This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

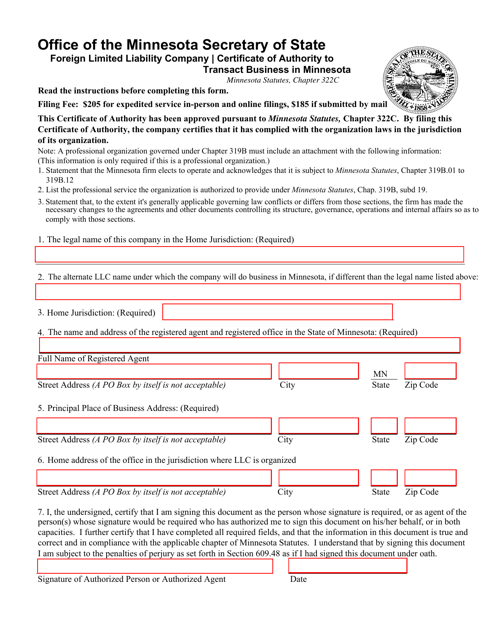

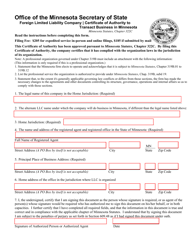

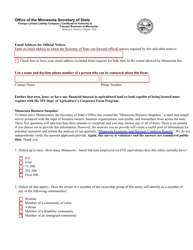

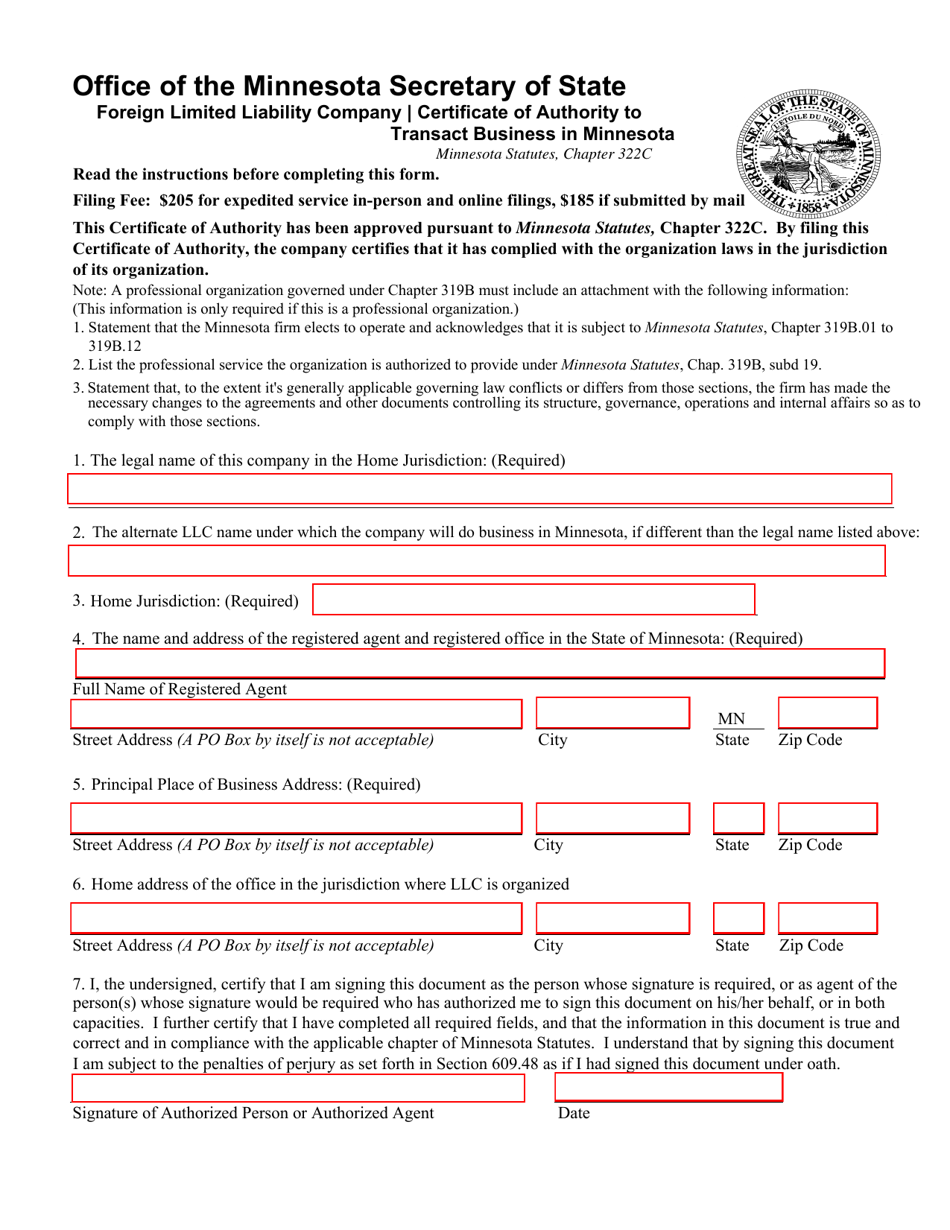

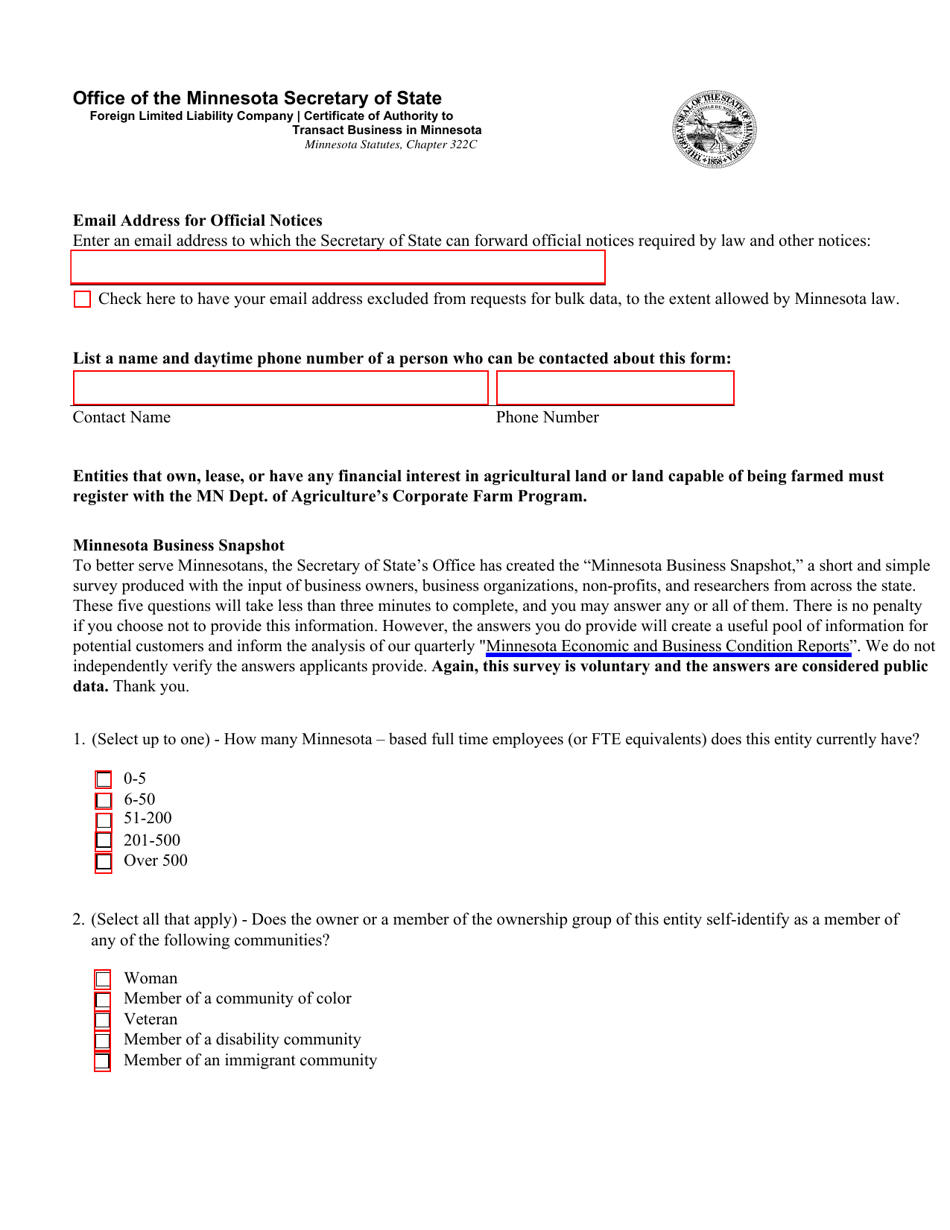

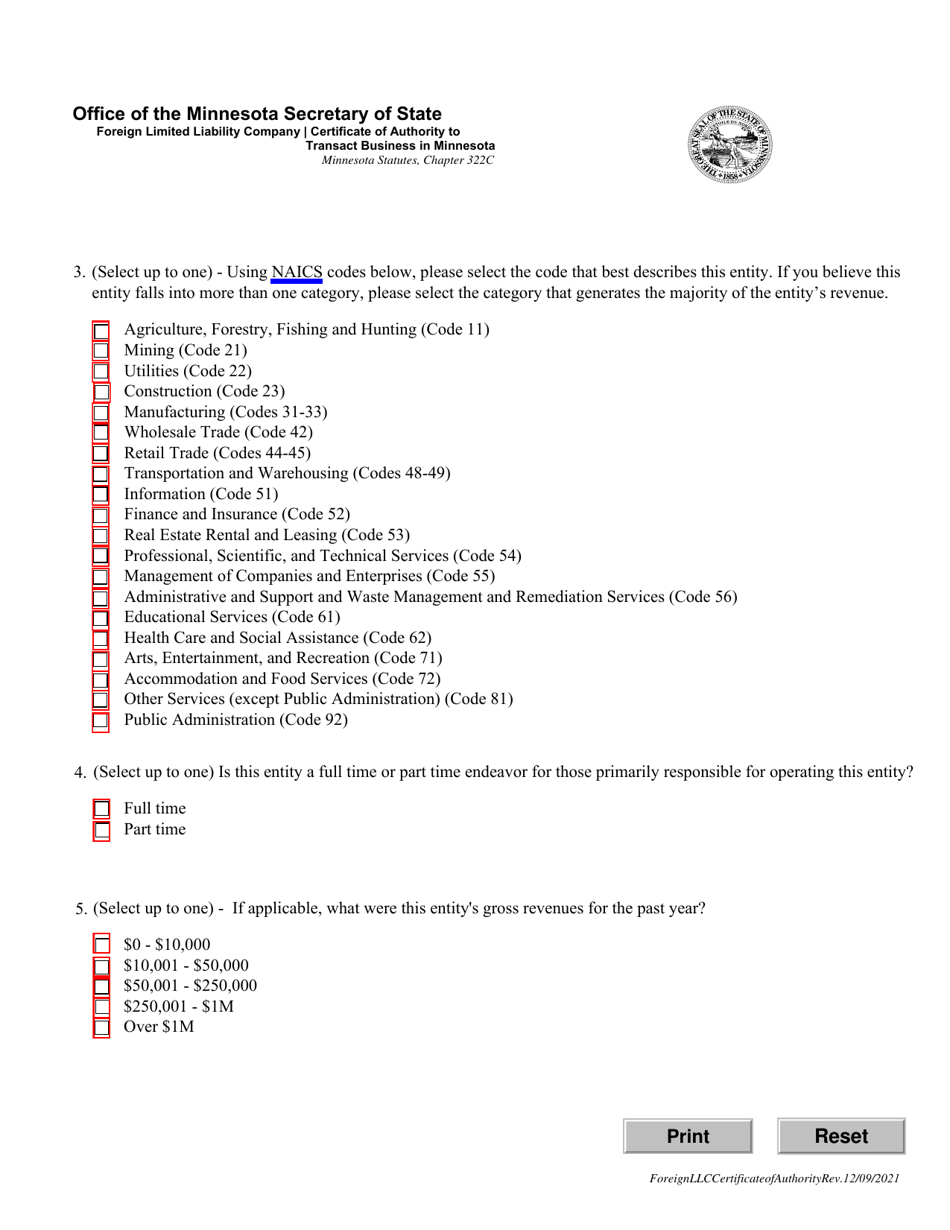

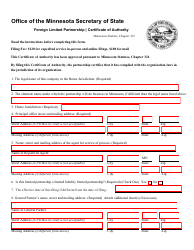

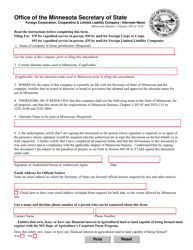

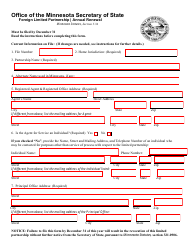

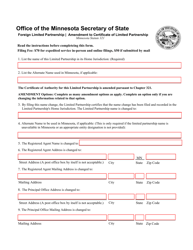

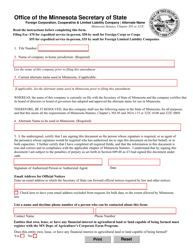

Foreign Limited Liability Company Certificate of Authority to Transact Business in Minnesota - Minnesota

Foreign Transact Business in Minnesota is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

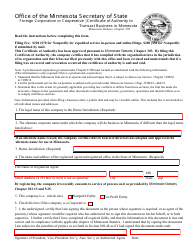

Q: What is a Foreign Limited Liability Company Certificate of Authority?

A: It is a document that allows a foreign LLC to conduct business in Minnesota.

Q: What is a foreign LLC?

A: It is a limited liability company that was formed in a different state or country.

Q: Why does a foreign LLC need a Certificate of Authority?

A: It is required by the state of Minnesota to ensure that the LLC is authorized to do business in the state.

Q: How can a foreign LLC obtain a Certificate of Authority in Minnesota?

A: The LLC needs to file an application with the Minnesota Secretary of State and pay the required fees.

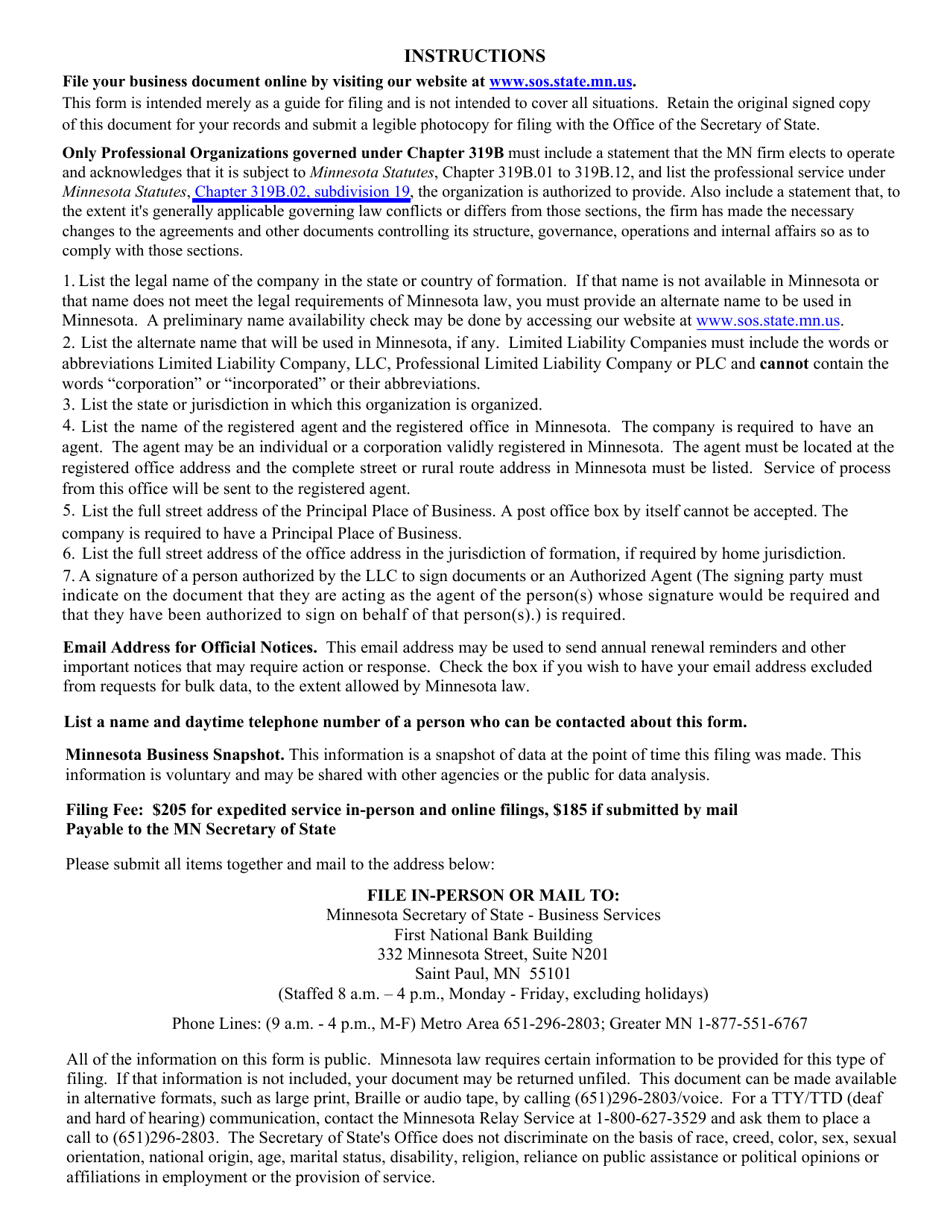

Q: What information is required in the application for a Certificate of Authority?

A: The LLC needs to provide its name, state of formation, registered agent in Minnesota, and other relevant details.

Q: What are the fees for obtaining a Certificate of Authority?

A: The fees vary depending on the type of LLC and the services required. It is best to check with the Minnesota Secretary of State for the current fee schedule.

Q: Can a foreign LLC start doing business in Minnesota without a Certificate of Authority?

A: No, it is illegal for a foreign LLC to transact business in Minnesota without first obtaining a Certificate of Authority.

Q: What happens if a foreign LLC does business in Minnesota without a Certificate of Authority?

A: The LLC may face penalties, fines, and other legal consequences. It may also be unable to enforce its contracts in Minnesota courts.

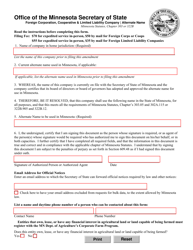

Q: Is the Certificate of Authority valid indefinitely?

A: No, the Certificate of Authority needs to be renewed periodically, usually every year.

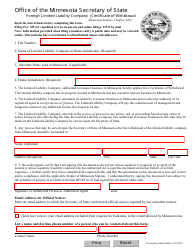

Q: Can a foreign LLC withdraw from doing business in Minnesota?

A: Yes, the LLC can file a withdrawal application with the Minnesota Secretary of State to cease its business operations in the state.

Form Details:

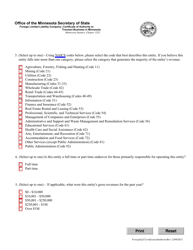

- Released on December 9, 2021;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.