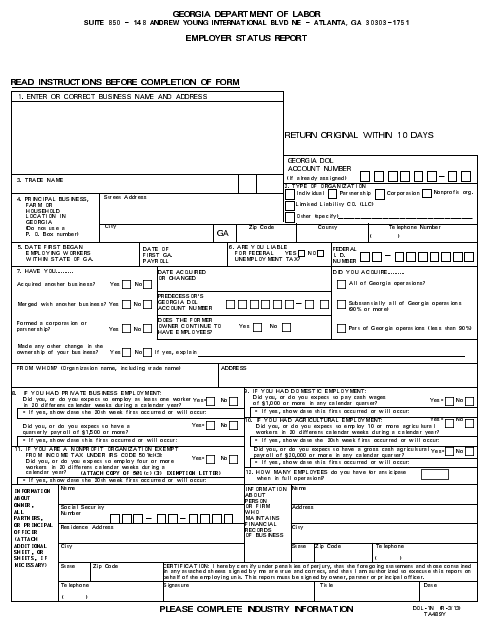

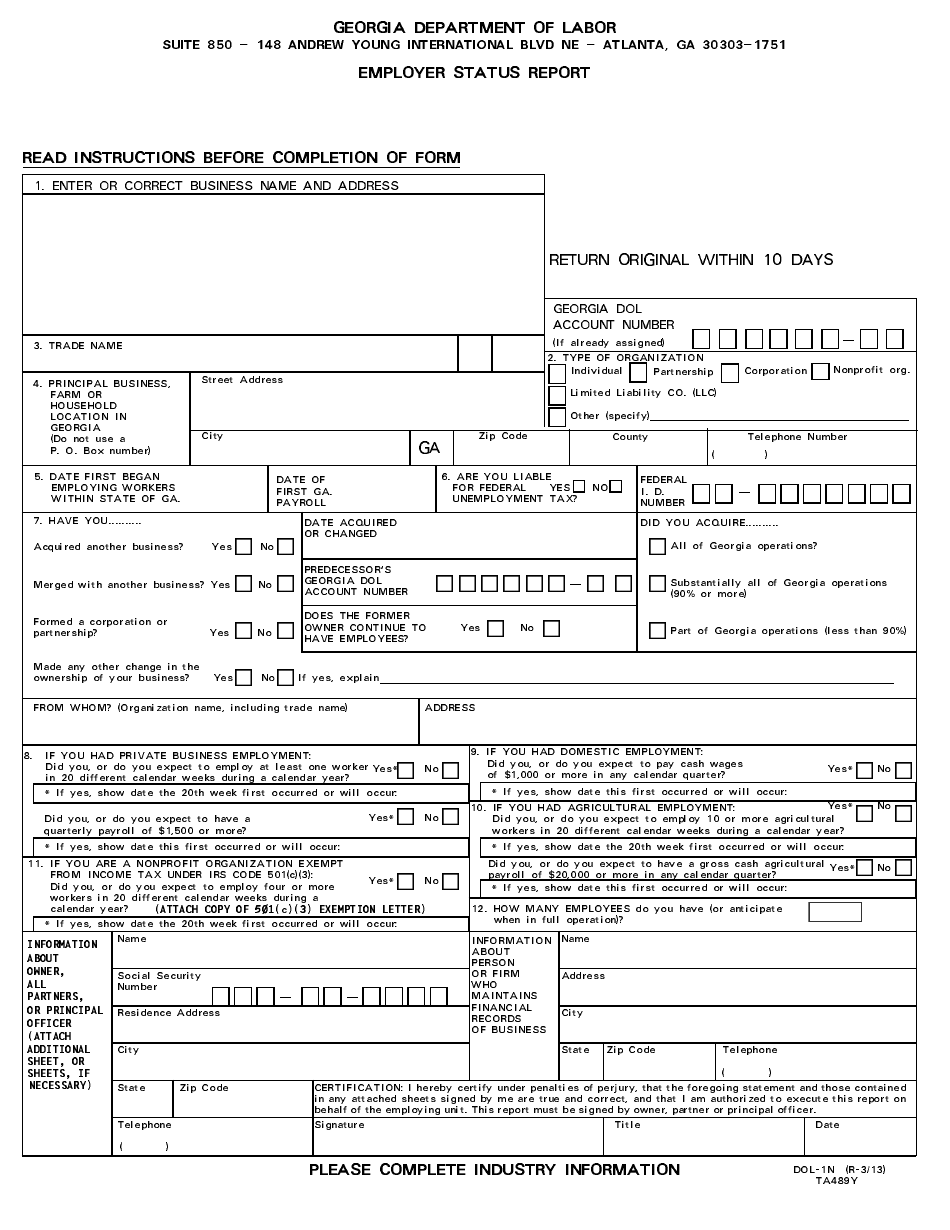

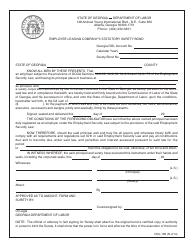

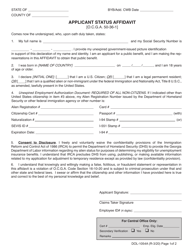

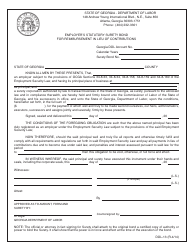

Form DOL-1N Employer Status Report - Georgia (United States)

What Is Form DOL-1N?

This is a legal form that was released by the Georgia Department of Labor - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

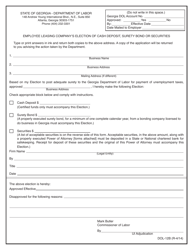

Q: What is the DOL-1N Employer Status Report?

A: The DOL-1N Employer Status Report is a form used in Georgia to report changes in an employer's status.

Q: Who needs to file the DOL-1N Employer Status Report?

A: All employers in Georgia need to file the DOL-1N Employer Status Report.

Q: What changes in status should be reported on the DOL-1N Employer Status Report?

A: Any changes in an employer's status, such as a change in ownership, location, or type of business, should be reported on the DOL-1N Employer Status Report.

Q: How often does the DOL-1N Employer Status Report need to be filed?

A: The DOL-1N Employer Status Report needs to be filed within 10 days of any changes in an employer's status.

Q: Is there a fee for filing the DOL-1N Employer Status Report?

A: No, there is no fee for filing the DOL-1N Employer Status Report.

Q: What are the consequences of not filing the DOL-1N Employer Status Report?

A: Failure to file the DOL-1N Employer Status Report or filing false information can result in penalties and legal consequences.

Q: Are there any additional documents that need to be submitted with the DOL-1N Employer Status Report?

A: No, there are no additional documents that need to be submitted with the DOL-1N Employer Status Report. However, supporting documentation may be requested by the Georgia Department of Labor for verification purposes.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the Georgia Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DOL-1N by clicking the link below or browse more documents and templates provided by the Georgia Department of Labor.