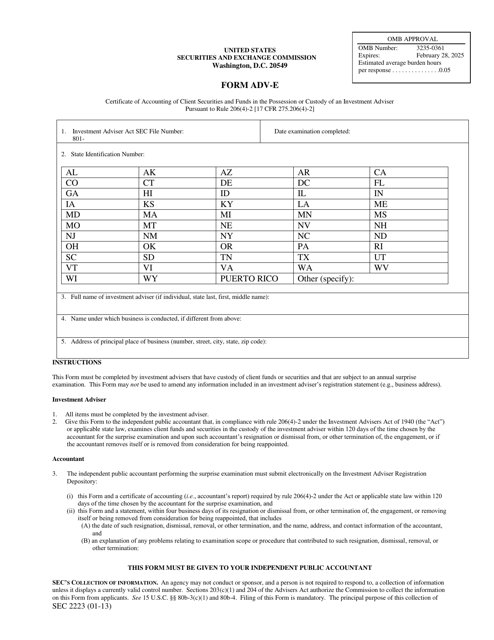

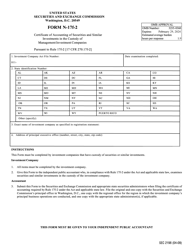

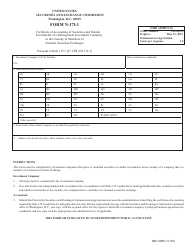

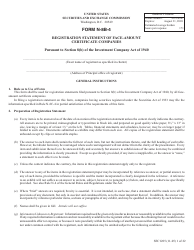

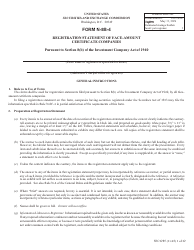

SEC Form 2223 (ADV-E) Certificate of Accounting of Client Securities and Funds in the Possession or Custody of an Investment Adviser

What Is SEC Form 2223 (ADV-E)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on January 1, 2013 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SEC Form 2223 (ADV-E)?

A: SEC Form 2223 (ADV-E) is a certificate of accounting of client securities and funds in the possession or custody of an investment adviser.

Q: What is the purpose of SEC Form 2223 (ADV-E)?

A: The purpose of SEC Form 2223 (ADV-E) is to provide information about the accounting and custody practices followed by an investment adviser regarding client securities and funds.

Q: Who needs to file SEC Form 2223 (ADV-E)?

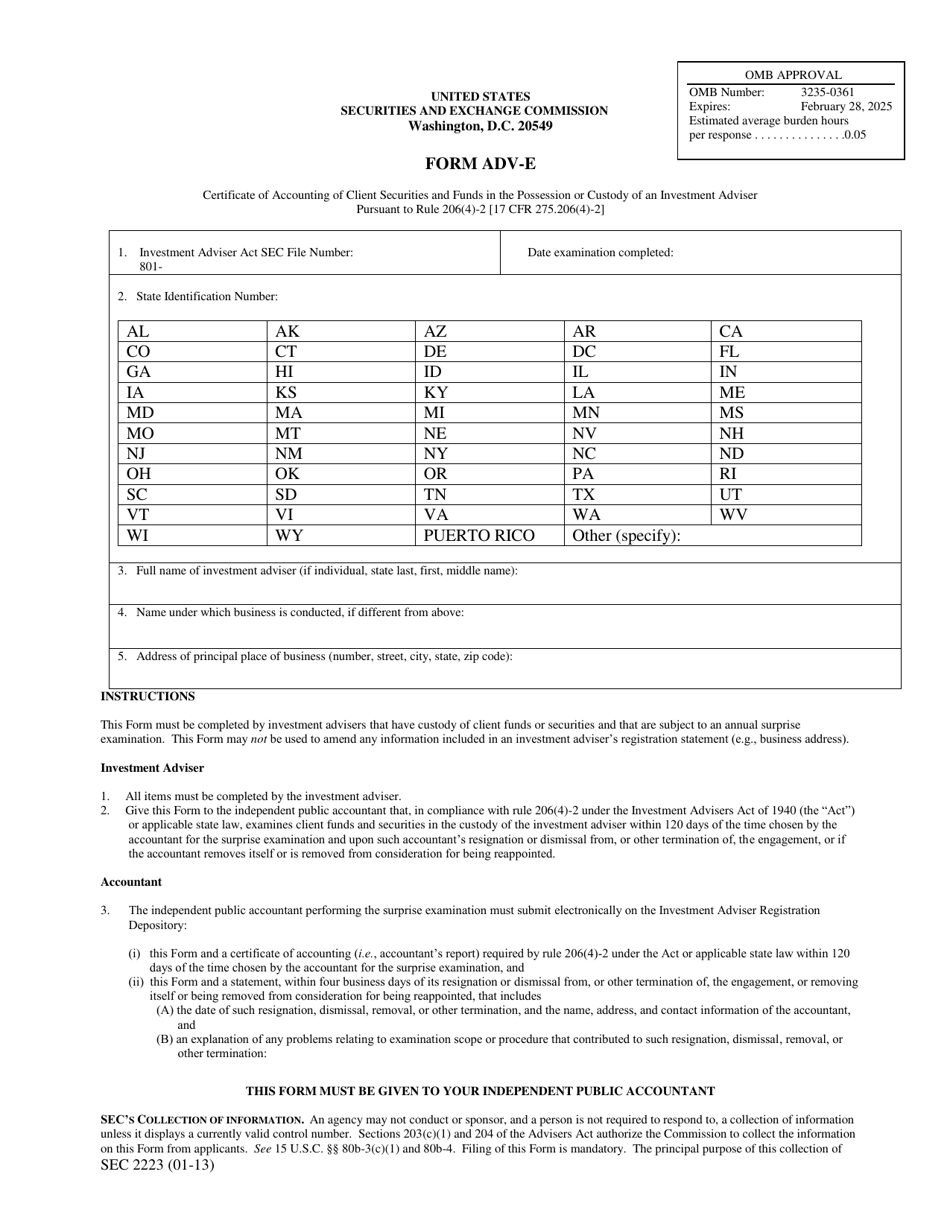

A: Investment advisers who have possession or custody of client securities and funds are required to file SEC Form 2223 (ADV-E).

Q: What information is included in SEC Form 2223 (ADV-E)?

A: SEC Form 2223 (ADV-E) includes information about the investment adviser's accounting principles, policies, and procedures related to the safekeeping of client securities and funds.

Q: When is SEC Form 2223 (ADV-E) filed?

A: SEC Form 2223 (ADV-E) is filed annually within 120 days of the end of the investment adviser's fiscal year.

Form Details:

- Released on January 1, 2013;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of SEC Form 2223 (ADV-E) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.