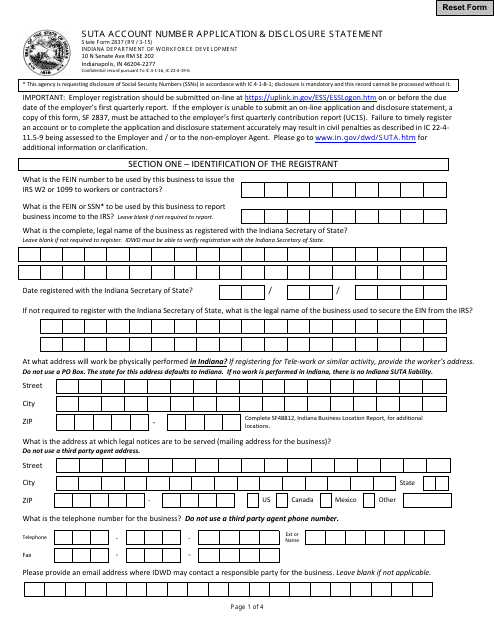

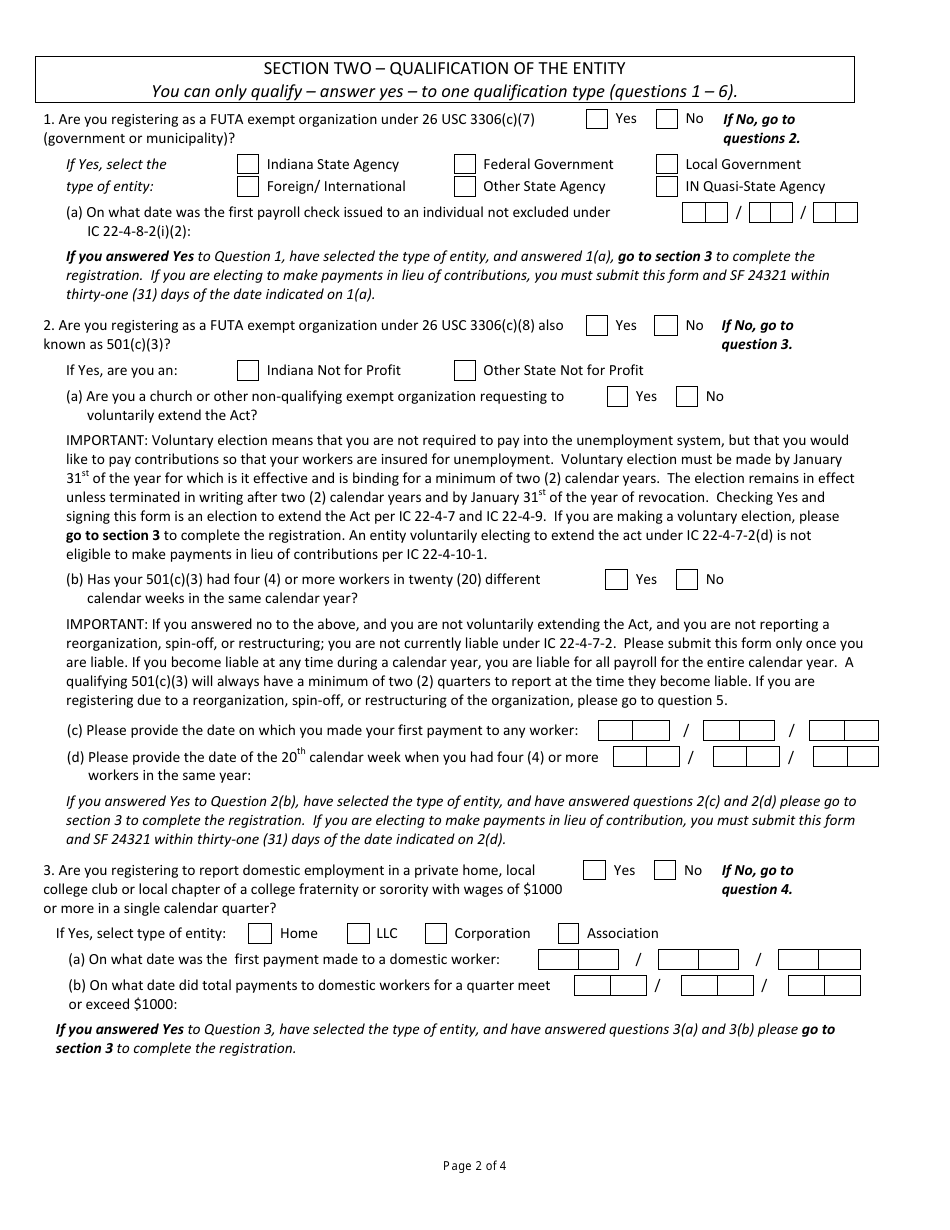

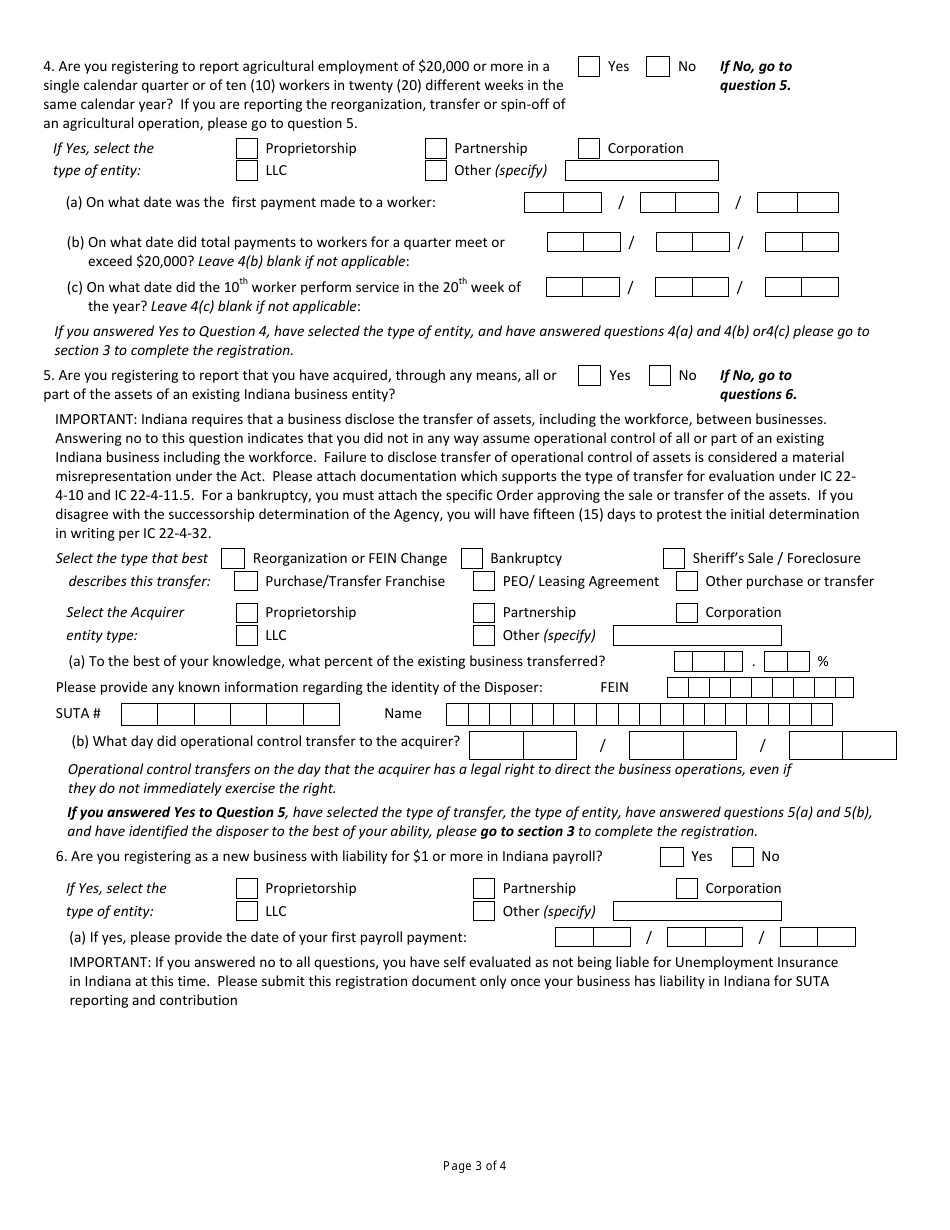

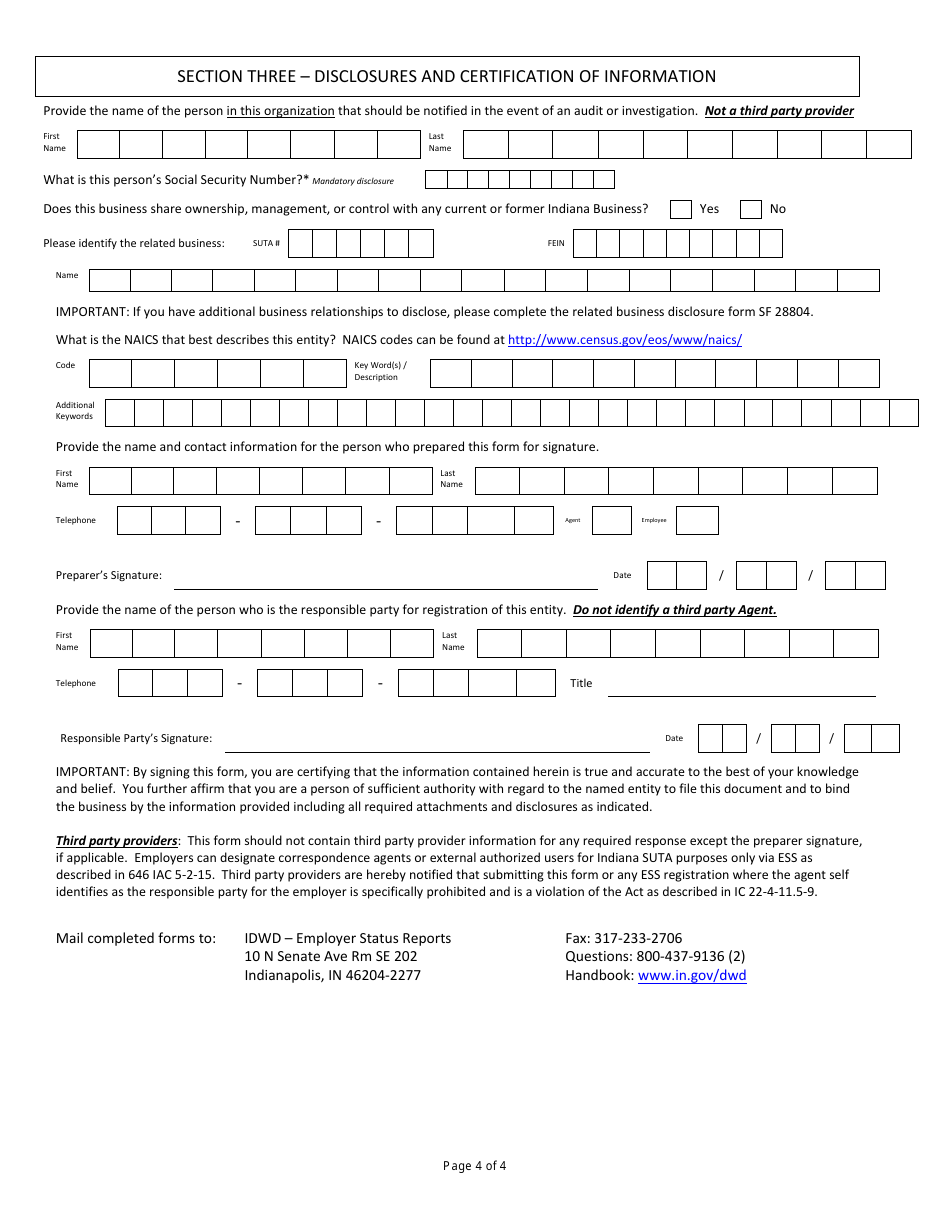

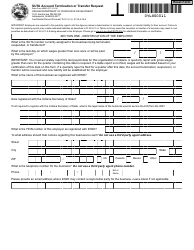

State Form 2837 Suta Account Number Application & Disclosure Statement - Indiana

What Is State Form 2837?

This is a legal form that was released by the Indiana Department of Workforce Development - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2837?

A: Form 2837 is the SUTA Account Number Application & Disclosure Statement for Indiana.

Q: What is the purpose of Form 2837?

A: The purpose of Form 2837 is to apply for a SUTA (State Unemployment Tax Act) account number in Indiana.

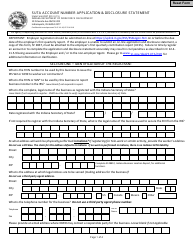

Q: What information do I need to provide on Form 2837?

A: On Form 2837, you will need to provide information about your business, such as the legal name, address, and contact details.

Q: Is there a fee to apply for a SUTA account number in Indiana?

A: No, there is no fee to apply for a SUTA account number in Indiana.

Q: How long does it take to process Form 2837?

A: The processing time for Form 2837 may vary, but it is typically processed within a few weeks.

Q: What happens after my Form 2837 is processed?

A: Once your Form 2837 is processed, you will be assigned a SUTA account number by the Indiana Department of Workforce Development.

Q: What if I need to update the information on my Form 2837?

A: If you need to update the information on your Form 2837, you should contact the Indiana Department of Workforce Development.

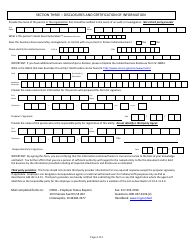

Q: Are there any other requirements for maintaining a SUTA account in Indiana?

A: Yes, there may be other requirements, such as filing quarterly wage reports and paying unemployment taxes. You should contact the Indiana Department of Workforce Development for more information.

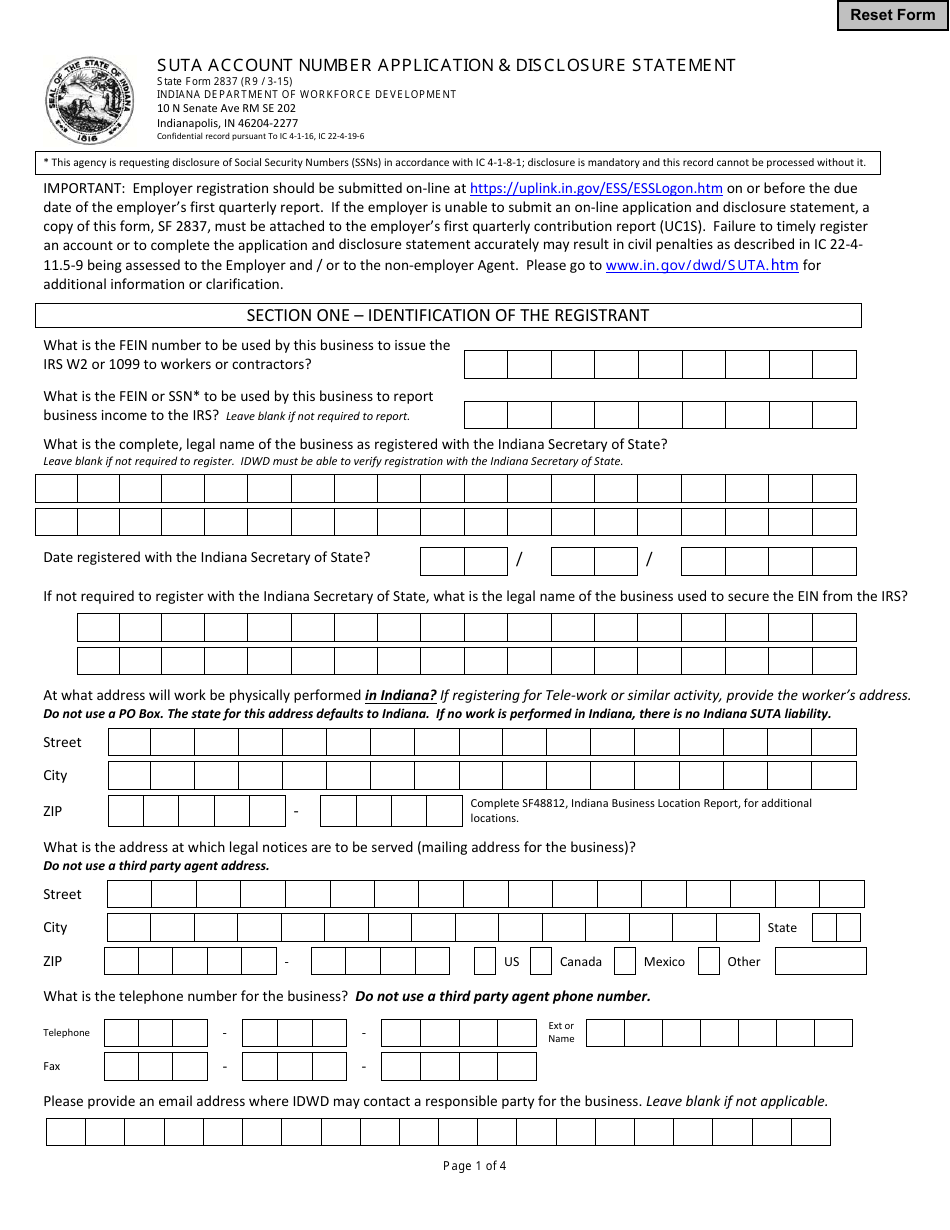

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Indiana Department of Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 2837 by clicking the link below or browse more documents and templates provided by the Indiana Department of Workforce Development.