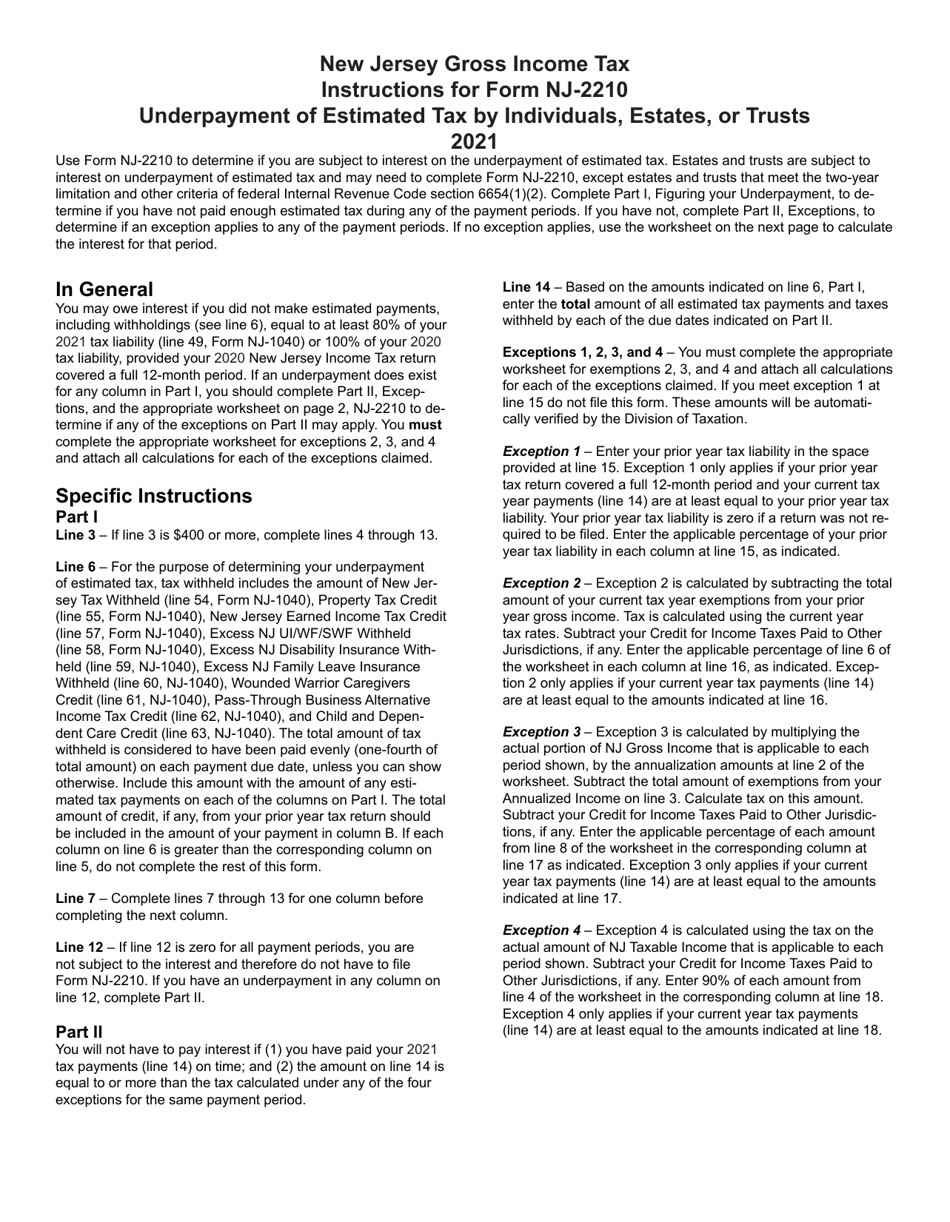

Q: What is Form NJ-2210?

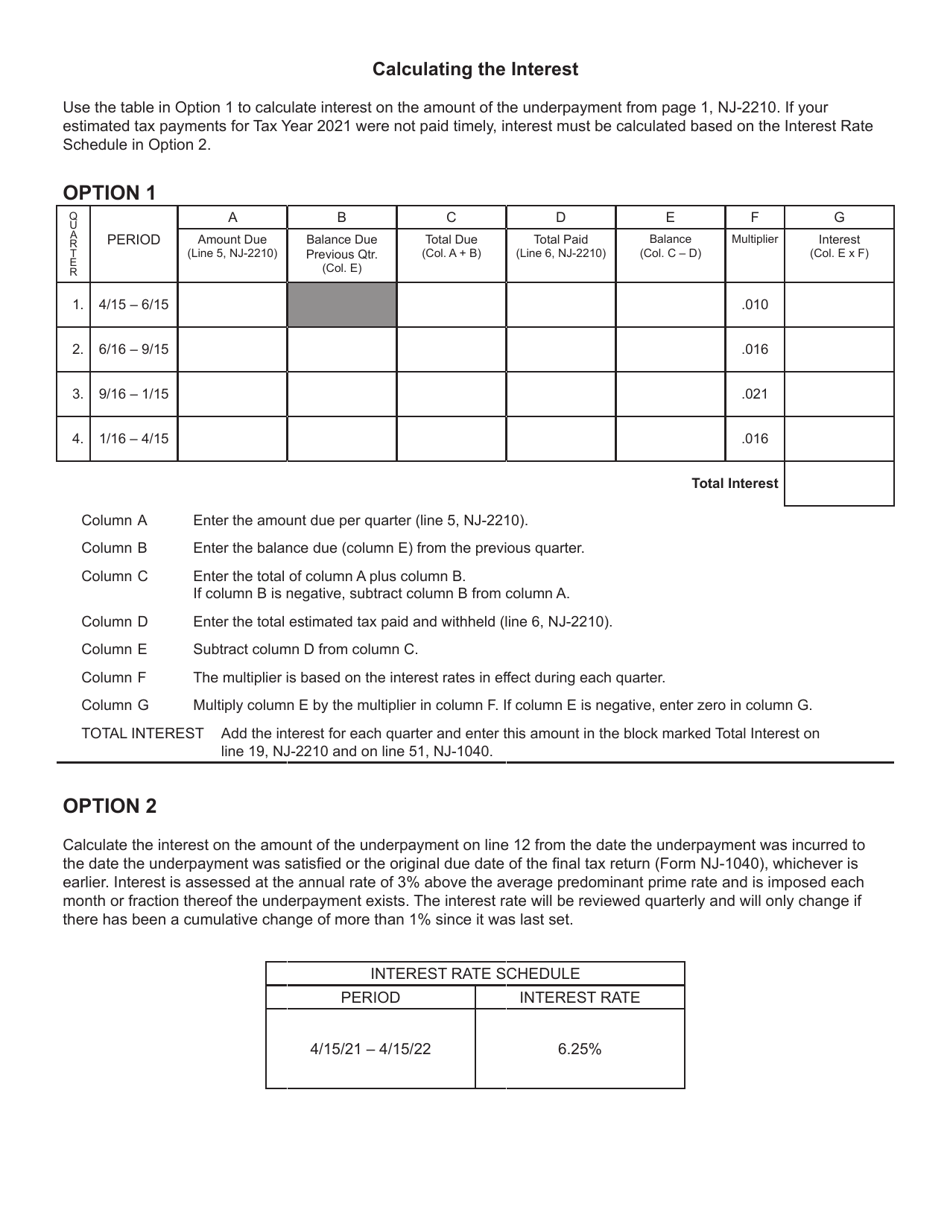

A: Form NJ-2210 is used to calculate and pay any underpayment of estimated tax by individuals, estates, or trusts in the state of New Jersey.

Q: Who needs to file Form NJ-2210?

A: Individuals, estates, or trusts in New Jersey who have made estimated tax payments that are less than the required amount may need to file Form NJ-2210.

Q: What is the purpose of filing Form NJ-2210?

A: The purpose of filing Form NJ-2210 is to calculate and pay any underpayment of estimated tax in order to avoid penalties and interest.

Q: When is Form NJ-2210 due?

A: Form NJ-2210 is generally due on the same date as your New Jersey income tax return, which is typically April 15th of the following year.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-2210 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.