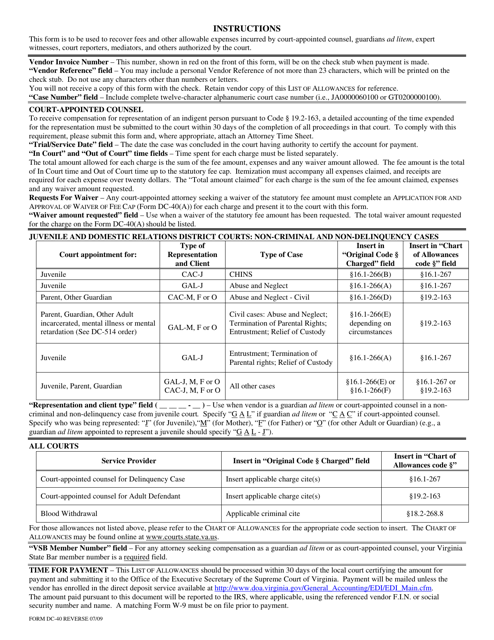

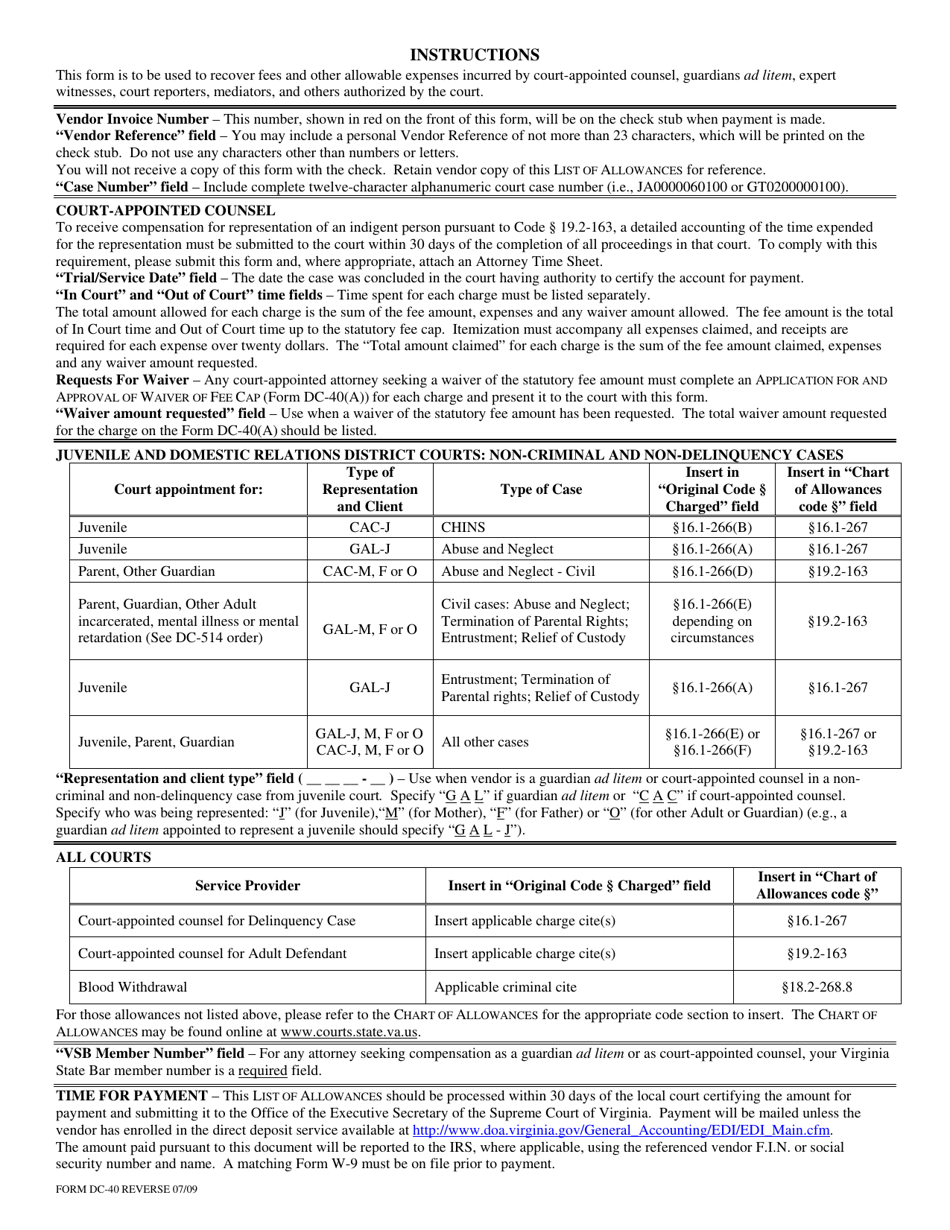

Instructions for Form DC-40 List of Allowances - Virginia

This document contains official instructions for Form DC-40 , List of Allowances - a form released and collected by the Virginia District Court.

FAQ

Q: What is Form DC-40?

A: Form DC-40 is a document used in Virginia for reporting allowances.

Q: What are allowances?

A: Allowances refer to the amount of money that can be deducted from an individual's income for tax purposes.

Q: Who needs to complete Form DC-40?

A: Anyone who wants to claim allowances on their Virginia tax return needs to complete Form DC-40.

Q: How do I complete Form DC-40?

A: You need to provide your personal information, including your name, social security number, and address, and then fill in the appropriate sections to claim your allowances.

Q: When is the deadline for filing Form DC-40?

A: The deadline for filing Form DC-40 is April 15th of each year.

Q: Are there any penalties for not filing Form DC-40?

A: Yes, there may be penalties for not filing Form DC-40 or filing it late. It is important to file on time to avoid penalties.

Q: Can I claim allowances on my federal tax return as well?

A: Yes, you can claim allowances on both your Virginia and federal tax returns.

Q: Do I need to attach any additional documents with Form DC-40?

A: In most cases, you do not need to attach any additional documents with Form DC-40. However, it is always a good idea to keep supporting documentation for your records.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia District Court.