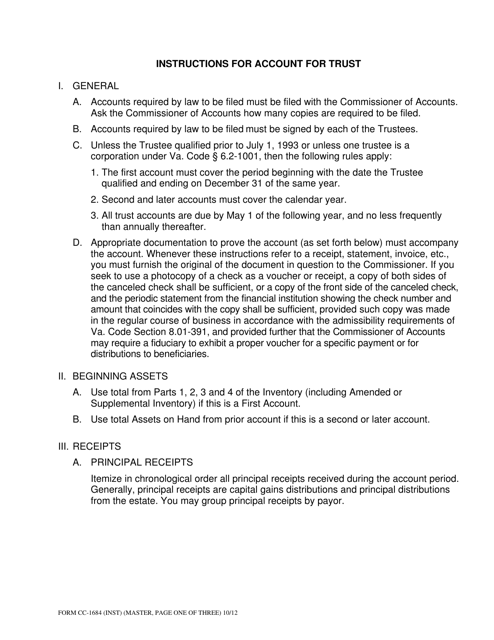

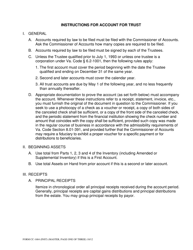

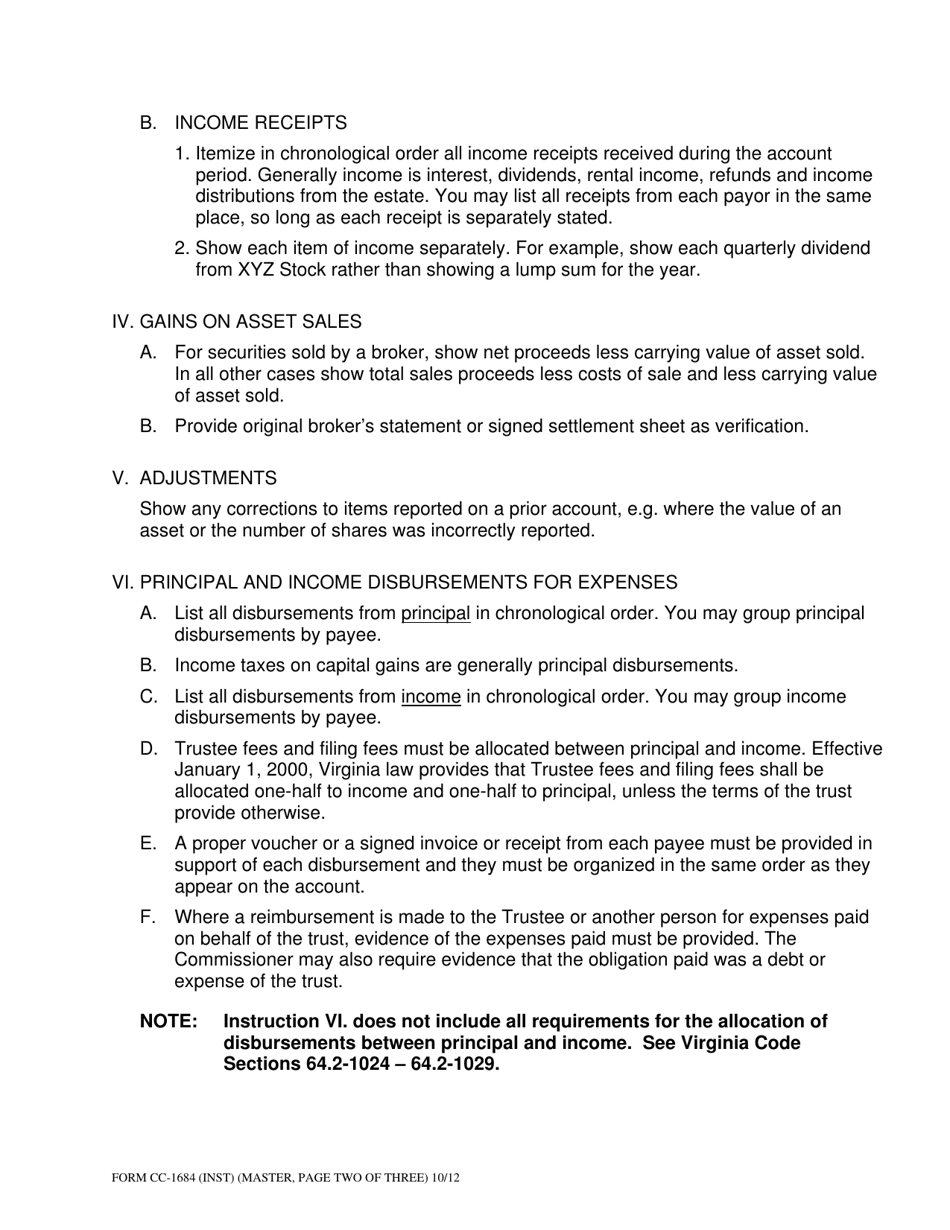

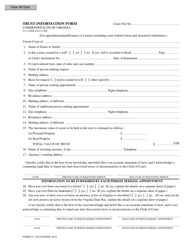

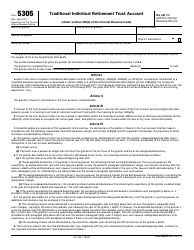

Instructions for Form CC-1684 Account for Trust - Virginia

This document contains official instructions for Form CC-1684 , Account for Trust - a form released and collected by the Virginia Circuit Court. An up-to-date fillable Form CC-1684 is available for download through this link.

FAQ

Q: What is Form CC-1684?

A: Form CC-1684 is an account for trust form used in Virginia.

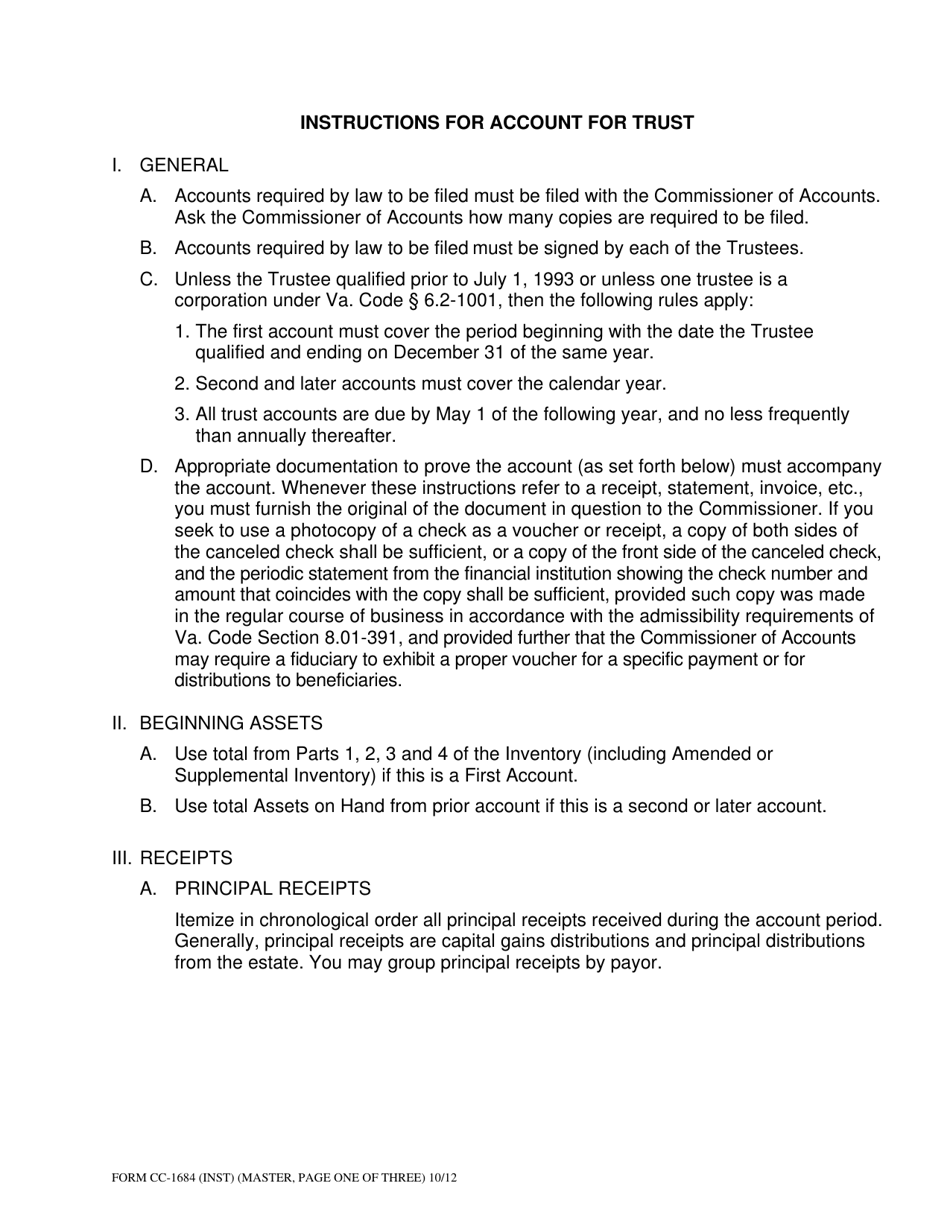

Q: Who needs to file Form CC-1684?

A: Individuals or entities who have created a trust in Virginia are required to file Form CC-1684.

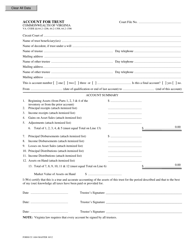

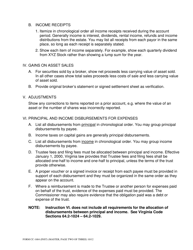

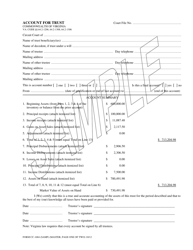

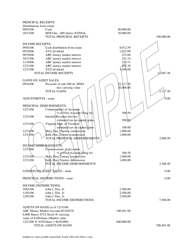

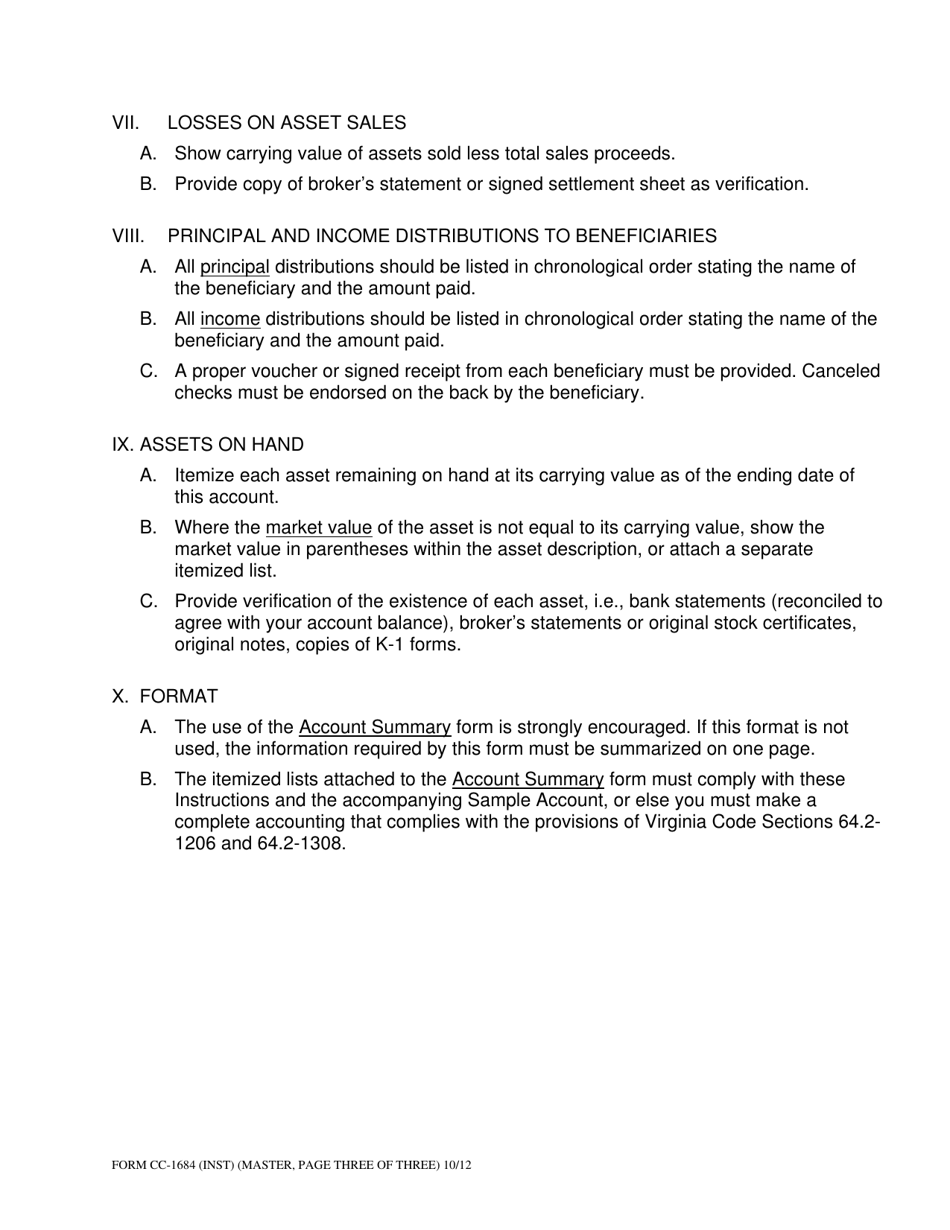

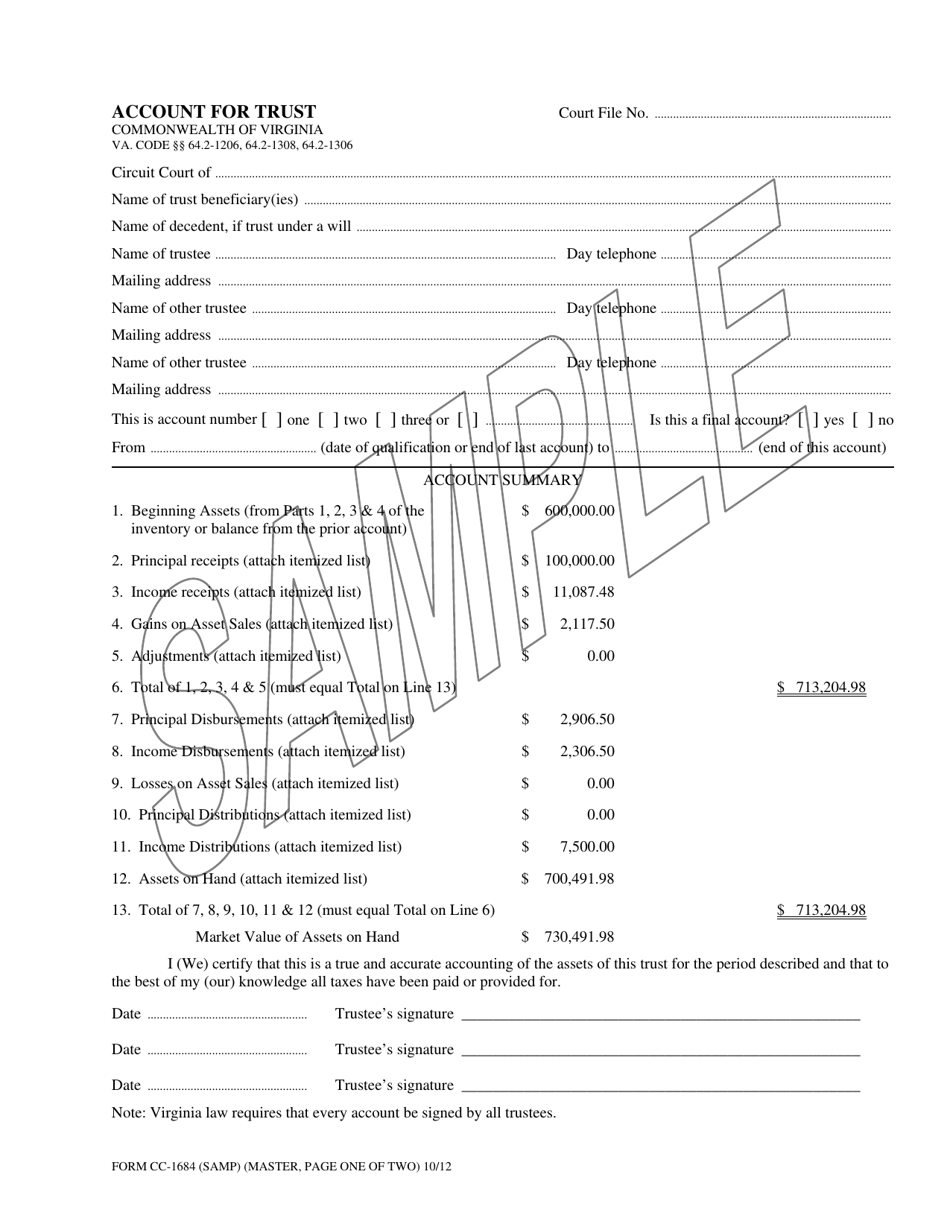

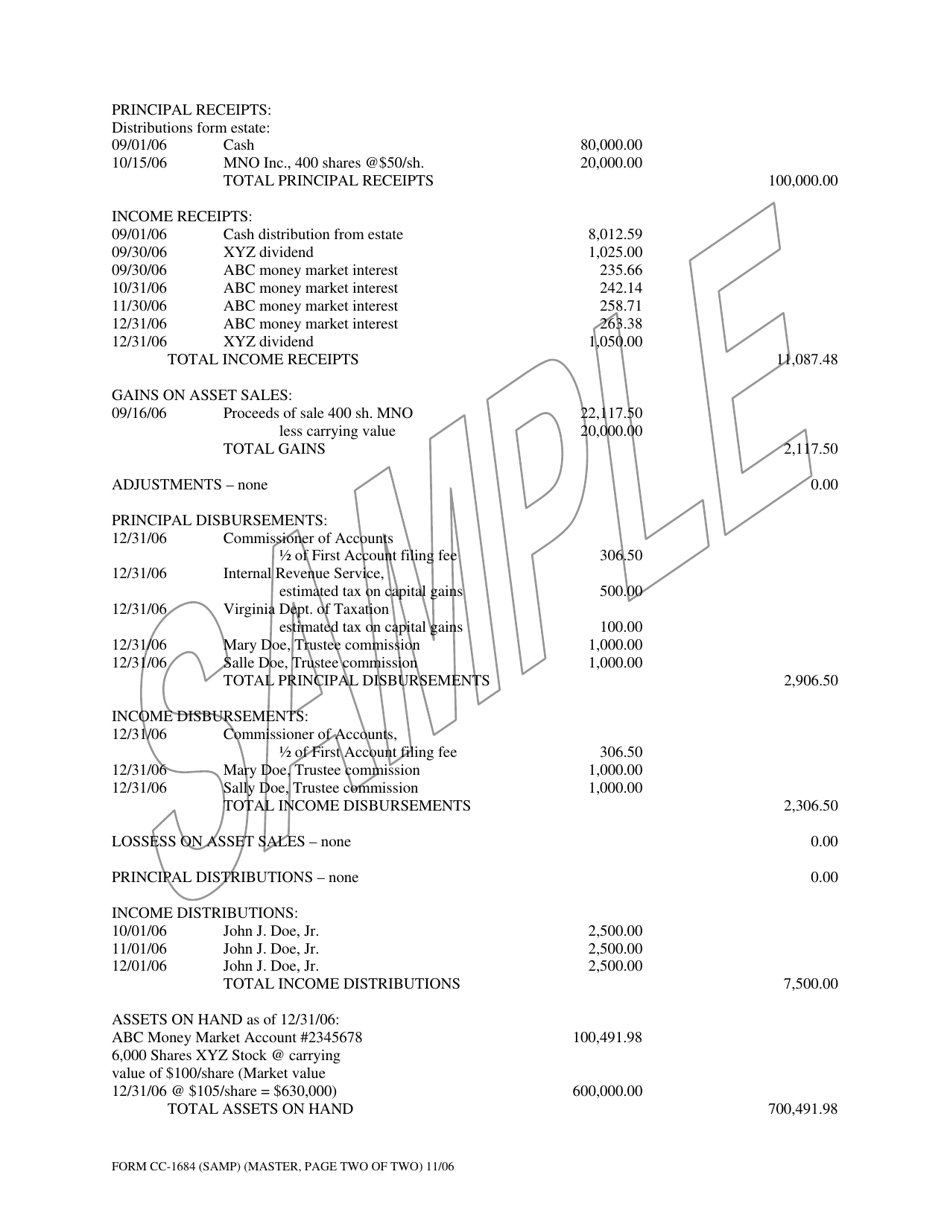

Q: What information is required on Form CC-1684?

A: Form CC-1684 requires information about the trust, such as the name and address of the trustee, the value of the trust, and any income or expenses.

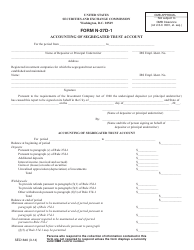

Q: When is Form CC-1684 due?

A: Form CC-1684 is due on or before May 1st of each year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form CC-1684. The penalty is 6% of the tax due for each month or part of a month that the return is late, up to a maximum of 30%.

Q: Can I file Form CC-1684 electronically?

A: No, Form CC-1684 cannot be filed electronically. It must be filed by mail.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Circuit Court.