This version of the form is not currently in use and is provided for reference only. Download this version of

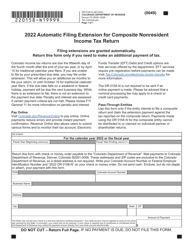

Form DR0106EP

for the current year.

Form DR0106EP Composite Nonresident Return Estimated Income Tax - Colorado

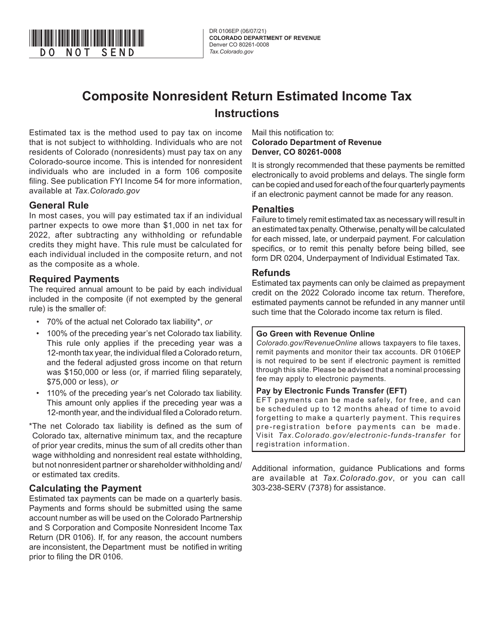

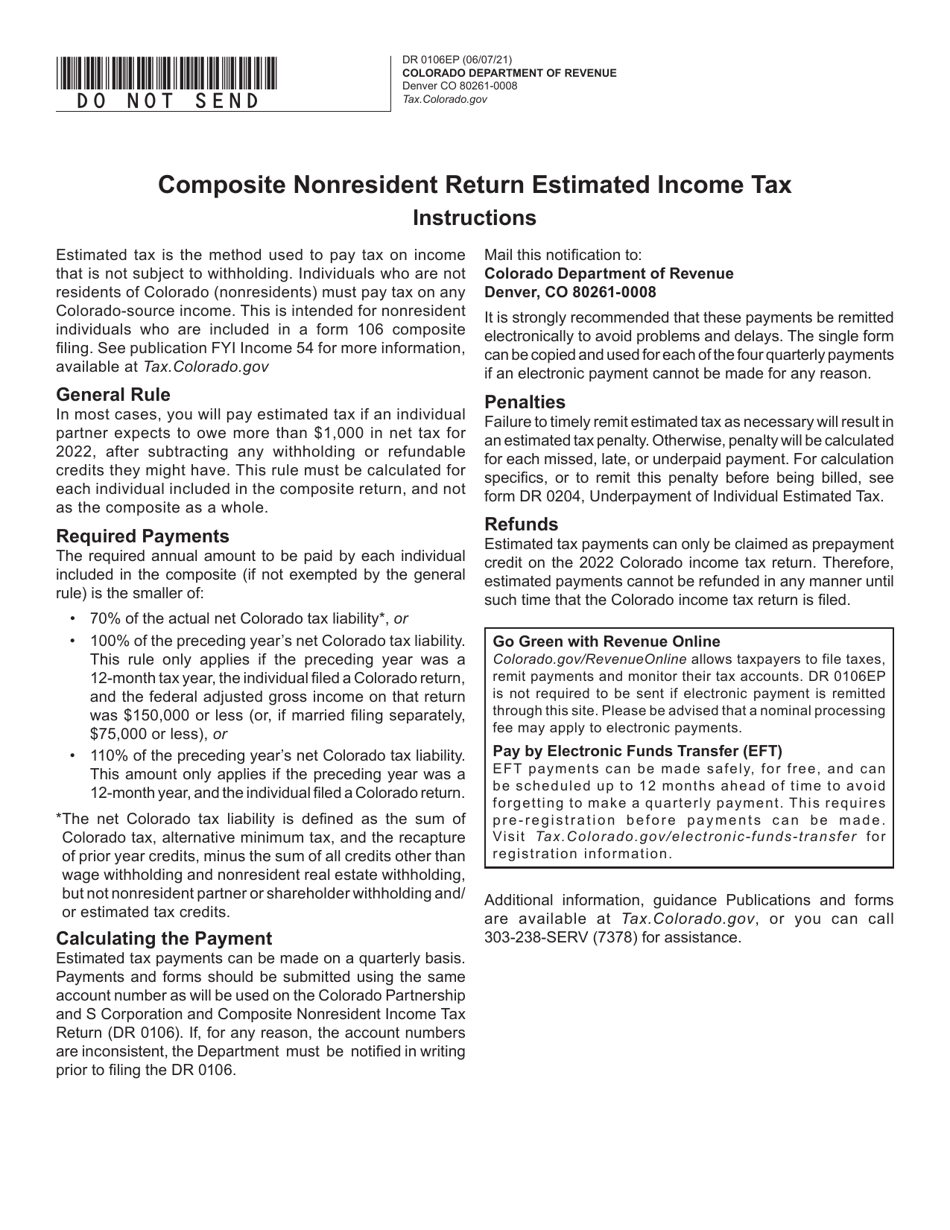

What Is Form DR0106EP?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0106EP?

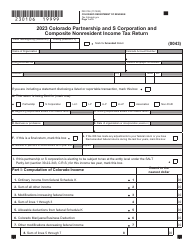

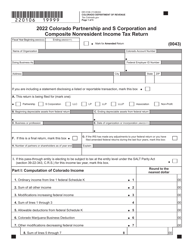

A: Form DR0106EP is a specific tax form used in Colorado for filing composite nonresident returns for estimated income tax.

Q: Who needs to file Form DR0106EP?

A: Form DR0106EP is only required for nonresident individuals or entities in Colorado who have Colorado-source income and elect to have the tax paid on their behalf.

Q: What is a composite nonresident return?

A: A composite nonresident return is a tax return that allows a pass-through entity to pay income tax on behalf of its nonresident individual owners or partners.

Q: What is estimated income tax?

A: Estimated income tax is a system where taxpayers pay a portion of their expected tax liability in advance throughout the year.

Q: What information do I need to complete Form DR0106EP?

A: To complete Form DR0106EP, you will need information about your Colorado-source income, the pass-through entity's name and federal employer identification number, and the names and Social Security numbers of the nonresident owners or partners.

Q: Are there any deadlines for filing Form DR0106EP?

A: Yes, the deadline for filing Form DR0106EP is the same as the deadline for filing the applicable tax return for the pass-through entity, which is typically April 15th.

Q: Can I make changes to Form DR0106EP after filing?

A: Yes, if you need to make changes to a previously filed Form DR0106EP, you can file an amended return using Form DR0106X.

Q: Is there a fee for filing Form DR0106EP?

A: No, there is no fee for filing Form DR0106EP.

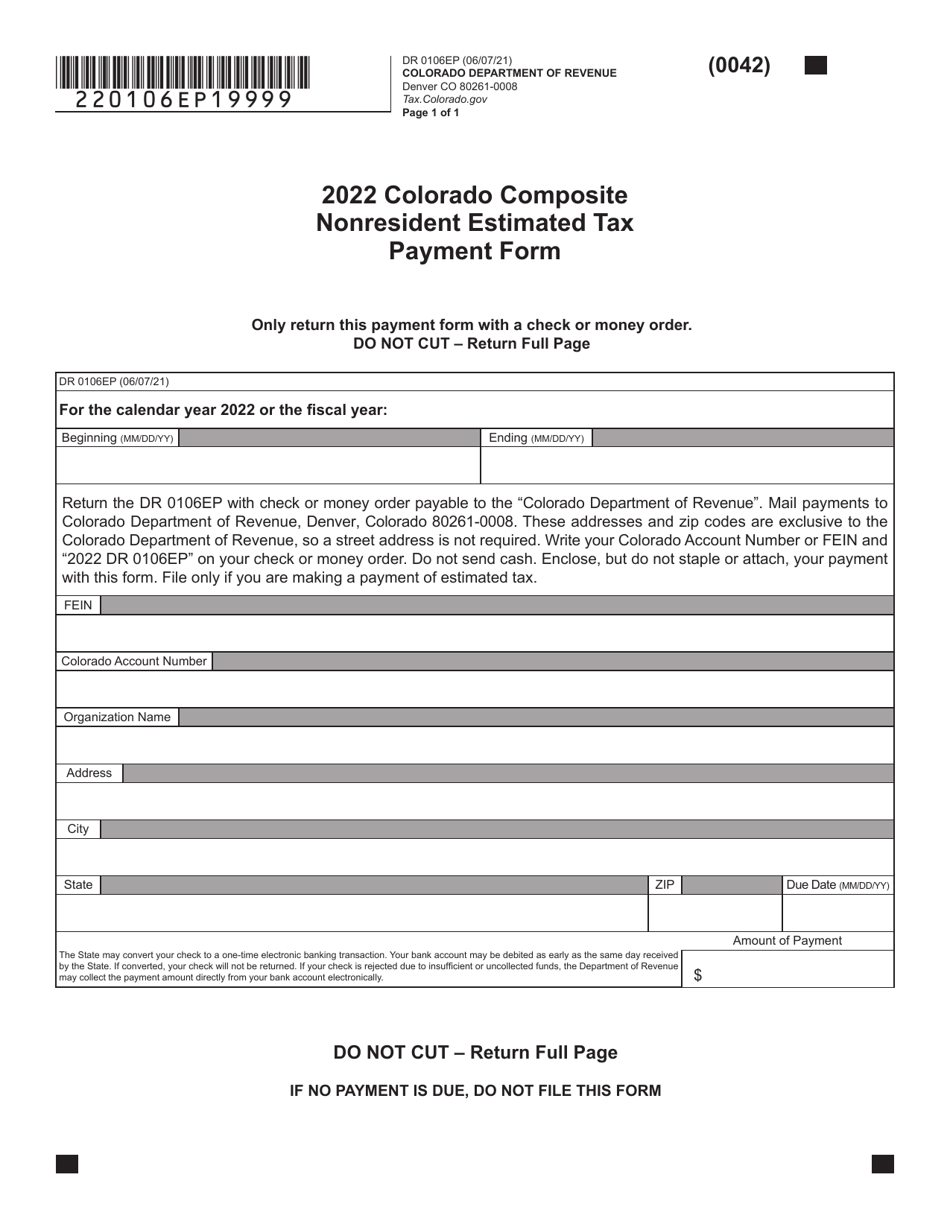

Form Details:

- Released on June 7, 2021;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0106EP by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.