This version of the form is not currently in use and is provided for reference only. Download this version of

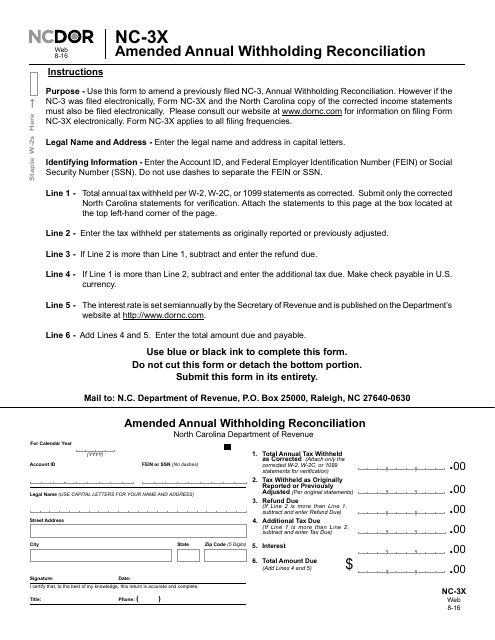

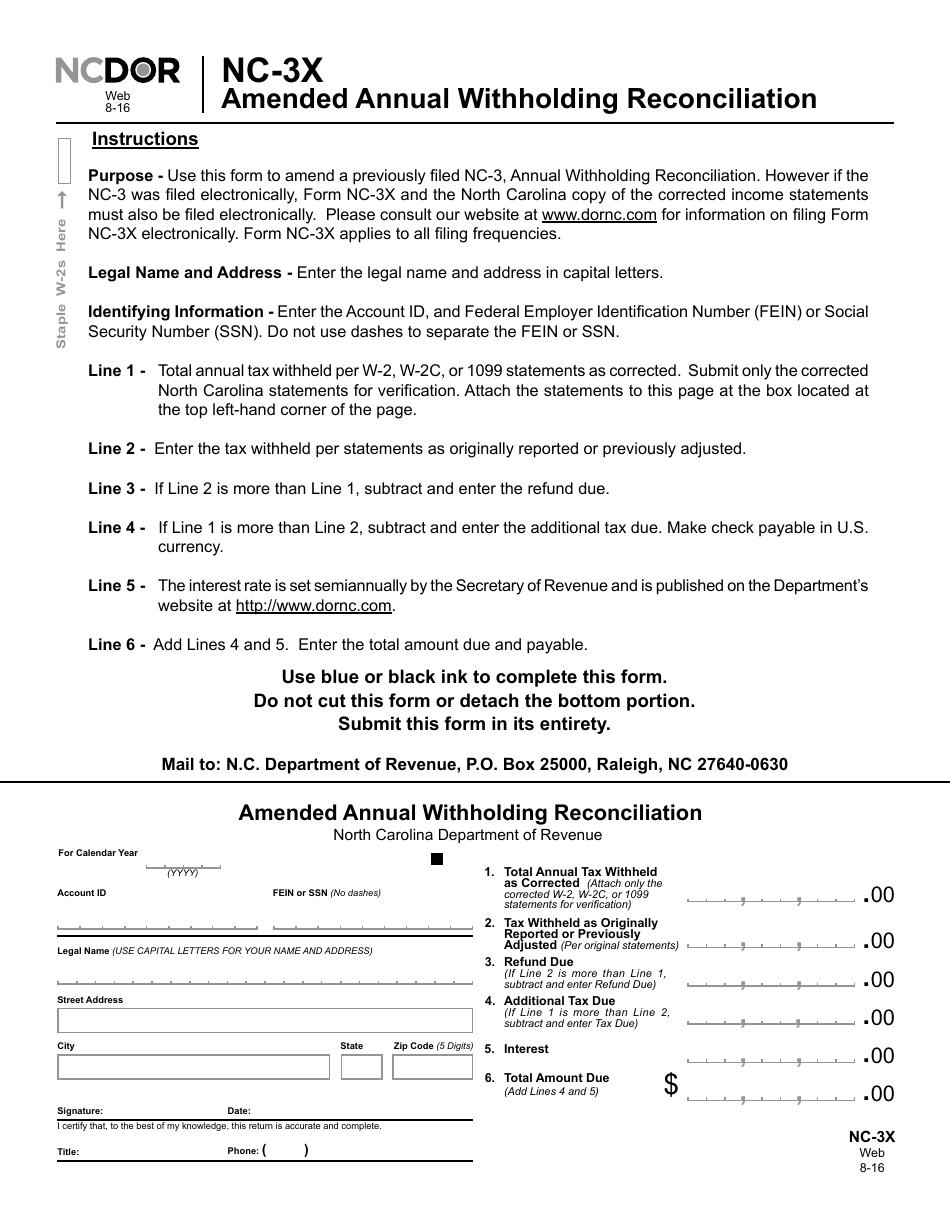

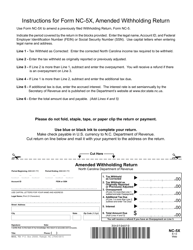

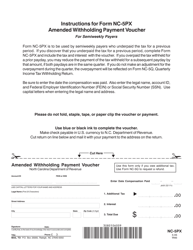

Form NC-3X

for the current year.

Form NC-3X Amended Annual Withholding Reconciliation - North Carolina

What Is Form NC-3X?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-3X?

A: Form NC-3X is the Amended Annual Withholding Reconciliation form for North Carolina.

Q: Who needs to file Form NC-3X?

A: Employers in North Carolina who need to make amendments to their previously filed annual withholding reconciliation must file Form NC-3X.

Q: What is the purpose of Form NC-3X?

A: Form NC-3X is used to correct any errors or omissions in the previously filed annual withholding reconciliation (Form NC-3), and to reconcile any discrepancies between the amounts reported and the amounts actually withheld.

Q: When is Form NC-3X due?

A: Form NC-3X must be filed by the same deadline as the original annual withholding reconciliation, which is January 31st of the year following the tax year.

Q: Is there a penalty for not filing Form NC-3X?

A: Yes, failure to file Form NC-3X may result in penalties and interest being assessed by the North Carolina Department of Revenue.

Form Details:

- Released on August 1, 2013;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-3X by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.