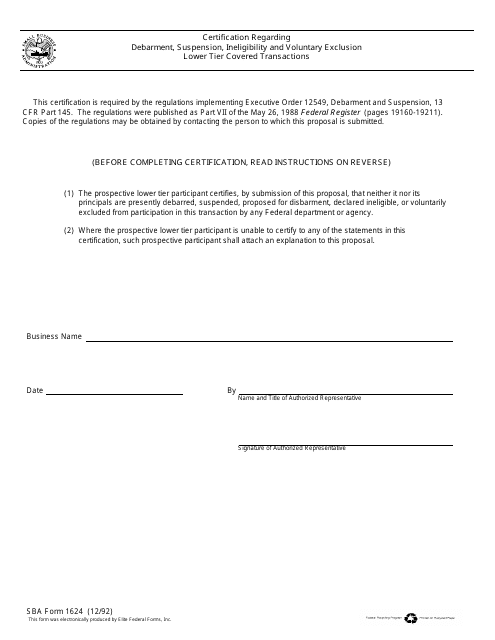

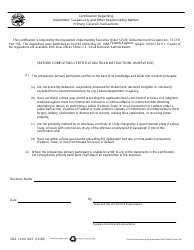

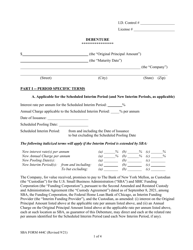

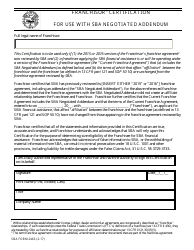

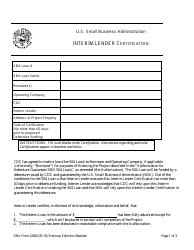

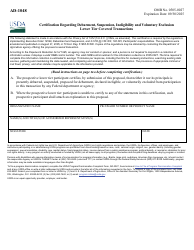

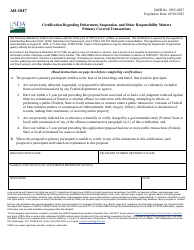

SBA Form 1624 Certification Regarding Debarment, Suspension, Ineligibility and Voluntary Exclusion Lower Tier Covered Transactions

What Is SBA Form 1624?

This is a legal form that was released by the U.S. Small Business Administration on December 1, 1992 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

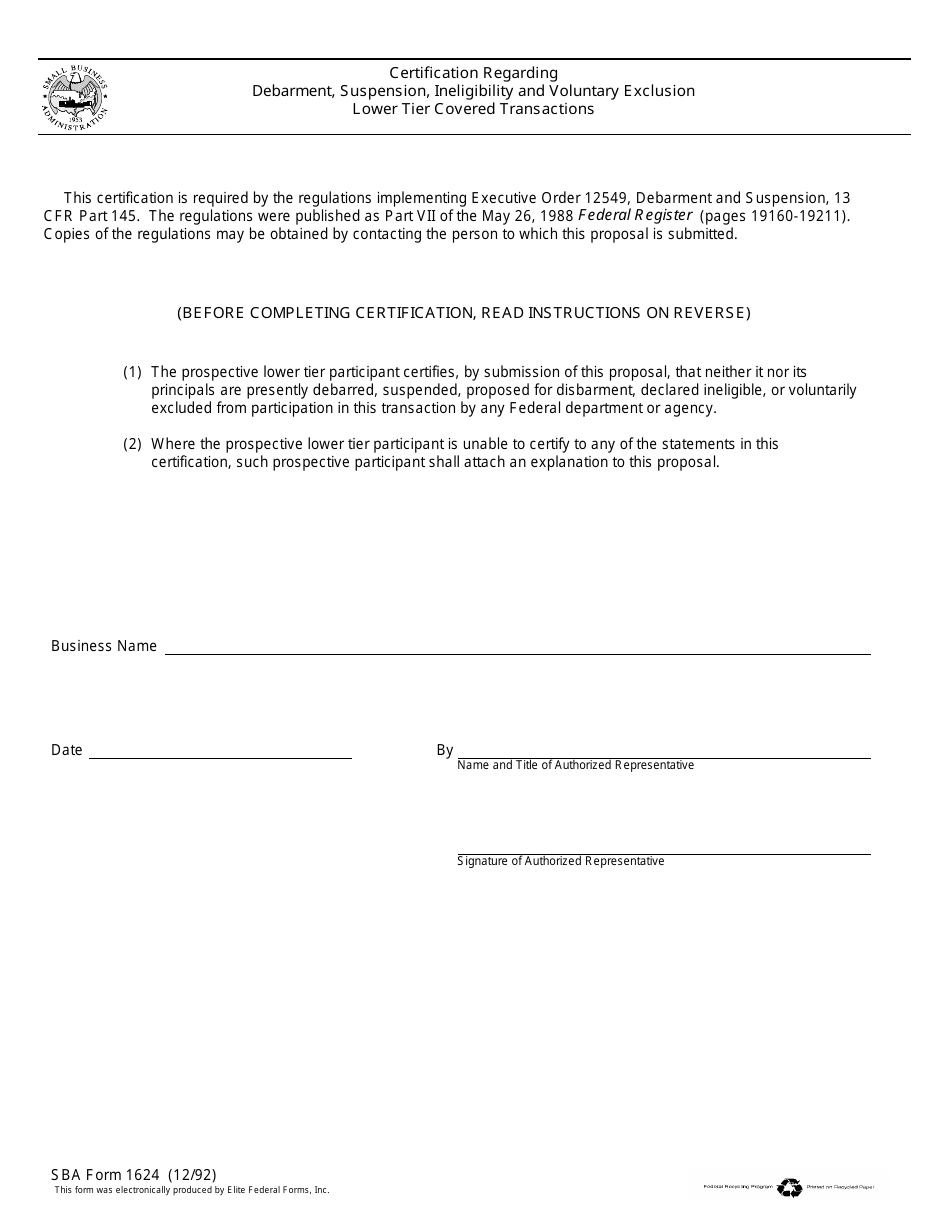

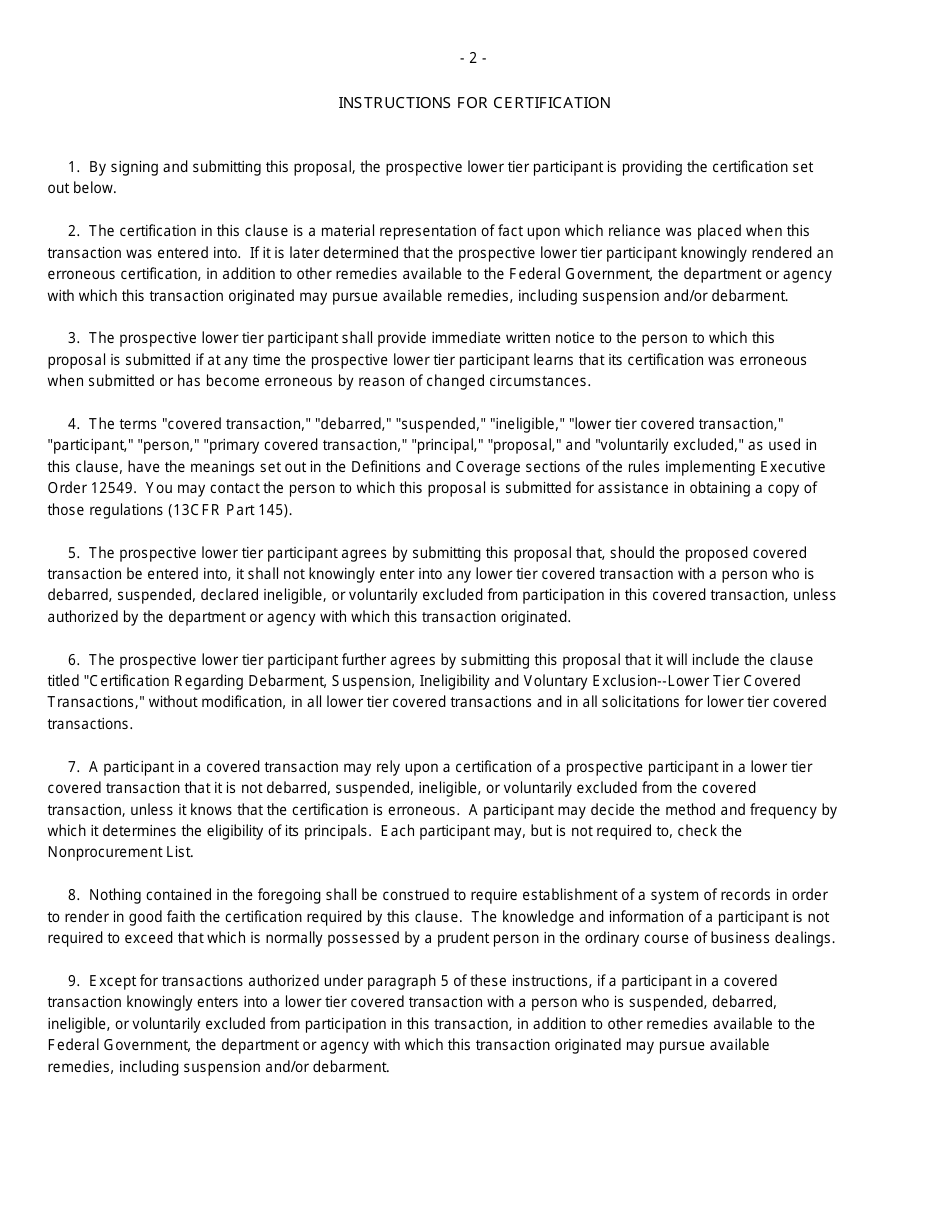

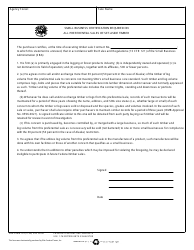

Q: What is SBA Form 1624?

A: SBA Form 1624 is a certification form regarding debarment, suspension, ineligibility, and voluntary exclusion for lower tier covered transactions.

Q: What does SBA Form 1624 certify?

A: SBA Form 1624 certifies that the applicant for a lower tier covered transaction is not debarred, suspended, or otherwise ineligible to participate in federal programs.

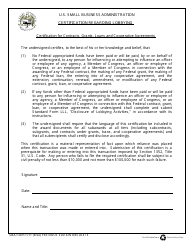

Q: What is a lower tier covered transaction?

A: A lower tier covered transaction refers to transactions at a level below the primary transaction, such as subcontractors or subgrantees.

Q: What is debarment?

A: Debarment is the exclusion of individuals or entities from receiving federal contracts or assistance due to certain legal or ethical violations.

Q: What is suspension?

A: Suspension is a temporary exclusion from federal contracts or assistance pending an investigation or legal proceedings.

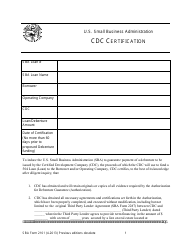

Q: What is ineligibility?

A: Ineligibility refers to being disqualified or prohibited from participating in federal programs for various reasons, such as previous violations or non-compliance.

Q: What is voluntary exclusion?

A: Voluntary exclusion is when an individual or entity voluntarily chooses to exclude themselves from participating in federal programs to avoid potential penalties or consequences.

Q: Why is SBA Form 1624 important?

A: SBA Form 1624 is important because it ensures that the participants in lower tier covered transactions are eligible and free from any debarment, suspension, ineligibility, or voluntary exclusion that would disqualify them from receiving federal contracts or assistance.

Form Details:

- Released on December 1, 1992;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 1624 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.