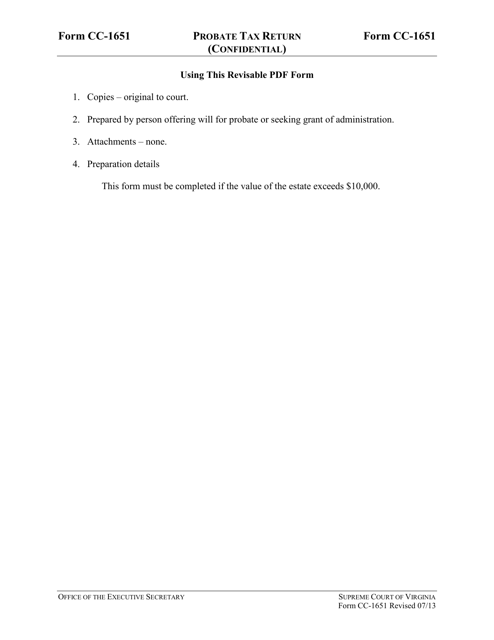

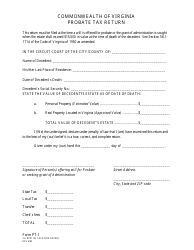

Instructions for Form CC-1651 Probate Tax Return - Virginia

This document contains official instructions for Form CC-1651 , Probate Tax Return - a form released and collected by the Virginia Circuit Court. An up-to-date fillable Form CC-1651 is available for download through this link.

FAQ

Q: What is Form CC-1651?

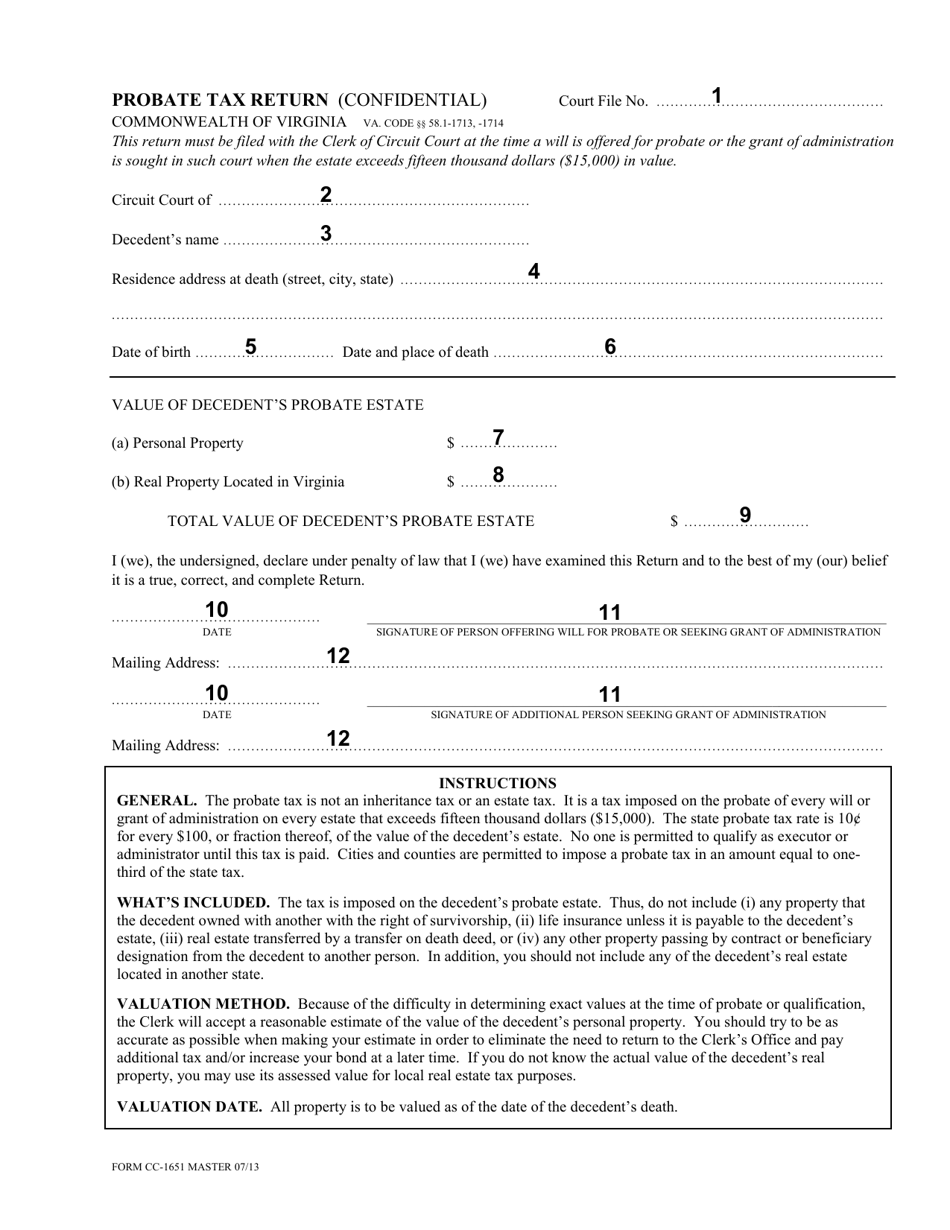

A: Form CC-1651 is the Probate Tax Return for the state of Virginia.

Q: Who needs to file Form CC-1651?

A: Anyone who is responsible for administering the estate of a deceased person in Virginia needs to file Form CC-1651.

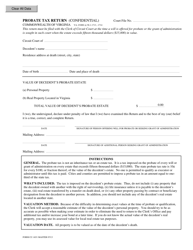

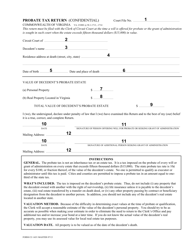

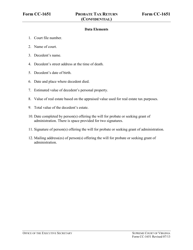

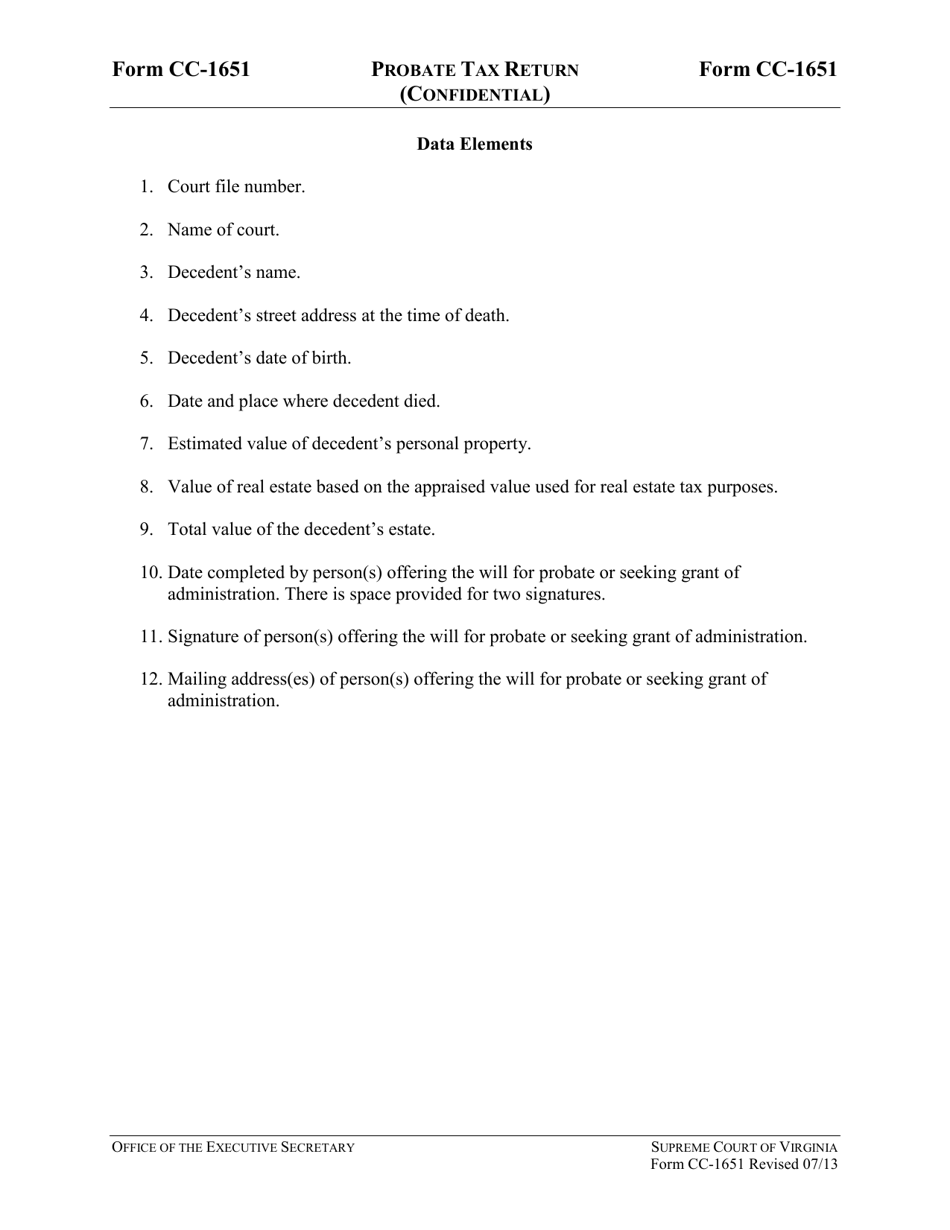

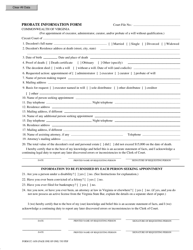

Q: What information is required on Form CC-1651?

A: Form CC-1651 requires information such as the deceased person's personal and financial details, the value of the estate, and any applicable deductions.

Q: When is the deadline for filing Form CC-1651?

A: The deadline for filing Form CC-1651 is within nine months after the date of the decedent's death.

Q: Are there any fees associated with filing Form CC-1651?

A: Yes, there are probate tax fees associated with filing Form CC-1651. The amount of tax is based on the value of the estate.

Q: What happens if I don't file Form CC-1651?

A: If you fail to file Form CC-1651 or pay the required probate tax, you may face penalties and interest charges.

Q: Can I get an extension to file Form CC-1651?

A: Yes, you can request an extension of time to file Form CC-1651 by submitting a written request to the Virginia Department of Taxation.

Q: Who can help me with questions about Form CC-1651?

A: If you have questions about Form CC-1651 or need assistance with filling out the form, you can contact the Virginia Department of Taxation or consult a tax professional.

Instruction Details:

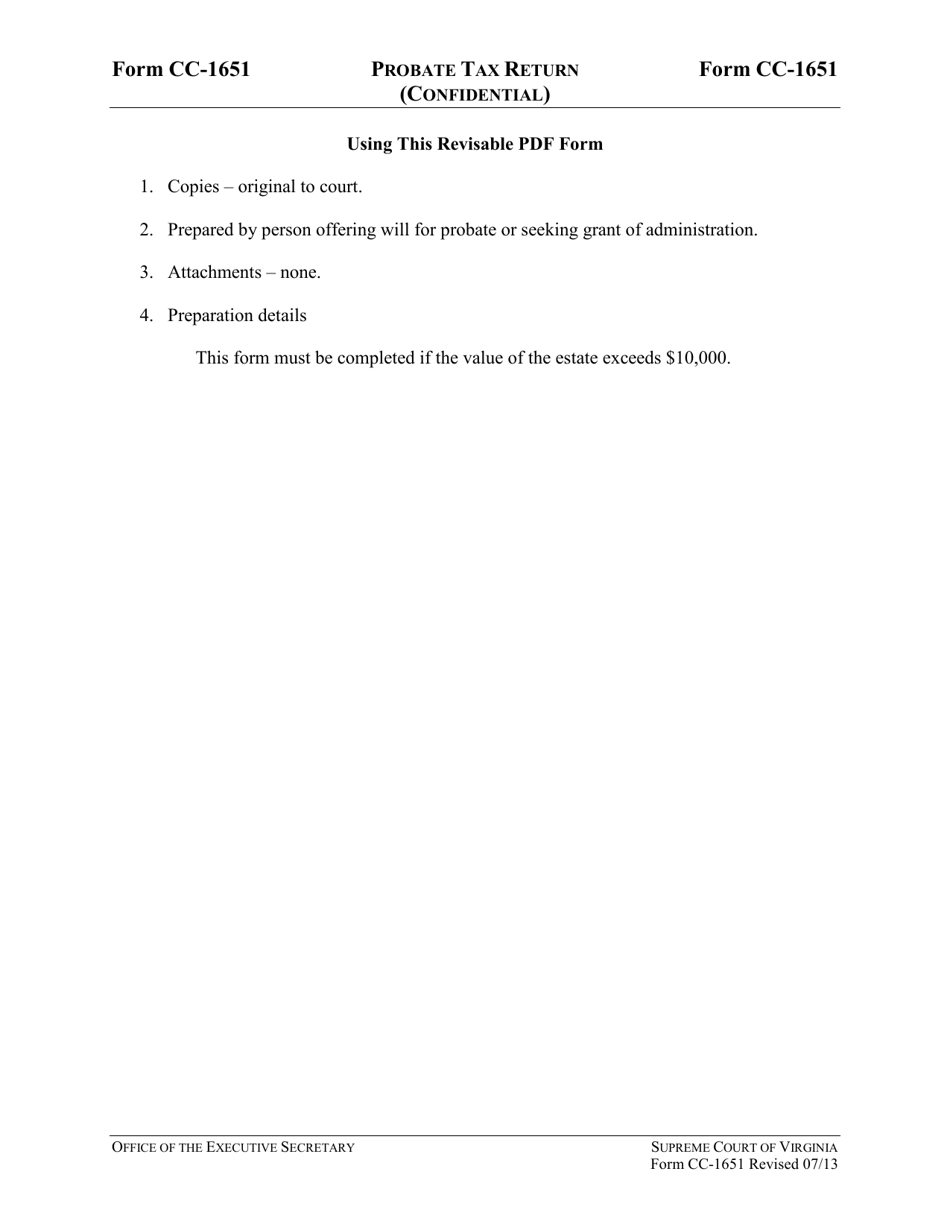

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Circuit Court.