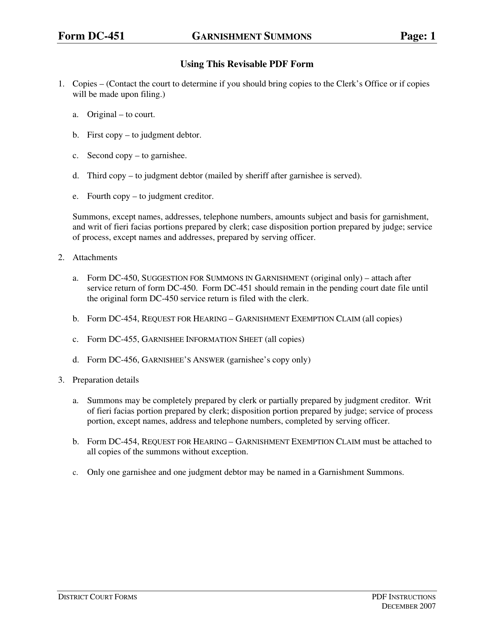

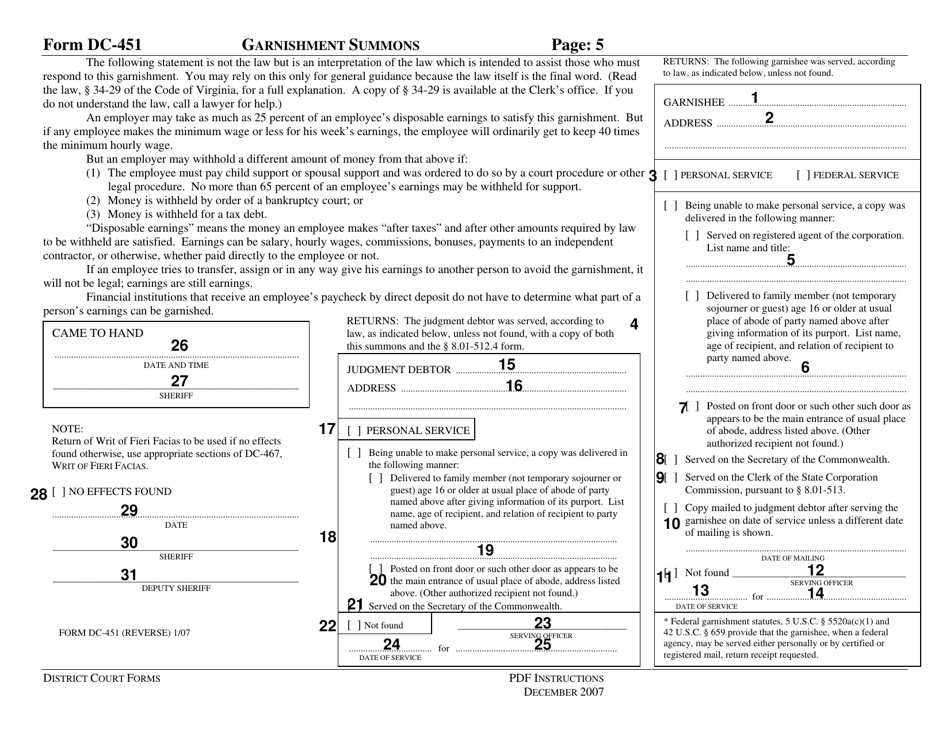

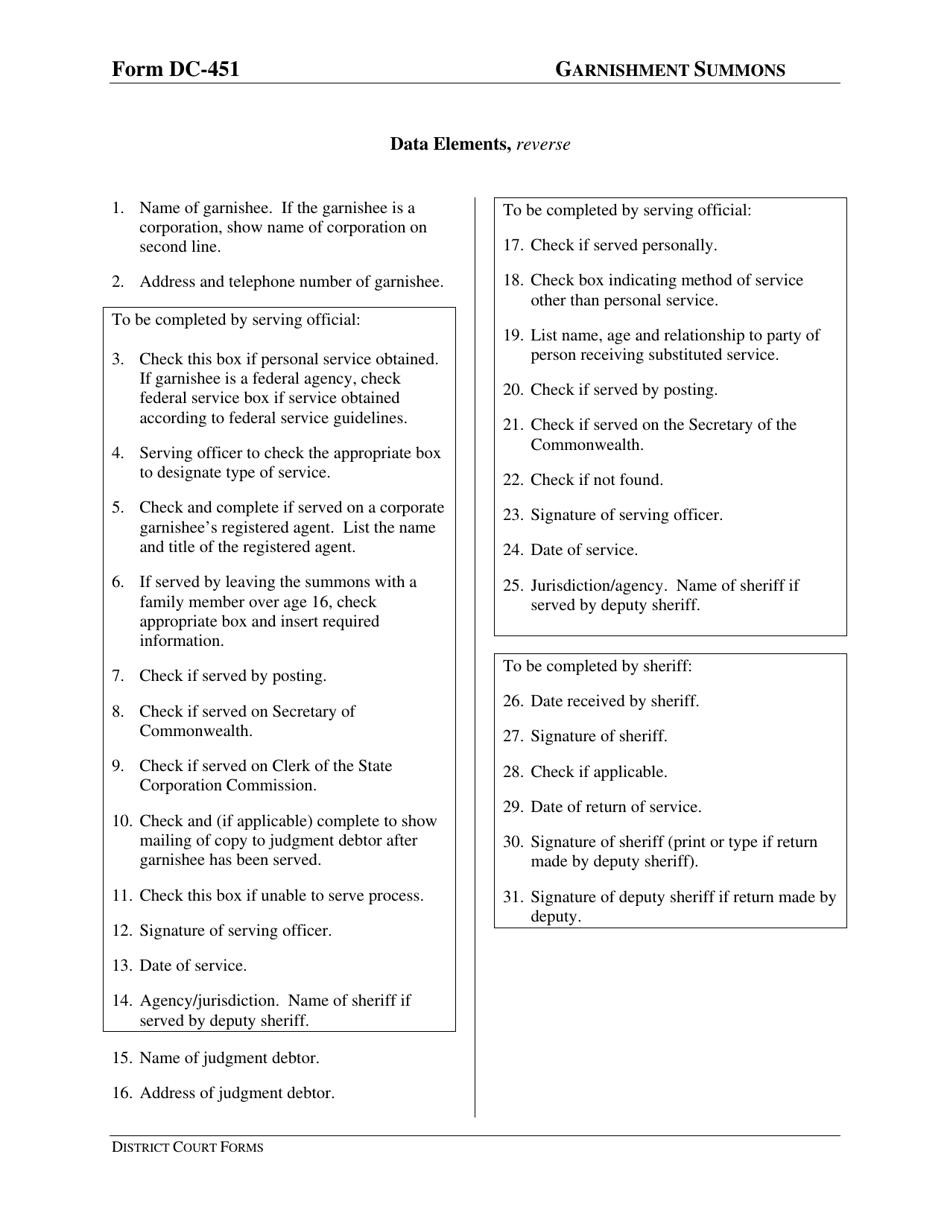

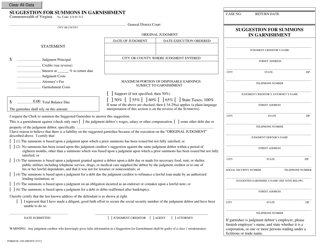

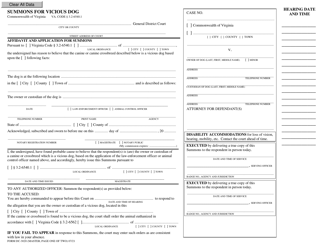

Instructions for Form DC-451 Garnishment Summons - Virginia

This document contains official instructions for Form DC-451 , Garnishment Summons - a form released and collected by the Virginia District Court. An up-to-date fillable Form DC-451 is available for download through this link.

FAQ

Q: What is Form DC-451?

A: Form DC-451 is the Garnishment Summons used in Virginia.

Q: What is the purpose of Form DC-451?

A: The purpose of Form DC-451 is to initiate the process of garnishing a debtor's wages in Virginia.

Q: Who can use Form DC-451?

A: Form DC-451 can be used by any creditor who wants to collect a debt through wage garnishment in Virginia.

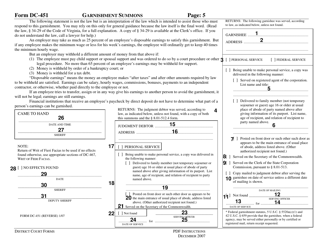

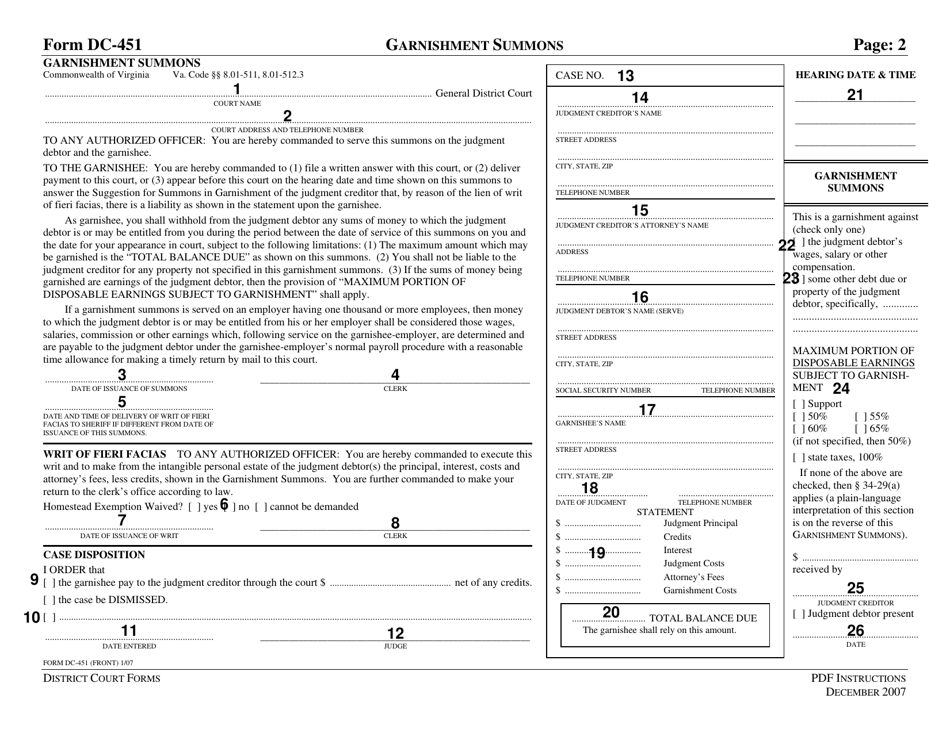

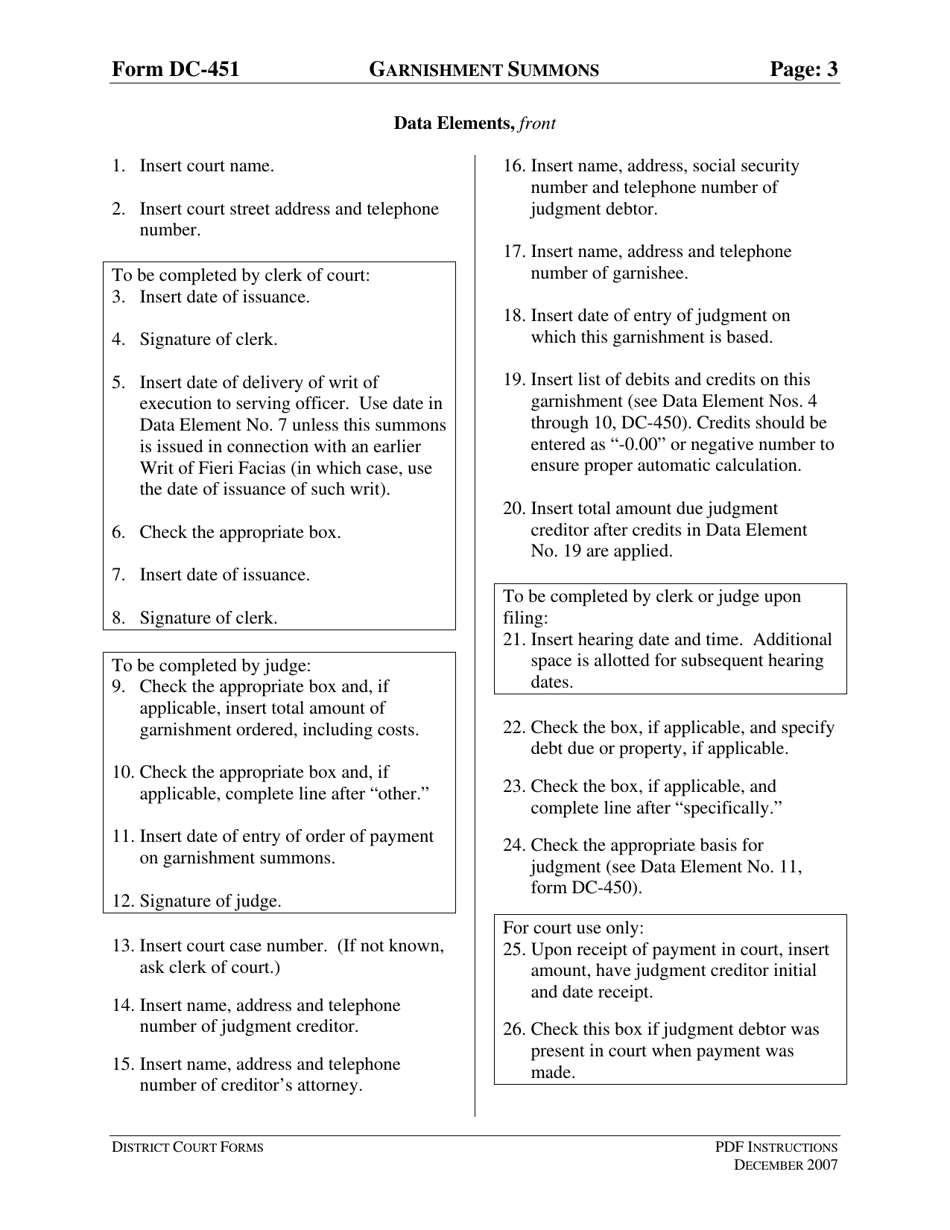

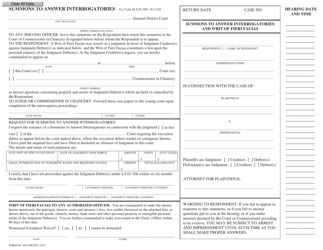

Q: What information is required on Form DC-451?

A: Form DC-451 requires the creditor to provide information about the debtor, the debt, and the employer.

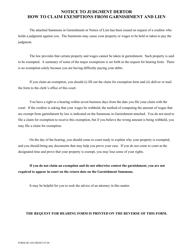

Q: What is the process after filing Form DC-451?

A: After filing Form DC-451, the court will issue the garnishment summons and the creditor must serve it on the debtor's employer.

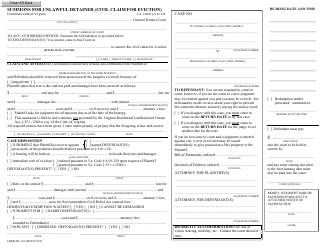

Q: What happens after the garnishment summons is served on the employer?

A: After being served with the garnishment summons, the employer is required by law to withhold a portion of the debtor's wages to satisfy the debt.

Q: Are there any limitations on wage garnishment in Virginia?

A: Yes, there are limitations on wage garnishment in Virginia. The amount that can be garnished depends on the debtor's disposable earnings and other factors.

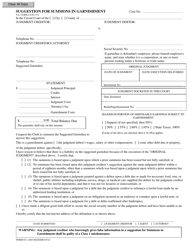

Q: What should I do if I receive a garnishment summons?

A: If you receive a garnishment summons, you should seek legal advice and understand your rights and options.

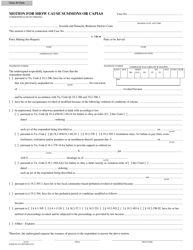

Q: Can an employer terminate an employee for wage garnishment?

A: No, an employer cannot terminate an employee solely because of wage garnishment in Virginia.

Instruction Details:

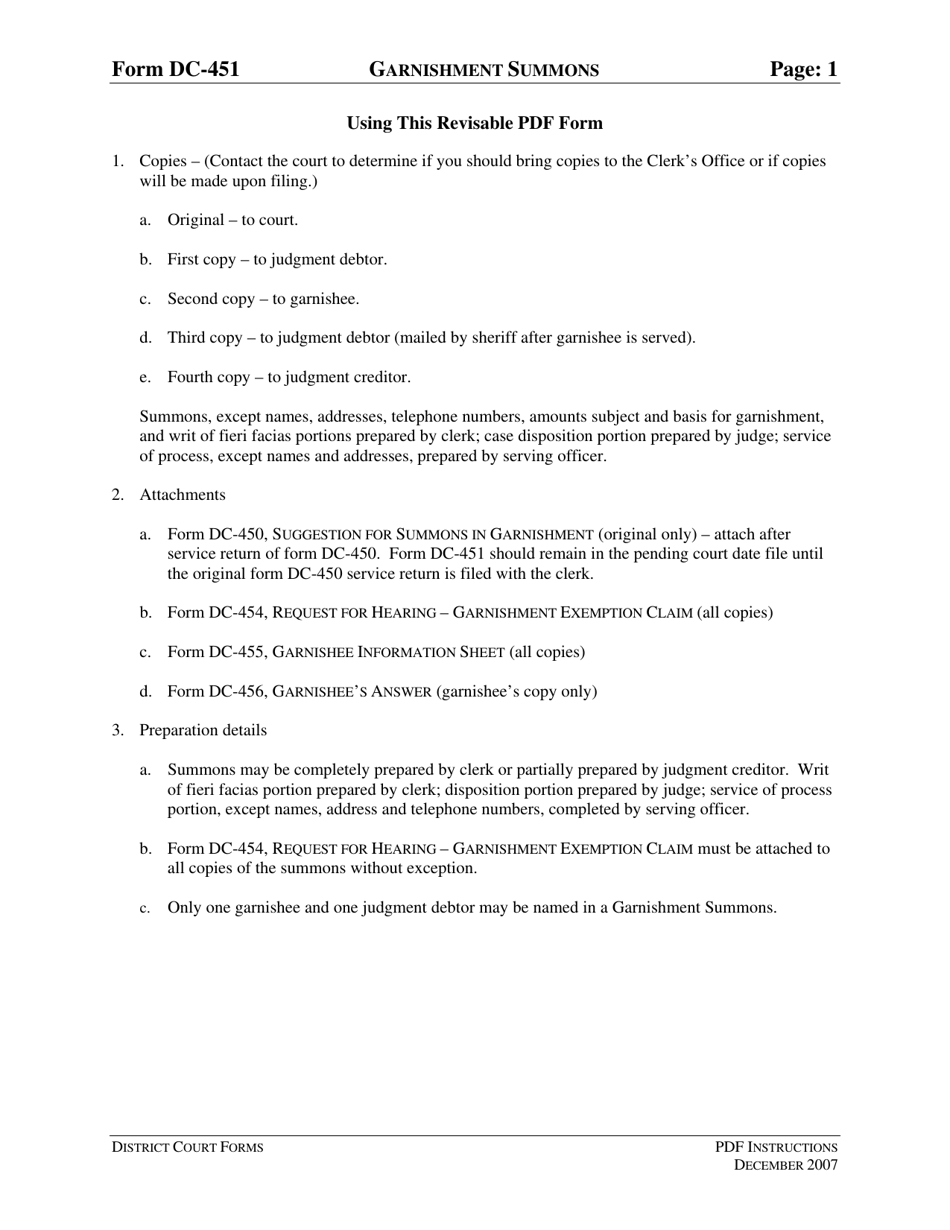

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia District Court.