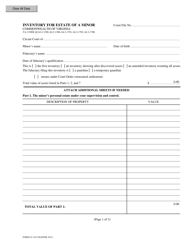

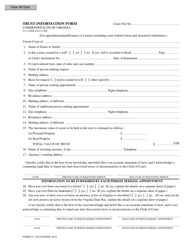

Instructions for Form CC-1673 Inventory for Trust - Virginia

This document contains official instructions for Form CC-1673 , Inventory for Trust - a form released and collected by the Virginia Circuit Court. An up-to-date fillable Form CC-1673 is available for download through this link.

FAQ

Q: What is Form CC-1673?

A: Form CC-1673 is the Inventory for Trust form in Virginia.

Q: What is the purpose of Form CC-1673?

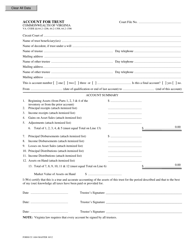

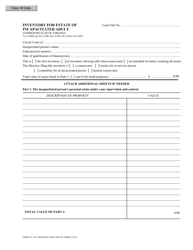

A: The purpose of Form CC-1673 is to list and value the assets and liabilities of a trust.

Q: Who needs to fill out Form CC-1673?

A: Any trustee of a trust in Virginia is required to fill out Form CC-1673.

Q: When should Form CC-1673 be filed?

A: Form CC-1673 should be filed within 16 months after the date of death of the decedent or within four months after qualification of the fiduciary, whichever is later.

Q: Are there any fees associated with filing Form CC-1673?

A: Yes, there is a filing fee for submitting Form CC-1673. The fee amount may vary depending on the county.

Q: What information is required on Form CC-1673?

A: Form CC-1673 requires information such as the name of the trust, the name and address of the trustee, a list of assets and their values, and details of any liabilities.

Q: Can additional pages be attached to Form CC-1673?

A: Yes, additional pages can be attached to Form CC-1673 if needed to provide a complete inventory of the trust assets.

Q: What happens after Form CC-1673 is filed?

A: After Form CC-1673 is filed, it becomes part of the public record and will be reviewed by the court and interested parties.

Q: Are there any penalties for not filing Form CC-1673?

A: Yes, there may be penalties for failing to file Form CC-1673, which can include fines or removal of the trustee.

Q: Is Form CC-1673 the same as a tax return?

A: No, Form CC-1673 is not a tax return. It is solely for the purpose of providing an inventory of trust assets.

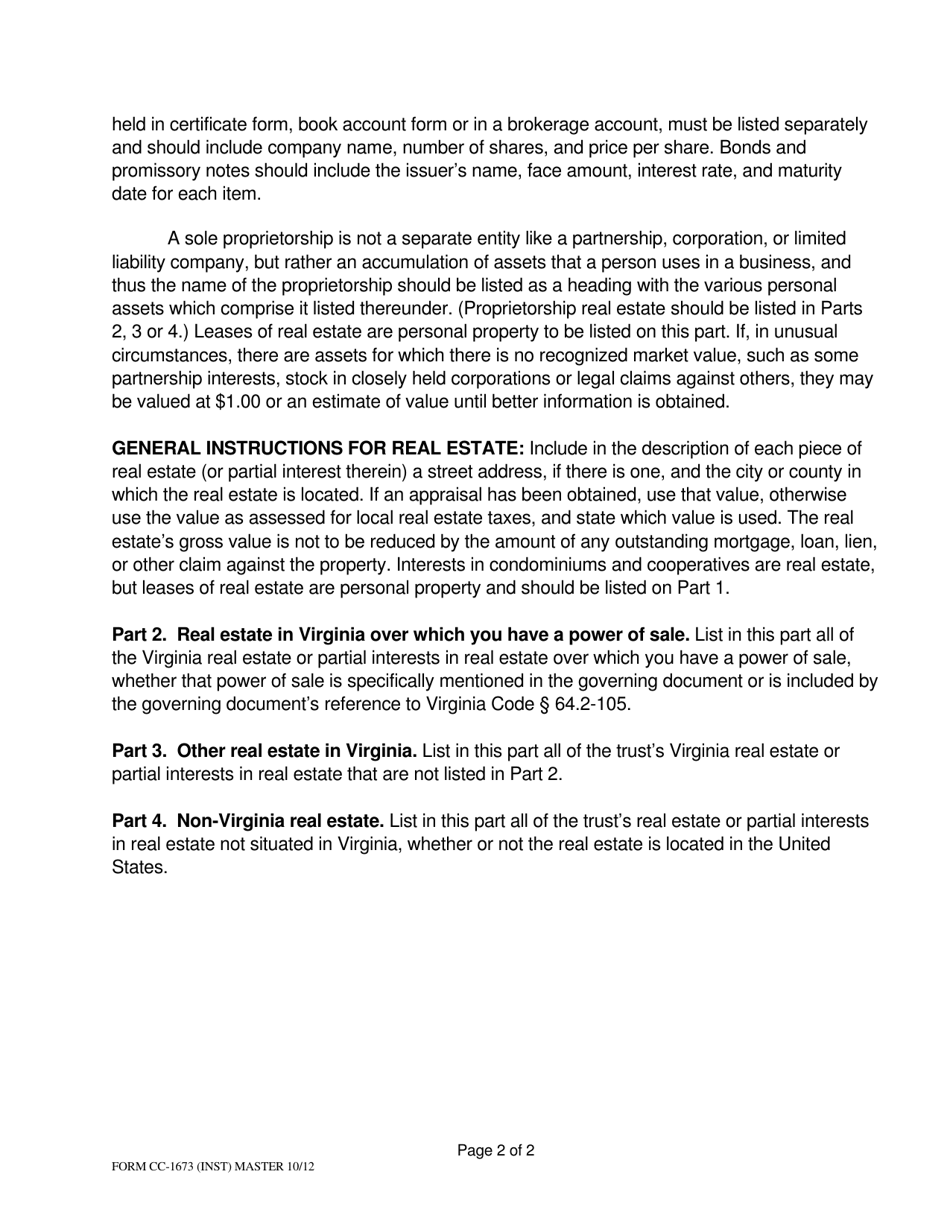

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Circuit Court.