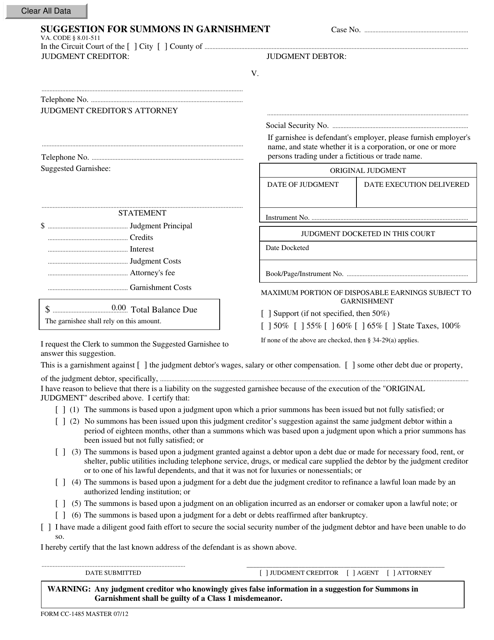

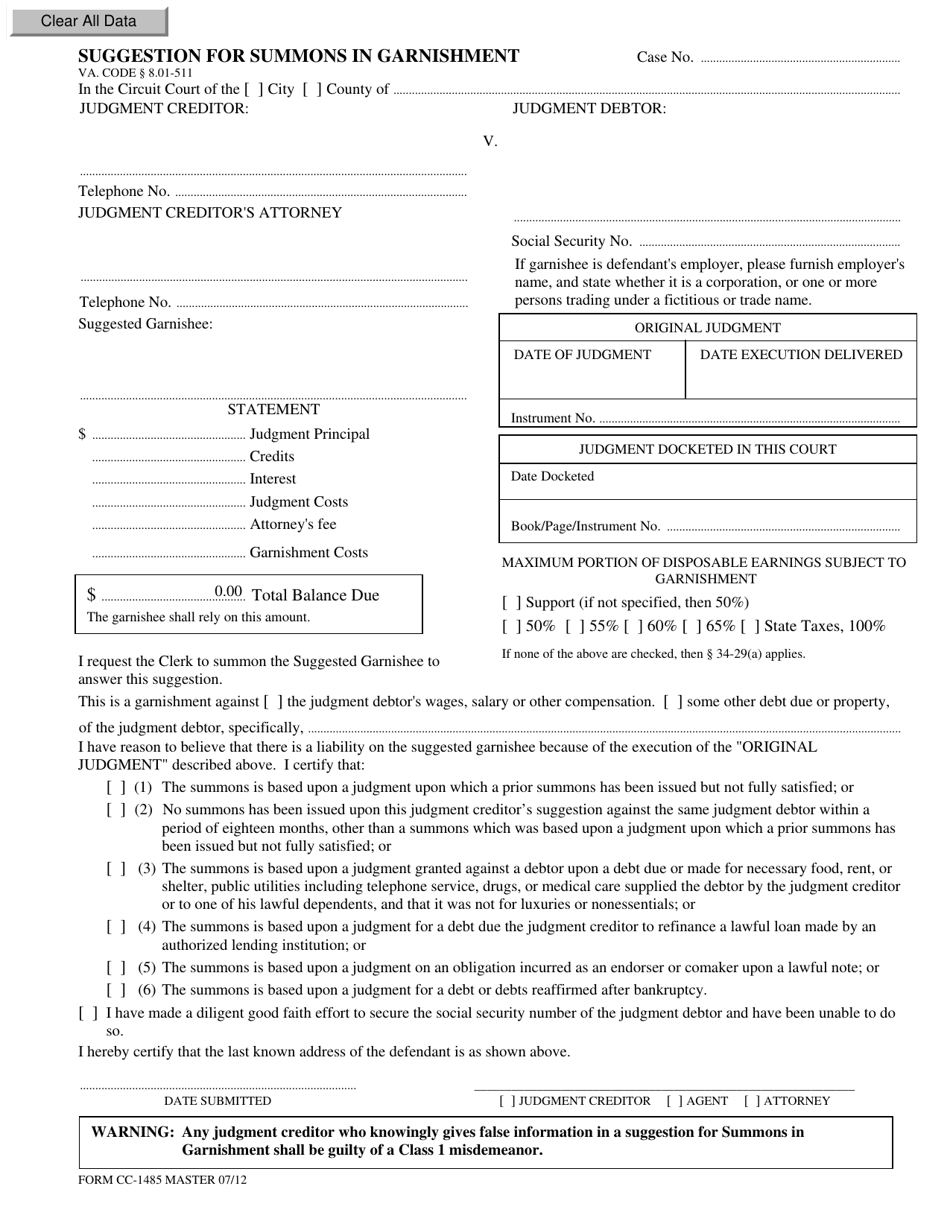

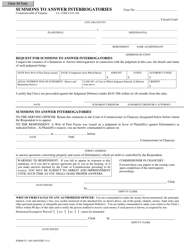

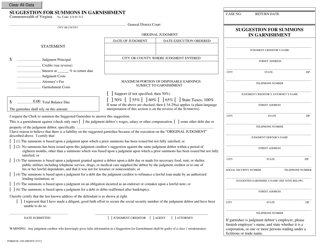

Form CC-1485 Suggestion for Summons in Garnishment - Virginia

What Is Form CC-1485?

This is a legal form that was released by the Virginia Circuit Court - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CC-1485?

A: Form CC-1485 is a suggestion for summons in garnishment in Virginia.

Q: What is a summons in garnishment?

A: A summons in garnishment is a legal process where a creditor can collect money owed by a debtor by garnishing the debtor's wages or bank account.

Q: Who can use Form CC-1485?

A: Form CC-1485 can be used by creditors in Virginia who are seeking to collect a debt through garnishment.

Q: What information is required on Form CC-1485?

A: Form CC-1485 requires information about the debtor, including their name, address, and employer, as well as details about the debt being collected.

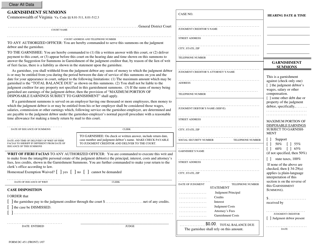

Q: What should I do if I receive a summons in garnishment?

A: If you receive a summons in garnishment, you should consult with an attorney to understand your rights and options for responding to the garnishment.

Q: Can a debtor challenge a garnishment?

A: Yes, a debtor has the right to challenge a garnishment by filing a claim of exemption or other legal defense.

Q: What happens if a garnishment is successful?

A: If a garnishment is successful, the creditor will receive a portion of the debtor's wages or money in their bank account, as allowed by law.

Q: Are there limits on how much can be garnished?

A: Yes, there are federal and state limits on how much can be garnished from a debtor's wages or bank account to protect them from undue hardship.

Q: Can a creditor garnish federal benefits?

A: No, federal benefits such as Social Security or disability payments are generally exempt from garnishment.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Virginia Circuit Court;

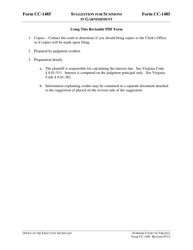

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CC-1485 by clicking the link below or browse more documents and templates provided by the Virginia Circuit Court.